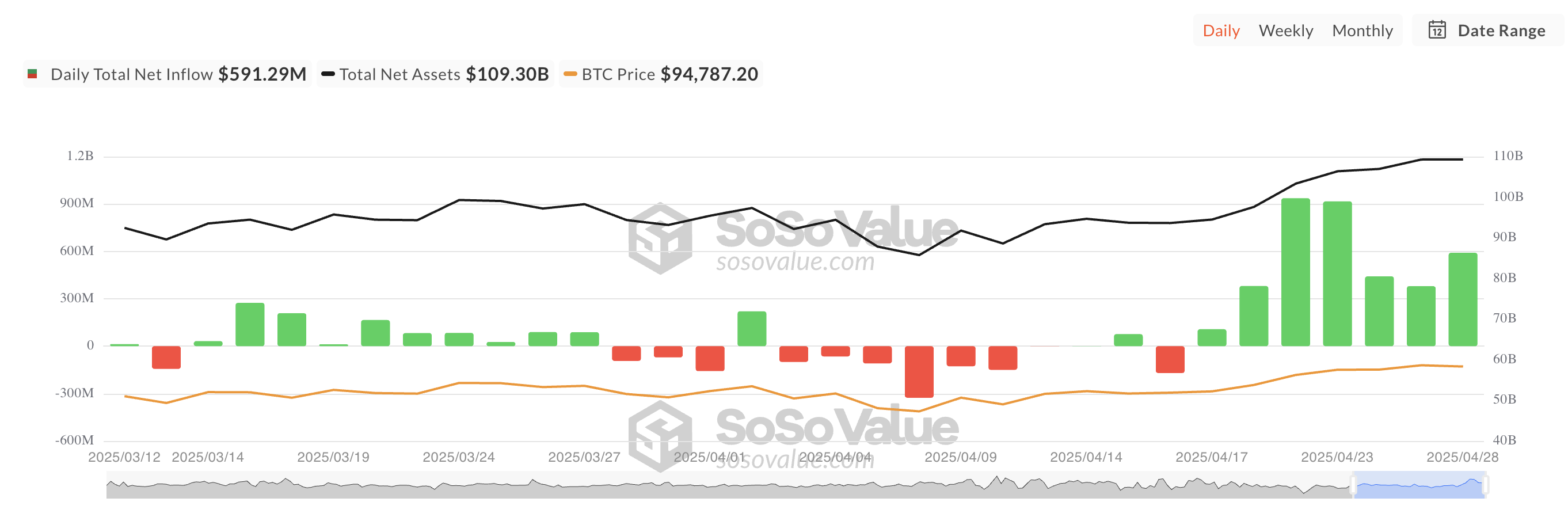

Bitcoin spot ETF continued to attract inflows on Monday, raising over $500 million in new funds and recording a positive trend for 7 consecutive days.

This persistent momentum reflects a renewed investor interest in Bitcoin exposure through regulated investment instruments, despite market volatility.

Steady BTC ETF Inflows

On Monday, Bitcoin spot ETFs recorded net inflows of $591.29 million, attracting new investor demand and continuing their 7-day upward trend. This occurred while the major cryptocurrency sought stable support above $94,000.

Once again, BlackRock's iShares Bitcoin Trust (IBIT) led the way, recording the largest inflows among similar funds. The fund increased its total cumulative net inflows to $42.17 billion with inflows of $970.93 million.

The Bitcoin spot ETF managed by ARKB, Ark Invest, and 21Shares recorded the largest net outflow yesterday, with $226.3 million leaving the fund on Monday. Despite this retreat, ARKB's total historical net inflows remain at $2.88 billion.

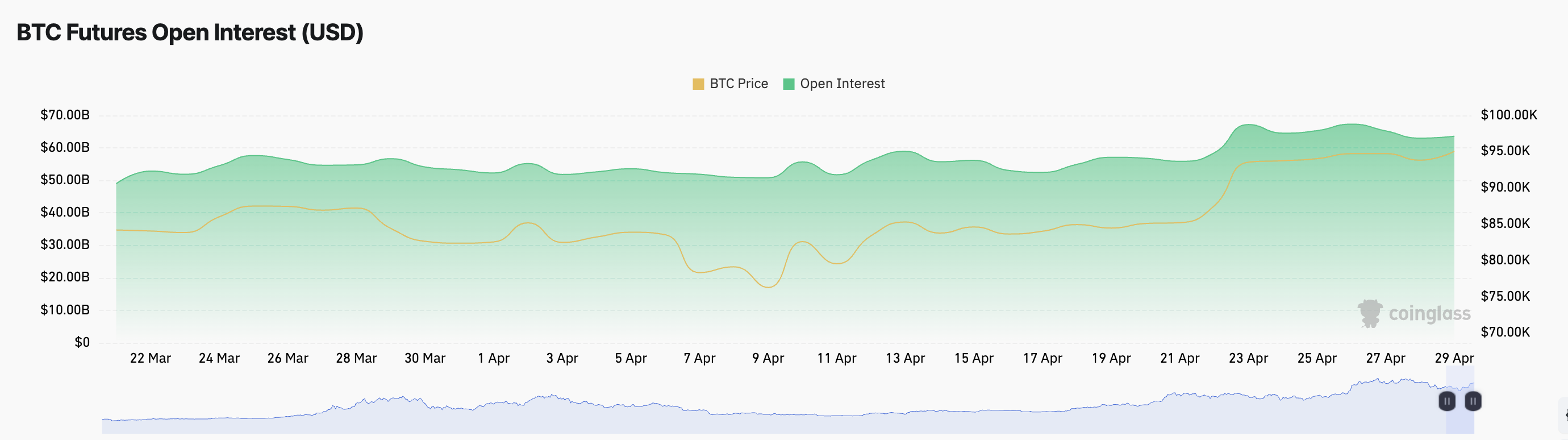

Increase in Open Interest Sets the Stage for Bearish Option Sentiment

Bitcoin futures market open interest increased by 2% over the past day, indicating an increase in outstanding futures contracts. The coin's price recorded a slight increase of 0.14% during the same period.

The increase in open interest suggests that more traders are opening new positions rather than closing existing ones. This bullish signal could potentially strengthen Bitcoin's price in the short term.

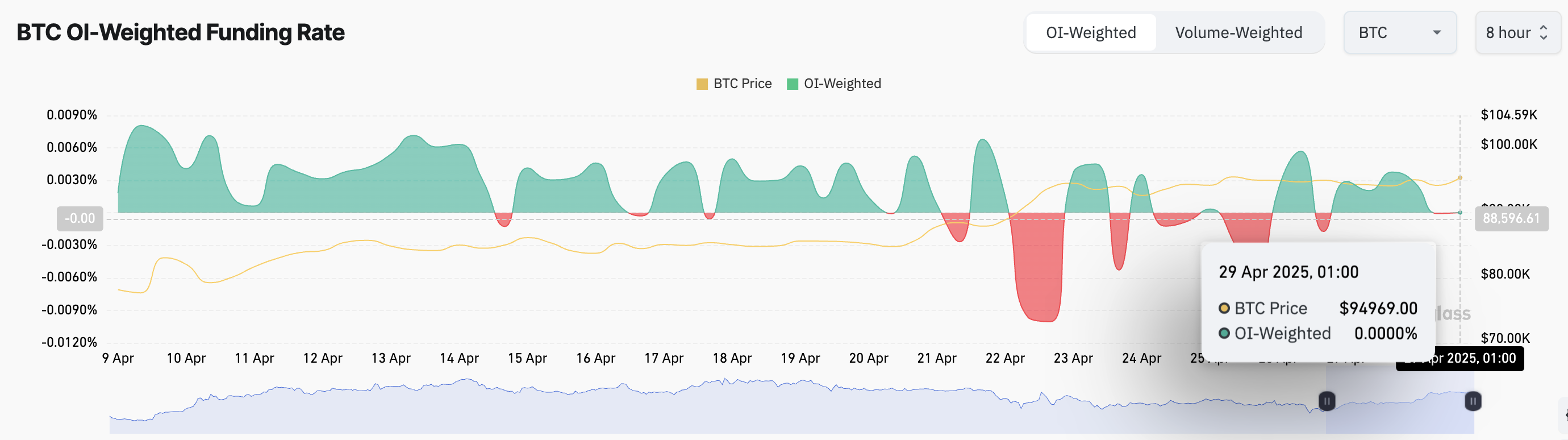

At the time of writing, Bitcoin's funding rate is 0%, indicating a balance between long and short positions. This neutral funding rate suggests no immediate dominance of a bull or bear market in the coin's perpetual futures market.

This reduces the possibility of sudden liquidations and suggests that major price movements may require new momentum rather than being driven by leveraged pressure.

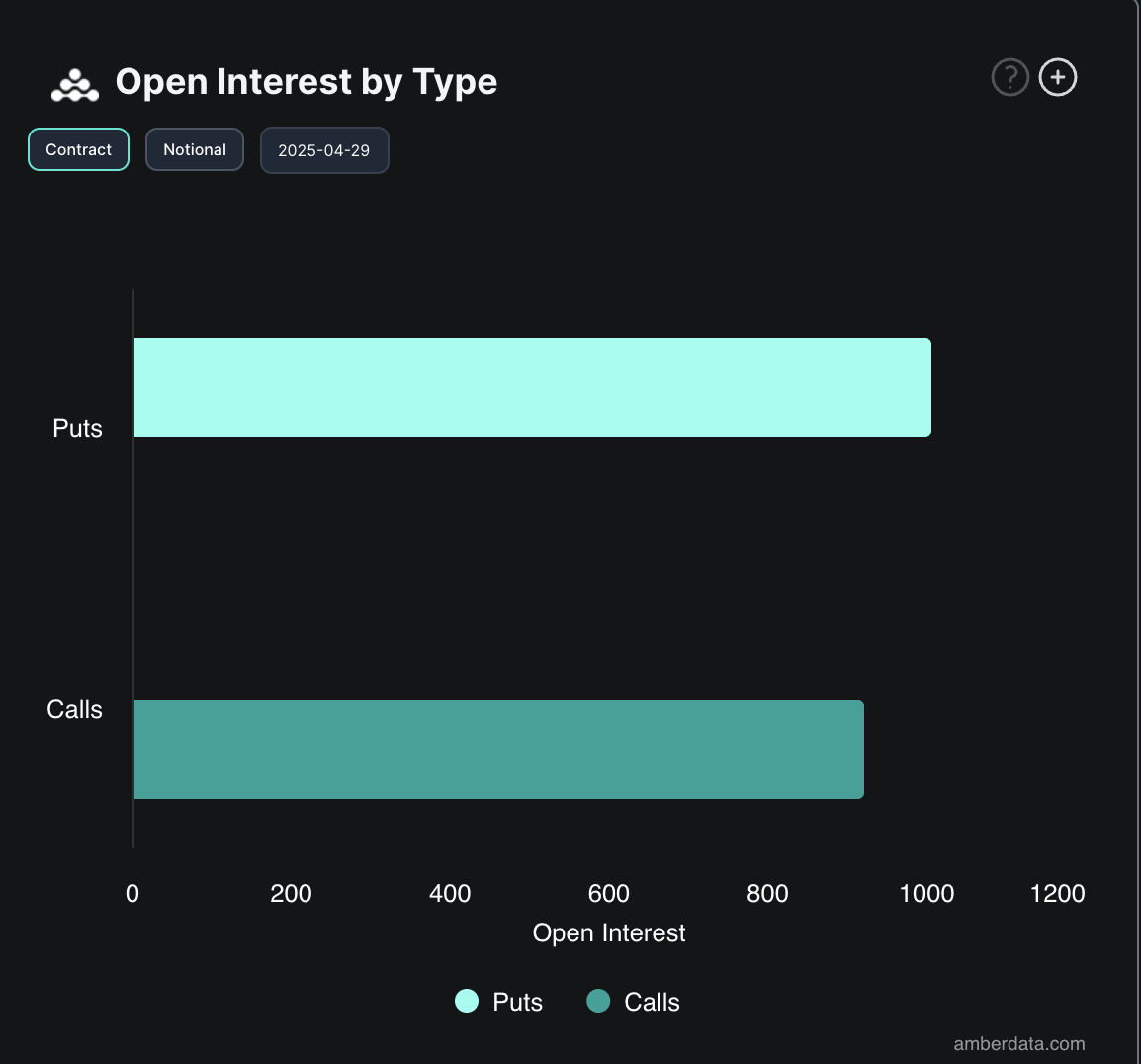

However, the sentiment among Bitcoin options traders is clear. Today's high put demand indicates a more cautious or bearish outlook among Bitcoin options traders.

The increased interest in these bearish contracts suggests that many investors anticipate a potential Bitcoin price pullback, despite recent ETF inflows.

Bitcoin may enter a consolidation within a narrow range until a clear breakout or decline occurs.