The old financial market adage "Sell in May" has long been a guideline for investors trying to avoid summer volatility. However, according to some analyses, this adage may not apply to Bitcoin in the upcoming month.

Various claims indicate significant differences in the 2025 market environment. These factors suggest that prices may rise rather than fall in May.

4 Reasons Selling in May 2025 Could Be a Mistake

A key reason recently emphasized by many analysts is that Bitcoin is now closely linked to the global M2 money supply.

M2 measures the amount of money circulating in the economy. It includes cash, savings deposits, and highly liquid assets. Historically, M2 has shown a strong correlation with Bitcoin prices. When central banks like the Federal Reserve, ECB, and PBoC increase money supply, Bitcoin tends to rise.

Kaduna shared a chart confirming this trend will continue in 2025. According to this pattern, May could be a breakthrough for Bitcoin. Not all analysts agree with this view, but investors are increasingly accepting it, creating a positive market sentiment.

"Selling in May will be a big mistake," Kaduna emphasized.

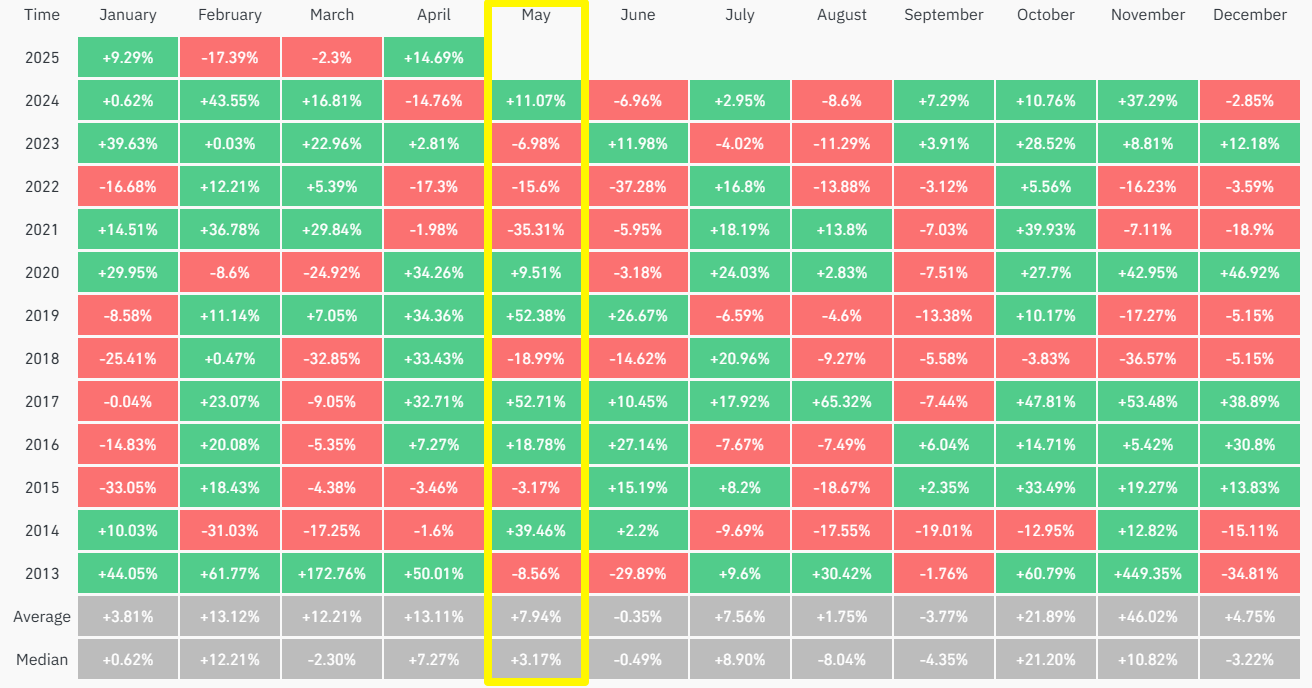

Secondly, historical data supports Kaduna's outlook. According to Coinglass, Bitcoin has recorded over 7.9% returns in May over the past 12 years. While financial markets often experience summer volatility, Bitcoin does not always follow that pattern.

Instead, May often shows positive performance. While not the strongest month, it performs better than June and September. One investor observed on X that since 2010, Bitcoin has experienced 9 green Mays and 6 red Mays.

The original adage originated from the stock market, and historical data applies better to stocks, not necessarily to cryptocurrencies.

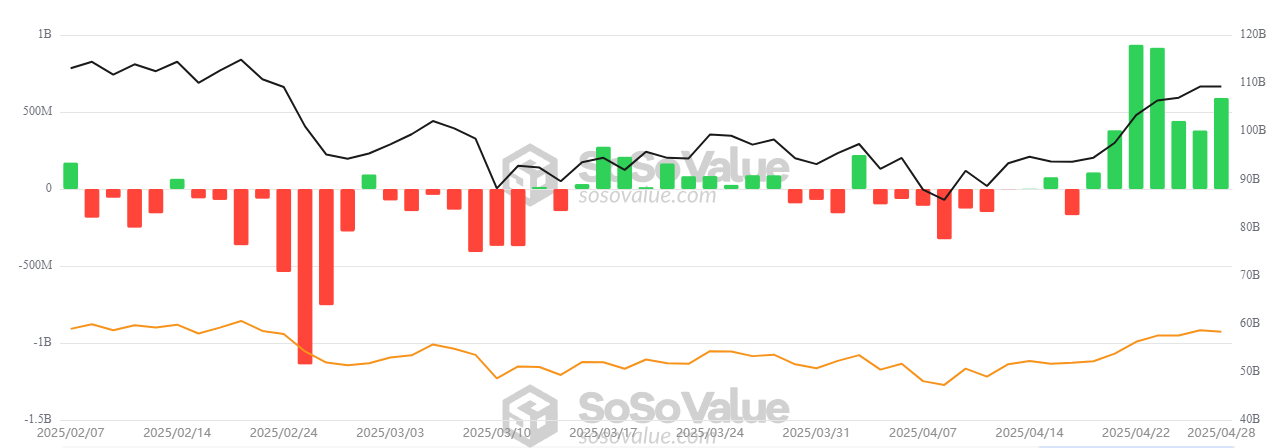

Another key point supporting Kaduna's paper is the increase in Bitcoin ETF inflows. BeInCrypto recently reported that spot Bitcoin ETFs attracted new investor demand on Monday, recording $591.29 million in net inflows and continuing a 7-day winning streak.

Notably, BlackRock's iShares Bitcoin Trust (IBIT) led the way, raising $970.93 million in a single day and bringing total cumulative net inflows to $42.17 billion.

This increase reflects investor confidence and long-term optimism about Bitcoin in 2025. This sentiment could continue in May, potentially providing additional upward momentum to Bitcoin prices.

Lastly, Bitcoin is clearly moving away from its correlation with the S&P 500, which historically has signaled significant price surges.

Investor arndxt noted this difference. BeInCrypto also reported growing divergence between Bitcoin and the Nasdaq index. Bullish analysts interpret this as a sign that Bitcoin is behaving as an independent asset less connected to traditional markets.

"The old 'Sell in May' adage does not apply equally to cryptocurrencies. Liquidity pressures are easing, and this May could signal the start of acceleration, not a pause." – predicted by arndxt.

Strong M2 correlation support, positive May performance in Bitcoin's history, massive ETF inflows, and separation from traditional indices suggest that selling Bitcoin in May 2025 could be a serious mistake.

However, investors should be cautious. Key Fed data on CPI, interest rates, and trade tensions could still bring uncertainty to the May outlook.