Trump's Trade Policy Shocks Global Financial Markets, Triggering Revaluation of Bitcoin (BTC) and Stocks

The Bitcoin and cryptocurrency market has witnessed significant volatility over the past few weeks, resulting from the impact of tariffs imposed by U.S. President Donald Trump, which has shocked traders and investors.

Bitcoin, Stocks Massive Revaluation Imminent?

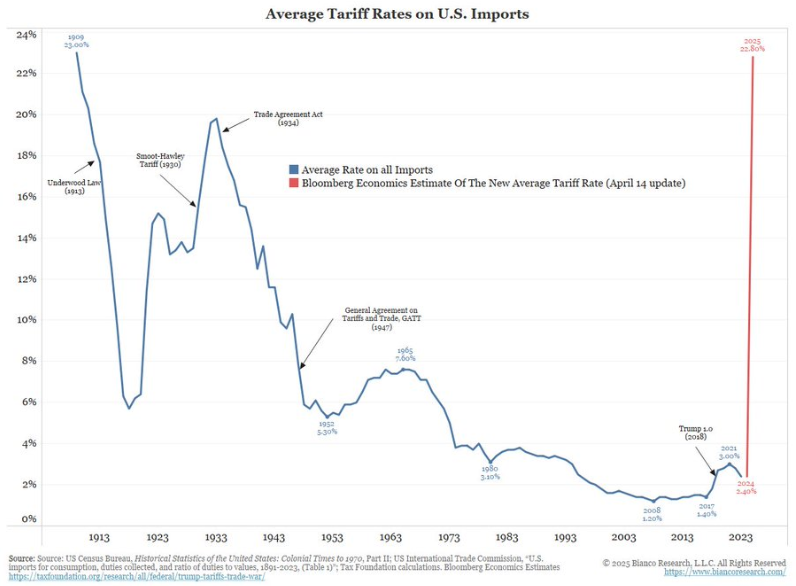

The recent surge in Trump tariffs has positioned Bitcoin as a potential beneficiary. Venture capital firm MV Global emphasized the surge in U.S. tariffs by 2025, noting it's at a level last seen in the 1930s, resulting in over $10 trillion in stock losses globally.

"As a result, capital outflows are reconfiguring investment flows across asset classes." – MV Global mentioned.

As liquidity is quietly being reconstructed, analysts anticipate a major market revaluation with Bitcoin at its center.

This prediction came after MV Global's global economic index recently turned bullish. This often precedes a broader asset revaluation, particularly tracking cross-border capital flows and monetary conditions.

"Liquidity is quietly being reconstructed across major economies. With the global economic index turning bullish, historical patterns suggest Bitcoin and stocks might be on the threshold of a major revaluation." – MV Global mentioned.

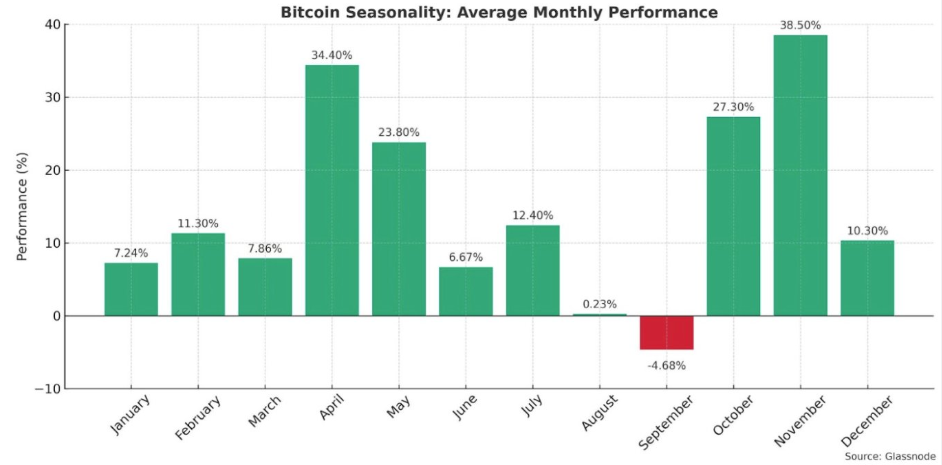

Indeed, Bitcoin's performance is already outpacing traditional markets, supported by over 34.4% returns in April. Macroeconomic instability and capital outflows are driving this seasonal pattern.

Based on this, analysts argue that the current market outlook is similar to historical periods when investors sought decentralized alternatives away from the dollar-centric system.

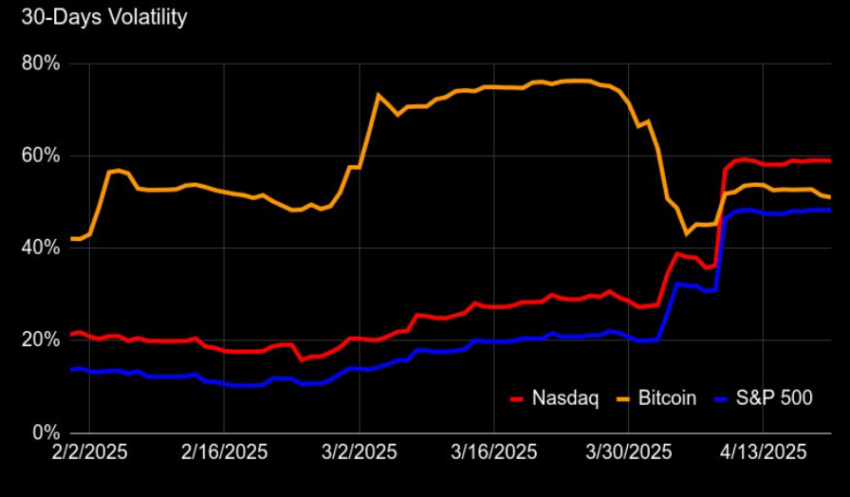

Thomas Greif, Product Strategy Lead at Brains Mining Ecosystem, agrees. He points out that Bitcoin's volatility is aligning more closely with major stock indices.

"If you thought Bitcoin was too volatile, you might need to reevaluate your passive investment strategy for retirement." – Greif mentioned.

According to Matthew Sigel, Head of Digital Assets Research at VanEck, this new macroeconomic backdrop could accelerate Bitcoin's transition from a speculative asset to a functional currency hedge.

"Bitcoin is evolving from a speculative asset to a functional monetary tool, especially in economies looking to bypass the dollar and reduce exposure to the U.S.-led financial system." – Sigel wrote.

Sigel's claim reflects broader trends. Bitcoin is increasingly recognized as a strategic asset as geopolitical and trade tensions escalate, aligning with recent U.S. crypto news publications that note Bitcoin positioning itself as a hedge against traditional finance (TradFi) and U.S. Treasury risk.

Bitcoin's potential to solidify its position as a reserve or settlement asset could grow. This optimism emerges as more economies move away from traditional U.S. monetary influence. BeInCrypto reported that Russia is considering a ruble-pegged stablecoin to challenge U.S. dollar dominance.

As stock markets shake and liquidity rotates, Bitcoin's resilience could redefine how investors prepare for geopolitical uncertainty.