The U.S. Treasury predicts that the stablecoin market could reach a market capitalization of $2 trillion by 2028. This represents a 7-fold increase from the current level of approximately $240 billion.

Meanwhile, MEXC COO says this milestone could be achieved by next year.

Stablecoin Market, Explosive Growth by 2028?

The Treasury shared an optimistic outlook in the Treasury Borrowing Advisory Committee (TBAC) report released on April 30th. The report explained several key drivers of stablecoin's rapid adoption and market growth.

Institutional interest in cryptocurrency products like BTC and ETH ETFs is increasing. Particularly, stablecoins play a central role in blockchain-based transactions as financial asset tokenization expands.

Merchant integrations like PayPal's stablecoin acceptance further broaden its practicality as a payment mechanism. The increase in stablecoins providing interest income enhances their attractiveness as value storage and revenue-generating assets.

Moreover, clear regulatory frameworks that include stablecoins in liquidity management strategies and allow banks to access public blockchains will integrate stablecoins into the traditional financial system. These developments position these assets in a crucial place for market expansion.

"The evolving market dynamics, structure, and incentives have the potential to accelerate the trajectory of stablecoins, reaching a market capitalization of around $2 trillion by 2028," the report read.

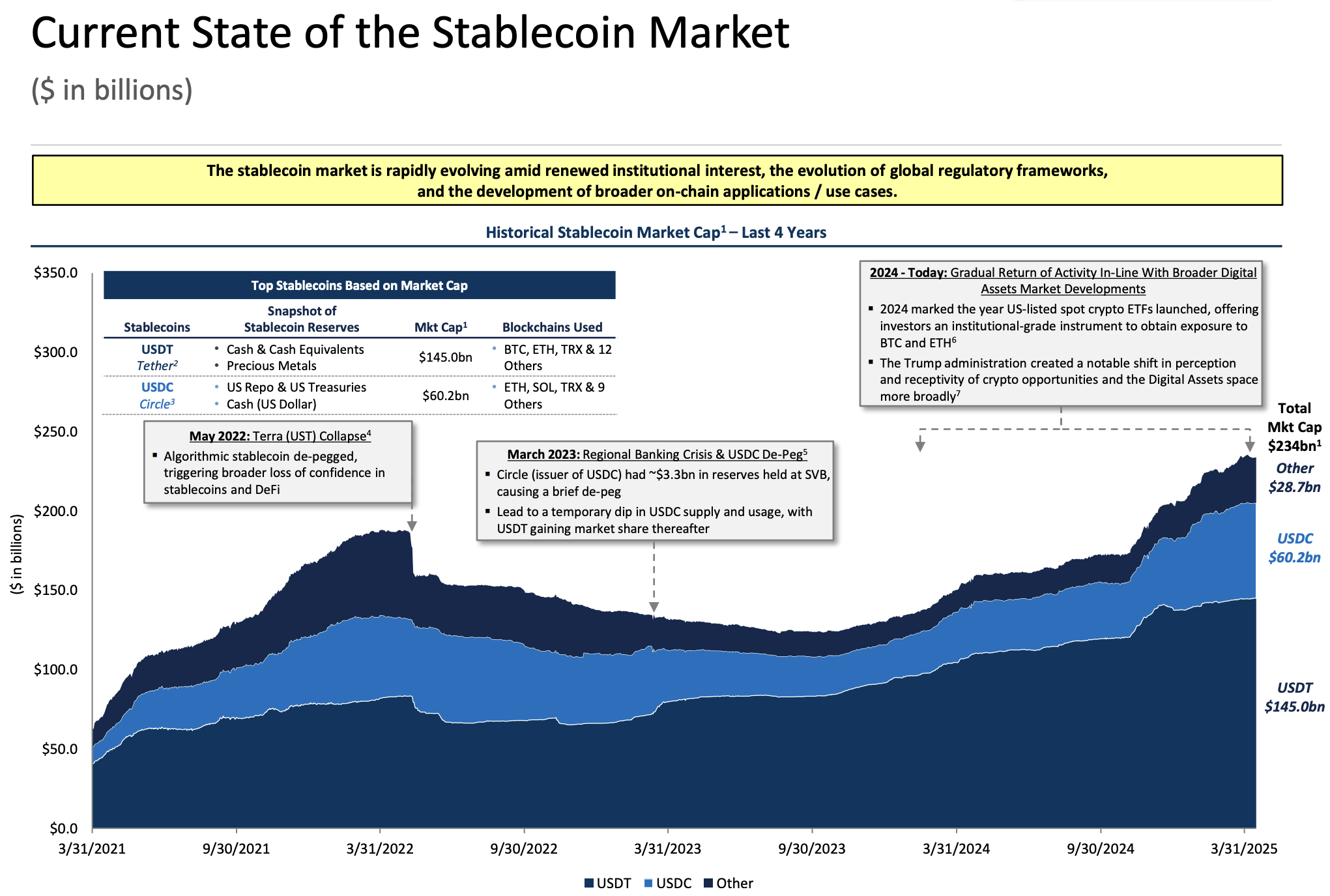

Currently, USD-pegged stablecoins dominate the market, accounting for over 99% of market capitalization. Tether (USDT) leads with a market cap of $145 billion. Circle's USDC (USDC) is second with a market cap of $60 billion.

Therefore, their increasing adoption can significantly impact banking and financial markets. Stablecoins offering interest income or unique payment features could lead to a demand shift from traditional bank deposits to stablecoins. This might require banks to raise interest rates or seek alternative funding sources.

Additionally, the report mentioned that stablecoin adoption could increase demand for short-term Treasury bonds. This depends on the passage of the GENIUS Act. The proposed bill would require stablecoin issuers to hold U.S. Treasury bonds as reserves.

Furthermore, the reserve requirements specified in the bill could help mitigate de-pegging risks. This would reduce issuers' need to rely on the Federal Reserve during stress or volatility periods.

"Stablecoin demand could have a net-neutral impact on U.S. monetary supply, but the appeal of USD-pegged stablecoins could convert non-USD liquidity holdings to USD," the report added.

MEXC COO Predicts $2 Trillion Stablecoin Market in 2026

Nevertheless, Tracy Jin, COO of cryptocurrency exchange MEXC, believes the $2 trillion market could be closer.

"Many sovereign banks and corporations are exploring stablecoin issuance, especially from other fiat currencies, and as governments prioritize regulatory clarity, stablecoin market capitalization could exceed $2 trillion by 2026," Jin told BeInCrypto.

Jin emphasized that ongoing macroeconomic uncertainty is likely to drive further stablecoin market cap growth.

"Despite the recent volatile market environment, stablecoin demand has remained robust, increasing by over $38 billion since the beginning of the year. Stablecoins now represent 1% of global M2 USD monetary supply, processed over $33 trillion in volume last year alone, and processed $2.8 trillion just last month," she said.

According to Jin, the expanded role of these assets in DeFi, cross-border payments, and digital asset trading is expected to play a crucial role in the next stage of cryptocurrency market growth and broad mainstream adoption of digital assets.

Particularly, their ability to provide stability and liquidity during market volatility and liquidity shortages firmly establishes their importance as key assets for institutional and individual investors.