Welcome to the US Cryptocurrency Morning Briefing. Here's a brief summary of today's key cryptocurrency developments.

Grab a cup of coffee and take a look at experts' views on stablecoin adoption. Dollar-pegged digital assets are showing significant growth, becoming a notable threat to the US Treasury.

Today's Cryptocurrency News: Stablecoin Market to Reach $2 Trillion by 2028, US Treasury Forecast

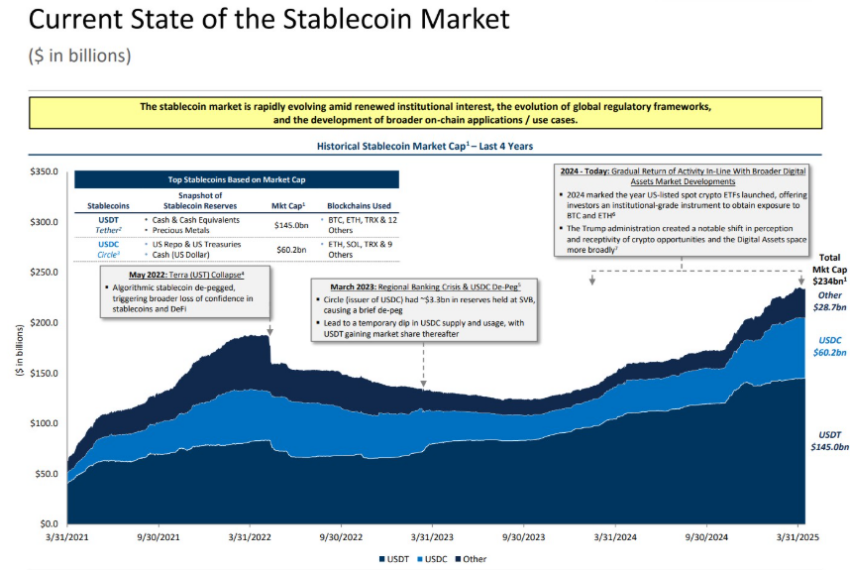

The US Treasury Borrowing Advisory Committee (TBAC) predicted in its Q1 2025 report that stablecoins could reach a market capitalization of $2 trillion by 2028.

"Changes in market dynamics, structure, and incentives could accelerate the potential for stablecoin market cap to reach around $2 trillion by 2028." Read the excerpt from the report.

According to BeInCrypto, this represents an 8-fold increase from the current level of about $234 billion, with USD-pegged stablecoins dominating the market (99%).

MEXC exchange COO Tracy Jin added that this target could be achieved by 2026.

The US Treasury acknowledged that under new regulations, stablecoin issuers must hold [short-term] Treasury bonds. It said this would strengthen the correlation between US Treasury demand and stablecoin adoption.

However, the US Treasury noted that stablecoin growth could force retail banks to pay higher interest rates to depositors.

In this context, BeInCrypto contacted Max Keiser to warn about the growing stablecoin market. The Bitcoin pioneer suggested this could worsen US debt levels and weaken the dollar's value.

"Stablecoins are the financial hospice where fiat currencies like the US dollar are dying," Keiser told BeInCrypto.

Keiser argued that increased stablecoin usage dilutes the dollar's value. In his view, the expansion and growth of stablecoin usage will ultimately "drive the US dollar to its death".

Will Stablecoins Replace Dollar Dominance? Standard Chartered's Opinion

Keiser linked the rise of stablecoins to increasing national debt, opposing political promises of debt reduction.

"This also means that US debt will not decrease as promised by Trump, but increase," he added.

BeInCrypto also contacted Geoff Kendrick, Head of Digital Assets Research at Standard Chartered, who mentioned that the Treasury had adopted their $2 trillion stablecoin prediction.

"The US Treasury is using our $2 trillion stablecoin forecast in their prediction based on this TBAC presentation. The tail is wagging the dog," Kendrick told BeInCrypto.

Kendrick expects a surge in stablecoin issuance under upcoming US legislation. While agreeing with the US Treasury's prediction, he noted caveats regarding the T-bill market.

"Specifically, I believe stablecoins will grow from $230 billion to $2 trillion by the end of 2028. That growth would require holding $1.6 trillion in US Treasuries as reserves, which is all the new Treasury issuance planned during that period," he added.

Meanwhile, Tether, the issuer of the world's largest stablecoin USDT, is considering launching a US-specific stablecoin by late 2025 or early 2026.

Tether CEO Paolo Ardoino stated that discussions are ongoing for the Trump administration to position stablecoins as a strategic financial tool and make the US a global cryptocurrency leader.

"We are just exporting what we believe is the best product made in America. And that is the US dollar," Ardoino said in an interview.

Increased stablecoin adoption is expected to provide more legitimacy to cryptocurrencies, with Bitcoin potentially benefiting from the resulting liquidity. Institutional investors are already shifting to cryptocurrencies over traditional assets, as recent US cryptocurrency news publications indicate.

Today's Chart

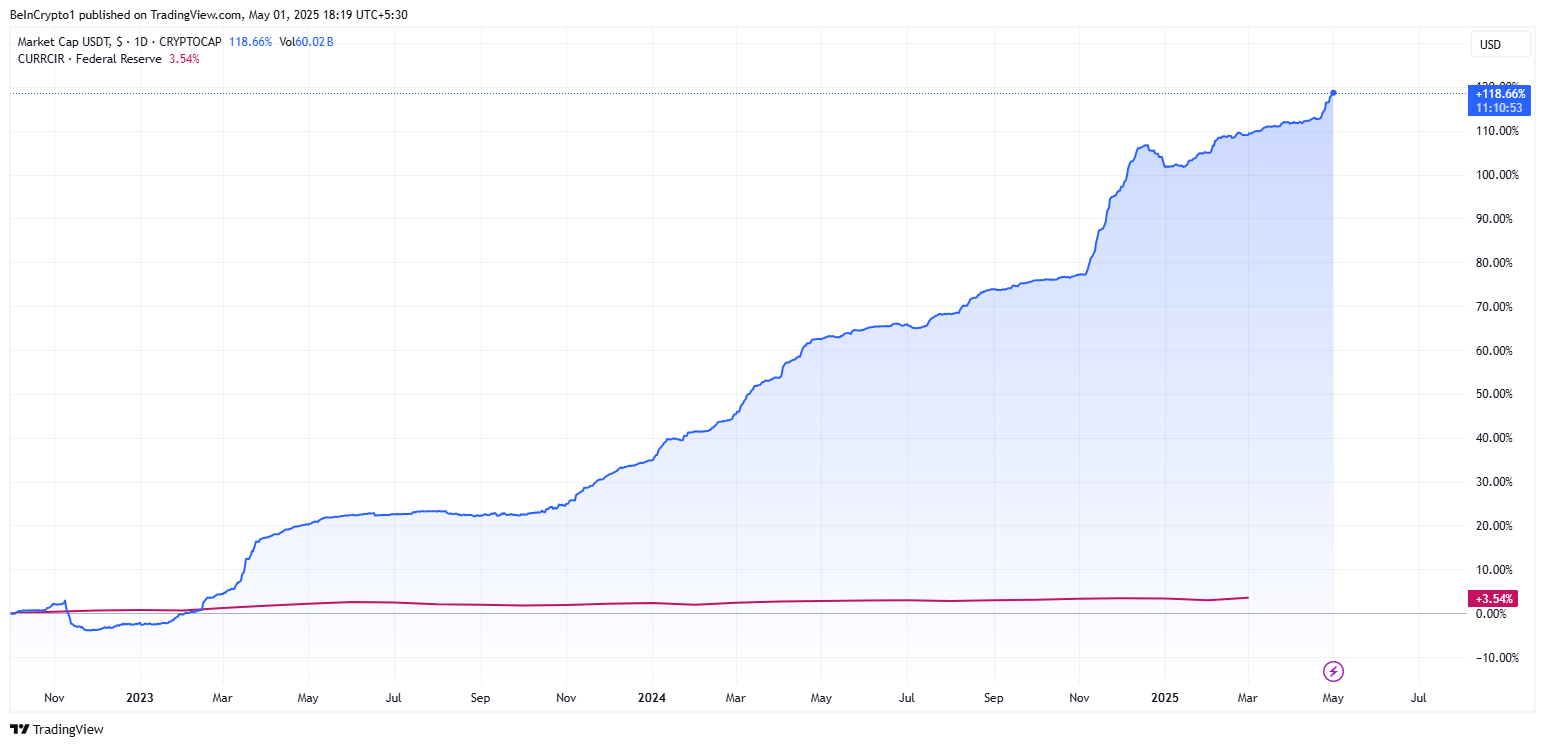

The chart shows the market cap of USDT (blue), which accounts for over 60% of the total stablecoin market cap. It has grown significantly compared to the Fed's circulating currency (red) since November 2023.

This demonstrates the rapid growth of stablecoins relative to the US dollar, emphasizing their increasing market dominance.

This is a summary of today's notable cryptocurrency news:

Today's Major News

- Eric Trump announced the integration of USD1 Stablecoin by World Liberty Financial. This is in conjunction with TRON at Token2049, with USD1 selected for MGX's $2 billion investment.

- Bitcoin showed good performance despite economic uncertainty. It reached an all in Argentina, suggesting it can serve as a safe haven.

- Trump's crypto assets could account for 37% of total assets. This includes TRUMP meme coin and World Liberty Financial.

- $56 million was of outflow occurred from Bitcoin ETF. This is the first time since April 16, indicating a slowdown in institutional demand.

- Robinhood's first-quarter crypto revenue doubled to $252$.52 million. Trading volume increased by 28% year%-, showing strong growth.

- Bitcoin is approaching $61 billion in profitability. Early strength signals are appearing, and BTC price shows signs of recovery>

- Base has has become the largest Ethereum Layer 2, surpassing Arbitrum. This is a result of transitioning from stage 0 to stage 1 maturity.

- AI Agent Tokens led the cryptocurrency market recovery. Growing 39.4% in the past 30 days, out-percoins dec.<><><<>closing April 30<>94 (+33.47%).92 $22.78 (+3.94%)<>mMARA)<37 $13.954.95 td (+)$7.523.52 (+3.3.87%)$8.10<$8.65 ..79%)Finance.Yahoo