Bitcoin price rose over 12% last week, reaching $96,500, which exceeds the average purchase price of "short-term whales" who bought Bitcoin in the last 6 months.

JA Martoon, an analyst at on-chain cryptocurrency platform CryptoQuant, told BeInCrypto that these whales have recovered their breakeven point of $90,890. He explained that they are now seeing profits, which lowers the likelihood of selling and adds stability to the market.

Short-term Bitcoin Whales Return to Profitability

Short-term whales are addresses holding Bitcoin for less than 6 months. These whales are now seeing total profits as BTC exceeds their average realized price.

Historically, when these participants reach profitability, they tend to stop or reduce selling pressure.

CryptoQuant's short-term/long-term whale realized price chart shows the orange line (based on short-term whale costs) rising along the white market price curve in recent weeks.

This confirms that most short-term holders would profit if they sell at current levels.

On-chain data reinforces its significance. The perpetual exchange funding rate remains deeply negative, indicating heavy short positions for a potential short squeeze if buying continues.

Meanwhile, long-term holders have steadily rebuilt their accumulation. Additionally, the network hash rate set a record of 1.04 ZH/s this month.

These indicators suggest that miners and patient investors are confident in maintaining the rally's trajectory.

Seasonal Factors and Macro Dynamics Strengthen Outlook

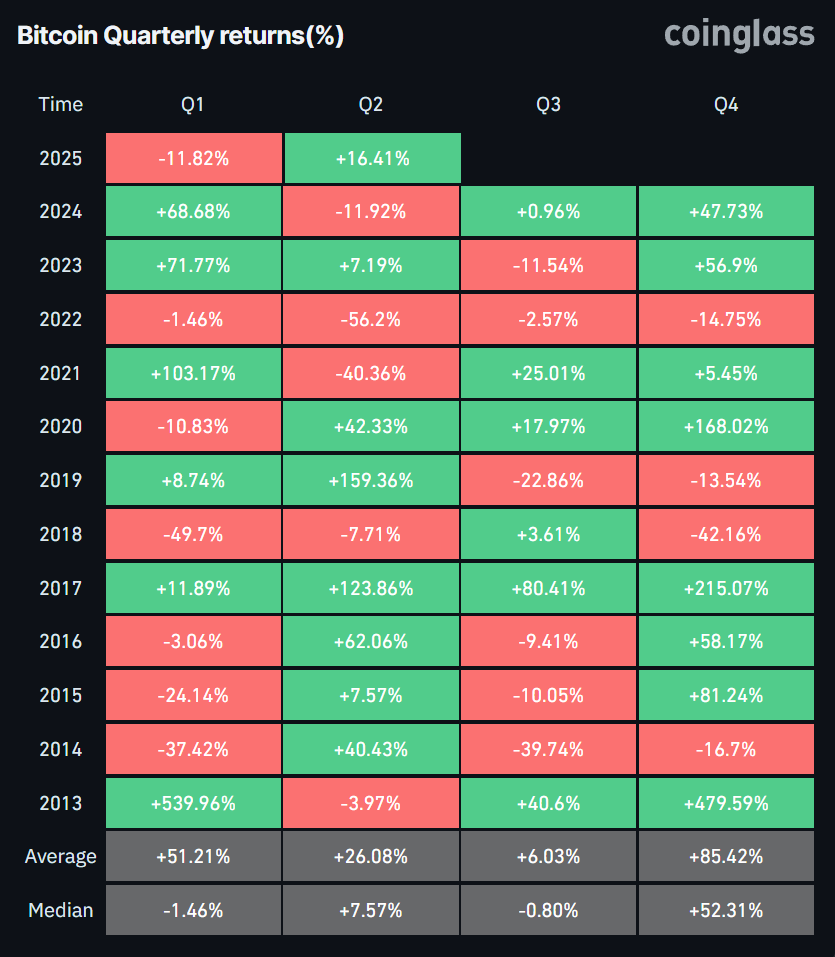

Seasonal trends often cool summer rallies. Historically, Bitcoin averaged a 26% increase in Q2, but the median since 2013 was only 7.6%. Sharp declines like the 56.2% drop in Q2 2022 have occurred.

Q3 is typically weaker, showing an average 6% return with a slightly negative median. As May approaches, many are preparing for the "sell in May" effect in stocks. The S&P 500 has recorded only a 1.8% return from May to October since 1950.

Macro factors are also important. US inflation has eased to 2.4%. The market now expects the Fed to cut rates in late 2025.

A weak dollar supports risk assets like Bitcoin. Spot Bitcoin ETFs saw $3 billion in net inflows at the end of April, showing strong institutional demand.

Overall, whale profits, healthy on-chain signals, and supportive macro trends support Bitcoin's rally.

However, seasonal headwinds and derivative imbalances remain. Traders should set clear risk limits and monitor funding rates and economic news during the summer.