Major altcoin ETH recorded a slight increase of about 1% over the past 24 hours, breaking out of the market downturn. The coin is currently trading at $1,842.

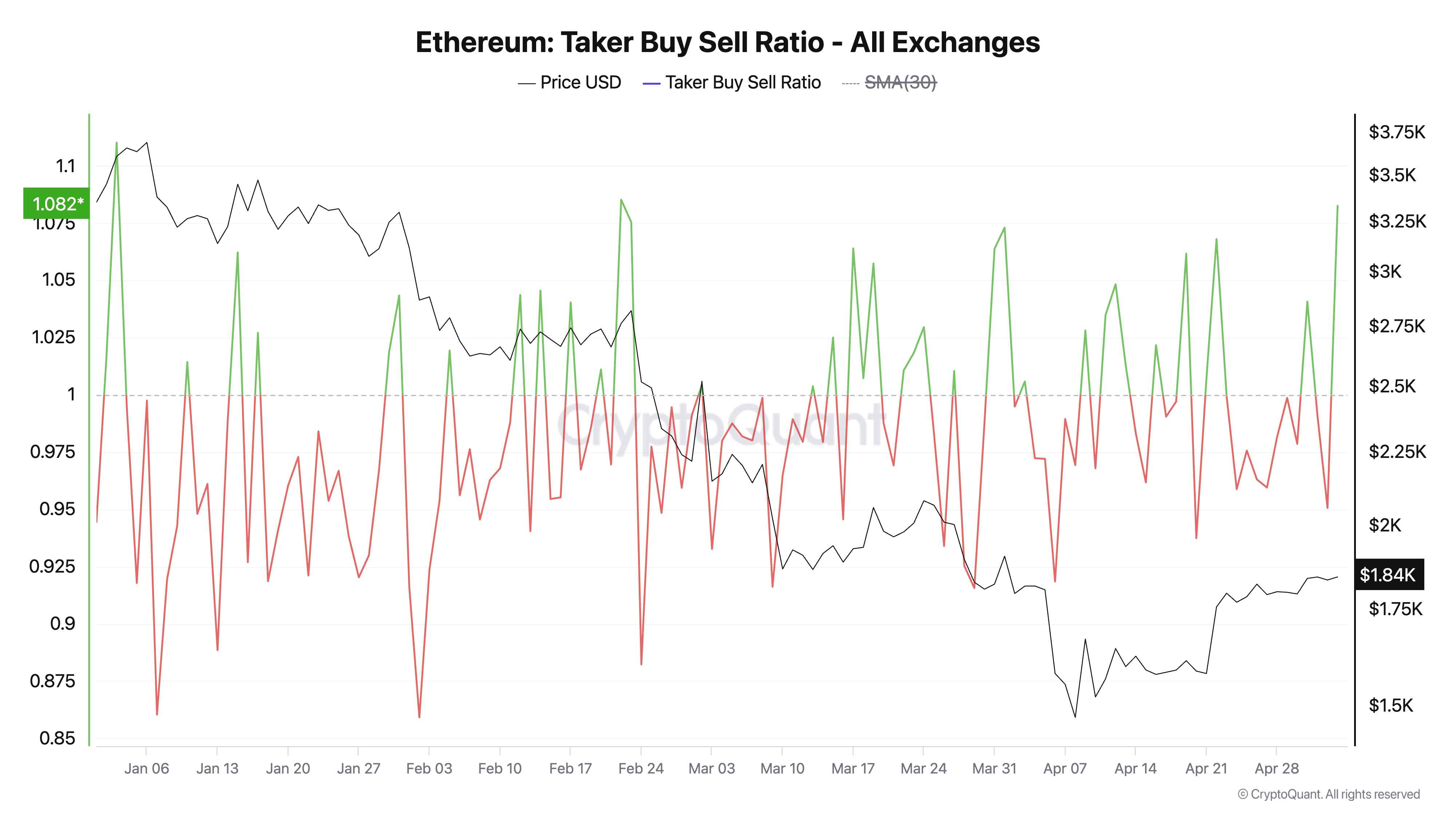

This indicates new buying pressure in the futures market for the asset as the key momentum indicator, the taker buy-sell ratio, has surged to its highest level in 30 days.

Traders Focusing on ETH Rise... Buying Pressure Increases

According to the cryptocurrency on-chain platform CryptoQuant, ETH's taker buy-sell ratio is currently at 1.08, reaching its highest point since early April.

This indicator measures the ratio of buy and sell trading volumes in ETH's futures market. A value above 1 indicates that more traders are actively buying ETH contracts, while a value below 1 suggests selling pressure is prevalent.

The ratio of 1.08 is tilted favorably towards buyers, reflecting traders' confidence that the price will continue to rise.

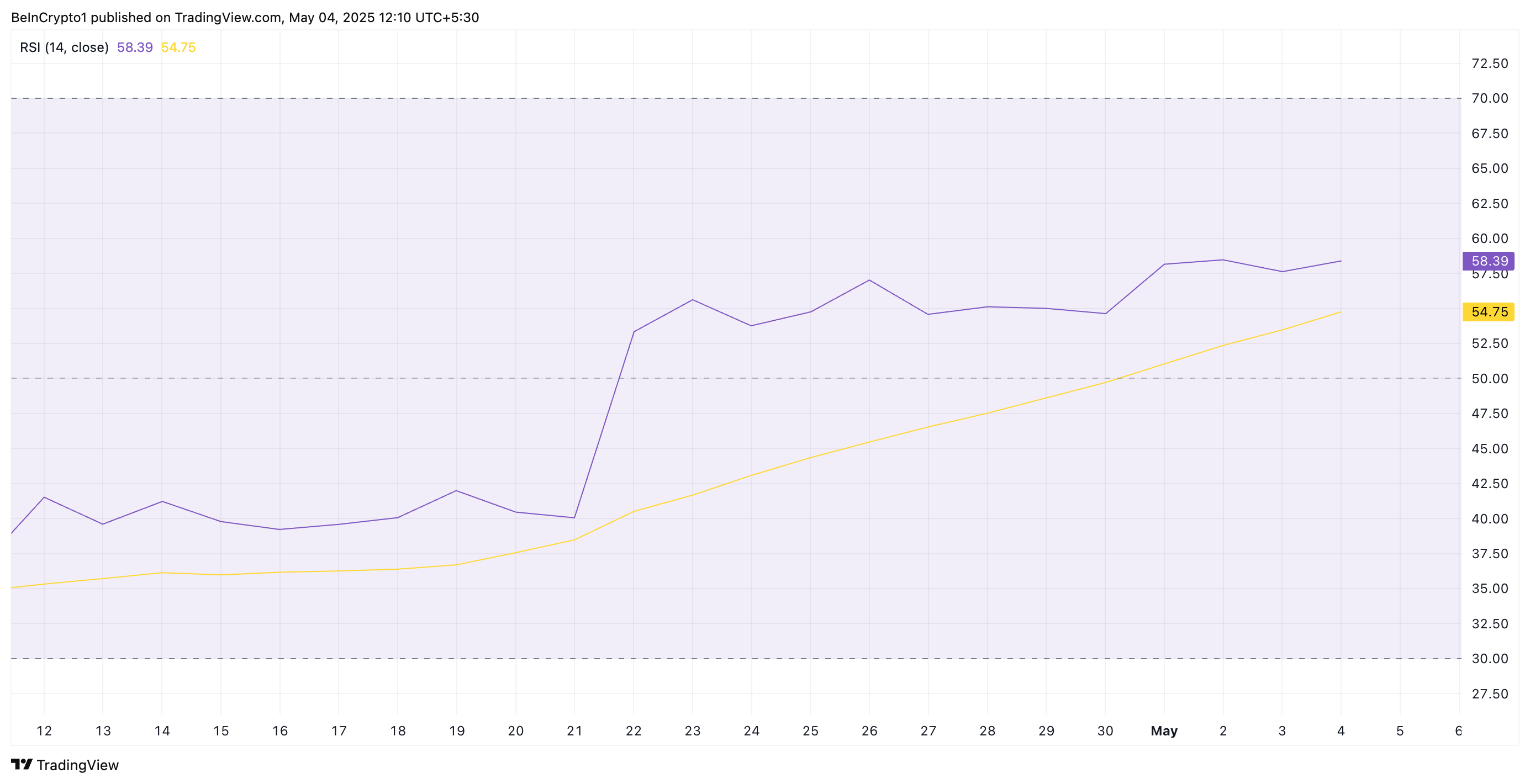

Moreover, the altcoin's Relative Strength Index (RSI) continues to show an upward trend, supporting this positive outlook. The current RSI is rising to 58.39.

The RSI indicator measures the overbought and oversold market conditions of an asset. Ranging from 0 to 100, a value above 70 indicates the asset is overbought and a decline is expected. Conversely, a value below 30 suggests the asset is oversold and a rebound is anticipated.

ETH's RSI value confirms a strong buying bias for the altcoin and strengthens the possibility of further increases.

ETH Building Strength Above Short-Term Support Line

Currently, ETH is positioned above the 20-day Exponential Moving Average (EMA), forming a dynamic support below the price at $1,770.

The 20-day EMA measures the average price of the asset over the past 20 trading days, with more weight given to recent prices. When an asset trades above this key moving average, it indicates short-term upward momentum. This suggests that recent prices are forming higher than the average of the past 20 days. Traders consider this a signal of basic strength or an early upward trend.

Therefore, as buying pressure increases, ETH can maintain its upward trend towards $2,027.

On the other hand, if buying activity decreases, the coin could lose its recent gains and fall below the 20-day EMA, potentially dropping to $1,385.