According to VanEck's digital asset monthly summary for April 2025, Bitcoin (BTC) showed its potential as a macro hedge by outperforming stocks during a highly volatile month.

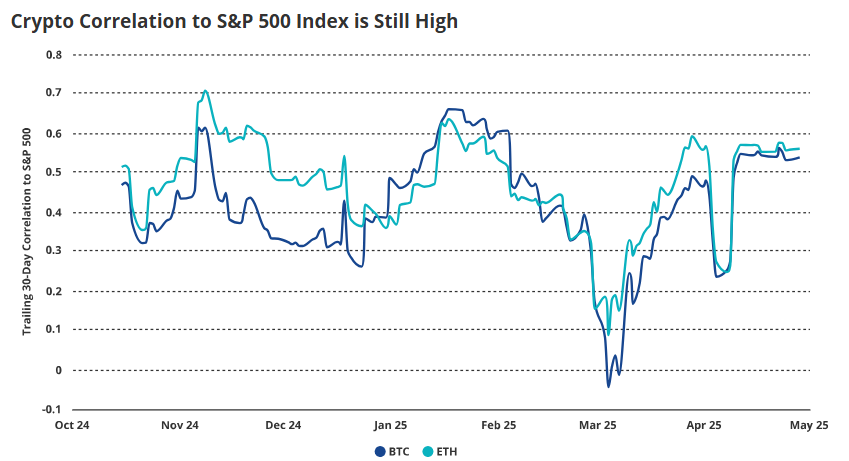

However, the quick return to correlated behavior suggests that Bitcoin is not yet fully prepared to completely independent from risk markets.

April Market Sell-off, Bitcoin Stronger Than Stocks

Bitcoin temporarily diverged from traditional markets like stocks. But its independence may not have lasted long.

"Bitcoin showed separation from stocks during the week ending April 6th." – Matthew Sigel, Head of Digital Assets Research at VanEck wrote.

This period coincided with President Donald Trump's announcement of comprehensive tariff measures, which triggered a global market sell-off. While S&P 500 and gold declined, Bitcoin rose from $81,500 to over $84,500, suggesting a shift in investor perception.

However, that momentum did not last long. As the month progressed, Bitcoin's price movements re-synchronized with stocks. VanEck noted using Artemis XYZ data that the 30-day BTC-S&P 500 correlation dropped below 0.25 in early April but rose back to 0.55 by month's end.

"Bitcoin was not meaningfully decoupled," the report emphasized.

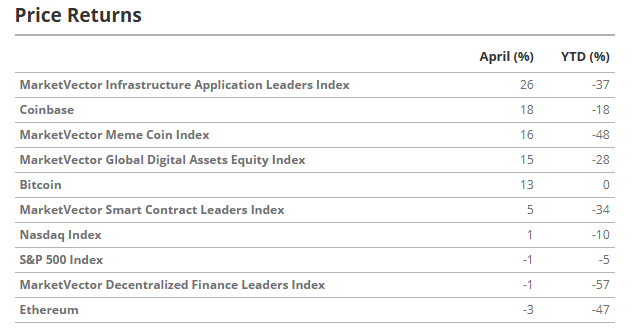

Bitcoin rose 13% in April, outperforming Nasdaq's 1% loss and S&P 500's flat performance. More interestingly, Bitcoin's volatility decreased by 4%, while stock volatility doubled amid geopolitical tensions and trade uncertainty.

While the short-term situation appears confusing, VanEck is observing early signs of structural change. The report emphasizes increasing sovereign and institutional interest in Bitcoin's sovereign and long-term macro hedging potential as a store of value.

"Structural tailwinds are forming. Bitcoin continues to receive support as a sovereign and non-correlated asset," Sigel wrote.

VanEck pointed to Bitcoin's use in international trade by Venezuela and Russia as early signals of this transition.

Corporate Bitcoin Accumulation Increases in April

Meanwhile, corporate BTC accumulation surged in April. Notable purchases included Strategy's (formerly MicroStrategy) 25,400 BTC and companies like Metaplanet and Semler Scientific.

SoftBank, Tether, and Cantor Fitzgerald also announced establishing a new company, 21 Capital, with plans to purchase Bitcoin worth $3 billion.

These developments follow Standard Chartered's claim that Bitcoin is growing as a hedge against traditional finance (TradFi) and U.S. Treasury risks.

Banks argued that Bitcoin's resilience amid currency stress reflects portfolio defense against vulnerabilities in debt markets denominated in fiat currency.

"I believe Bitcoin is a hedge against both TradFi and U.S. Treasury risks. The threat to remove Jerome Powell as Fed Chair constitutes Treasury risk, so hedging is in progress." – Jeff Kendrick, Head of Digital Assets Research at Standard Chartered, told BeInCrypto.

However, this resilience did not extend to the broader cryptocurrency market. According to VanEck, meme coins, speculative DeFi AI tokens, and altcoins like Ethereum and Sui experienced significant declines.

The MarketVector Smart Contract Leaders Index dropped 5% in April and was down 34% year-to-date. Solana stood out as a rare winner, rising 16% thanks to network upgrades and increased institutional financial interest.

Sui entered the top 10 in smart contract platform revenues with a 45% increase in daily DEX trading volume. Meanwhile, Ethereum declined 3%, with its fee revenue market share dropping from 74% two years ago to 14%.

The overall altcoin trend was weak, with speculative energy continuing to decrease. Meme coin trading volume dropped 93% between January and March, and the MarketVector Meme Coin Index fell 48% year-to-date.

Nevertheless, Bitcoin's relative strength in April regarding price and volatility indicators might hint at the asset's future direction. VanEck's report concludes that while Bitcoin has not yet completely broken away from risk asset behavior, the foundations for long-term separation are quietly being laid.