Bitcoin (BTC) and the broader cryptocurrency market are waiting for the Federal Open Market Committee (FOMC) meeting and Jerome Powell's press conference on Wednesday.

The U.S. Federal Reserve will announce its latest interest rate decision on Wednesday.

Bitcoin Awaits FOMC Ruling... Cryptocurrency Market Tense

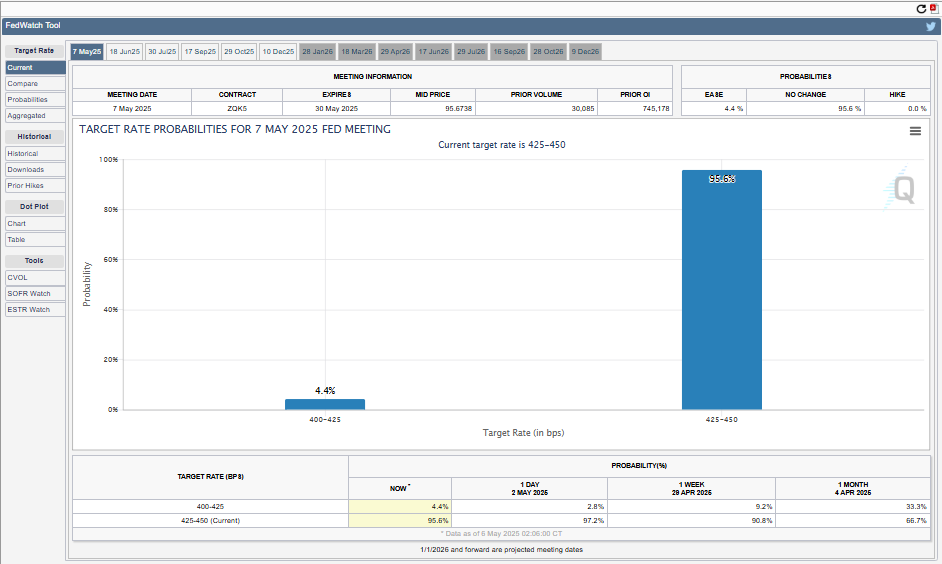

According to data from the CME FedWatch Tool, market participants see a 95.6% probability that the Fed will maintain interest rates at 4.25% – 4.5%. Accordingly, they are focusing on the tone and guidance of Fed Chair Jerome Powell at Wednesday's meeting.

"...if 3.5% [currently 4.4%] is realized, the market will show an enormous positive reaction," Bitcoin Sensus wrote.

Despite the high likelihood of the Fed maintaining interest rates, volatility is almost certain. Traders are taking a risk-averse stance, and Bitcoin price is establishing a bottom in the range of $94,000.

Similarly, ETF inflows are slowing down, and liquidations are increasing. Swiss Block analysts describe this as a "battle" of resistance. They cite negative funding rates and high open interest, saying that bears are strengthening their short positions.

"The $97,000–$98,500 range is crucial. Momentum can trigger short liquidations and raise BTC. But be careful: if confidence disappears, the bear trap can turn into a bull trap," Swiss Block warned.

This week's FOMC meeting is a critical moment for risk assets. According to past data, three out of the last five FOMC decisions have yielded positive results for Bitcoin. However, this meeting is taking place amid high uncertainty.

The market is still digesting weak GDP figures, ongoing trade war tensions, and inflation concerns. Particularly, Trump's tariff statements have blurred expectations of a June rate cut.

"The May FOMC meeting this Wednesday will lead to a rate hold, and June expectations have also changed to a hold," veteran trader Matthew Dixon mentioned.

Powell's Remarks: Bitcoin Surge or Crash?

This ambiguity is fueling market anxiety. In December 2023, Powell's hawkish turn caused a "bloodbath" across risk markets, and some traders fear it might repeat this time.

"Bull markets don't die of old age—they are murdered by the Fed. If Powell's tone reflects the December bloodbath or ignores negative GDP, the market could repeat the same violent crash... It's a drunk dart game for Wall Street analysts," trader Jim said.

Meanwhile, analysts like Michael van de Poppe are viewing the recent gold rally as a cautious signal.

"We are still seeing risk-averse sentiment ahead of the Fed meeting... Bitcoin accumulation is good... I expect Ethereum to rise after Wednesday," he said.

Another analyst, Crypto Seth, observed increasing degen activity as Bitcoin price forms a local bottom near $94,000.

"Degens are building positions anticipating movement. Market makers might drive the price down before taking long positions... Bitcoin could be highly volatile until the FOMC," he said.

The broader macroeconomic backdrop is equally uncertain. Analysts point to how US-China trade tensions impact consumption, labor markets, and ultimately political outcomes.

"Uncertainty is now a burden, not a negotiation tool for Trump." – They argued.

Amid the swirling fear, a breakthrough remains possible. If Jerome Powell takes a more dovish stance or hints at rate cuts by year-end, an upward trend could begin. According to BitMEX co-founder and former CEO Arthur Hayes, Bitcoin price could surge if the Fed switches to quantitative easing (QE).

However, if the Fed reinforces a hawkish stance, Bitcoin might revisit recent lows. As the Wednesday FOMC meeting approaches, the market is walking a tightrope, with all eyes focused on Powell's decision.

According to BeInCrypto data, Bitcoin is currently trading at $94,474, down 0.16% in the last 24 hours.