Ethereum is preparing for the upcoming Pectra upgrade tomorrow, and on-chain data suggests that validators are preparing for market volatility.

Despite ETH's poor price performance last week, the decrease in validator exits indicates confidence among network participants.

Ethereum Validators Remain Robust Ahead of Pectra

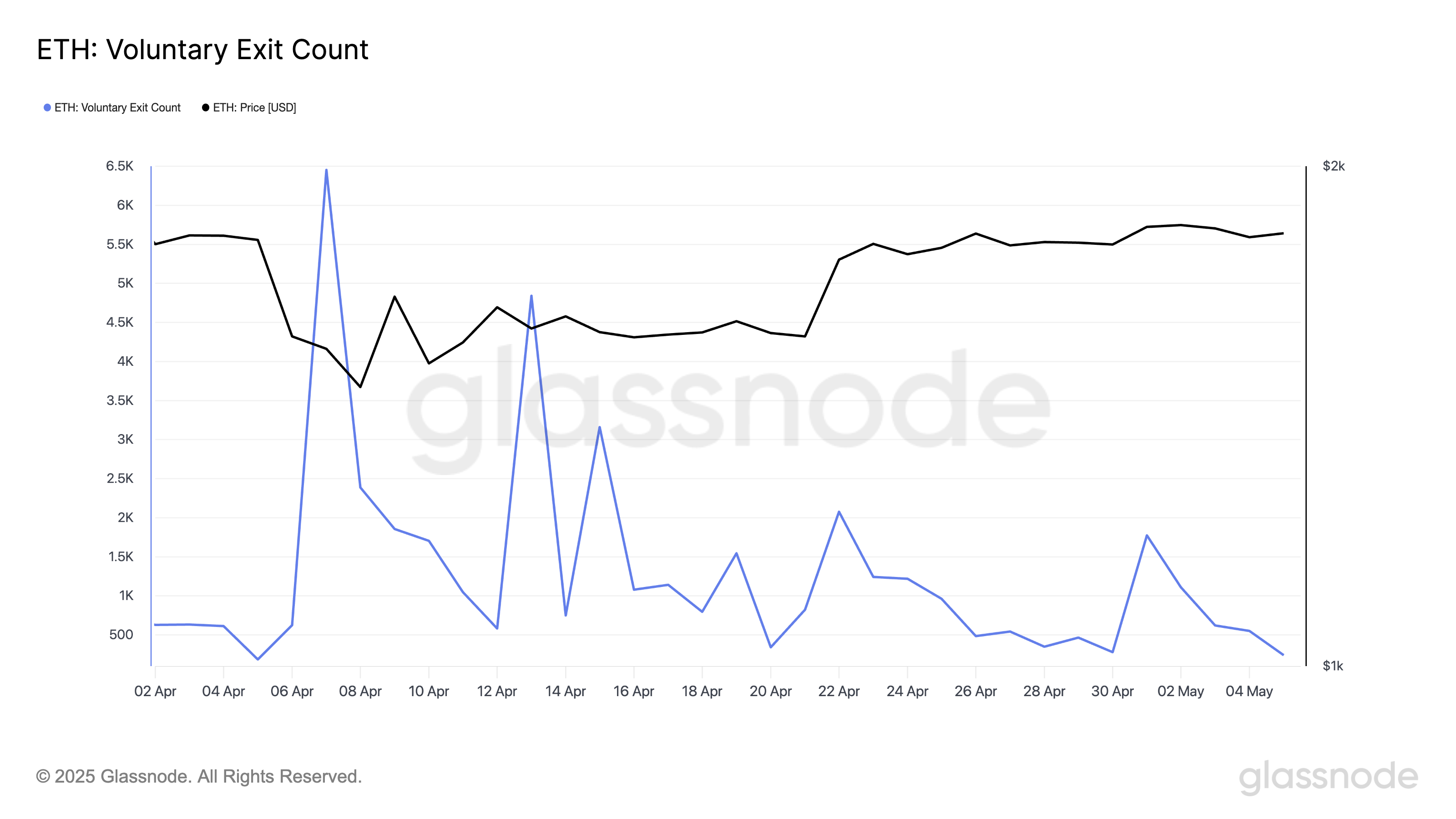

According to glassnode, the number of voluntary exits of Ethereum validators has noticeably decreased since May 1st, indicating fewer validators leaving the network. On May 5th, only 238 validators left the network, which is the lowest daily validator exit count since April 5th.

This trend indicates that more validators are choosing to remain rather than liquidating their staked ETH, which is a signal of long-term confidence in the network and its coin.

With exits decreasing, Ethereum validators are optimistic about the network's short-term outlook and the potential impact of the Pectra upgrade. If this sentiment continues, it could help lay the groundwork for an ETH rally after the upgrade.

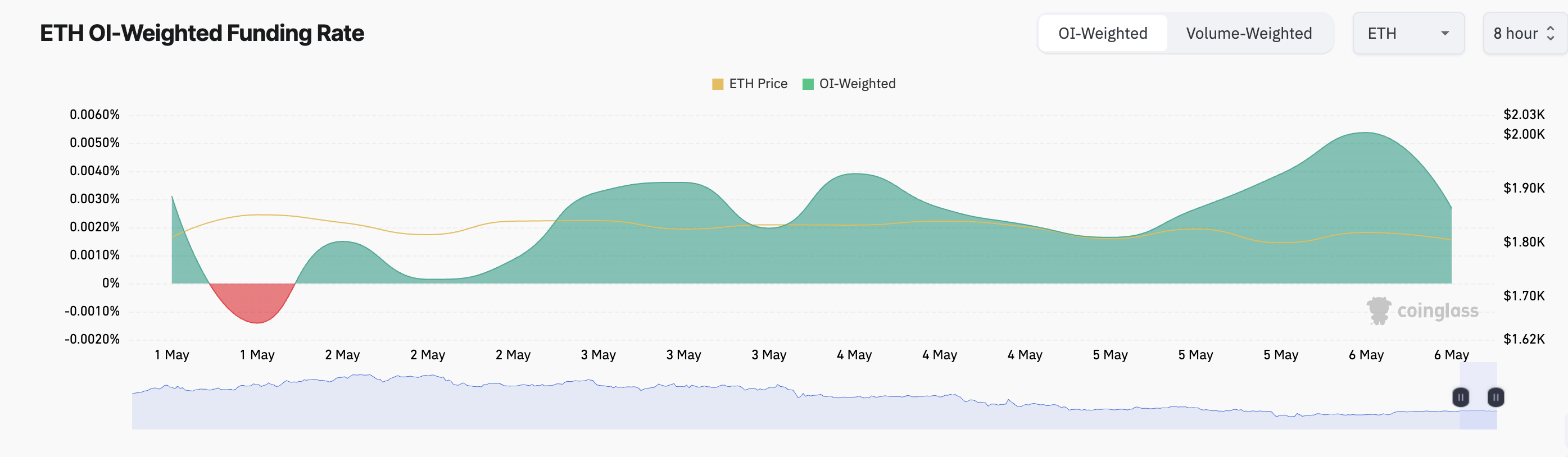

Moreover, the coin's continued positive funding rate reinforces the bullish sentiment around ETH. At the time of reporting, ETH's funding rate was 0.0027%, indicating that traders are still willing to pay a premium to maintain long positions.

The positive funding rate suggests bullish sentiment dominates the futures market, with long position holders paying costs to maintain trades against short sellers. This dynamic reflects traders' expectations of price increases.

Despite ETH continuing to struggle to definitively break the $2,000 level, futures traders remain optimistic, consistently making leveraged bets and expecting price surges.

Preparing for Bull Market... Concerns of 'Buy the Rumor, Sell the News'

As the Pectra upgrade countdown continues, the decrease in Ethereum validators' exits could reduce ETH's circulating supply and contribute to a bullish breakout after the upgrade. If bullish sentiment persists, ETH's price could rise to $2,027.

However, the risk of a "sell the news" event still exists.

If the upgrade fails to meet market expectations or triggers profit-taking, ETH could face downward pressure despite the optimistic signals from validator behavior. In this case, the price could drop to $1,744.