According to Bitfinex, the key indicators of Bitcoin (BTC) suggest that the current upward cycle has not yet reached its peak, implying the possibility of a continued market rally. However, this optimistic outlook depends on the stabilization of broader macroeconomic conditions.

The report mentioned that a short-term decline is still possible. Nevertheless, if Bitcoin can maintain a critical technical level above $95,000, the overall trend appears positive.

Will Bitcoin's Price Surge Continue?

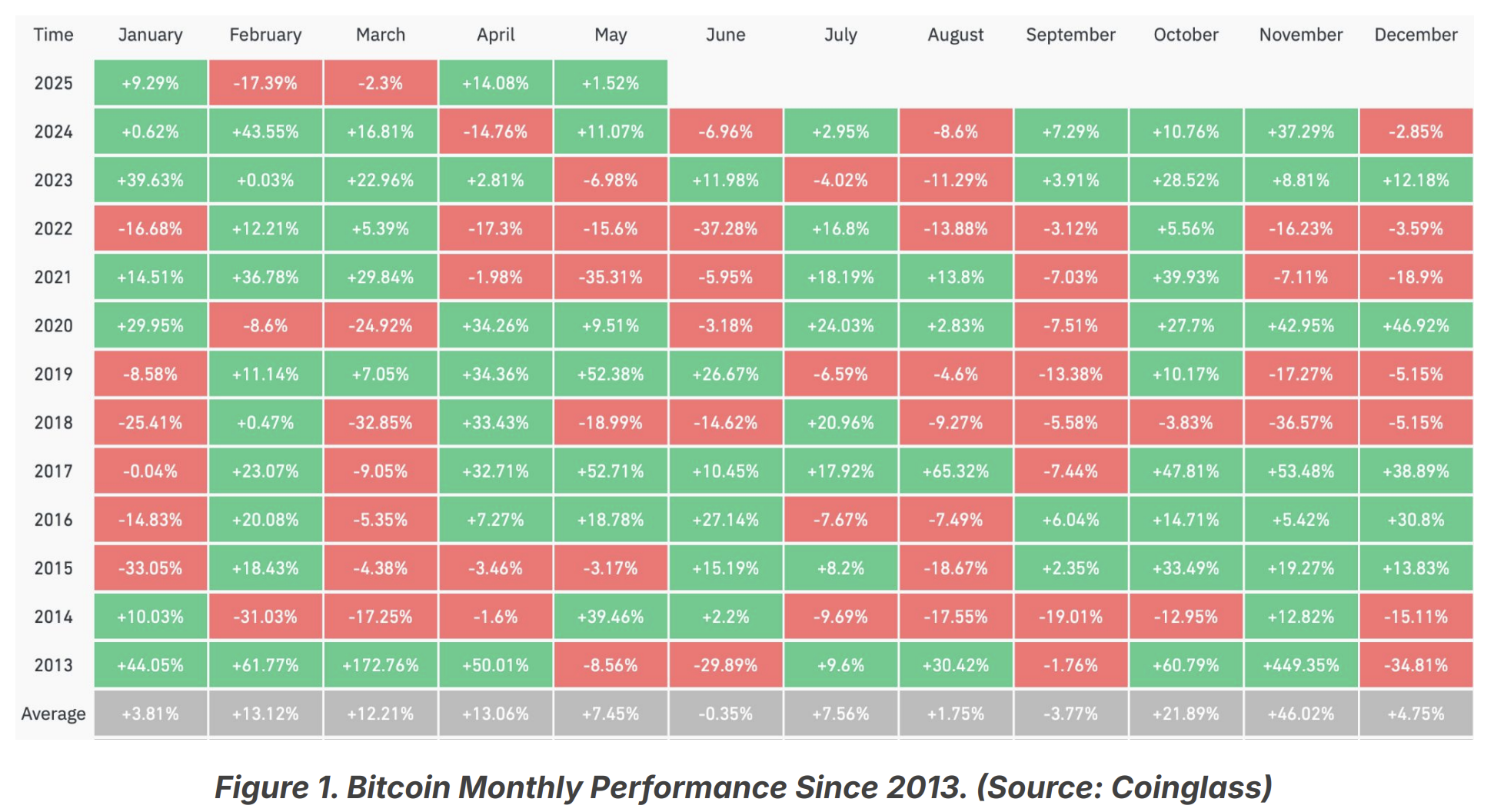

According to Bitfinex's latest report, Bitcoin's April performance exceeded the average return rate. In April 2025, BTC recorded a monthly increase of 14.08%. This was higher than the historical average of 13% and the median return of 7.3%.

"April has traditionally been a strong seasonal month for BTC, but recent years showed more modest results, and this year's performance is even more notable," according to the report.

Particularly, the beginning of the month was challenging for Bitcoin. The Trump administration's tariff announcement caused a price plunge, dropping to $74,501.

However, amid a declining dollar value and inflation concerns, Bitcoin found a new foundation. In the latter part of the month, prices rose again, recovering 32% from the previous low and reaching a local high of $97,900.

This strong finish highlighted Bitcoin's resilience amid macroeconomic uncertainty and reflected investors' optimistic expectations about its future potential. On-chain data further reinforced this.

For example, the stability of miner holdings indicated market confidence. Holdings slightly increased from 1,808,315 BTC in December 2024 to 1,808,674 BTC as of May 5th.

This suggested that miners, who typically sell to cover operational costs, are deliberately adopting a holding strategy. This behavior implied they are anticipating future price increases.

Moreover, the Fuel Multiple, an indicator comparing miner revenues to historical averages, remains below 2. This meant miners do not believe the current price is the market's peak.

Miners typically sell during market rallies or extreme situations, but their continued holding despite recent increases supports the potential for further Bitcoin growth.

"The fact that they are still holding even after recovering 32% from April's low suggests that they may not have seen the final stage of the current upward cycle, despite recent volatility and macroeconomic uncertainties," according to the report.

While the long-term outlook remains positive, Bitfinex emphasized a critical short-term challenge for Bitcoin: recovering the $95,000 level.

"The $95,000 level is currently in a correction and serves as a crucial turning point, acting as the lower boundary of a three-month range that defined the market structure from November 2024 to February 2025," Bitfinex noted.

According to their analysis, transforming the $95,000 level into strong support would indicate the market has shifted to an upward trend. It could also open the possibility of testing all-time highs.

However, if BTC fails to maintain this level, it could become a resistance point for prices. In this case, a short-term decline or correction is expected.

"Therefore, the next few days are likely to determine whether the recent strength will develop into a sustained breakthrough or re-test the lower support zone," the report added.

Bitfinex also assessed the strength of the current Bitcoin rally using the Short-Term Holder (SHT) cost basis, which represents the average purchase price of recently held coins. According to them, this has historically

"served as a boundary between bull and bear markets."

This cost basis is currently at $93,340. Bitcoin successfully broke through this threshold, signaling short-term momentum. However, maintaining this level will be crucial in determining whether the rally continues or loses momentum.

Meanwhile, Bitcoin was trading at $94,236 at the time of reporting, having declined 0.1% over the past day. This is 13.4% below its all-time high. Whether this gap can be closed remains to be seen.