In the past 24 hours, over $200 million in leverage positions were liquidated in the cryptocurrency market.

According to the current aggregated data, short positions overwhelmingly dominated the liquidated positions, showing a unique pattern. This is interpreted as a massive liquidation of short sellers who bet on the recent cryptocurrency market rebound.

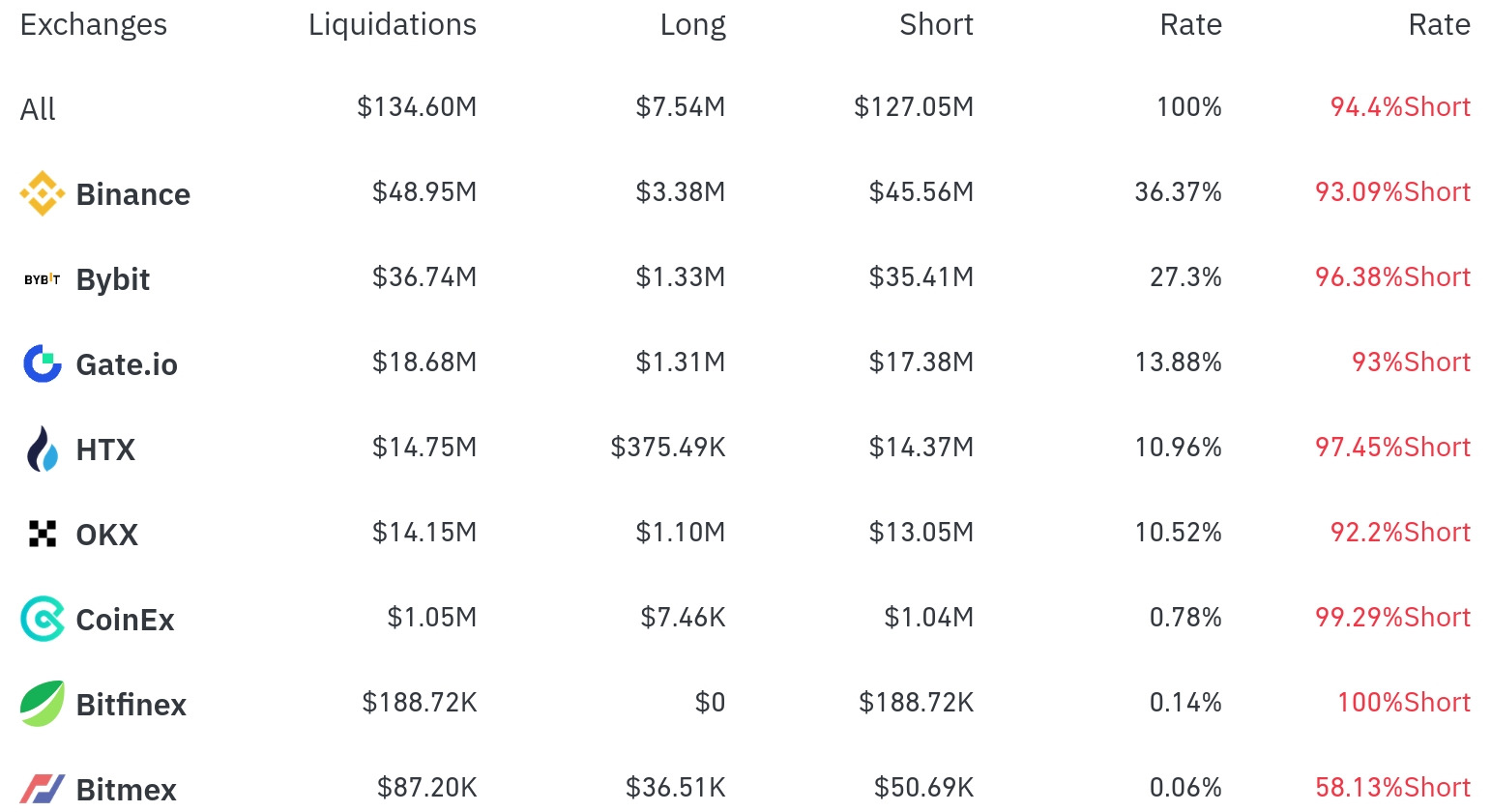

Binance experienced the most position liquidations in the past 4 hours, with a total of $48.95 million (36.37%) liquidated. Among these, short positions accounted for $45.56 million, or 93.09%.

Bybit was the second-highest exchange with liquidations, with $36.74 million (27.3%) of positions liquidated, of which short positions were $35.41 million (96.38%), overwhelmingly dominating.

Gate.io saw approximately $18.68 million (13.88%) in liquidations, with a 93% short position ratio. HTX and OKX also experienced liquidations of $14.75 million and $14.15 million respectively, with both exchanges showing short position liquidation rates exceeding 90%.

By coin, Bitcoin (BTC) had the most liquidated positions. Bitcoin saw approximately $113.58 million in positions liquidated over 24 hours, with $71.49 million in short positions liquidated over 4 hours. Bitcoin's price is currently $98,958, up 2.52% over 24 hours.

Ethereum (ETH) had about $64.29 million in positions liquidated over 24 hours, with $37.13 million in short positions liquidated over 4 hours. Ethereum's price is $1,895, up 3.73% over 24 hours.

Solana (SOL) had approximately $8.63 million liquidated over 24 hours, with its price rising to $151, up 3.35%. Sui (SUI) saw $6.40 million in liquidations with a strong 6.36% price increase.

Doge (DOGE) experienced $4.84 million in liquidations over 24 hours with a 4.52% price increase, with $2.70 million in short positions liquidated over 4 hours.

Notably, the TRUMP Token showed a strong 9.63% increase, with $3.58 million in liquidations over 24 hours. Over 4 hours, $2.51 million in short positions were liquidated.

Additionally, Bitcoin Cash (BCH) saw $1.93 million in liquidations over 24 hours with a steep 9.98% increase.

This large-scale short position liquidation appears to have occurred as the cryptocurrency market shifted to an overall upward trend. Particularly, with top market cap cryptocurrencies rebounding simultaneously, traders who bet on a decline saw massive position liquidations.

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>