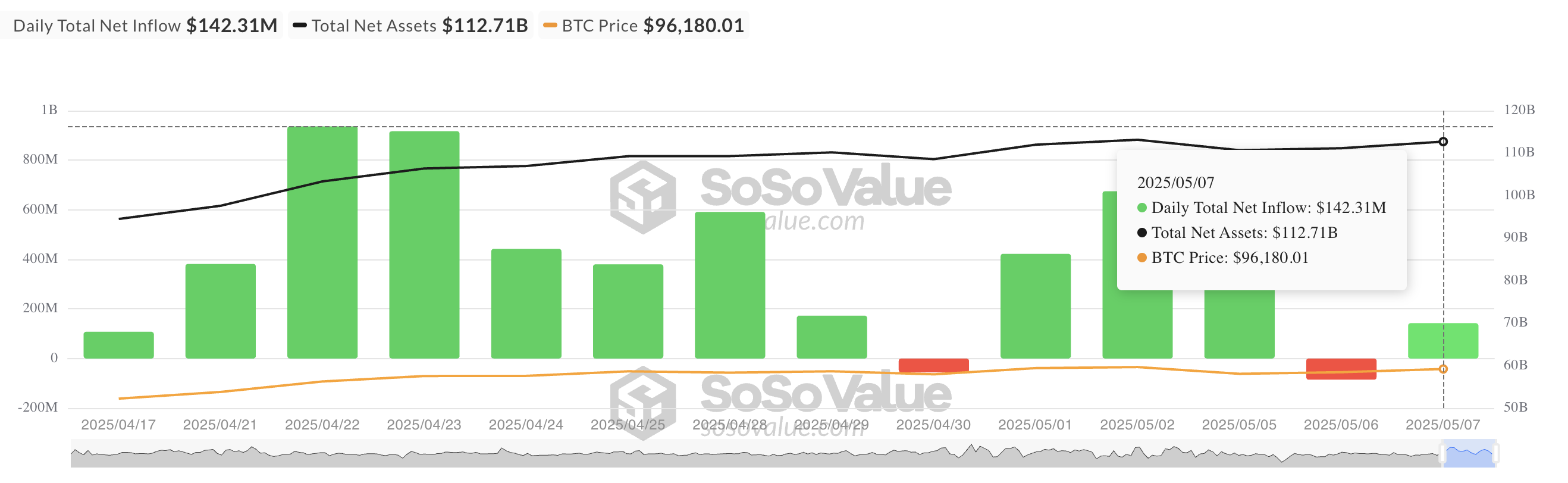

Bitcoin spot ETF experienced a roller coaster week with inflows and outflows as investors reacted to macroeconomic signals.

However, after the US Federal Reserve decided to hold interest rates, a new wave of optimism spread through the market. This decision seems to have reassured investors and reignited institutional interest in BTC-based funds.

Bitcoin ETF Rebound

The week started strongly. On Monday, $425.45 million flowed into BTC spot ETFs. However, on Tuesday, this upward momentum was interrupted as institutional investors withdrew funds ahead of the Federal Open Market Committee (FOMC) meeting, resulting in a net outflow of $85.64 million.

But on Wednesday, the trend reversed thanks to the Fed's decision to hold rates. This announcement rapidly restored investor confidence and triggered a new capital inflow of $142.31 million into BTC ETFs.

On May 7th, Ark Invest and 21Shares' ARKB recorded the largest single-day inflow of $57.73 million, with total cumulative net inflows reaching $2.68 billion.

The second-largest daily inflow was recorded by Fidelity's FBTC, with $39.92 million flowing into the fund. FBTC's total historical net inflow now stands at $11.64 billion.

According to SosoValue, no fund recorded a net outflow on Wednesday.

Options and Futures Signal Bitcoin Strength

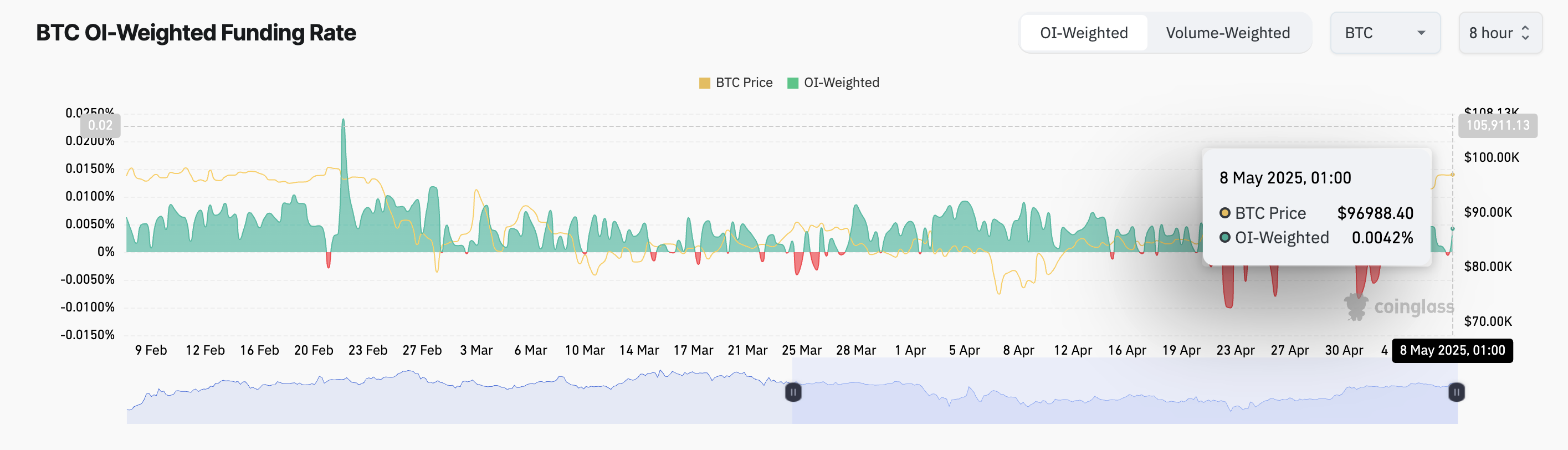

The new optimism extends beyond ETF inflows. BTC has risen 2% in the past 24 hours and is currently trading at $98,888. This price surge is accompanied by a positive funding rate, indicating an increase in leveraged long positions.

At the time of reporting, this is 0.0042%. The funding rate is a periodic fee exchanged between long and short positions in perpetual futures contracts to align prices with the spot market. When positive, long position holders pay shorts, indicating a dominant upward trend in the BTC market.

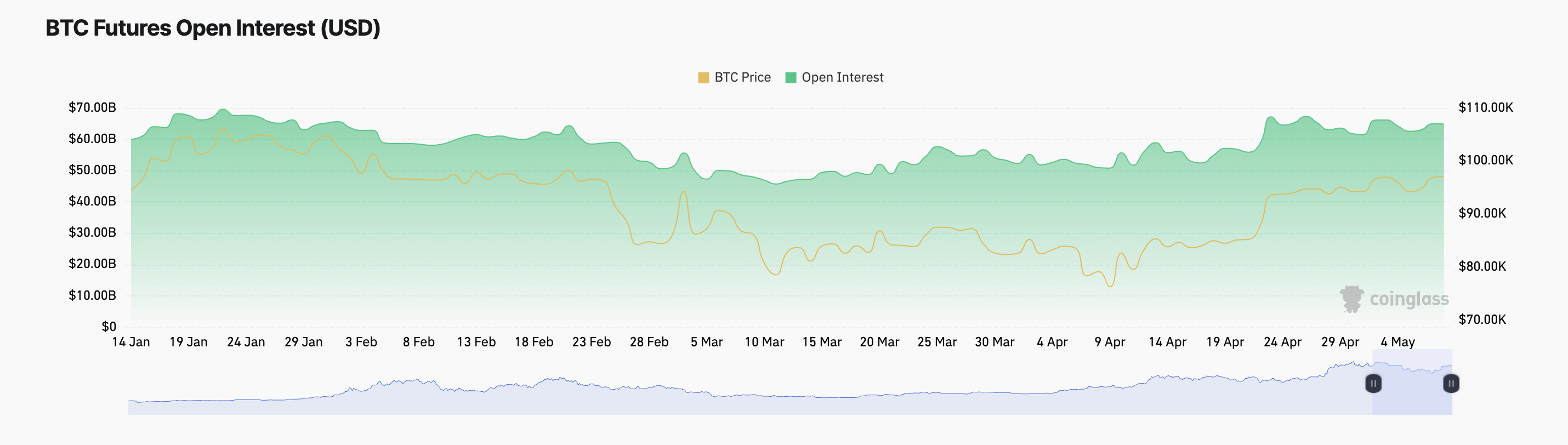

However, notably, BTC's futures open interest decreased slightly by 0.18% over the past day, suggesting that while traders are generally optimistic, some leveraged positions may have been liquidated as BTC surged.

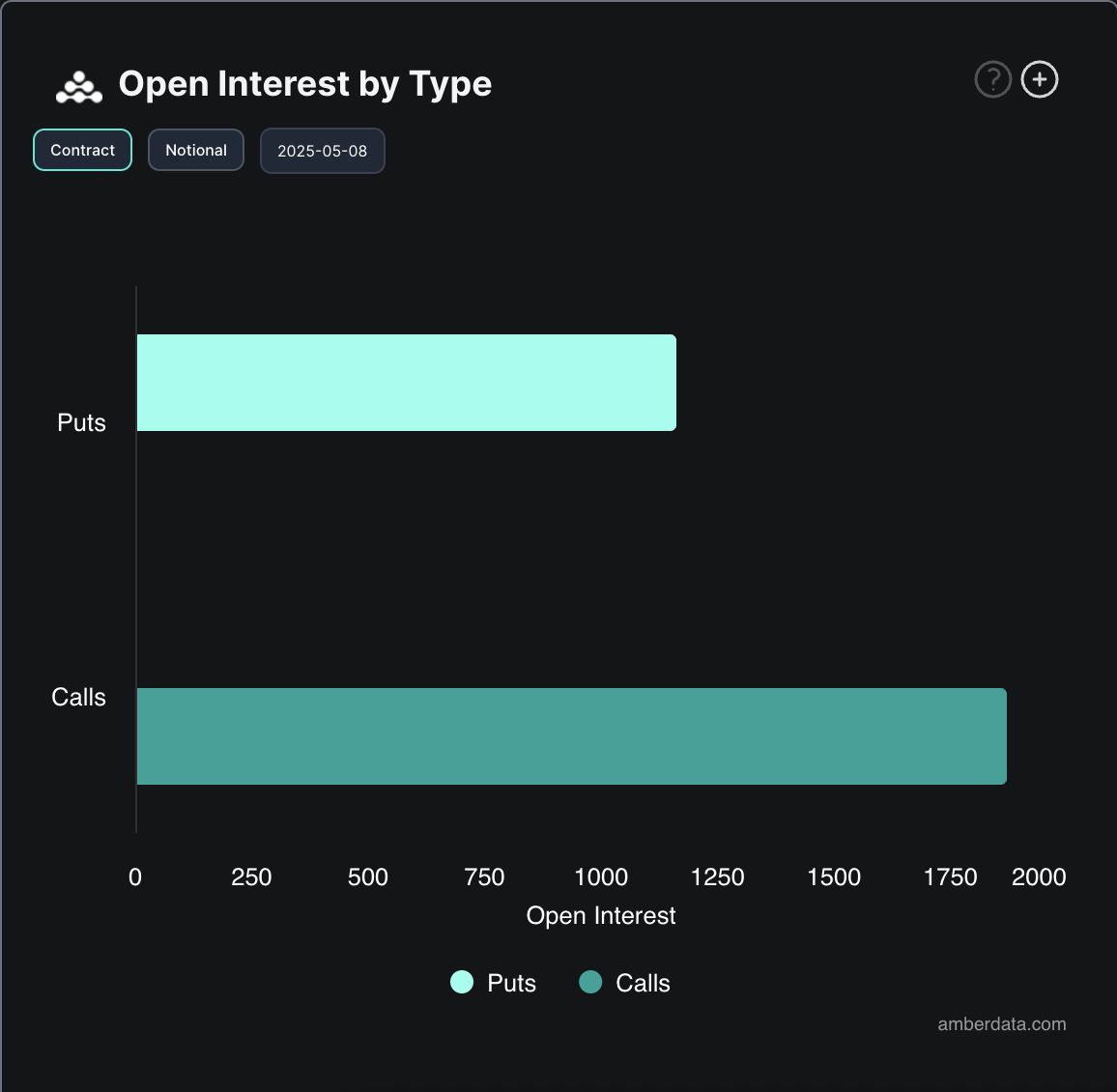

Meanwhile, traders also captured an upward trend in the options market. Demand for call options has surged, exceeding puts, indicating traders increasingly anticipate an upward movement.

These trends suggest growing confidence that BTC could rise even higher if macroeconomic conditions remain favorable.