While the U.S. Federal Reserve (Fed) has frozen interest rates for three consecutive times, Bitcoin (BTC) price retreated to the $95,000 range at one point but successfully rebounded, currently trading around $97,000.

According to CoinMarketCap, a global virtual asset market site, as of 8 am on this day, BTC was trading at $97,254.99, up 1.04% from the previous day. At the same time, Ethereum (ETH), the leading altcoin, recorded $1,817.24, up 0.32%. XRP dropped 0.95%, trading at $2.12 per coin. Solana (SOL) rose 1.12% to $147.78.

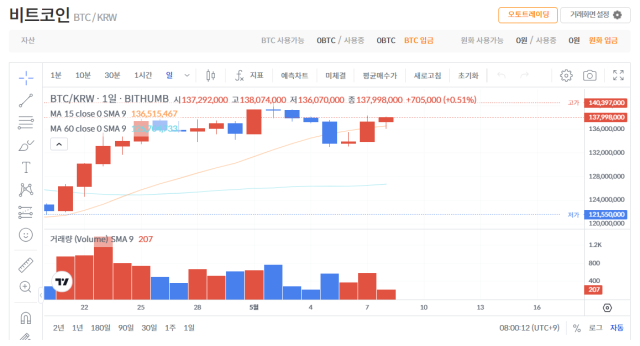

At Bithumb, a domestic exchange, BTC recorded 137,998,000 won, up 0.51% from the previous day. ETH was down 0.04% to 2,581,000 won, and XRP was trading at 3,020 won, up 0.13%.

At the Federal Open Market Committee (FOMC) meeting, the Fed maintained the current interest rate at 4.25-4.5% and essentially suggested no rate cut in June. In its statement, the Fed noted that "economic forecast uncertainty has increased" and "the risk of higher unemployment and inflation has grown". Accordingly, the New York stock market initially declined but eventually closed higher after news of potential AI semiconductor regulation relaxation from the Trump administration.

BTC showed a similar trend. After the interest rate freeze announcement, BTC price dropped to the $95,800 range at one point but rebounded, currently trading around $97,000.

The Crypto Fear and Greed Index from alternative data analysis company Alternative.me recorded 67 points, up 8 points from the previous day, maintaining a 'greed' state. The index indicates that values closer to 0 suggest a contracted investment sentiment, while values closer to 100 indicate market overheating.

- Reporter Shin Jung-seop

- jseop@sedaily.com

< Copyright ⓒ Decenter, reproduction and redistribution prohibited >