Bitcoin (BTC) enters an important zone with unstable trading in the second week of May. Conflicting technical signals and increasing macroeconomic uncertainty shape short-term expectations. While the ADX of the Directional Movement Index is rising, downward pressure remains dominant and momentum is weak across multiple indicators.

Although the price maintains support at $92,900, the weakening moving averages and the upcoming FOMC meeting make Bitcoin's path to recovery at $100,000 uncertain, but not impossible.

BTC Trend Strength Rising... Still Dominated by Bears

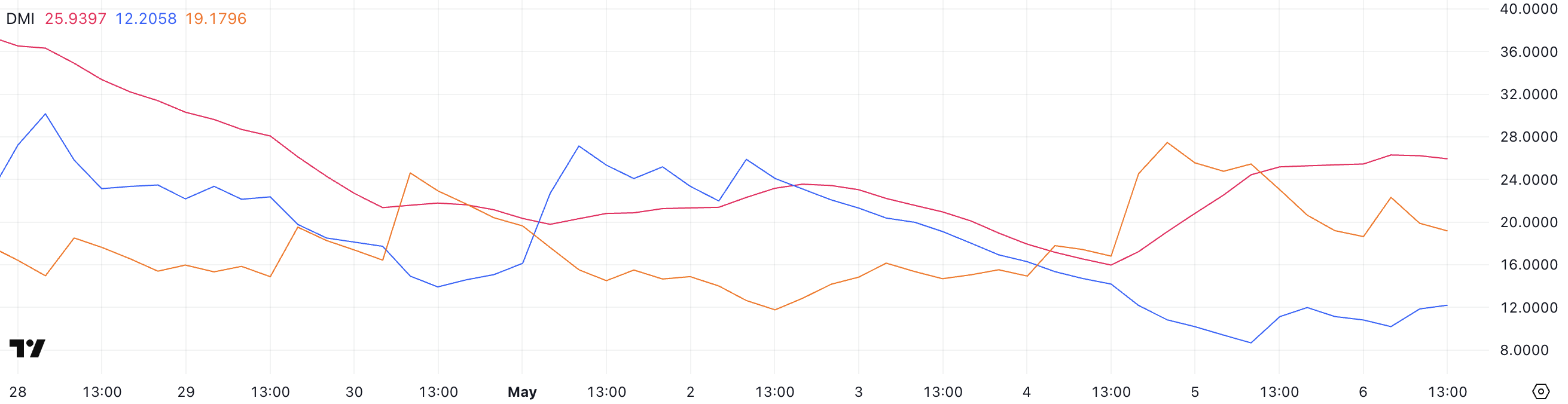

Bitcoin's Directional Movement Index (DMI) shows notable changes.

The ADX, which measures trend strength regardless of direction, has sharply jumped from 15.97 to 25.93 two days ago. This exceeded the key threshold of 25, indicating a trend is beginning.

This rising ADX suggests volatility is returning, and while the direction itself remains unclear, a new directional movement may be forming.

Looking at the DMI components, +DI (upward strength) slightly rebounded from yesterday's low of 8.67 to 12.2, but remains significantly down from 21.31 three days ago.

Meanwhile, -DI (downward strength) is at 19.17, slightly down from its peak of 25.44 but still higher than three days ago. This indicates that recent downward momentum has somewhat eased, but sellers still maintain the upper hand.

With the ADX rising and -DI leading, Bitcoin could face pressure unless +DI recovers sharply.

Bitcoin Trapped Below Ichimoku Cloud, Momentum Stagnant

The current Bitcoin Ichimoku chart reflects a market correction with a slight downward trend. Price movement is positioned very close to the blue baseline, typically indicating medium-term trend momentum.

Trading below this line suggests BTC lacks the strength to recover short-term upward momentum. White candlesticks floating near the cloud's lower boundary indicate uncertainty among traders, with no clear breakout visible.

At this stage, the green cloud itself is relatively thin, implying a vulnerable support zone that could easily break if downward pressure returns.

Moving forward, the red Leading Span B at the expected cloud's top acts as a dynamic resistance, limiting upward attempts. For a stronger upward signal, BTC must definitively close above the baseline and entire cloud.

Complicating matters further, the conversion line is flat and overlapping with the baseline, indicating weak momentum and lack of direction. Flat conversion and baseline lines often herald sideways movement or delayed trend development.

Until Bitcoin definitively breaks above the cloud with increased volume, the current setup leans neutral to bearish, with price trapped in a zone of low confidence and limited momentum.

Bitcoin's $100,000 Recovery Prospects... Maintaining Critical Support

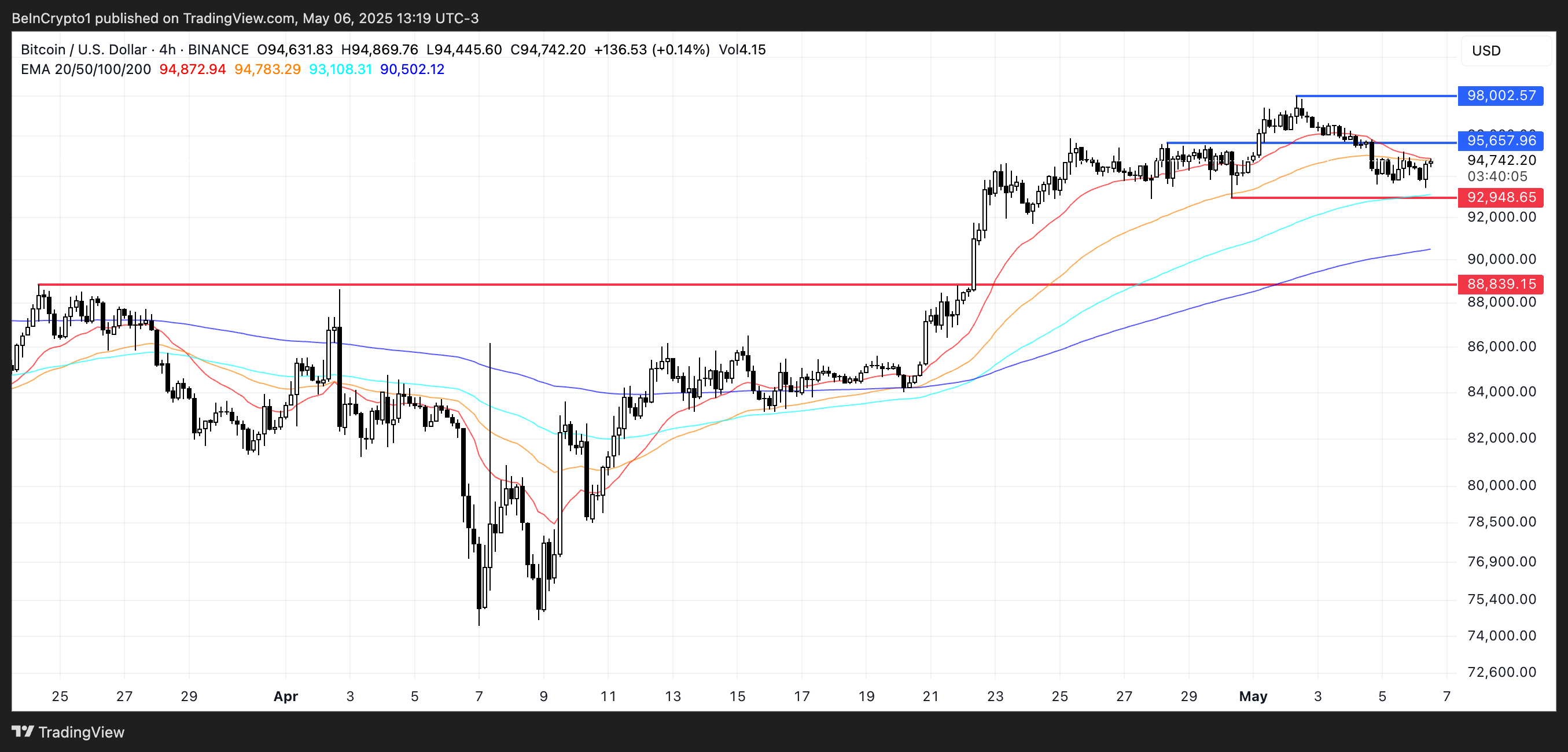

Bitcoin price has remained solidly above $90,000 since April 22nd. Repeatedly maintaining support near $92,945, it remains stable despite broader market uncertainty. Exponential Moving Averages (EMAs) still reflect an upward structure, with short-term averages positioned above long-term averages.

However, initial signs of momentum weakening emerge as short-term EMAs begin to slope downward. This suggests buyers might soon lose strength.

If BTC fails to maintain key support, it could drop to $88,839, potentially breaking a structure maintained for over two weeks.

Nevertheless, some analysts remain confident. Nick Purin, founder of Coin Buro, believes Bitcoin is positioned to recover $100,000, despite upcoming FOMC meeting volatility:

"This week will be highly volatile. First, there's the FOMC meeting tomorrow. While it's clear there won't be a rate cut, Powell's statements could move markets. Moreover, with low trading volume and long/short ratio at 50/50, BTC could move in either direction. The good news is significant buying interest exists between $90,000 and $93,000, so a drop to that level isn't concerning. It will likely rebound. Overall, the BTC/USD chart continues to record higher lows and looks strong." – Purin told BeInCrypto.

Nick explains the potential impact of the Fed's next decision on markets in the coming months:

"If the Fed provides dovish language and guidance about a June rate cut, Bitcoin has room to rise back to $100,000. It remains a liquidity magnet. However, even if Powell sounds hawkish, the impact on BTC will be minimal. Spot BTC ETFs are absorbing assets, companies are building BTC treasuries, and the correlation between Bitcoin and stocks is breaking down. Moreover, historical data shows BTC has risen in 9 out of 12 Mays. So while volatility might increase, the near future looks promising. Therefore, following the 'sell in May' adage would be crazy at this point." – Purin told BeInCrypto.

Momentum recovery could first see BTC retest resistance, potentially reaching $95,657, and if broken, could lead to $98,002 and ultimately challenge the psychological $100,000 level.

This week, as macro headwinds and technical crossroads converge, the next move will depend on how BTC responds to the support zone and the market's overall reaction to the Federal Reserve's statements.