Over the past 24 hours, the cryptocurrency market experienced significant volatility as Bitcoin (BTC) officially broke through $100,000. This price movement triggered massive liquidations of nearly $1 billion across the market and led to changes in trader behavior.

Additionally, the Bitcoin derivatives market data is heating up. Analysts are concerned about the potential for a larger liquidation wave.

Bitcoin Breaks $100,000... Long Position Liquidations Surge

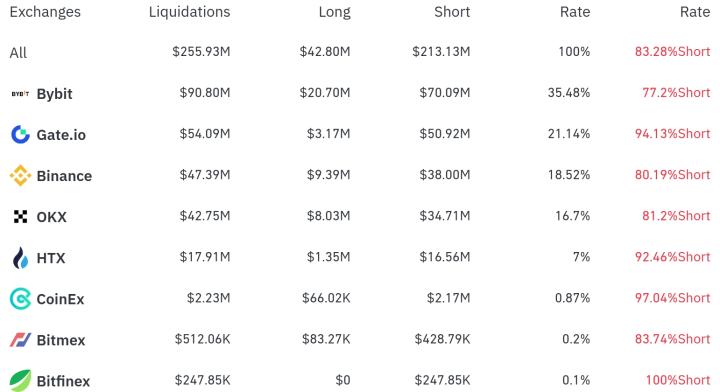

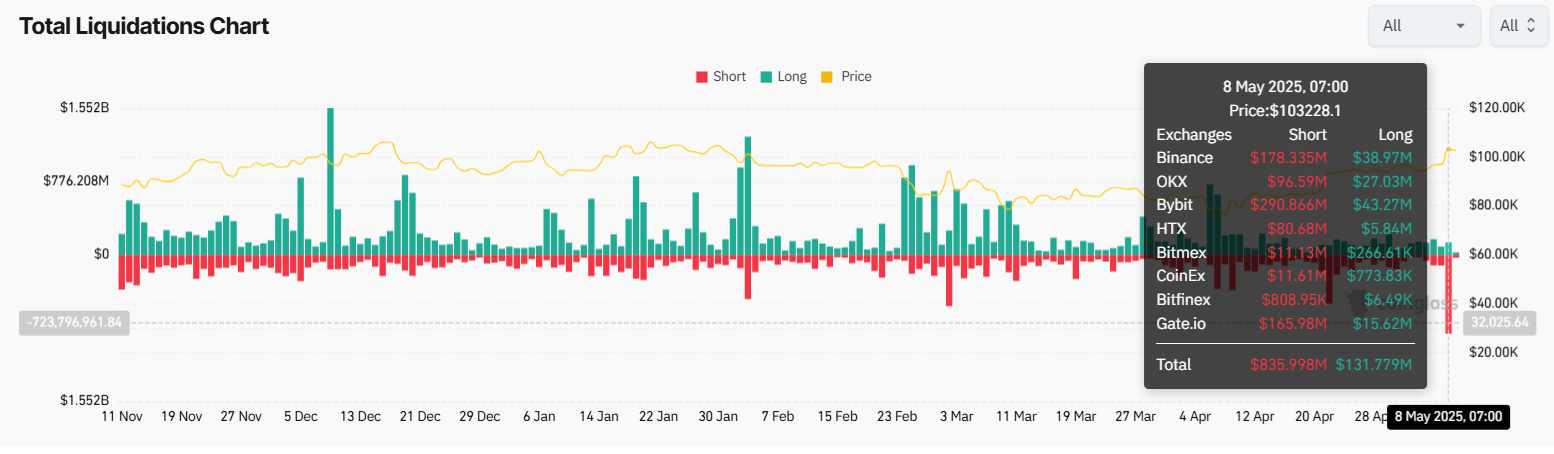

According to Coinglass data, approximately 190,000 traders were liquidated, with total losses reaching $970 million. Short positions were hit the hardest, recording $836 million in losses. This is the largest short liquidation event since 2021. Coinglass mentioned that the actual numbers could be even higher.

"This is the largest short liquidation since 2021... Binance has not fully disclosed liquidation data, and the actual data is higher." – Coinglass statement.

While short positions were liquidated, the market faces a new risk: a sharp increase in long positions.

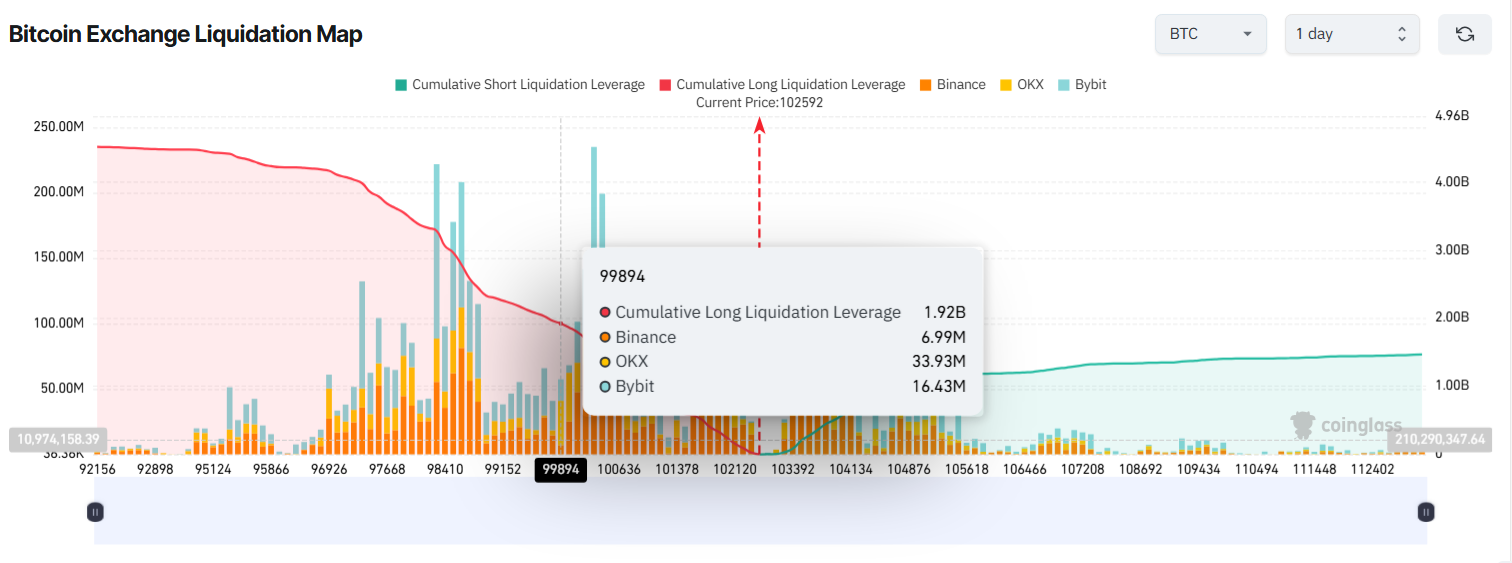

According to Coinglass's 24-hour Bitcoin liquidation map, if Bitcoin drops below $100,000, long positions across exchanges could face liquidations of nearly $2 billion. This raises concerns about a potential "long squeeze" where large long position liquidations could trigger panic selling and accelerate price declines.

The same map shows that total liquidations could reach $3.45 billion if Bitcoin falls below $98,000.

The overwhelming potential liquidations in long positions indicate a shift in trader psychology. Many are expecting Bitcoin's price to continue rising, placing more money and using higher leverage.

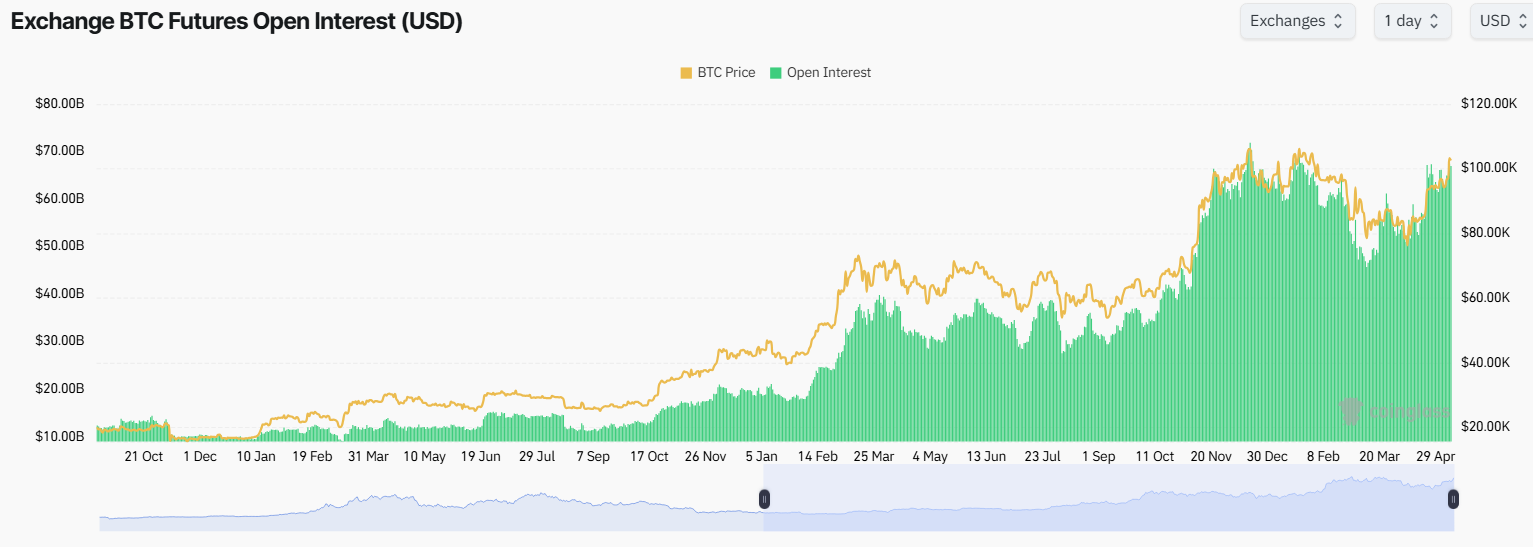

Additionally, Coinglass data shows that Bitcoin futures open interest across exchanges has reached an all-time high of $67.4 billion. This reflects a surge in demand for short-term leveraged trading. Traders are making large bets on the upward trend, which increases risk if the market suddenly reverses.

Historically, whenever Bitcoin's open interest exceeded $65 billion, a market correction soon followed.

Bitcoin is gaining attention not only for breaking $100,000 but also for its increasing influence in global finance. At one point, Bitcoin surpassed Amazon to become the fifth-largest asset globally, with a market capitalization of $2.05 trillion. Meanwhile, Standard Chartered predicts that Bitcoin may soon reach an all-time high and could reach $120,000 in the second quarter.