Bitcoin's once predictable boom and bust cycle is becoming increasingly meaningless, according to CryptoQuant CEO Ki Young Ju.

This opinion comes as BTC price maintains levels above $100,000, with the pioneering cryptocurrency gaining tailwinds from institutional interest and macroeconomic trends.

CEO Ki Young Ju: "Bitcoin Cycle Theory is Outdated"

Ki Young Ju, CryptoQuant CEO, admitted that his prediction two months ago about the end of Bitcoin's upward cycle was incorrect.

"Two months ago, I said the upward cycle was ending, but I was wrong. Bitcoin selling pressure is easing, and massive inflows are happening through ETFs... In the past, the market was quite simple... Old whales, miners, and retail investors were passing assets to each other." – Ki Young Ju, CryptoQuant CEO posted.

This opinion emerges as ETF and institutional investors from traditional finance (TradFi) inject new dynamics into the digital asset market. According to CryptoQuant management, ETFs, MicroStrategy (now Strategy), and institutions are writing a new scenario.

Historically, on-chain analysts tracked miner holdings, whale movements, and retail inflows to identify cyclical peaks.

According to Ki Young Ju, this system worked well when everyone was trying to exit the market simultaneously. However, today these indicators are becoming blurred. Strategy currently holds 555,450 BTC and recently purchased an additional 1,895 BTC for $180.3 million.

The company's Bitcoin holdings have increased by 50.1%, thanks to a long-term accumulation strategy and continued institutional confidence, not cyclical timing.

The introduction of spot Bitcoin ETFs in the US and increasing allocations from global TradFi players are forcing analysts to revise their assessments of liquidity flows.

BeInCrypto also reported that US-based ETFs experienced net inflows again in May, which pulled Bitcoin back above $100,000. This milestone further destabilized the traditional cyclical narrative, reflecting the structural changes Ki Young Ju also observes.

"It seems time to discard the cycle theory... Now it's more important how much new liquidity comes from institutions and ETFs rather than old whales' selling." – CryptoQuant analyst

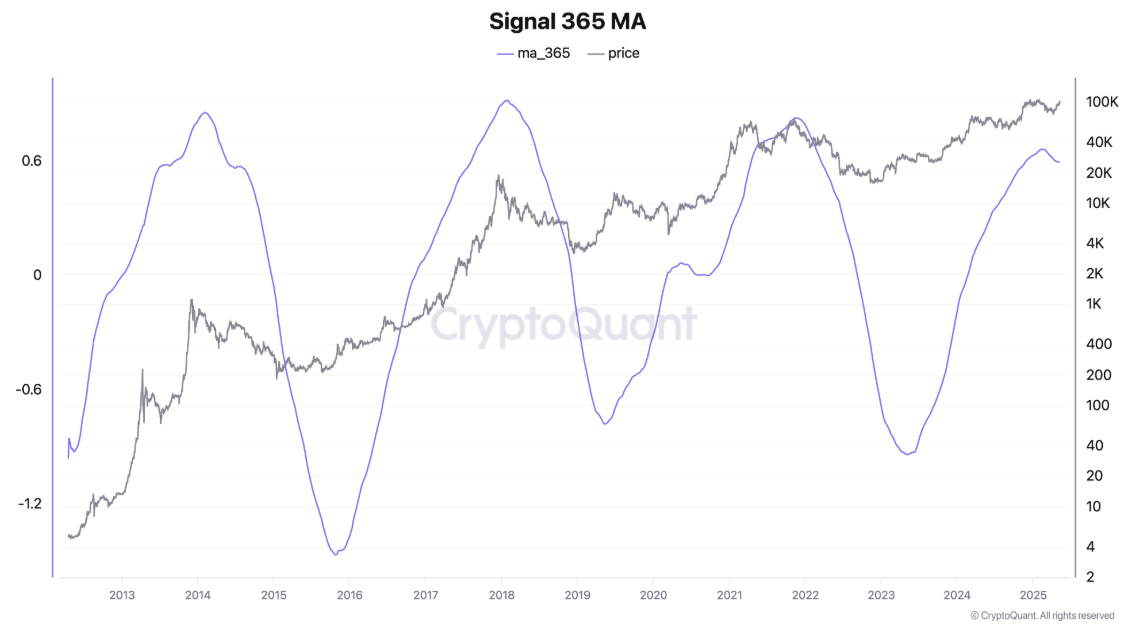

Nevertheless, Ki Young Ju argues that on-chain data still holds analytical value. He mentions the Signal 365 MA chart tracking how far Bitcoin's price deviates from its 365-day moving average as a long-term indicator.

However, this model, which once precisely described cyclical extremes, now shows signs of recalibration amid new variables.

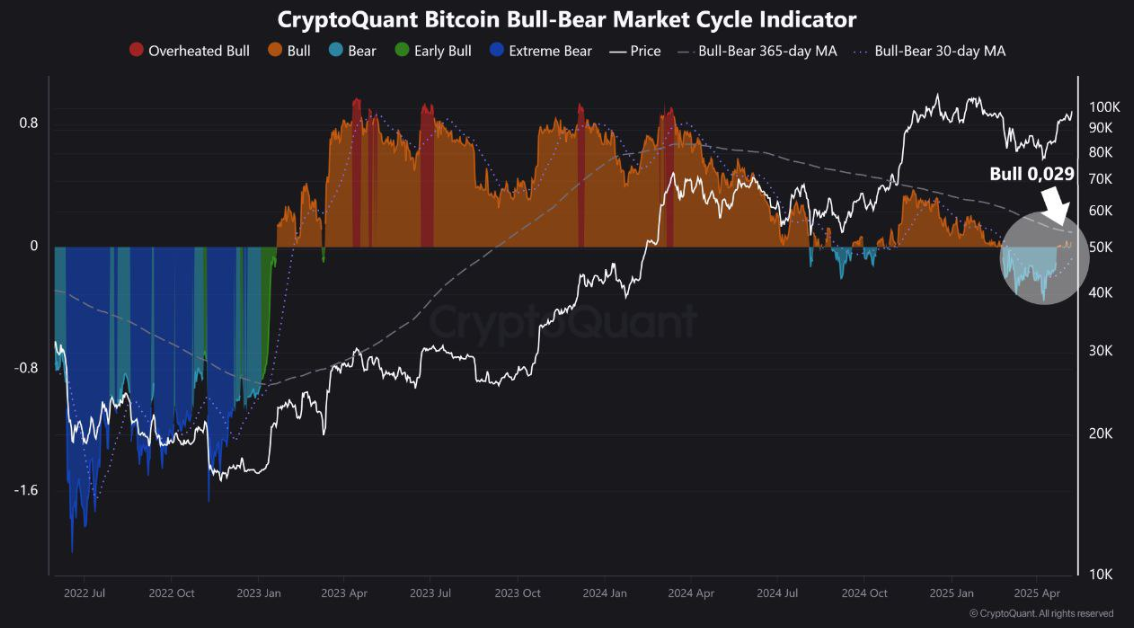

Elsewhere, analyst Kyledoops noted on X that CryptoQuant's Bull-Bear Indicator showed a weak upward signal for the first time since February, as BTC recovered $100,000.

"30DMA is rising. Historically, crossing above 365DMA initiated big moves. It could be nothing, or it could be everything." – Kyledoops observed.

Beyond chart signals, macro forces are also accelerating the convergence of Bitcoin and TradFi. BeInCrypto reported that Bitcoin is increasingly viewed as a hedge against US Treasury risk and fiat currency value decline. This view is also reflected in traditional asset management.

The Bitcoin market no longer fits into old cyclical frameworks. Analysts might need to adjust their frameworks according to ETF inflows, institutional holdings, and TradFi's increasing footprint.

"My being wrong doesn't mean on-chain data is useless. Data is just data, and perspectives vary. I will strive to provide higher-quality analysis going forward." – Ki Young Ju

This perspective suggests that the Bitcoin market is maturing, and the playbook is being rewritten in real-time as TradFi increasingly takes the lead.