This week, the cryptocurrency market experienced a day of judgment and revelation. BlackRock drew attention by warning about the possibility of quantum computing decrypting BTC.

Meanwhile, Pi Network announced a $100 million fund to support Web3 startups. The following is a summary of this week's cryptocurrency headlines, including criticism of Coinbase's mishandling of a large internal data breach.

BlackRock Threatens BTC with Quantum Computing

The major highlight of this week's cryptocurrency was BlackRock's latest ETF submission update. The asset manager sparked a new controversy by warning that quantum computing advancements could weaken BTC's cryptographic foundation.

"To be clear, these are fundamental risk disclosures. They will highlight all potential issues that may arise regarding any listed products or underlying assets invested in. This is completely standard and honestly entirely understandable." – ETF Analyst James Seyfarth

The disclosure in BlackRock's BTC ETF risk statement mentioned that a quantum technology breakthrough could render current security standards obsolete. This was noted as a candid acknowledgment from a financial giant betting on BTC's long-term viability.

While this scenario is hypothetical, BlackRock's inclusion suggests an increasing institutional awareness of risks beyond volatility or regulation.

Theoretically, BTC's reliance on elliptic curve cryptography could be vulnerable to future quantum decryption. While some dismiss this threat as a distant possibility, others agree that preparing post-quantum protection is not too early.

With trillions of dollars potentially flowing into tokenized markets in the next decade, BlackRock's stance adds urgency to ongoing efforts to future-proof blockchain security.

Pi Network Unveils $100 Million Fund… Faces Criticism

Another highlight of this week's cryptocurrency was Pi Network's $100 million fund. BeInCrypto reported that the network plans to allocate 10% of its native token supply to support developers creating apps within its mainnet ecosystem.

The fund aims to nurture real-world applications and stimulate long-term utility for users.

"Pi Network Ventures has officially launched. This is a $100 million initiative held in Pi and dollars, investing in startups and businesses that promote Pi's utility and real-world adoption." – Official Announcement

However, the announcement was controversial, with some critics pointing out the project's lack of transparency. They highlight suspicious ecosystem development, unfulfilled promises, and referral reward failures.

Nevertheless, the fund represents a serious commitment to supporting Web3 startups, aligning with Pi Network's long-standing promise of grassroots cryptocurrency adoption.

Analysts Suggest Ethereum Could Overtake Bitcoin

Analysts this week suggested that Ethereum stands at a crossroads to challenge BTC's market dominance. They argue that Ethereum could challenge BTC in price and fundamental utility.

Analysts point to Ethereum's massive lead in daily active users, network revenue, and ecosystem development, suggesting a "flippening" could still occur.

"Ethereum is completely overwhelming Bitcoin right now. At this pace, Ethereum could soon become the #1 digital asset. Bitcoin maximalists are in disbelief." – Investor Gordon

While Bitcoin remains the ultimate store of value, Ethereum is leading innovation in DeFi, Non-Fungible Tokens, and Layer-2 scaling.

Internet Capital Market Tokens: Emerging Crypto Trend?

As traditional finance (TradFi) seeps into blockchain, internet capital market tokens are becoming a new hot frontier. BeInCrypto cited LaunchCoin (LAUNCHCOIN), Dupe (DUPE), and CreatorBuddy (BUDDY) as notable tokens this week.

These tokens actively promote on-chain versions of legacy financial products beyond speculation. LaunchCoin, particularly from the Believe app, stands at the center of the internet capital market trend.

LaunchCoin on Believe is transforming meme coin creation on Solana. Users can directly launch with tickers and names on X, with community interest attracting funding. However, exposure risk is high as Believe controls the backend.

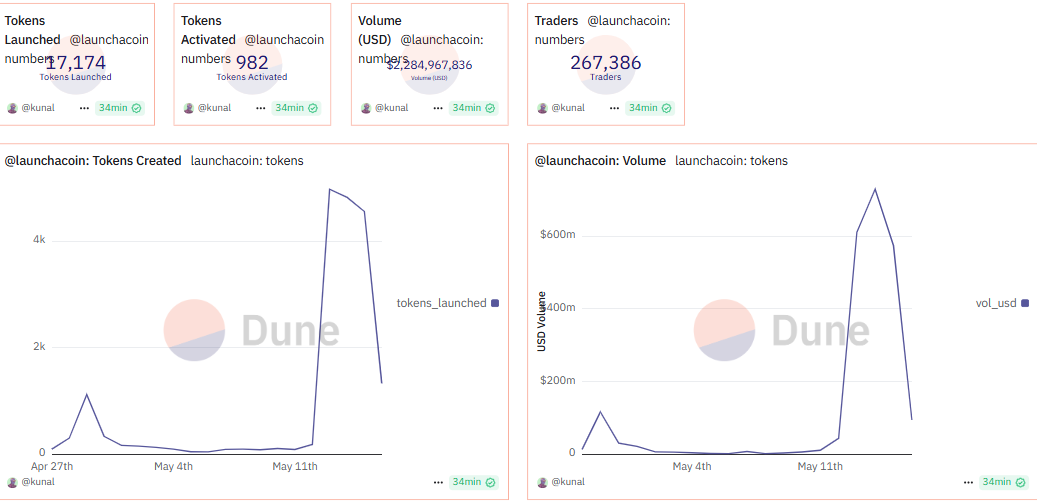

According to Dune dashboard data, the platform has launched over 17,000 tokens and has 267,386 active traders.

Total trading volume reaches $2.2 billion, with increasing interest and participation. However, momentum could weaken.

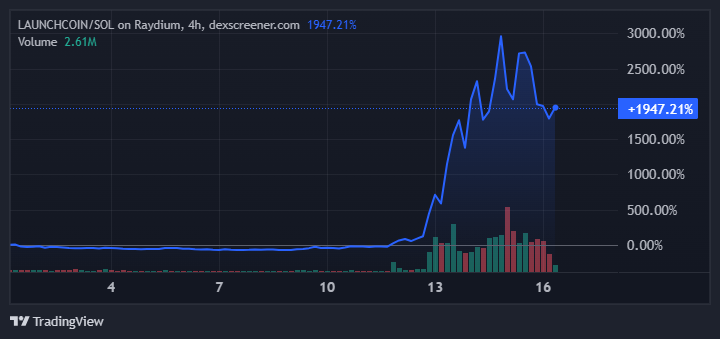

DexScreener data supports this outlook, showing easy momentum in price movements. However, the price remains above the bottom, rising 1,947% on a 4-hour basis.

Coinbase Refuses Ransom Demand... Data Breach Controversy

One of the biggest stories in cryptocurrency this week is the Coinbase data breach. The exchange confirmed that a malicious support employee leaked sensitive customer data of some users.

The perpetrators are demanding a ransom of $20 million, and Coinbase has refused. The platform now offers a $20 million reward to identify the culprits.

However, the leaked records include sensitive data such as government IDs and home addresses, causing users to have safety concerns. Some customers have reportedly been victims of targeted phishing attempts and identity fraud.

Meanwhile, true anger stems from the claim that the incident occurred in January but was only recently disclosed.

"Coinbase knew user data was stolen since January but hasn't said anything until now? We have received endless reports of Coinbase users losing assets to impersonators. Now we know the reason." – Duo Nine, famous analyst

Critics argue that the delay exposed users for months. This incident highlights the risks of centralized data systems and could accelerate demands for decentralized identity and self-custody solutions.