Bitcoin has recently broken through $111,000, recording a new all-time high. However, data from major exchanges suggests that traders are becoming increasingly cautious about continued growth.

According to Coinglass data, over 53% of Bitcoin positions are currently Short. This means that the majority of traders are anticipating a price decline. In contrast, only 47.43% of active positions are Longing.

Despite Bitcoin's All-Time High, Most Traders Shift to Bearish Stance

This pattern is also reflected on Binance, where Short trades account for 54.05% of open interest, while Longing stands at 45.95%.

This shift towards Short reflects the market's skeptical sentiment, despite Bitcoin reaching a new high.

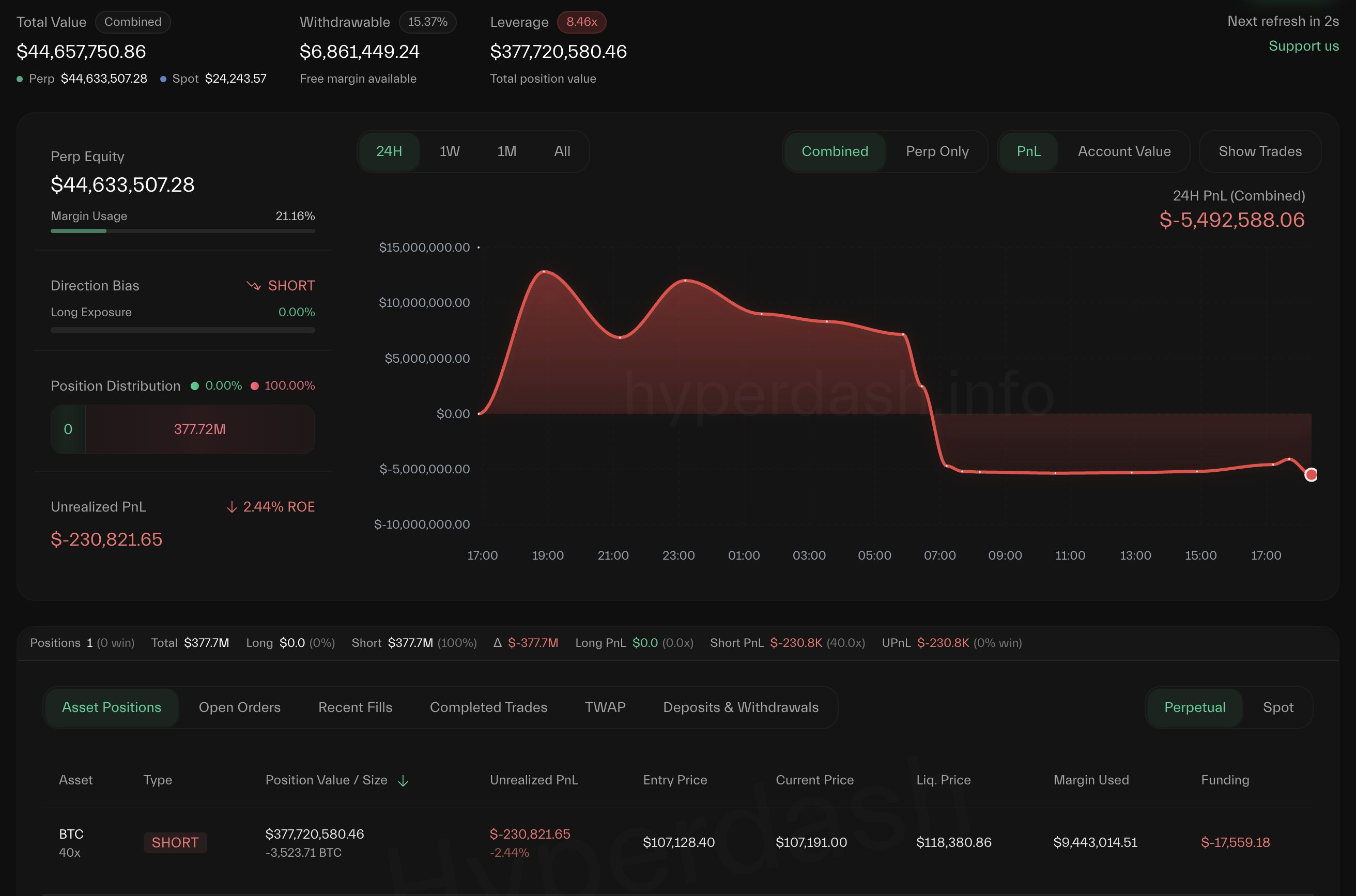

This mood change was reinforced by the recent actions of renowned crypto whale James Wynn, who withdrew his bullish position after suffering millions in losses.

Previously, Wynn maintained a 40x leverage Longing position worth about $1.25 billion, but closed it after Bitcoin's price dropped from $109,000 to around $107,107.

He liquidated his Longing position with a loss of $13.39 million in less than an hour on May 25th.

Subsequently, he opened a Short position of 3,523 BTC, worth approximately $377 million, at $107,128. The new trade could be liquidated near $118,380.

Market analysts suggested that Wynn's shift reflects fatigue in the current bullish cycle.

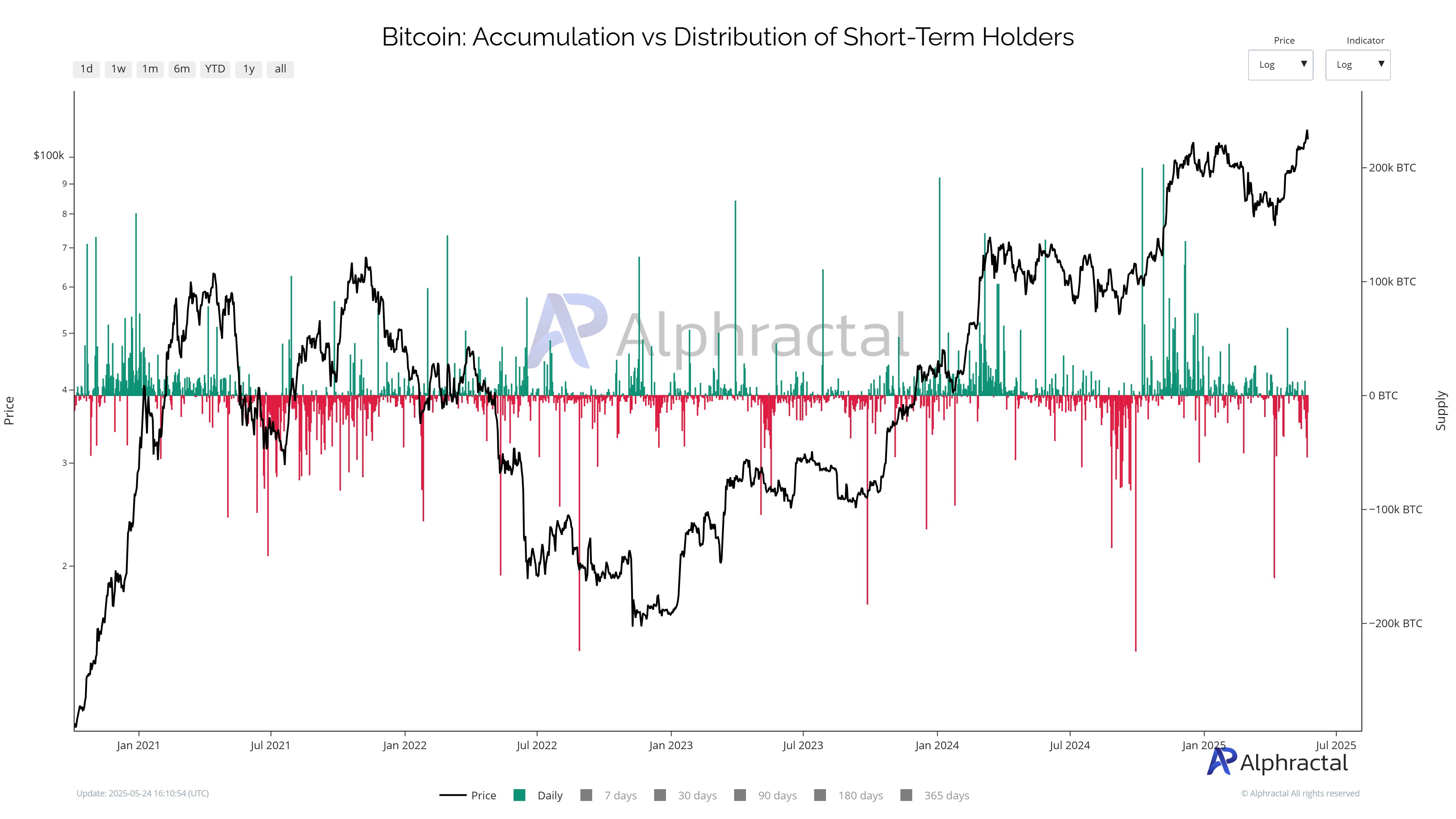

According to blockchain analysis company Alphractal, short-term holders have begun distributing coins. Historically, a decrease in short-term holder supply indicates Bitcoin is approaching a local peak.

The company noted that the short-term holder realized price is currently at $94,500, which is the last strong support line before losses occur.

In contrast, long-term holders remain robust, with their realized price rising to $33,000. This emphasizes a growing behavioral gap.

Alphractal warned that while Bitcoin previously recorded record highs under similar conditions, the current cycle is approaching fatigue.

They also added that various macro indicators and historical halving trends suggest a potential correction after October 2025.