The Bitcoin market shows an expansion of exchange inflows on a daily basis and an increase in trading centered in Europe, continuing the tension between short-term selling pressure and trading vitality.

According to CoinGlass as of the 26th, the total Bitcoin balance of major global exchanges is approximately 2,177,629.84 BTC.

A total of 36,151.54 BTC was net inflow during the day, while 19,887.59 BTC was net outflow over the past week, and 42,205.36 BTC was net outflow over the past month. This suggests that while short-term buying inflows are occurring, long-term holders are still moving assets externally in the medium to long term.

Coinbase Pro holds 662,954.41 BTC, still maintaining the largest Bitcoin holdings. On a daily basis, 1,005.65 BTC was net inflow, while weekly and monthly trends show net outflows of -6,612.96 BTC and -50,355.92 BTC respectively.

Binance holds 564,413.53 BTC, with clear short-term buying trends showing net inflows of 30,267.31 BTC daily, 28,958.28 BTC weekly, and 17,897.35 BTC monthly.

Bitfinex holds 396,133.15 BTC, with 1,233.63 BTC net inflow during the day. While weekly showed a net outflow of -3,218.6 BTC, monthly showed a net inflow of 2,685.42 BTC, indicating a change in direction.

Largest Daily Net Inflow Exchanges ▲Binance (+30,267.31 BTC) ▲KuCoin (+6,009.44 BTC) ▲OKX (+1,399.19 BTC)

Largest Daily Net Outflow Exchanges ▲Kraken (-2,904.81 BTC) ▲Bybit (-1,856.71 BTC) ▲Bitstamp (-46.35 BTC)

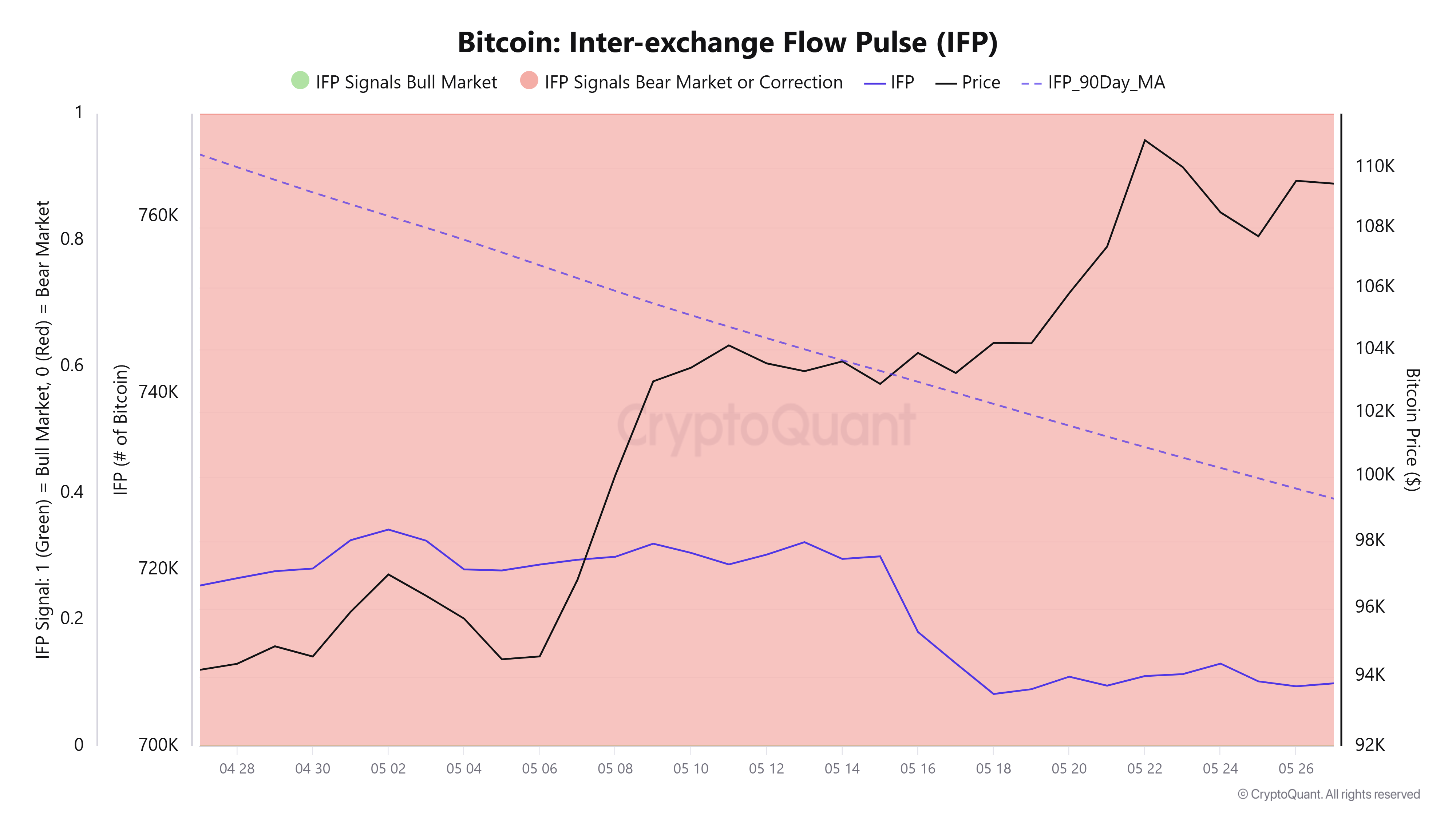

According to CryptoQuant, the IFP (Inter-exchange Flow Pulse) indicator as of the 27th was 707,137 BTC, slightly increasing from the previous day (706,792.5 BTC). The price dropped to $109,471.2 from the previous day's $109,569.8, showing a growing divergence between price and liquidity flow.

The IFP was below the 90-day average (728,075.9 BTC), indicating that inter-exchange liquidity remains below average. On this day, the 'Bear Market or Correction' signal was maintained as on the previous day.

IFP is a representative liquidity indicator that judges market vitality through Bitcoin movement between exchanges. Generally, above average indicates an active buying movement that forms the basis of a bull market, while below average suggests a more cautious sentiment.

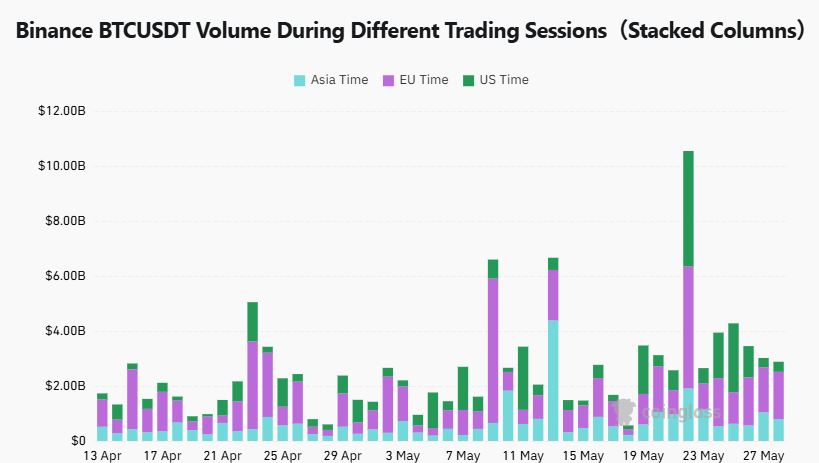

According to CoinGlass, Binance BTCUSDT trading volume on the 27th was $795.13 million in the Asian time zone, $1.72 billion in the European time zone, and $365.86 million in the US time zone.

Compared to the previous day (26th), Asia showed a clear decrease (-23.6%), Europe a slight increase (+3.7%), and the US a slight rebound (+9.2%). Overall, the European time zone maintained the most stable trading flow, while Asia showed a clear trading contraction reflecting short-term fatigue.

Particularly, while US time zone trading volume increased somewhat from the previous day (334.93 million), the absolute scale remains low.

With price volatility continuing to stagnate, the overall trading momentum has weakened. The Asian region is expanding its wait-and-see attitude, while the European time zone maintains some market leadership, acting as a core short-term liquidity section.

The US time zone recovery remains limited, with no clear buying signals and a mood of waiting to confirm the trend rather than "bottom fishing".

For real-time news...Go to TokenPost Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>