Bitcoin continues to decline for two consecutive days, maintaining a struggle near its major support line. With trading volume and dominance decreasing together, the market sentiment leans more towards a wait-and-see approach rather than a technical rebound.

📈 Price right now

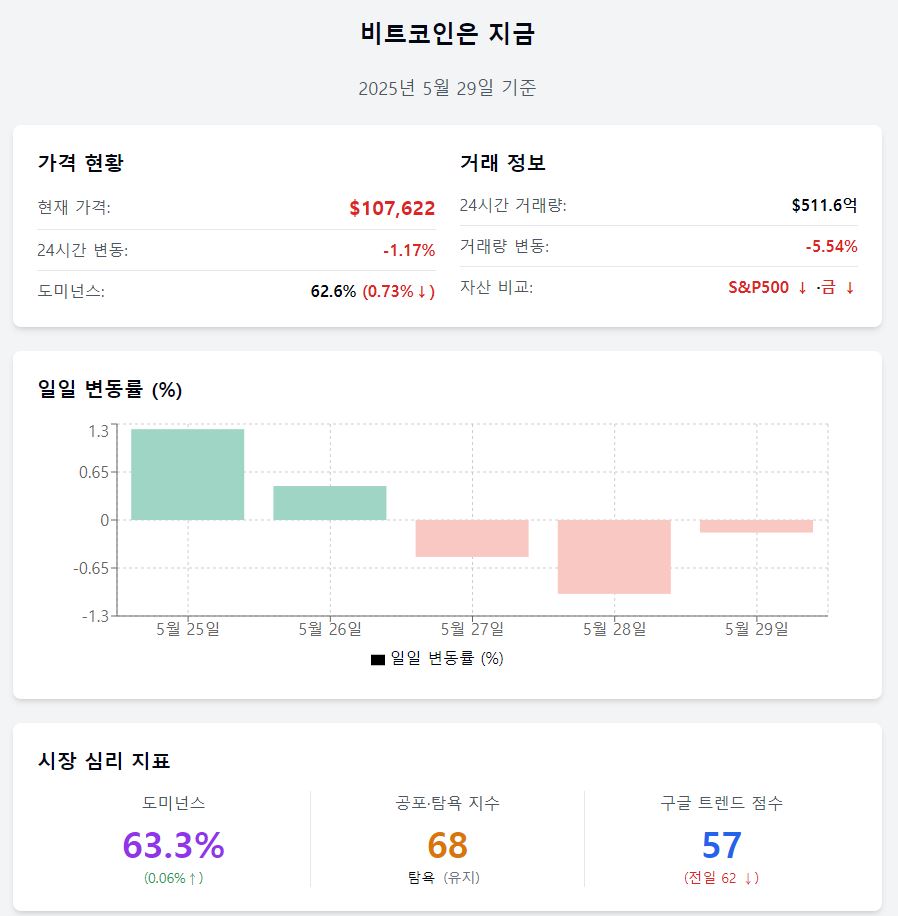

Price $107,622.20 (–1.17%) Bitcoin is trading at $107,622, down 1.17% from the previous day. While maintaining its major support line, it has failed to break through recent highs, expanding downward pressure.

Trading volume $5.166 billion (–5.54%) Trading volume decreased by 5.54% from the previous day, reducing market vitality. The market shows a predominant wait-and-see sentiment over buying pressure.

Daily fluctuation –0.17% Bitcoin declined 0.17% from the previous day, continuing its three-day downward trend. After rising +1.23% and +0.46% on the 25th and 26th, it has since declined –0.5% and –1%, entering a gradual adjustment phase.

Asset comparison S&P500↓·Gold↓ The S&P500 index fell –0.56%, and gold dropped –0.83%, with traditional assets also showing a correction. With both stock and gold markets adjusting, Bitcoin reflects a contraction in investment sentiment.

MACD –459.31 The daily MACD is –459.31, with a significant expansion of decline. Short-term downward momentum is strong, while the weekly MACD (1588.30) maintains a positive trend, keeping medium-term growth potential alive.

❤️ Investment sentiment now

Dominance 62.6% Bitcoin dominance fell 0.73% to 62.6%. This is interpreted as funds being somewhat dispersed into altcoins.

Fear & Greed Index 65 (Greed) The Fear & Greed Index remains in the greed zone at 65. Slightly lower than the previous day (68) and last week (73), market optimism has somewhat weakened.

Google Trend score 58 The Google Trend score decreased from 61 to 58. User interest and search volume have decreased, maintaining a wait-and-see stance.

🧭 Market now

SSR 18.13 The Stablecoin Supply Ratio (SSR) slightly decreased to 18.13. While still at a high level, the slight increase in stablecoin circulation suggests potential liquidity improvement.

NUPL 0.568 NUPL slightly decreased to 0.568. Many holders are in the profit zone, but profit-taking sentiment may also be at play.

Exchange balance 2,446,900 BTC (–0.17%) Bitcoin holdings on exchanges have decreased, suggesting investors are maintaining a holding strategy over selling.

Exchange net inflow –3,835 BTC (+1.39%) 3,835 BTC were net outflowed in a day, with investors moving assets outside exchanges. The sentiment leans towards long-term holding over short-term selling.

Active wallets 1,088,447 Active wallet count increased by about 173,541 from the previous day, temporarily recovering user base activity. Contrary to decreased trading volume, user interest remains maintained.

For real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized reproduction and redistribution prohibited>