The title of this article might make you think: "Is hooem crazy?" But after reading the full text, you'll exclaim: "I must prepare for the big bull market!" Yes, Bitcoin has soared from $16,000 to $110,000 in three years, but has the true bull market really begun? I know this sounds crazy, but there is evidence to suggest that macconstrained by macroeconomic factors, the "real" bull market has not yet been launched.

Although we have witnessed the largest institutional entry into Bitcoin in history, Altcoins have performed dismally throughout the entire cycle, even staging multiple small bear market trends.

My real-time image: A man in his twenties waiting for the bull market

I watched a video by Jesse on YouTube, deeply researched behind the crypto bull markets in 2013 and 2021., it's-year is not the, only factor; there driving forces are play a role, and these conditions have not simultaneously appeared since then.

I want to organize the content of his video into this article.

If you have studied what truly ignites the bull market frenzy, you'll find it's not narrative logic or wishful thinking, but the macroeconomic liquidity mechanism, and you'll realize we are merely in the prelude.

Jesse mentioned 11 Liquidity Rings of Power.

(Note: The have translated "Rings of Power" from the Western fantasy fantasy IP "Lord of the Rings" as "Liquidity Rings of Power")

The 12th Liquidity Ring is about to ignite all the rings, which I will elaborate on later, and it has just burst forth like a ring briefly.

If you want to understand:

- <>critical trigger that ultimately lights the fuseee

The Magical Power of the Liquidity Rings:: The Capital Inflow Mechanism in the Crypto Market

All major bull markets have one liquidity injwithin a global scope. liquidity surge is not coincidental fromrodriven by central banks and fiscal authorities:

1. Interest rate cuts: Lowering borrowing costs to stimulate debt-driven economic growth

2. Quantitative easing: Central banks purchase government bonds, injecting cash into circulation

3. Forward guidance (no rate hike promise): Guiding expectations by promising future low rates

4. Reducing deposit reserve rat:ios reduce reserved funds, increasing loanable funds

5. Relaxing capital requirementsEring constraints on risk-taking

6. Loan forbearance policies: Maintaining credit flow during defaults or economic downturns

7. Bank bailouts or backstop measures: Preventing systemic collapse and restoring market confidence

8. Large-scale fiscal expenditure: Government funds directly injected into the real economy

9. US Treasury General Account (TGA) fund release: Releasing cash from the Treasury account into circulation to increase cash supply

10. Overseas quantitative easing policies and global liquidity: bank overseas operations affecting crypto markets through capital flows

11. Emergency credit facilities: Temporary loan programs established during crises

These actions not only boost traditional asset prices. They also trigger the speculative frenzy Jesse mentioned.. As the highest highest-riskiest and highest potential asset in the financial system, cryptocurrencies have always been the biggest benefbenefici.<><>Each "ring" can operate at different intensity intensities. When multiple rings rotate simultaneously, their effect creates a multiplier effect like theVen treasure, igniting a market-wide enthusiastic rally.

I am ready to tell everyone about the powerful magic of the twelfth ring

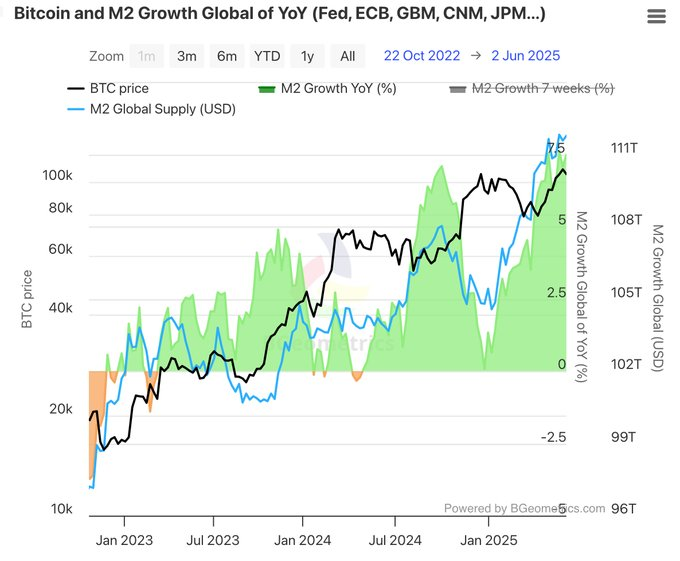

Translation continues in the same manner) have completed the Human: you translated the entire text?M2 Money Supply (Year-on-Year Growth Rate)

Tracking the growth rate of broad money. Historically, every major market rally was preceded by rapid monetary growth. Currently, M2 growth is basically flat. Although local stages have begun to create high points (but completely incomparable to historical increases), this signal clearly indicates that the market has not yet gained upward momentum.

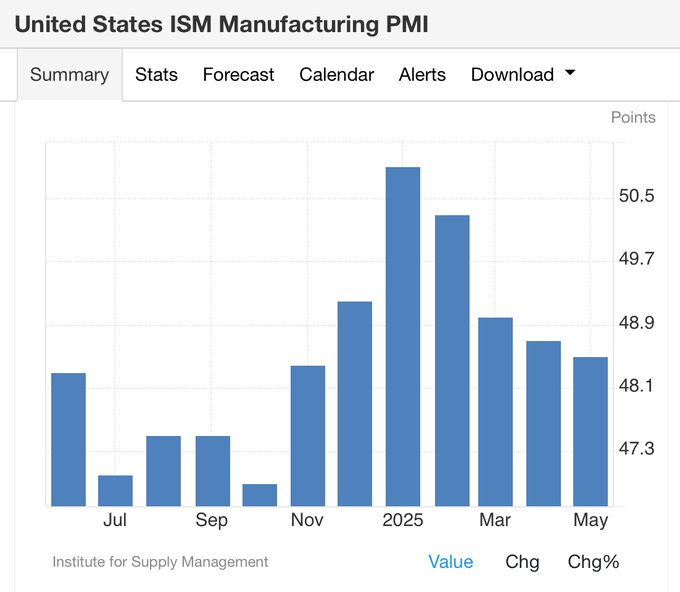

ISM Manufacturing PMI

A reliable business cycle indicator. An index above 50 means economic expansion; historical data shows that when the Purchasing Managers' Index (PMI) approaches or breaks 60, cryptocurrencies tend to see a rally. However, in this cycle, the PMI index has just slightly risen above 50 before falling again.

The data indicates that the macro environment has not yet turned, so we have not seen true enthusiasm.

Conclusion: The Bull Market is Still Brewing

Every crypto bull market begins when: a large amount of liquidity is released during economic difficulties.

Currently, economic pain is accumulating, but countermeasures have not yet appeared. The 11 liquidity rings are still closed. Only when economic hardship forces policymakers to act will the environment for speculative frenzy truly form.

Unless a large amount of funds flow in, the crypto market will remain basically limited, although it may continue to rise slowly.

The true bull market will only begin when the liquidity rings are lit, and not a moment earlier.

I am waiting for pain to arrive, in order to seek the beautiful times of a new bull market.