Top-tier crypto venture capital firm Andreessen Horowitz (a16z) crypto division's Data Science Partner Daren Matsuoka published an article titled "Stablecoins: A 1+ billion-user onboarding opportunity" yesterday, revealing the astonishing potential of stablecoins in the global financial market. He pointed out that stablecoins currently provide the first credible opportunity to bring one billion people into the crypto world, fundamentally changing the payment ecosystem.

Stablecoin Trading Volume Astonishing, Challenging Traditional Payment Giants

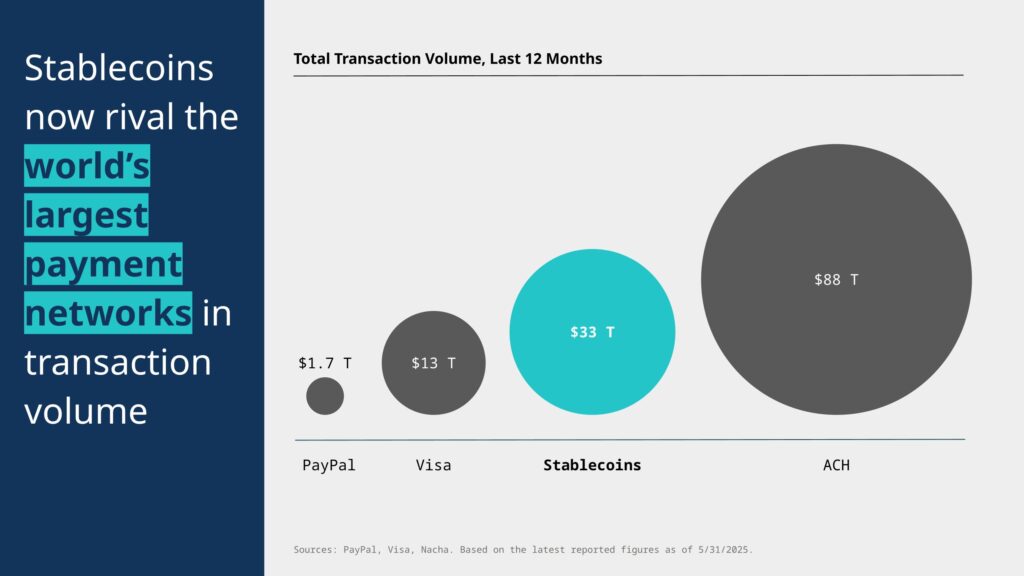

In the report, Matsuoka detailed key stablecoin data, first noting that stablecoin trading volume has reached $33 trillion in the past 12 months, continuously setting new historical highs. This figure is nearly 20 times PayPal's transaction volume, 3 times Visa's, and rapidly approaching the transaction volume of the Automated Clearing House (ACH).

In summary, stablecoins' performance has positioned them among the world's major payment networks, competing with these traditional financial giants with decades of history.

Holding $128 Billion in US Treasuries, Potentially Becoming the Largest Holder by 2030

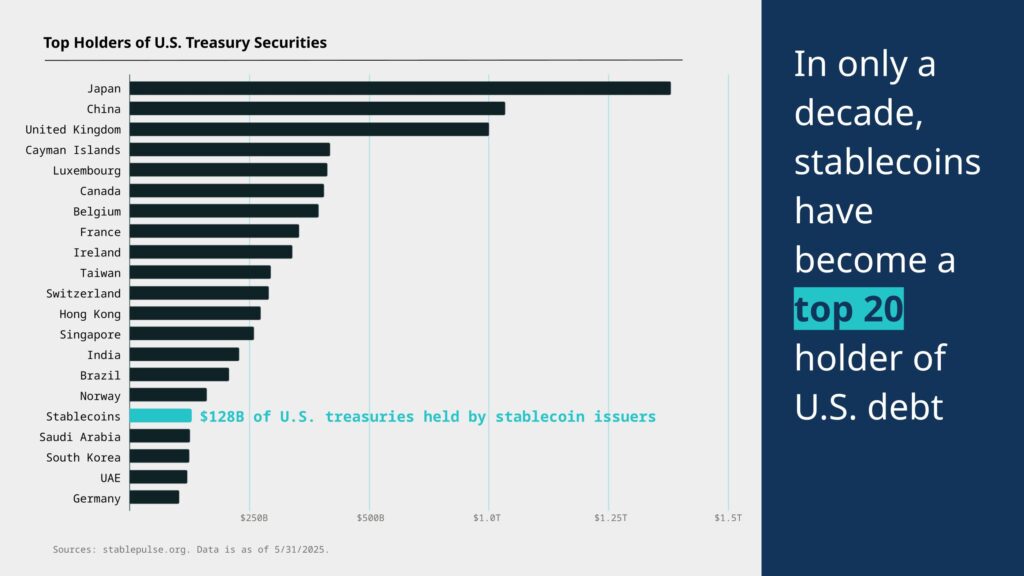

Meanwhile, the report also pointed out that one result of stablecoins' rapid growth is holding $128 billion in US Treasuries, becoming one of the top 20 US debt holders, surpassing countries like Saudi Arabia, South Korea, UAE, and Germany. Citibank even predicts that by 2030, the amount of US Treasuries held by stablecoins could surge to $3.7 trillion, becoming the largest holder on the list.

US Dollar Tokenization Trend Significant, Supply Reaches New High

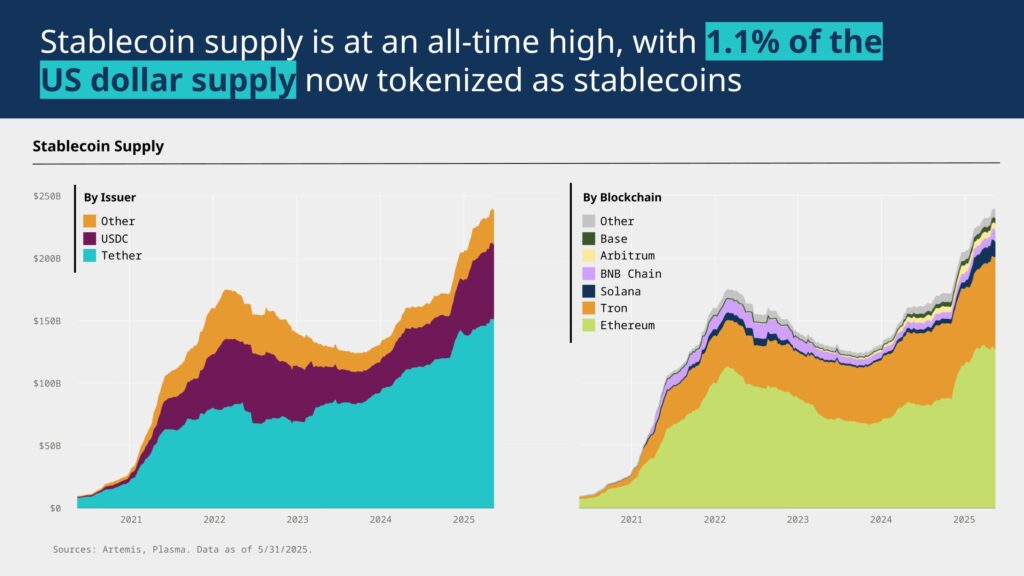

Matsuoka also emphasized that the total supply of stablecoins is at a historical high, exceeding 1% of the total US dollar supply, now tokenized as stablecoins. This trend reflects the prevalence of stablecoins as digital assets, gradually becoming an important tool for global financial transactions.

Low Cost, High Efficiency: Stablecoins Reshaping Payment Experience

One of the most notable points in the report is that stablecoins have become the cheapest way to send US dollars: transaction time is less than 1 second, with fees below 1 cent. Compared to existing US payment options, many of which are complicated and costly, stablecoins' advantages are evident. Matsuoka believes this is due to significant improvements in blockchain infrastructure, such as high-throughput Layer 1 blockchains like Solana and Ethereum Layer 2 solutions like Base, making stablecoins an efficient payment tool.

Infrastructure Progress Unlocking New Application Scenarios

Matsuoka finally stated that stablecoins' success is not limited to trading volume growth, but also demonstrates organic usage and market fit independent of crypto trading. This phenomenon breaks the stereotype that stablecoins are only used for speculative trading, proving their potential in actual payment scenarios. He further pointed out that infrastructure improvements are unlocking more new application scenarios for stablecoins, with promising future development:

This is a great example of how infrastructure improvements can unlock new application scenarios, and I'm looking forward to seeing what other possibilities will be unlocked.