Last Thursday evening, Circle, the issuer of USDC (with about 25% market share), the world's second-largest stablecoin, was officially listed on the New York Stock Exchange with an initial price of $31 per share. Circle triggered circuit breakers multiple times during the day and closed with a 168.48% increase, at $83.23, with a market value exceeding $18.5 billion, and continued to rise nearly 30% the next day.

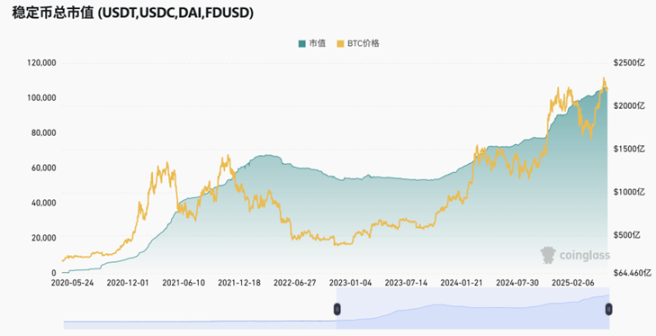

Currently, the total market value of global stablecoins has exceeded $250 billion, with USDT and USDC together accounting for 86% of the market share. This is why Circle repeatedly adjusted its opening pricing before the IPO, as the market was much hotter than expected.

Because of Circle's listing on the New York Stock Exchange, the concept of "stablecoin" has occupied financial headlines for several days, and to some extent, it has allowed more traditional financial professionals to re-recognize the value of stablecoins.

Almost on the same day, the Hong Kong Special Administrative Region officially announced that August 1, 2025, will be the implementation date of the "Stablecoin Regulations," further boosting the heat of stablecoins in the financial market. Similarly, the American GENIUS Stablecoin Act is also on the way, and everything seems to be just right.

We will not discuss the value of stablecoins too much here. After experiencing explosive growth in recent years, if one still denies its significance, it is probably as necessary to rethink and adjust one's perception as saying "BTC is useless" now.

Going back to almost the same period 4 years ago, during the previous bull market cycle, the largest US Crypto exchange Coinbase successfully listed on Nasdaq, with its stock price once soaring to $429 and a market value exceeding $112 billion, bringing hundreds of times returns to many early investors.

However, it then entered a adjustment period of more than 2 years, and its performance in the months after listing was criticized, even being called a "garbage company". But because of Coinbase's successful listing, traditional financial markets saw another emerging financial market rising, which led to the current BTC ETF and various reserve assets.

Similarly, for Circle's listing, its significance lies in bringing a stablecoin that was previously only recognized by a certain group of people to the "grand stage" and gaining the favor of some old money. After all, if it remains in the vision of only a small group of people, it is difficult to enter the mainstream world, especially by demonstrating financial capabilities and corporate transparency through listing, which is crucial for the development of stablecoins.

As Circle co-founder Jeremy Allaire said in an interview with Bloomberg: "The IPO will bring more trust, compliance, and transparency to Circle's regulated stablecoin network, and help establish cooperation with other financial institutions."

In 2008, Satoshi Nakamoto proposed the form of a "de-trusted currency" and created BTC, with the ideal of using this new form of currency to counter financial institutions that indiscriminately issue currency. However, today BTC can no longer effectively serve as a means of payment due to various restrictions, which is why stablecoins have developed rapidly.

In a sense, stablecoins have replaced part of Nakamoto's ideal, of course, only "in form", as stablecoins have returned to institutional logic, merely borrowing its technical form. However, we cannot deny its value based on this point.

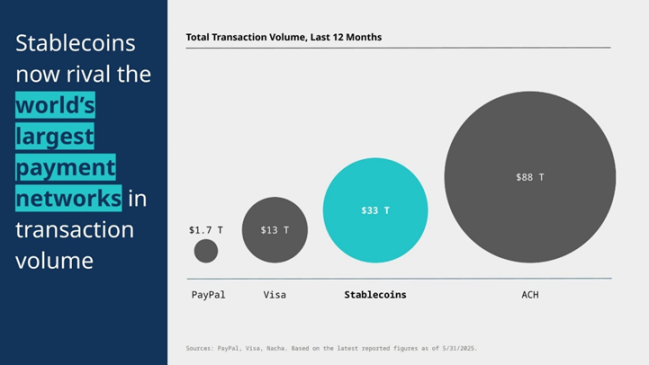

a16z Crypto noted in its latest report that in the past 12 months, stablecoin transaction volume has reached $33 trillion, continuously setting new historical highs, nearly 20 times PayPal's transaction volume and close to 3 times Visa's transaction volume.

Some may feel that the current market size of stablecoins is not small, but compared to the traditional payment market size of tens of trillions of dollars, it still seems a bit "naive". However, if stablecoins could become a single market with over $1 trillion in scale in the next 3-5 years, perhaps we are just at the beginning.

Therefore, Circle's listing is more like a small celebration of "naming" for stablecoins, and the big show after the celebration is just beginning. As the most mature application in the Crypto industry besides trading, stablecoins may be the true key to bringing Web3/Crypto applications into thousands of households, rather than the early NFT craze.

For investors and entrepreneurs, there are also many opportunities in this period. After all, making money with money is always a good business. But if one cannot be a money creator, at least one can be a service provider in this field. Everything is just beginning, with risks and opportunities coexisting.

So, what will Circle's market value be in 4 years?