Written by: Nathan

Compiled by: Dingdang, Odaily

Editor's Note: Since Circle announced its listing, an invisible boundary in the stablecoin market has been officially drawn: USDC and USDT have begun to take different development paths. USDC focuses on compliance and transparency, gradually embedding itself into the US financial system, becoming a "permissioned dollar" serving institutional users and fintech scenarios; while USDT relies on its extensive on-chain liquidity and deep market foundation, continuing to play a key role in global trading, payment, and asset hedging scenarios.

This difference essentially reflects the different priorities of "value realization" in different markets. For some users, compliance and programmability are crucial; for others, liquidity, accessibility, and a permissionless user experience are paramount. Therefore, we need a new cognitive model to understand how different types of users realize value through stablecoins. This is what the "Hierarchy of Stablecoin Value Realization" aims to explore.

Although each person obtains benefits from stablecoins differently, ultimately these benefits stem from four core value propositions: low cost, high speed, permissionless, and programmability.

Nathan, the original author, explained in another article 'The What and Why of Programmable Money': Programmable money is money that can set behavioral logic like code. It is a stablecoin and the fuel for smart contracts. It can set: when, why, and how to transfer. And all this no longer depends on banks or trust, but only on the code itself.

These four value propositions correspond to four core use cases: storage, payment, transfer, and yield.

The "Hierarchy of Value Realisation" is a new cognitive model explaining the most valued points of stablecoins for different user types.

This article will focus on two user groups: "those who need stablecoins" and "those who don't need stablecoins so much", namely: emerging market users and Western market users.

Two Major User Groups of Stablecoins

Simply put, in emerging markets, stablecoins are building a new financial infrastructure; while in Western markets, stablecoins are more of a supplement, integrated into existing fintech and traditional financial systems.

This rule applies broadly to both emerging stablecoin projects and veteran players.

Based on this, we can outline different "value realization hierarchies" for the two user types.

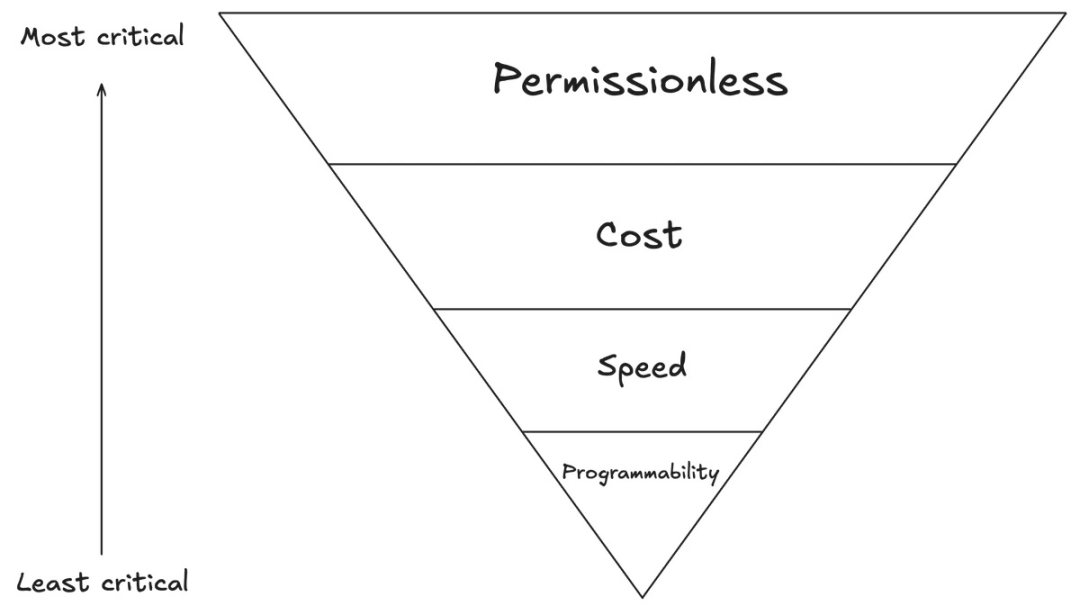

I. Value Realization Hierarchy for Western Market Users

Western markets mainly correspond to "Global North" countries: politically stable, with developed financial systems, where most people have bank accounts and can earn interest on savings.

In these markets, "programmability" is the core driver of stablecoin innovation. This is similar to the explosive development of the internet, iPhone, or smart contracts: programmability brings new financial innovations, which is the love and advantage of the Western world.

Next is "speed". The settlement speed of cross-border or local payments has long been a key challenge in fintech, with settlement delays consuming liquidity and creating opportunity costs, thus ranking second in Western markets.

"Cost" ranks third. Although reducing transfer costs is a highlight of stablecoins, transaction fees in Western markets are already low, far from the exorbitant 115-dollar fee on a 200-dollar remittance in emerging markets.

The importance of "permissionless" is lowest in Western markets. Because most people already have bank accounts and can easily use cash or transfer payments, they naturally don't need stablecoins to access financial services.

Therefore, Circle and USDC have an advantage in Western markets. As a company fundamentally oriented towards fintech, Circle emphasizes programmability, low cost, and efficiency, which align with Western users' usage preferences. Now, more and more Western enterprises choose to develop stablecoin solutions based on USDC.

Additionally, "yield" is gradually becoming an additional focus for Western users. Since they are accustomed to earning interest from bank deposits, they question why holding stablecoins doesn't provide similar returns.

This is completely different in emerging markets, where users are more concerned about the stability of value and the ability to obtain dollars, rather than yield.

According to the author's perspective: In fact, yield has never been the decisive factor for stablecoins' success in these markets. As industry analysis points out, USDT became the most liquid stablecoin globally precisely because it doesn't need to allocate Treasury yields to users, yet can dominate through strong accessibility and deep liquidity. For many users in high-inflation or capital-restricted areas, avoiding the risk of local currency depreciation is far more meaningful than a 3% annual interest rate. They care more about: Can I safely exchange my assets to dollars, can I transfer out anytime, can I use it locally?

Therefore, in these regions with true "product-market fit", stablecoin liquidity is far more important than yield capacity. Liquidity tends to concentrate, ultimately forming a network effect for top stablecoins. This is why stablecoins like USDT can be widely adopted globally, even without a yield mechanism.

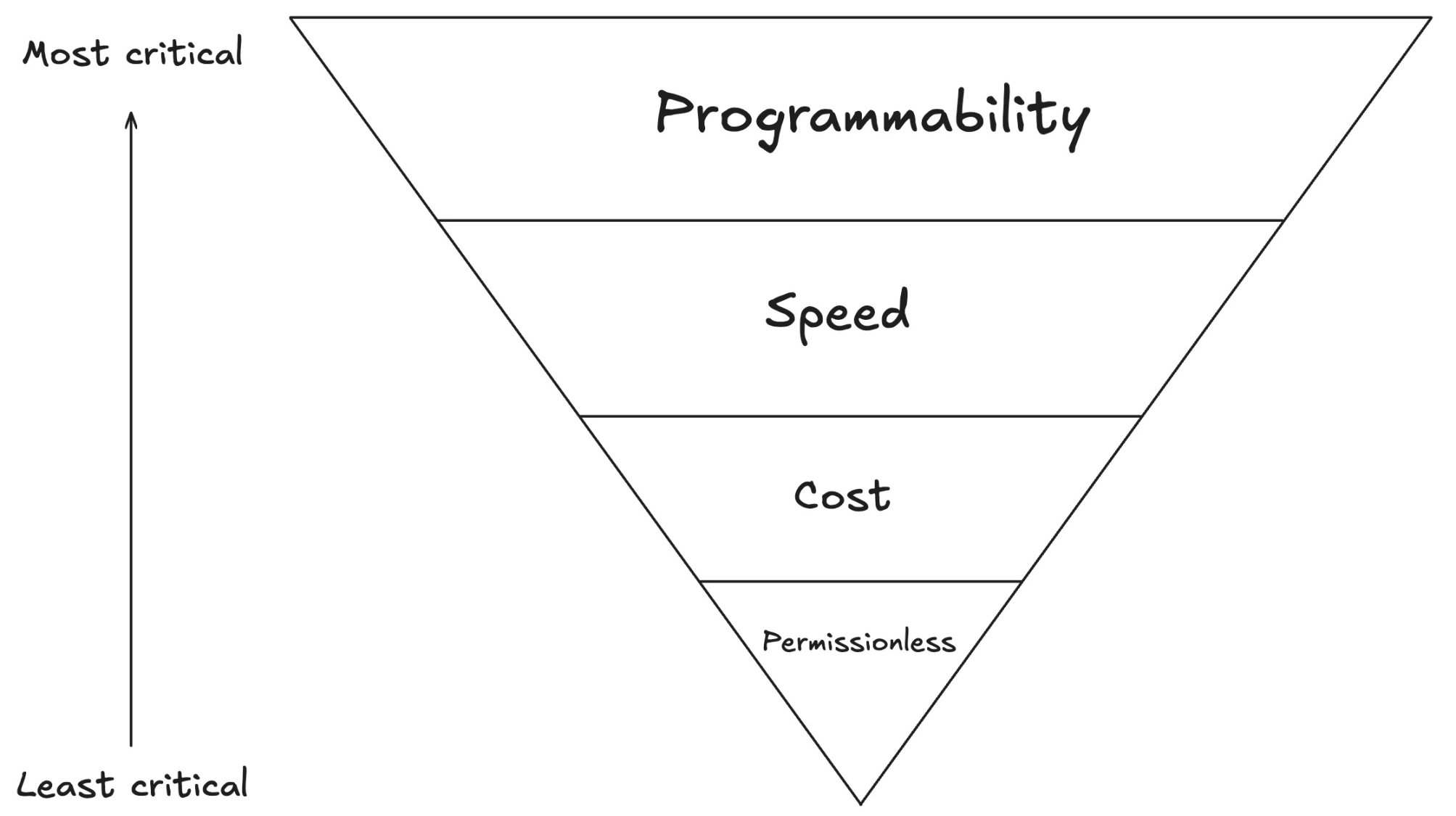

II. Value Realization Hierarchy for Emerging Market Users

Compared to the West, emerging markets (the "Global South") have relatively weak financial infrastructure, widespread local currency inflation, and low bank service penetration.

The emergence of stablecoins allows users in these regions to freely acquire, transfer, and use stable currencies like dollars for the first time, which was unimaginable in the past.

Therefore, for emerging market users, "permissionless" is the most core and transformative value proposition. Regardless of whether they have a bank account, users can directly access the dollar system, thus unlocking financial freedom.

Next is "low cost". In emerging markets, cross-border remittance fees remain high. For example, when a father sends money home to support his family, the fees might consume a large portion of the transfer amount. Stablecoins greatly reduce these remittance costs.

Third is "speed". Current cross-border transfer systems are inefficient, with funds often taking days or even weeks to arrive. Stablecoins can achieve second-level transfers, solving the economic and living difficulties caused by fund delays.

Last is "programmability". Although this value proposition also has profound impacts on emerging markets (such as unlocking insurance, lending, contract payments, etc.), its perceived short-term value is slightly lower compared to the first three.

Overall, Tether's USDT has been hugely successful in emerging markets. By providing freely usable, widely accepted, and highly liquid USDT, Tether has provided critical financial services for millions of unbanked people. Its success is precisely based on the realization of these fundamental value points.

Summary and Reflection

Circle is adapted to Western markets, as it better fits the needs of fintech companies;

Tether serves a broader user base, especially those who truly depend on stablecoins.

In other words, Circle wins with "tool attributes", Tether wins with "survival necessity".