Written by: 1912212.eth, Foresight News

In the early morning of June 13, Bitcoin dropped from $108,000 to $102,664, experiencing a rare seven consecutive four-hour declines. Ethereum fell from around $2,800 to $2,455, with an unusual nine consecutive four-hour declines. Altcoins were generally hit hard due to the overall market impact.

According to Coinglass's open interest data, the network liquidated $1.12 billion in 24 hours, with long positions liquidating $1.04 billion. The largest single liquidation occurred on Binance's BTCUSDT, valued at $201 million.

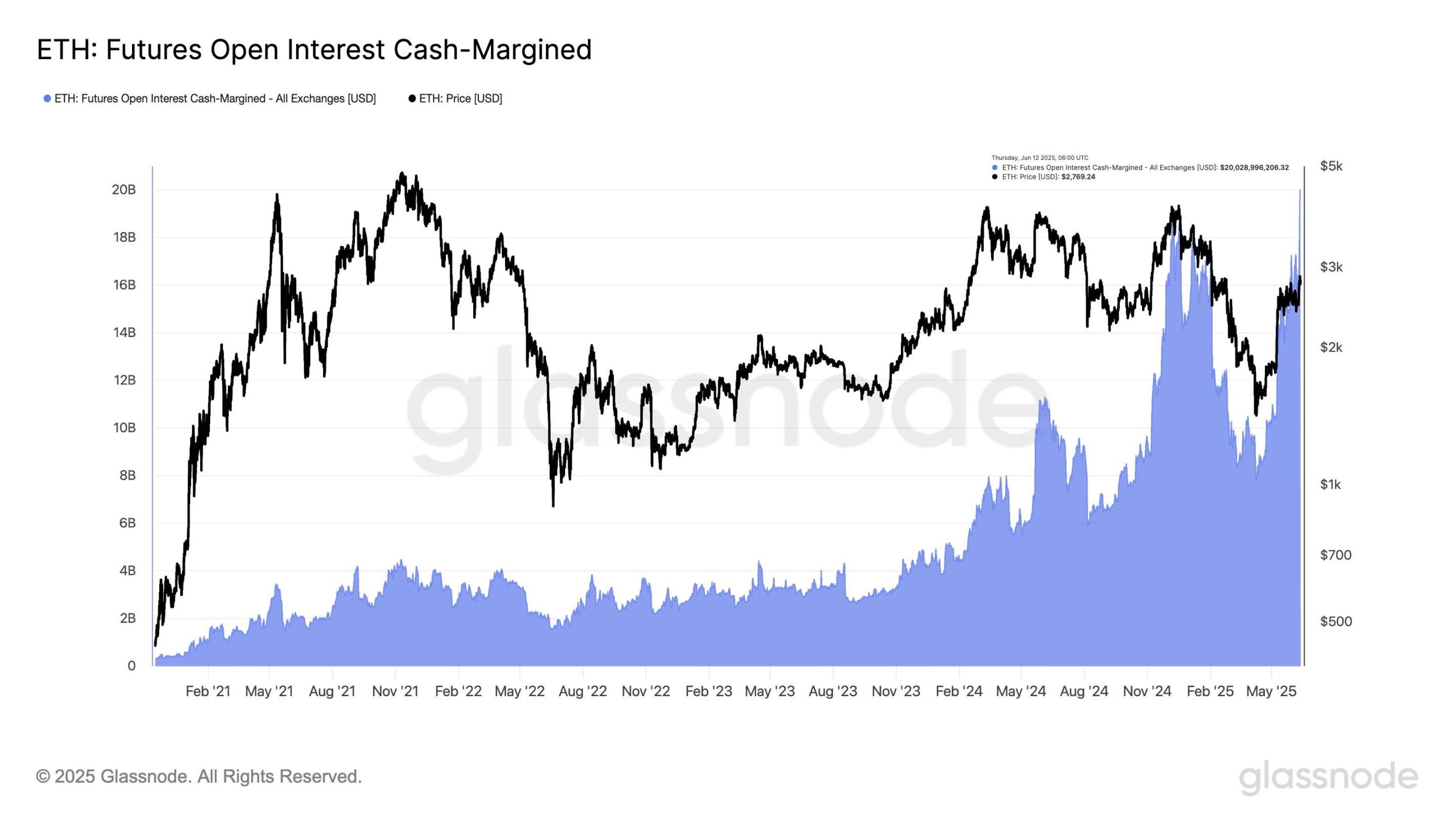

On June 12, glassnode's monitoring data showed that Ethereum's open interest just hit a historical high, exceeding $20 billion. Despite ETH's slight pullback from the $2,800 level, market leverage continues to accumulate as traders increase leverage using stablecoins.

Additionally, after SharpLink Gaming, an "ETH micro-strategy" listed company, filed with the SEC regarding "PIPE investor stock sales", its stock price plummeted nearly 70% after-hours, significantly negatively impacting ETH.

The company submitted an S-3ASR registration statement allowing the resale of up to 58,699,760 shares for over 100 shareholders related to its PIPE financing. The market initially interpreted this as PIPE investors selling their shares. The company's board chairman, Joseph Lubin, clarified on X platform that the market "misread" the S-3 document, which is merely a pre-registration of shares for potential resale - a standard procedure in traditional finance after PIPE transactions, not indicating actual selling.

The significant growth in futures open interest reveals that the current price increase is primarily driven by leveraged futures traders, not spot buyers. Compared to Bitcoin, which is still driven by spot demand, Ethereum's trend shows divergence. Recent surge in call option purchases, combined with gamma hedging effects, puts ETH at risk of significant gap movements. The market becomes increasingly fragile and sensitive to momentum changes.

As the market anticipated Ethereum's strong rebound leading altcoins, it unexpectedly turned downward again. What exactly happened?

Israel and Iran Reignite Military Conflict

In the early morning of the 13th local time, Israeli Defense Minister Katz stated that Israel launched an airstrike against Iran. Katz said that after a preemptive strike against Iran, Israel is expected to face missile and drone attacks soon. According to Xinhua News Agency, Israeli Prime Minister Netanyahu issued a statement saying that Israel's military action against Iran will "continue for days".

Currently, Israel is in a state of emergency. CNN cited Israeli sources reporting that Israel is preparing for a major Iranian retaliation, larger than previous Iranian attacks on Israel. Sources said Israel intends to continue attacking Iran until it believes the nuclear threat is eliminated, though some doubts exist within Israeli security institutions about achieving this through unilateral action. Israel's primary targets include Iran's nuclear facilities, military assets, and key military personnel.

Iranian state television just reported unconfirmed reports that Revolutionary Guards Commander General Soleimani may have been killed in the Israeli attack. The station added that another senior guard officer and two nuclear scientists might also have died. The report provided no further details.

International Brent crude and WTI crude futures rose over 8%. NASDAQ futures briefly expanded losses to 2%, S&P 500 futures fell 1.8%, and Dow futures fell 1.6%. Spot gold briefly rose to $3,420 per ounce, up nearly 1% intraday.

Federal Reserve Delays Rate Cut

Since the Federal Reserve's rate cut in December 2024, they have not softened their stance on rate reduction.

US President Trump has also been vocal about this. Recently, he frequently expressed on social media his desire for the Federal Reserve to lower rates, saying, "We have a lot of short-term debt, and I like long-term low-interest debt. If we lower rates by 1%, it means paying 1% less."

"Recommend the Federal Reserve cut rates by 200 basis points."

Powell has not backed down. While the market expected Powell might be fired, Trump also stated he "won't fire Federal Reserve Chairman Powell, he just needs to lower rates, as our inflation data looks good."

Hedge fund giant Paul Tudor Jones suggests that US President Trump will choose a "very dovish" Federal Reserve chairman.

Recently, after CPI data and May's core PPI were published, traders anticipate two rate cuts by the Federal Reserve this year, potentially starting in September.

In the current tight market liquidity, even slight disturbances can easily trigger significant market declines.

Black Swan Events Emerge

The international market has been turbulent recently. On June 12, an Indian airline Boeing 787 aircraft crashed en route to the UK, marking the first crash for this aircraft model. Multiple media reports indicate over 240 fatalities, causing Boeing's stock to drop over 6%.

Previously, after an intense argument between Tesla founder Musk and US President Trump, the dispute recently concluded with Musk's apology. Reuters reported that Trump praised Tesla during a White House event on California electric vehicle regulations, saying: "I like Tesla... I discussed electric vehicles with Musk," and "Musk actually likes me."

Los Angeles riots continue, with curfews implemented in some areas. Global Times reported at least 378 arrests in Los Angeles since last Saturday. The LA mayor announced a curfew from 8 PM to 6 AM in central city areas. The ongoing conflict between Trump and California Governor Newsom continues, with protests against illegal immigrant enforcement spreading from Los Angeles to other parts of the US.

Subsequent Market Outlook

HashKey Capital investment manager Rui tweeted, "Altcoin liquidity has reached freezing point. Excluding market maker trading volume at new lows, order books lack buy and sell orders, naturally causing prices to slowly decline. Good news fails to attract buyers, exchange listings only see robot orders for thirty seconds, with new coins starting to decline immediately after listing. Regardless of rise or fall, altcoin market cycles have become much shorter, miss it and you're out."

Trader ERIC with millions tweeted that after Bitcoin's oversold signal, it only rebounded slightly before continuing to decline, with the noteworthy price range around $101,000.