Author: Xie Zhaoqing, Tencent News 'Qianwang'

"Busy" has become the norm for Hong Kong investment bankers in the past period.

"I have several business trips to the mainland every week, chasing and competing for projects," said a lead underwriter from a top Chinese investment bank in Hong Kong.

He currently has 8 Hong Kong stock IPO projects, with 2 already submitted for listing, 2 to be filed soon, and the remaining companies have been on-site for some time. In addition, he has several ongoing projects, competing for the final underwriting contracts with other firms, including A-share companies going public in Hong Kong.

"I return to Hong Kong for meetings, stay for about a day, and then start traveling again," another investment banker said. "Taking flights or high-speed trains has become a daily routine. The market is hot, and the work pace is like returning to 2018 and 2019 before the pandemic."

HKEx's IPO data also confirms the market's enthusiasm. Public data shows that as of June 15, HKEx had 30 companies go public, with Haidilao Sauce, Sanhua Intelligence, and two medical companies preparing for listing - if these 4 are included, the total fundraising would reach 100 billion Hong Kong dollars, an increase of over 5 times compared to the same period last year. This has also brought HKEx back to the top of global IPO fundraising after six years.

Agricultural Bank International Capital Market Head Bian Jing said this round of Hong Kong stock IPOs is the best window period since the second half of 2021.

He believes this wave of companies going public in Hong Kong are excellent, including industry leaders like CATL, Hengrui Pharmaceutical, and Haidilao. Many sovereign funds and overseas top long-term funds he has contacted have gradually returned to Hong Kong and become active. Meanwhile, regulatory support for mainland leading enterprises going public in Hong Kong, including expediting the filing process, has revitalized the Hong Kong capital market.

Mainland Companies Accelerate Hong Kong IPO: Raising 522 Billion HKD in a Week, Over 200 in Queue

[Rest of the text continues in the same translation style...]

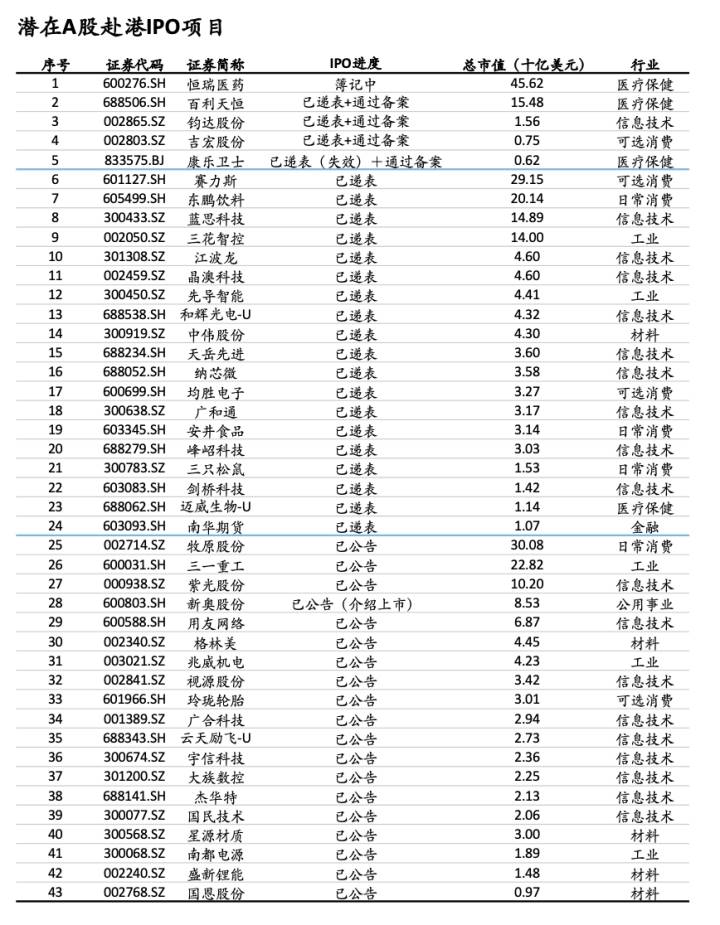

It is not difficult to understand that most of the A-share companies going public in Hong Kong have good targets, with market values mostly exceeding $10 billion, and even close to $50 billion. As of May 20th, the data of A-share companies publicly stating their intention to list in Hong Kong is as shown in the following chart (image source: UBS).

"We must seize this policy window," Lin Zilong believes, which is the idea of many mainland issuers he has encountered. He thinks that the mindset of mainland issuers has begun to change significantly, becoming more proactive about listing. These issuers believe that they can now go public in Hong Kong during the dividend period, move forward, and after raising funds, they can conduct share buybacks or develop overseas businesses.

Bian Jing stated that this wave of mainland companies going public in Hong Kong is also influenced by the current "going global" trend of Chinese enterprises. From his understanding, many mainland companies listing in Hong Kong currently have a strong need for overseas expansion or global industrial layout.

A mid-sized securities firm executive observed that the approval for A-share companies listing in Hong Kong seems to be faster compared to new stocks listing in Hong Kong or the US. He also suggested that this might be because the A-share companies currently going to Hong Kong are mostly domestic industry leaders that are already listed on the A-share market, making their materials and review potentially easier.

Of course, the liquidity of the Hong Kong stock market is improving, which is also a point of concern for issuers. Public data shows that the Hong Kong Stock Exchange's average daily trading volume in the first five months of 2025 was 242.3 billion Hong Kong dollars, a 120% increase from 110.2 billion Hong Kong dollars in the same period last year.

Unlike previous A-share companies listing southward, in addition to liquidity, the valuation of Hong Kong stocks is also changing. The Hang Seng Index has risen above 24,000 points, and the price gap between A-shares and Hong Kong stocks is gradually narrowing, even showing a "Hong Kong stock premium over A-shares" phenomenon.

Taking CATL as an example, it was listed at 263 Hong Kong dollars per share, about 7% lower than A-shares. However, it opened more than 12% higher on the first day, with a peak increase of over 18%, and closed at 306.20 Hong Kong dollars per share, slightly premium to that day's A-share price (263.00 yuan per share). This phenomenon is rare among A+H shares. In fact, CATL's subsequent market performance has continued to have a slight premium over A-shares.

This is not common among the more than 100 companies listed simultaneously on A and H shares. Previously, H-share prices of A-share companies listing in Hong Kong were generally at a discount to A-shares. Public data shows that only a few companies like BYD and China Merchants Bank have previously shown premiums.

Some central fund managers believe that in addition to the scarcity of targets, CATL's Hong Kong stock issuance structure, which results in a relatively small free float, is also a factor driving the stock price up. (Note: CATL's free float is 3.9 billion shares for A-shares and 1.56 billion shares for H-shares).

Wang Shuguang, a member of the management committee of CICC, stated that good Chinese companies listing in Hong Kong may have a certain premium over A-share trading prices, reflecting international capital's recognition. This may subsequently feedback to the A-share market, drawing more investors' attention to these undervalued A-share companies.

An executive of a mid-sized securities firm believes that before the A-share market is fully opened, there are not many options for Chinese assets to go public in the foreseeable future, except for the Hong Kong market. This is because, due to geopolitical factors, issuers are more cautious about listing in the US or Europe.

If the choice is not made well, the best listing opportunity might be missed. Shein, the cross-border e-commerce leader, is the best example.

Shein once planned to list in the US, UK, or even Singapore, but recently planned to submit a listing application in Hong Kong. During these years of deliberation, Shein's valuation has been halved, from a peak of $100 billion to reportedly less than $30 billion.

CATL Set a "Bad" Precedent: Investment Banks Are Competing Even at a Loss

Regarding how long this trend of A-share companies listing in Hong Kong will continue, Wang Shuguang also believes that it will be a trend that may last for a long time.

Public data shows that nearly 50 A-share companies have clearly stated their intention to list in Hong Kong this year. As of June 13th, 5 A-share companies have already listed in Hong Kong, including CATL, Hengrui Pharmaceuticals, and Jihong Stock, with Haitian Flavor and Sanhua Intelligence also in the process of public offering.

Zhu Zhengqi believes that the pool of A-share listed companies is large enough, and even the companies currently confirmed to list in Hong Kong can continue for a long time.

She also mentioned that this wave of Hong Kong IPO is not entirely driven by A-share companies listing southward. She cited companies like Mao Geping listed at the end of last year, and Mixue Ice Cream and Bruco listed early this year, which also had a hot market response, but these were new stock IPO projects, not A-shares listing in Hong Kong.

Bian Jing also believes that this trend may continue for some time. There are sufficient companies currently submitting listing applications in Hong Kong. At Agricultural Bank International, his team has 9 projects that have submitted applications, over 10 projects about to be submitted, and over 10 projects in negotiation.

Meanwhile, Bian Jing also believes that many long-term foreign funds and sovereign wealth funds have been gradually returning to Hong Kong.

According to his observation, in recent months' IPOs, many foreign sovereign wealth funds' names have appeared in IPO cornerstone investor lists. In fact, many other foreign sovereign wealth funds have been placing orders in the institutional subscription portion of IPOs—a part that does not require disclosure and is not well understood externally. "If these IPOs can provide funds with considerable returns, they will continue to stay in the Hong Kong market."

Tencent News' "Qiangwang" learned that the sovereign wealth funds returning this time include, but are not limited to, Temasek, GIC, and other Singaporean sovereign wealth funds, Canadian sovereign wealth funds, Malaysian sovereign wealth funds, and sovereign wealth funds from Abu Dhabi, Kuwait, and Saudi Arabia. They have participated in Hong Kong IPO orders in the past few months, all wanting to seize the opportunity and not miss this "China hot wave".

Most of the IPOs these funds participated in were profitable. Ernst & Young's data shows that in the past six months, about 70% of Hong Kong IPO projects made money on the first day.

These overseas large funds are particularly interested in good A-share companies that are undervalued and listing in Hong Kong. In the next long period, over 90% of the A-share companies listing in Hong Kong will have a market value exceeding $10 billion. Looking at the currently submitted companies, most are led by top investment banks in Hong Kong.

Lin Zilong believes that this wave of A-share companies with $10 billion valuations listing in Hong Kong may continue until next year, after which more companies with valuations below $10 billion might list—which is where his company, AJ Financial, and most mid-tier securities firms are focusing. Currently, his team's A+H projects are mostly concentrated on companies with valuations under $10 billion.

"It looks bustling, but it's actually just the excitement of big investment banks, with little to do with small and medium-sized investment banks," lamented an executive of a small and medium-sized investment bank. Most of his IPO projects have not been approved, and small investment banks cannot enter large A-share Hong Kong IPO projects. In his view, these large projects have absorbed most of the market funds, making small project issuance still very difficult.

However, the situation for big investment banks is not as good as outsiders might imagine. Multiple investment banking professionals revealed that while projects seem to have increased, IPO project profit margins are not as expected and are even declining, with some big investment banks losing money on IPO projects.

"The fees for A-share Hong Kong listing projects are being fiercely competed," multiple investment banking professionals disclosed. Even with fees being driven so low, investment banks are still aggressively bidding for IPO projects. This is because IPO projects are actually a "traffic acquisition tool" for investment banks—by establishing connections through IPO projects, subsequent refinancing in Hong Kong or family office businesses of management layers are what the parent companies of investment banks truly value. If they do not actively participate in IPO projects, they might miss out on subsequent fundraising businesses.

The most exaggerated case is the recently listed CATL, with a fixed underwriting fee of 0.2%. Many investment banking professionals believe that CATL's listing has actually set a "bad" precedent in the Hong Kong stock market, causing most A-share companies listing in Hong Kong to reference this in terms of fees.

Now, most A-share IPOs listed in Hong Kong have fixed underwriting fees below 1%, and even some foreign investment banks have quoted a fixed underwriting fee of 0.4% - which is far lower than the conventional IPO fixed underwriting fee of 3%-5%. Chinese investment banks in Hong Kong are more accustomed to winning projects with lower fixed underwriting fees.

For investment banks, the difficulty and workload of A-share listings in Hong Kong have not decreased, but the underwriting fees have significantly dropped. Many investment bank professionals participating in IPO projects complain that A+H projects are actually more exhausting than before, yet the income has become less. Many Chinese investment banks have seen their income and bonuses drastically reduced in recent years, but investment banking employees are hesitant to jump ship to foreign banks, which have much higher incomes.

This is because foreign banks often drastically reduce staff when projects decrease, making job security uncertain - while Chinese investment banks, especially bank-affiliated investment banks, are relatively more stable.

Bian Jing stated that in recent months, as the market improved and projects increased, investment banks have made corresponding adjustments in fees under staff shortage conditions. According to his understanding, some IPO project quotes, including sponsorship fees, have increased compared to before.

Previously, due to the cold market and few IPO projects, some Chinese investment banks had reduced sponsor signature fees to around 3 million Hong Kong dollars. The most extreme case was CATL, where the sponsorship fees, including foreign investment banks, were uniformly set at 300,000 US dollars, equivalent to 2.35 million Hong Kong dollars. CATL's sponsors included multiple investment banks such as JPMorgan Chase, Bank of America, and CITIC International.

Meanwhile, according to Bian Jing, at least five Chinese investment banks in Hong Kong have launched new recruitment plans as IPO projects have increased. "As the market improves, everything is gradually moving in a better direction, whether it's income or recruitment."

In the next extended period, Hong Kong investment banks will have much easier times.