Author: Oui Capital

Compiled by: Will Awang

In previous articles, such as " The crypto narrative of stablecoins is reshaping the African economic landscape " and " Web3 Payment 10,000-word research report: Stablecoins in Africa in 2025 ", we looked more at the financial changes brought about by stablecoins on the African continent. This bottom-up perspective is very touching.

From everyday tools: savings, consumption and credit, to B2B trade and cross-border payments, to access to credit, stablecoins are addressing issues such as dollar access, instant settlement and FX inefficiencies on the African continent, which are particularly prominent in markets where traditional payment channels are insufficient.

Stablecoins are already a reality for cross-border payments in Africa… the rest of the world is just catching up. — Zekarias Amsalu, Co-Founder of Africa Fintech Summit

Stablecoins are like when I was in the vast Serengeti grasslands, I received communication signals from the space orbit through Starlink. But this is not comprehensive. The vast majority of Africans still rely on traditional telecommunications. This is the same as the current financial situation in Africa. The reality of the fragmentation of various regional plates in Africa and the lack of financial infrastructure actually require the improvement of the entire financial technology transformation level, and blockchain stablecoins are just one of the best paths.

Therefore, we compiled an article from Oui Capital: Africa's Cross-border Payment Landscape, in order to see the butterfly effect of financial reforms from a comprehensive perspective of Africa's cross-border payment landscape. The report provides a comprehensive insight into the African cross-border payment market, outlining the market situation and key trends, regional differences, payment path selection and potential investment trends.

Through this report, we also see the missing side of the bottom-up transformation of stablecoins: such as the impact of regulatory coordination, the value that will be released by the interoperability between fintech companies and banks, and solutions to the pain points of rigid demand scenarios (this is also what Airwallex CEO Jack thought after commenting on stablecoins).

While some regional financial innovations can accelerate the flow of funds, the financial tracks that support Africa have not been synchronized. The traditional financial system has failed to provide stability, accessibility and efficiency, leaving people at risk of inflation and financial uncertainty, with limited control over savings and difficulty accessing global markets. But just as the region skipped the desktop era and went directly to the mobile field, now the African continent is ready to move beyond the outdated banking infrastructure and actively embrace the next generation of financial technology changes.

For the global fintech community, the question is not whether stablecoins will go mainstream. The question is what we can learn from where stablecoins are already taking hold: Africa.

Executive Summary

The African cross-border payments market is currently valued at $329 billion in 2025, with a projected compound annual growth rate (CAGR) of 12% to reach $1 trillion by 2035. However, the market faces inefficiencies that cost businesses and consumers billions of dollars each year. Factors such as growing trade, increased migration, rising penetration of mobile payments, and fintech innovations in Africa are reshaping the landscape. Despite progress, challenges such as high transaction fees, currency volatility, and regulatory fragmentation continue to hinder the realization of seamless transactions.

In 2022, the number of registered mobile payment accounts in Africa reached 781 million, a year-on-year increase of 17%, and the transaction volume reached US$837 billion, accounting for 66% of the global mobile payment transaction volume. Fintech solutions have significantly reduced the cost of remittances, averaging only 3.5%, making remittances faster and completed within minutes, while traditional bank fees are as high as 8-12%. In addition, intra-African trade is also growing, and small and medium-sized enterprises are increasingly using digital payments to efficiently process cross-border transactions. However, the market still faces many obstacles.

Despite this, Africa remains the region with the highest remittance costs in the world, averaging 7.4%-8.3%, which is mainly attributed to regulatory fragmentation and limited digital interoperability. Only 55% of African countries allow electronic KYC, resulting in duplication of compliance processes, while inconsistent foreign exchange policies in countries such as Nigeria further exacerbate transaction uncertainty and costs. In addition, foreign exchange liquidity challenges lead to the need for costly offshore USD/EUR clearing, resulting in additional costs of $5 billion per year due to illiquidity and double currency conversion.

Opportunities for investment and innovation abound, especially in enhancing the interoperability of digital payments and building a robust API and infrastructure layer. Connecting mobile payment networks could save up to $5 billion per year by addressing transaction inefficiencies. Additionally, the expansion of cryptocurrency and stablecoin payments presents a huge opportunity, reducing remittance fees by up to 60% compared to traditional banks and promising faster settlements with minimal foreign exchange costs. Finally, establishing a decentralized African foreign exchange exchange could significantly reduce foreign exchange conversion costs, stabilize exchange rates, and promote intra-African trade and remittances.

1. Market Overview and Key Trends

The African payments market is at a critical juncture. The growing popularity of digital payment channels, along with shifting migration patterns, are looking to formalize informal transactions by offering faster and cheaper alternatives to traditional bank transfers. Mobile payments, fintech solutions, and regulatory reforms are driving this shift, making digital payment channels more competitive.

This shift is expected to grow at a compound annual growth rate of 12% and has the potential to drive the total cross-border remittance market (both formal and informal) to $329 billion by 2025 and $1 trillion by 2035. However, while digital penetration is increasing, informal channels and traditional bank transfers remain entrenched due to cost, accessibility, and regulatory gaps.

Even as digital solutions evolve, some users still rely on old methods due to trust issues, inconsistent regulation or limited infrastructure. Can digital innovation truly absorb informal money flows at scale? Or will structural inefficiencies continue to drive the development of alternative methods of transferring money? The answer will determine whether the African payments landscape will achieve its expected formalization or whether the informal market can continue to thrive.

1.1 Formal cross-border remittance channels and market growth (2020 - 2035)

A. Current Market Value (2025)

The formal cross-border payments market in Africa is expected to reach $140.9 billion by 2025, growing at a compound annual growth rate of 12%. In 2023 alone, remittances to Africa are expected to reach $90.2 billion (5.2% of the continent’s GDP), a figure that is almost twice the amount of foreign aid Africa receives.

B. Historical compound annual growth rate (2020 - 2025)

Formal remittance inflows have continued to grow over the past five years, with a compound annual growth rate of between 10% and 15%, averaging 12%. Specifically, from 2020 to 2023, remittance inflows have increased significantly by 14.8%, mainly due to an increase in diaspora remittances.

1.2 Total cross-border remittance channels and market size estimates

A. Percentage of informal capital flows

Formal remittances to Sub-Saharan Africa total $53 billion to $54 billion in 2022, but informal channels account for a sizeable portion of total remittances, suggesting an underestimation of the market size. Informal remittances account for 35% to 75% of total remittances, meaning actual remittances, including informal transactions, could exceed $329 billion in 2025.

B. Cost Impact

Formal remittance fees average 7.4%, which encourages continued reliance on informal transfers. Digital solutions have reduced fees to 1.5% to 3%, making formal channels more attractive and likely to capture a larger share of informal financial flows.

C. Market Growth Forecast

As digital adoption continues to increase, a 12% compound annual growth rate is expected to drive the total remittance market to $1 trillion by 2035. This also highlights the huge opportunity for digital solutions to formalize more transactions, move informal financial flows to traceable online channels, and drive future market growth.

1.3 Key growth drivers of cross-border payments

A. Regulatory reform (Pan-African Payment and Settlement System (PAPSS) and African Continental Free Trade Area (AfCFTA))

The Pan-African Payment and Settlement System (PAPSS) is set to launch in 2022, enabling instant cross-border payments in local currencies, with the potential to save $5 billion per year. In addition, the African Continental Free Trade Area (AfCFTA) is harmonizing financial systems and reducing reliance on SWIFT and external banking intermediaries.

B. Regional migration, trade and urbanization

Intra-African remittances reached $20 billion in 2022, reflecting strong regional migration trends. Urbanization and intra-African trade are driving the development of South-South remittance corridors and strengthening regional financial integration.

C. Mobile payment penetration rate

Currently, 30% of cross-border remittances in Sub-Saharan Africa (SSA) are processed through mobile payments, with the amount processed reaching US$16 billion in 2022, a year-on-year increase of 22%. Mobile payment remittances have an annual growth rate of 48%, and the handling fee (1.5% - 3%) is lower than bank remittances (more than 7%).

1.4 Impact of Fintech Innovation on Cross-border Payments

A. Remittance volume through fintech channels

Digital remittance usage has doubled since 2020, with 71% of mobile remittances coming from Africa. By 2024, mobile payments process more than 30% of remittances in Sub-Saharan Africa, with fintech companies processing tens of billions of dollars in remittances each year.

B. The rise of fintech solutions (blockchain, API, digital wallets)

Africa has one of the highest cryptocurrency adoption rates in the world, with $125 billion in on-chain cryptocurrency transactions, highlighting the growing shift towards cheaper and faster remittance solutions.

Fintech APIs are enabling direct wallet-to-wallet remittances and interoperability, reducing reliance on high-cost intermediaries.

New banks and digital wallets offer seamless cross-border transfer services through mobile and online platforms, making remittances faster, more convenient and more cost-effective.

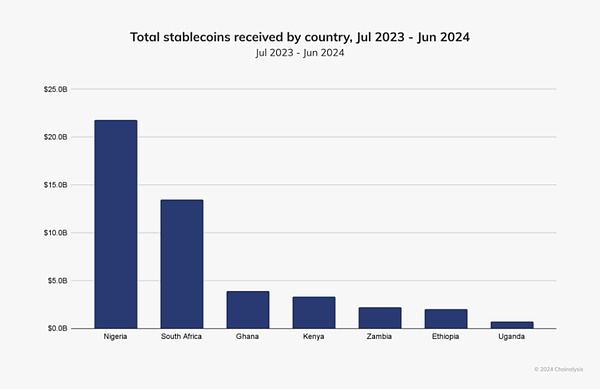

According to Chainalysis data, Africa is the fastest growing region for cryptocurrency adoption, with a year-on-year growth rate of 45% from 2022-2023 to 2023-2024, exceeding the 42.5% of other emerging markets such as Latin America. This rapid growth highlights the huge potential for stablecoin applications, especially in Africa where bank penetration remains among the lowest in the world.

C. Expected cost savings from digital innovation

Digital transfers have significantly reduced remittance fees from 7.4% to 3% or less, saving migrants $4-5 billion per year while making cross-border payments more affordable. In addition, PAPSS and fintech APIs are expected to eliminate $5 billion in correspondent banking fees, further speeding up transactions and reducing costs. For every 1% reduction in remittance fees, African households can save approximately $6 billion per year, highlighting the huge financial impact of digital innovation on the remittance industry.

II. Overview of Capital Flows in Various African Regions

While mobile money penetration is growing in some regions, it remains low in other regions, compared to East and West Africa. Central Africa’s financial system is more fragmented, heavily reliant on informal networks, and has limited interoperability between banks and mobile money platforms.

Here is an insight into the inflows and outflows by region:

2.1 West Africa

West Africa is one of the largest recipients of remittances in Africa, with inflows reaching about $48 billion in 2022 (World Bank 2023 data). Nigeria alone received $20 billion, mainly from the United States, the United Kingdom and Canada. Ghana, Senegal and Côte d’Ivoire also receive large amounts of remittances, thanks to their close migration links with France and other European countries.

Remittances between regions are also relatively large, such as Côte d'Ivoire-Burkina Faso ($1.5 billion), Ghana-Nigeria ($900 million) and Mali-Senegal ($750 million) (African Development Bank 2023 data).

These flows are primarily driven by trade, facilitated by informal networks due to high remittance fees that average 8-10% (IMF 2023). Despite advances in financial infrastructure, interoperability between mobile payments and bank-led systems remains a challenge in some regions. While Nigeria and Ghana have stronger bank-led systems that could facilitate greater inclusion, seamless transactions between mobile payments and traditional banking channels are still evolving.

The country ranks second overall in the Chainalysis team’s Crypto Global Adoption Index. The country received approximately $59 billion worth of cryptocurrencies between July 2023 and June 2024. Nigeria is also one of the leading markets for mobile crypto wallet adoption, second only to the United States. The country has actively worked on regulatory clarity, including through incubation programs, and has seen significant growth in the use of stablecoins for everyday transactions, such as bill payments and retail purchases.

(Sub-Saharan Africa: Nigeria Takes #2 Spot in Global Adoption, South Africa Grows Crypto-TradFi Nexus, Chainalysis)

As in Ethiopia, Ghana, and South Africa, stablecoins are an important part of Nigeria’s crypto economy, accounting for approximately 40% of all stablecoin inflows in the region—the highest in Sub-Saharan Africa. Nigerian users report a high frequency of transactions and the strongest understanding of stablecoins as a financial instrument, not just an asset class.

Crypto activity in Nigeria is driven primarily by small retail and professional-scale transactions, with about 85% of transfers valued at less than $1 million. Many Nigerians rely on stablecoins for cross-border remittances due to the inefficiency and high costs of traditional remittance channels. Cross-border remittances are the main use of stablecoins in Nigeria. It is faster and more affordable.

2.2 East Africa

East Africa leads in mobile money adoption, with more than 60% of remittance transactions being conducted digitally (GSMA 2023). Kenya, Uganda and Tanzania rely on M-Pesa, MTN, MoMo and Airtel Money to reduce remittance costs to 3%.

Remittances from the region are primarily directed to the Middle East, particularly Ethiopia ($5.3 billion), Somalia ($2.1 billion), and Kenya ($3.5 billion) (World Bank 2023). These flows support households and small businesses. However, cross-border payments within East Africa remain constrained by regulatory differences and a lack of seamless interoperability, limiting financial inclusion.

One of Kenya’s biggest strengths is its deeply ingrained mobile money culture. Launched by Safaricom in 2007, M-Pesa has become the backbone of Kenya’s financial system, processing about 60% of the country’s GDP and covering more than 90% of the adult population. Its success lies in providing banking services without the need for physical banks, allowing millions of Kenyans to deposit, withdraw, transfer money, and even obtain credit through their mobile devices. Stablecoins complement this ecosystem by allowing users to hold value in a stable currency and conduct frictionless transactions around the world.

In addition to mobile money, Kenya’s regulatory environment has been an important driver of fintech and Web3 development. Unlike many countries that take a restrictive stance on digital assets, the Kenyan Capital Markets Authority (CMA) actively promotes innovation through a regulatory sandbox, allowing blockchain-based companies to test and refine their products.

2.3 Southern Africa

Remittance flows to Southern Africa are huge, especially from South Africa. In 2022, South Africa sent $17 billion in remittances to its neighbors (Statista 2023 data), with Zimbabwe alone receiving $1.9 billion from South Africa, followed by Mozambique ($1.2 billion) and Malawi ($800 million). Labor migration is the main driver, with workers in the mining, construction and domestic service industries regularly sending money back home. However, remittance fees remain the highest in Africa, with an average fee of 12-15% for formal channels (World Bank 2023 data), which has led people to rely on informal networks, which account for nearly 40% of total remittances.

The remittance landscape in Southern Africa is largely dominated by banks, with traditional financial institutions dominating cross-border transactions. Unlike East Africa, where mobile payments are already widely adopted, mobile payment penetration in Southern Africa is relatively low. South Africa, for example, has a well-established banking system that handles the majority of remittances. However, high fees and slow processing times make many migrants prefer informal channels. Efforts to integrate mobile payments into the broader financial ecosystem are ongoing, but interoperability between mobile wallets and banks remains limited.

2.4 Central & North Africa

North Africa, led by Egypt ($32 billion), Morocco ($11 billion) and Algeria ($5.1 billion), remains one of the largest recipients of remittances, thanks to the large diaspora in Europe (World Bank 2023). More than 65% of remittance inflows come from France, Spain and Italy.

The Middle East is also an important source of remittances, especially for Egypt, with Saudi Arabia, the United Arab Emirates and Kuwait accounting for more than 50% of total remittance inflows to Egypt (World Bank 2023 data). Moroccan and Tunisian immigrants working in the Gulf countries also contribute a large amount of remittances, but remittances to Europe still dominate.

In Central Africa, the construction of remittance corridors is mainly driven by intra-African migration, with Cameroon receiving $2.8 billion in remittances from Chad and the Central African Republic (AfDB 2023 data). Due to limited financial infrastructure and high fees of more than 10% for formal channels, more than 70% of transactions are still informal. The financial landscape in North Africa is mainly dominated by banks, and most remittances are processed by formal financial institutions.

2.5 People who promote cross-border payments

A. Workers and migrants

The funds that labor migrants remit back home are mainly used for family expenses, education and health care.

The strongest migration patterns are rural to urban areas and from low-income African countries to high-income African countries, such as South Africa and Nigeria. Other examples include Egypt in North Africa and Kenya in East Africa, which have attracted large numbers of labor migrants due to their growing economic strength and job opportunities.

Remittances usually range from $200 to $500 per month, mainly for family support.

B. Traders and SMEs

Informal traders and small and medium-sized enterprises rely on remittances for inventory purchases, supplier payments, and cross-border trade expansion.

Mobile payments and fintech platforms are the main transaction channels, providing fast and convenient payment solutions.

Payment amounts range from $1,000 to $10,000, depending on trade volume and industry.

C. Corporate Transactions

Businesses process payroll for expatriate employees and gig workers through the remittance process.

Large supply chain transactions are increasingly leveraging fintech-enabled instant payments, reducing reliance on cash.

Transaction amounts can exceed $50,000, especially in the areas of logistics, payroll and supply chain settlements.

3. Global cross-border payment routes

Global cross-border payments operate through a complex, multi-layered infrastructure that enables the movement of funds between countries, currencies and financial institutions. This system is built on traditional banking networks, FinTech disruptors, foreign exchange (FX) settlement systems and emerging digital payment alternatives.

To understand how cross-border payments in Africa currently work, it is first necessary to understand how money flows in the global market. This section explores the key components of the existing global transaction methods, the main players, and the cost structures that define cross-border payments today.

3.1 Traditional Finance (TradFi) — Bank-led Infrastructure

TradFi supports most high-value international transactions, with each transaction typically ranging from $100,000 to billions of dollars. These payments are processed through secure, regulated banking channels that rely on interbank messaging, correspondent banking, and large-scale settlement systems.

Messaging and instructions: The communications infrastructure by which financial institutions securely send details of transactions. They do not move money, but enable banks, payment service providers and financial institutions to exchange payment instructions in a standardized format. Without these systems, banks would struggle to interoperate, making transfers slow, costly and error-prone.

FX Execution and Trading: The currency exchange layer facilitates and ensures that funds are exchanged at market rates. Banks, hedge funds, and corporates use the FX market to ensure liquidity, hedge currency risk, and settle international invoices. Without this layer, it would be difficult for companies to conduct cross-currency transactions, leading to inefficiencies in global trade.

FX Settlement and Clearing: FX settlement layers ensure that transactions are properly settled, thus avoiding the risk of default by either party. They use a payment-versus-payment (PvP) model, ensuring that both parties exchanging currencies are doing so simultaneously, thus eliminating counterparty risk. Without such a system, transactions can fail, with one party delivering currency but not receiving the expected funds.

Correspondent banking networks: Large global banks process payments between financial institutions that lack direct links, enabling them to process cross-border payments. These banks hold accounts on behalf of foreign banks, ensuring that funds flow correctly.

USE CASE: A US company paid $5 million to a German supplier via traditional bank wire.

A. Payment Initiation

A US company pays a German supplier $5 million via traditional bank wire.

Parties involved: For example: JPMorgan Chase (American bank), Deutsche Bank (German bank).

Cost and time impact: SWIFT fees range from $10 to $50. Payment initiation is instant, but processing may take several hours.

B. Foreign exchange (US dollar to euro)

JPMorgan uses its foreign exchange trading platform to convert dollars into euros.

Related parties: For example, EBS, Refinitiv FX Matching, CME FX.

Cost and time impact: FX spreads are 0.1% - 2% ($10,000 - $100,000 cost impact), and settlement times are seconds to minutes.

C. Foreign exchange settlement and clearing

Payments are settled via CLS Group to ensure both currencies are transferred simultaneously.

Related parties: For example, CLS Group (PvP settlement).

Cost and time impact: Secure FX settlement is ensured, but a small CLS fee is required (approximately USD 5 per USD 1 million settled).

Time: 1 working day.

D. Correspondent Bank and Final Settlement

In the absence of a direct connection between JPMorgan and Deutsche Bank, a correspondent bank processes the payment. Deutsche Bank deposits the money with the supplier and sends a final confirmation.

Related parties: Correspondent banks (e.g. HSBC).

Cost and time impact: Additional fees range from $20 to $100. Full transaction settlement takes 1 to 3 days.

Total cost estimate: $20,000 to $150,000, including SWIFT fees, FX spreads and correspondent bank fees. Settlement time: 1 to 3 days.

Why it’s expensive: Multiple intermediaries charge fees at every step, FX spreads can be wide, and settlement times are long.

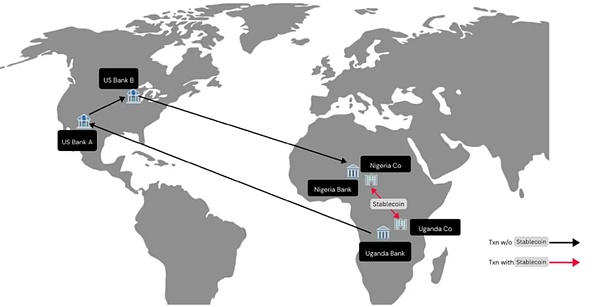

In Africa, due to the lack of traditional financial infrastructure, even to neighboring countries, cross-border remittances sometimes need to go through agent banks in the United States for transit.

3.2 Fintech disruptors – faster payment alternatives

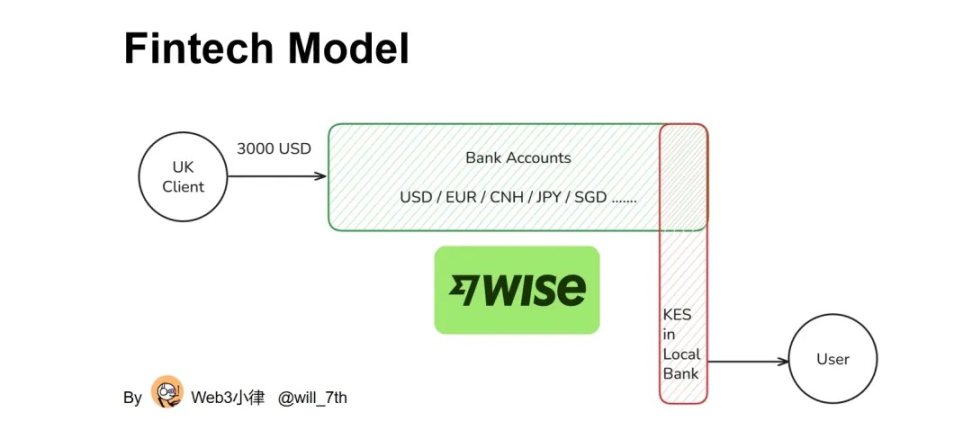

While traditional finance (TradFi) dominates high-value transactions, small businesses, freelancers, and digital-first companies need cheaper and faster alternatives. This has led to the rise of FinTech disruptors who bypass (optimize) correspondent banking networks and instead use local partnerships, pooled liquidity, and real-time settlement networks.

Fintech companies are transforming cross-border payments by bypassing traditional banking channels, offering faster, cheaper and more transparent transactions for amounts typically ranging from $100 to $50 million.

Total cost estimate: $12 to $30 in fees, saving up to $100 compared to banks.

Settlement time: Same day (hours not days).

Why it's cheaper and faster: Wise matches trades locally without the need for a correspondent bank, eliminating FX markups and SWIFT fees.

This settlement method of cross-border fund pools through local bank accounts can essentially achieve higher efficiency in fund delivery. This is why Airwallex CEO Jack said: I don’t see any advantages of stablecoins. However, this also tests the bank channel capabilities and position liquidity management capabilities of Fintech companies in various regions.

USE CASE: A freelancer in Kenya received $3,000 from a UK client through Wise.

A. Payment Initiation

A UK customer sent $3,000 via Wise instead of a traditional bank wire.

Related parties: Example: Wise (fintech alternative).

Cost and time impact: Transfers start immediately, fees: 0.4% -1% ($12 - $30).

B. Funding Pool Liquidity and Local Settlement

Wise matches this transaction with someone sending KES to the UK, thus avoiding a direct foreign exchange transfer.

Related parties: For example: Wise Local Settlement Network.

Cost and time impact: Close to mid-market price, 0.5% - 1% spread (savings of $60 - $100).

C. Local bank payment

Wise pays freelancers in KES from its local Kenyan bank account.

Related parties: For example: Cooperative Bank of Kenya.

Cost and time impact: Settlement time is within minutes to hours, no SWIFT fees.

3.3 Settlement based on cryptocurrency and blockchain

Blockchain and stablecoins completely replace banks, enabling instant, low-cost transactions for amounts ranging from $1 to $10 million. Cryptocurrency rails use decentralized ledgers, bypassing SWIFT and correspondent banks entirely, reducing settlement times from days to seconds.

Total cost estimation: The on-chain fees are negligible. The main cost is the acceptance fee of deposit and withdrawal currency, which is 0.4%-1% per side.

Settlement time: Immediate.

Why it’s cheaper and faster: Eliminates intermediaries, reduces fees by up to 99% compared to banks, and reduces settlement time from days to seconds.

Due to the existence of currency acceptance fees for deposits and withdrawals, the cost of cross-border capital pools does exist. However, for countries with foreign exchange controls, it is a great blessing to hold US dollars instead of the currency depreciated by inflation in their own country.

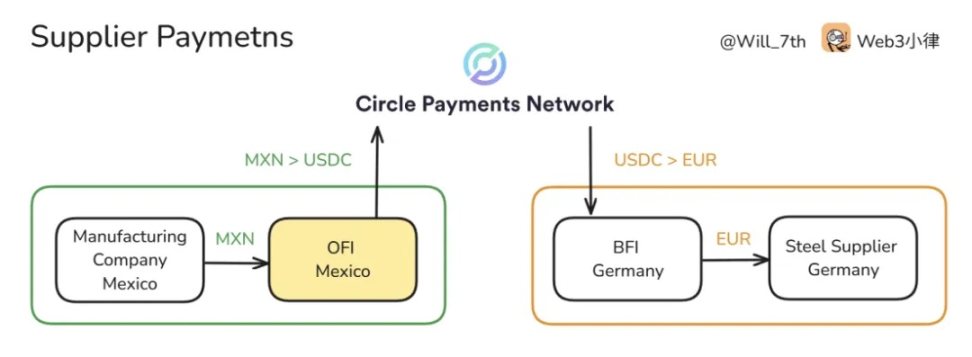

USE CASE: A textile factory in Mexico sends $1 million USDC to its supplier in Germany.

A. Blockchain transfer

The sender converts the local currency into $1 million USDC and transfers it through the blockchain.

Participants: For example: Ethereum, Solana, USDC issuer (Circle) 0.4% - 1% (US$4,000 - US$10,000).

Cost and time impact: Network fee: $1.

Time: seconds.

B. Cross-border Settlement

The recipient immediately receives $1 million USDC in his or her digital wallet.

Participants: For example: Cryptocurrency exchanges (Binance, Coinbase, Circle API)

Cost and time impact: No intermediaries required, instant completion.

C. Local Exchange and Payment

The recipient converts USDC into euros through an exchange.

Participants: For example: Binance, local fintech companies.

Cost and time impact: USDC issuer (Circle) 0.4% - 1% ($4,000 - $10,000), settlement completed within minutes.

3.4 Cross-border payment channels in Africa

Traditional finance (TradFi) dominates large payments, but costs remain prohibitively high, ranging from $20,000 to $150,000 per transaction. In contrast, fintech solutions offer a cost-effective alternative that can reduce fees by up to 90% for SMEs and freelancers. Even more transformative, blockchain-based settlements bypass traditional banks, reducing costs to near zero.

Despite these advances, remittances remain expensive with traditional service providers such as Western Union. However, fintech disruption is reshaping the landscape, offering faster and cheaper alternatives.

This shift is particularly urgent in Africa, where cross-border payments are fragmented, costly, and heavily reliant on correspondent banking and cash remittances. While global markets embrace real-time settlement and fintech-driven efficiencies, Africa remains reliant on legacy infrastructure, which creates delays and high fees. However, innovation is emerging.

The continent’s unique financial landscape, dominated by mobile payments, regional payment systems, and blockchain-based solutions, is beginning to address long-standing inefficiencies and enable a more inclusive, affordable future.

The main features of cross-border payments in Africa:

A. Low-volume, high-frequency trading dominates

Remittances, SME trade, and informal payments are the main use cases. The average remittance transaction in Africa is $200-400, with an estimated 60-80 million transactions per month (World Bank 2023). Informal cross-border traders typically process payments of $200-1000 per transaction, often multiple times per week (UNCTAD 2021).

B. Fintech and blockchain

Companies like Chipper Cash, Flutterwave and BitPesa are bypassing banks to enable faster and cheaper transfers.

C. Currency fragmentation

Africa has more than 40 currencies, resulting in high foreign exchange costs and reliance on USD/Euro settlements.

D. Heavy reliance on cash

Digital adoption is growing, but more than 80% of transactions are still paid in cash (World Bank, 2023). Cash still reigns supreme.

E. Powerful mobile payment network

Africa leads in mobile money penetration, with platforms such as M-Pesa, MTN MoMo and Airtel Money dominating.

F. Reliance on Correspondent Banks

Many African banks lack direct cross-border access, which increases transaction costs and processing times.

4. How are cross-border payments conducted on the African continent?

Remittance transactions typically go through multiple steps from sender to recipient and involve different financial entities and regulatory frameworks.

4.1 Remitter initiates transaction

Remitters choose payment channels based on cost, speed, accessibility, and convenience. Preferences vary by location, digital literacy, and financial infrastructure:

Mobile payments (e.g., M-Pesa, MTN MoMo)

Individuals in countries with a well-developed mobile payment ecosystem prefer mobile payments due to their low fees (typically 1-3% per transaction) and high accessibility. Transactions are usually instant, making them ideal for everyday remittances of less than $500.

Fintech applications (e.g., Chipper Cash, Grey)

Attract digital financial users who need faster transfers and better exchange rates. These services charge lower fees than banks (0-2% on average) and process transactions within minutes to hours.

Bank transfer (e.g., UBA, Ecobank)

Typically used by businesses and individuals with formal banking services for large transactions. However, these services have high fees (2-5%) and slow processing times (1-3 days), making them less suitable for urgent money transfers.

Cash deposits and withdrawals (e.g. Western Union, MoneyGram)

Still, they are crucial for recipients in rural areas where digital payment infrastructure is limited. These services charge 5-10% per transaction and require recipients to visit a physical store, but they are reliable and have wide coverage.

Cryptocurrency transfers (e.g., Bitnob, Afriex)

Favored by users seeking low-cost (0-1%) and borderless transactions, especially where foreign exchange trading is restricted. Settlement times can be instant or take several hours, depending on blockchain congestion and the availability of fiat on-ramps and off-ramps.

4.2 Transaction Processing and Routing

Transactions are processed by payment aggregators, remittance operators (MTOs), or routed through blockchain-based networks, each serving different market needs and operating models:

Mobile payment aggregators

These companies connect telecom operators, banks and international money transfer operators (IMTOs) to enable seamless routing of transactions. As aggregators, they do not directly own the customer relationship but facilitate interoperability. They focus on Africa as a whole, especially in areas with high mobile money penetration (East Africa, West Africa and parts of Central Africa). They typically generate revenue by charging transaction fees to international money transfer operators, telecom operators and banks.

At the same time, they often have payment rails that enable them to conduct direct-to-consumer (D2C) transactions for individuals and SMEs looking to transact across borders. Examples include Onafriq (formerly MFS Africa), Cauridor and Thunes.

Fintech Aggregators

These are digital payment infrastructure providers that offer businesses (merchants, fintechs, SMEs) a single API to accept multiple payment methods, including mobile payments, bank transfers, and card payments. Companies like Flutterwave, Paystack, and Fincra enable merchants to process digital payments from multiple sources through a single integration. They focus on countries with thriving digital economies and formalized banking sectors, such as Nigeria, South Africa, Egypt, and Kenya. Their revenue model is based on merchant transaction fees (1-4%), API subscription fees, and value-added services like fraud detection and instant settlement. These aggregators cater to businesses, merchants, and digital platforms that need seamless payment processing.

Traditional Banks and Correspondent Banking Networks

Transactions through banks are processed through the SWIFT network and correspondent banking relationships, which remain the primary way high-value transactions are processed. Most African banks lack direct access to foreign banks and therefore need to use intermediary correspondent banks (e.g. Citibank, JPMorgan Chase) to clear cross-border payments. This reliance increases costs and adds delays, with settlement times ranging from 1 to 5 days, as multiple intermediaries charge fees at each stage.

SWIFT processes over $80 billion in cross-border transactions involving African banks each month (SWIFT 2023), and is deeply entrenched in the financial system due to its global acceptance and regulatory compliance. However, this also makes it one of the most expensive solutions, with fees ranging from 0.5% to 3% of the transaction value, in addition to foreign exchange spreads and intermediary fees. Disrupting this system has proven difficult, although emerging alternatives such as PAPSS and blockchain-based networks are working to reduce costs and shorten settlement times.

Cash Pickup and Remittance Network

Western Union and MoneyGram transactions typically go through correspondent banks (such as Citibank and JPMorgan Chase) before reaching the recipient, adding multiple layers of fees and delays. Because most African banks lack direct international clearing capabilities, these remittance providers must move funds through the SWIFT system, which results in high transaction costs (5-10% per transfer) and extended processing times (hours to days). In addition, many banks act as cash pickup points for Western Union and MoneyGram, further reinforcing their reliance on banking infrastructure for physical payments and compliance checks.

Despite these inefficiencies, Western Union and MoneyGram remain firmly in control thanks to their extensive agent networks, regulatory compliance, and consumer trust built over decades. Their ability to offer cash pickup, bank deposits, and foreign exchange services ensures their continued dominance in Africa’s remittances space.

To compensate for these inefficiencies, startups like BnB Transfer have expanded payment options beyond traditional cash withdrawals. They now offer bank deposits, mobile payments, and agent network services, giving individuals and SMEs more flexible ways to access funds while reducing reliance on the expensive agent banking system.

Blockchain Networks and Cryptocurrency-Based Remittances

Platforms such as Afriex, Bitnob and Stellar process transfers based on a blockchain network. This provides instant transaction verification and reduces intermediaries, shortening transaction times to minutes and reducing the cost of each transaction to 0-1%. Users usually top up their cryptocurrency wallets through bank transfers, mobile payments or any other available access method.

While blockchain-based remittance solutions offer faster settlements and greater accessibility to users in countries with foreign exchange controls or limited banking infrastructure, these companies have struggled to scale due to regulatory uncertainty, limited fiat on- and off-ramps, and compliance restrictions. The inability to efficiently convert cryptocurrencies into local currencies has made it difficult for these providers to establish partnerships with major financial institutions, limiting their ability to process transactions at scale and compete with traditional remittance providers.

4.3 Foreign Currency Conversion

If the remittance involves different currencies, a currency conversion needs to be performed before payment can be made. Currency conversion is facilitated by multiple institutions, including banks, foreign exchange brokers, fintech platforms, and blockchain-based liquidity providers.

Banks and correspondent banks

Traditional banks rely on a network of correspondent banks to obtain foreign currency, which increases fees (typically 0.5% - 3% per transaction) and lengthens settlement times (1 - 3 days).

Forex Brokers and Fintech Platforms

Companies such as AZA Finance, VertoFX and Thunes provide alternative foreign exchange services, often offering better rates and faster settlement than banks. They aggregate liquidity from multiple sources to facilitate cross-border trade and remittances.

Blockchain-based liquidity provider

Platforms such as Stellar, Bitnob and Afriex use decentralized networks to provide real-time foreign exchange conversion at minimal cost (0-1% per transaction), but their scalability is limited due to regulatory barriers and low institutional adoption.

4.4 Last Mile Delivery

This requires depositing the funds into the recipient's mobile wallet, bank account, or withdrawing cash through a partner agent, bank or mobile payment operator.

Banks and Financial Institutions

For recipients who choose bank deposit, the financial institution will process the transfer. Settlement times vary from instant to 3 days, depending on the bank's infrastructure and interbank relationships.

Mobile payment operators

Platforms such as M-Pesa, MTN MoMo and Airtel Money enable direct wallet deposits, which are usually processed in real time or within a few hours.

Cash withdrawal network

Providers such as Western Union, MoneyGram and BnB Transfer offer on-site cash pickup at designated agent locations or partner banks. These transactions require additional KYC verification and processing fees.

5. African Payment Landscape and Key Players

Traditional institutions such as banks and money transfer operators (MTOs) rely on correspondent banks and the SWIFT network, which drives up costs and slows down settlements. The cross-border payments landscape in Africa is rapidly evolving as fintech companies offer users faster, cheaper and more convenient solutions.

In contrast, fintech disruptors are changing the payments ecosystem by offering direct-to-consumer services and developing infrastructure that empowers traditional institutions. This wave of innovation is reshaping Africa’s cross-border payments industry and intensifying competition.

5.1 Market opportunities and practical challenges

challenge:

There is no real intra-African clearing and settlement system. Payments need to be cleared in US dollars, which increases costs and reduces efficiency.

Lack of a unified African foreign exchange market. Lack of liquidity in local currencies leads to high costs for currency conversion.

There is limited interoperability between banks and fintech companies. Financial institutions operate in silos, leading to inefficiencies.

Slow adoption of PAPSS. Regulatory hesitation and liquidity constraints have slowed progress of regional payment schemes.

Over-reliance on SWIFT for cross-border transactions. African banks rely on expensive international payment networks.

opportunity:

A real-time gross settlement (RTGS) system that enables instant transactions within Africa without reliance on the US dollar.

A decentralized FX liquidity pool that facilitates trading in African currencies without a correspondent bank.

A standardized API layer designed to improve interoperability between banks and fintech companies.

The Pan-African Instant Payments Corridor (similar to Europe’s SEPA) aims to unify fragmented payment systems.

Providing African banks with an alternative to SWIFT to reduce their reliance on expensive international networks.

5.2 The Landscape of Financial Technology Innovators

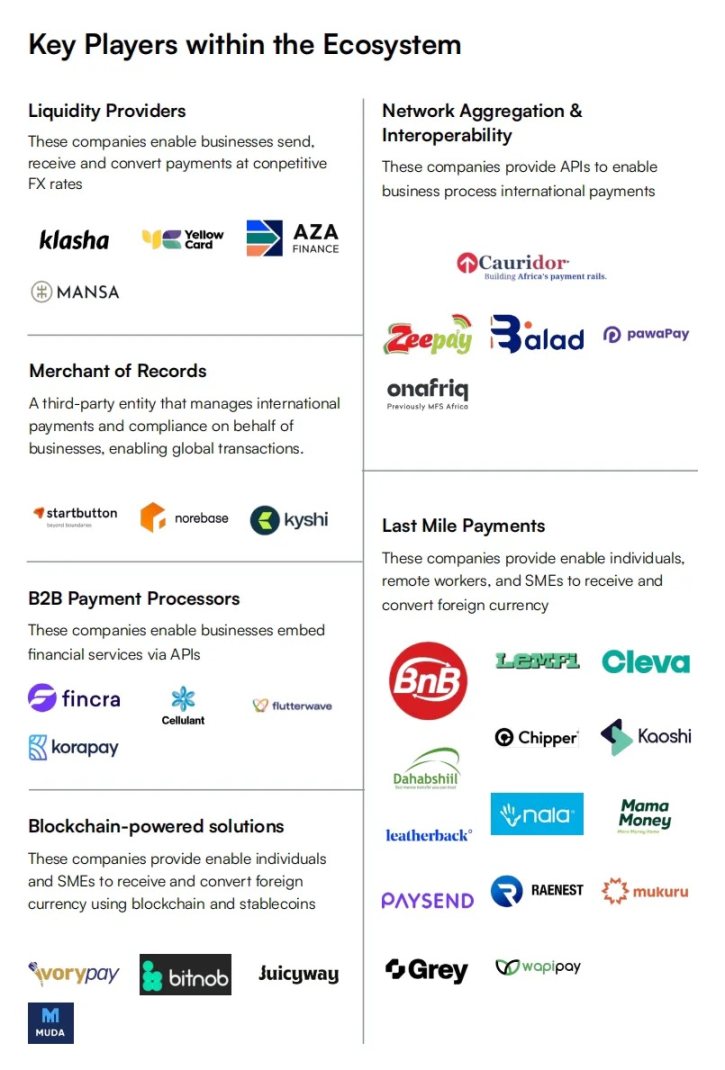

In view of the above opportunities and challenges, we can see the power of financial innovators:

The emergence of B2B Payment Processors (companies that enable businesses to embed financial services via APIs) and Last Miles Payments (companies that enable individuals, remote workers, and SMEs to receive and exchange foreign currencies) has significantly reduced transaction costs, often by 50% to 80% compared to traditional channels. Fintech platforms can now provide near-instant settlements within hours, significantly reducing the typical 2 to 5 day processing time required by banks. Despite this, the relatively low barriers to entry in these market segments have resulted in fierce competition and falling fees. Companies such as Chipper Cash and LemFi have eliminated transaction fees for specific channels, forcing traditional providers to rethink their pricing strategies.

Liquidity providers (those companies that enable businesses to send, receive and exchange payments at competitive prices) today offer competitive foreign exchange (FX) pricing and multi-currency settlement services, filling the gap left by traditional banks due to capital controls and dollar shortages. However, this sector remains difficult to scale due to high capital requirements, limited competition and fast market entry.

Network Aggregation & Interoperability Network aggregation service providers (companies that provide APIs to enable international payments for business processes) address Africa’s fragmented mobile payments ecosystem by enabling seamless cross-border payments. However, regulatory barriers and the dominance of telecom operators have hampered the development of this sector, requiring deep market consolidation and strategic partnerships.

Banks and traditional providers are responding to the changing landscape of cross-border payments in Africa as fintechs steadily gain market share. Incumbents such as Western Union and MoneyGram have taken steps to reduce fees and integrate mobile payment platforms, while banks are increasingly working with fintechs to innovate and enhance the customer experience. While traditional SWIFT-based transactions still play an important role, fintech solutions are gradually gaining traction by offering faster and more cost-effective alternatives, thereby promoting broader innovation across the industry.

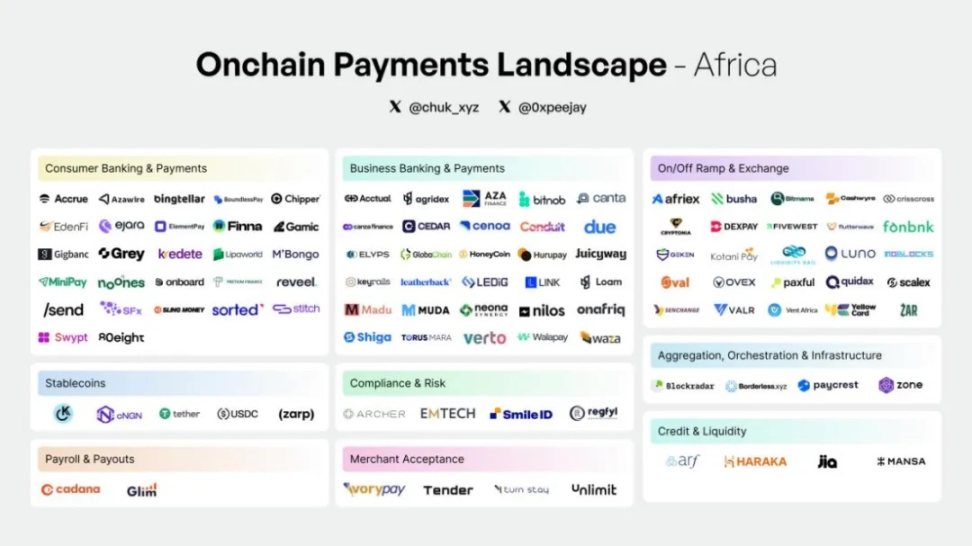

In addition to the fintech perspective presented by Oui Capital, Chuk from Paxos also drew an ecosystem map covering African payment channels, use cases, and companies to show the depth of the impact of the African stablecoin revolution and focus on Africa’s role in shaping its financial future.

(Mobile Money to Global Money: Africa’s Stablecoin Revolution, Chuk @ Paxos)

Looking ahead, Africa's cross-border payments industry will experience further price reductions, increased adoption of stablecoins, greater interoperability between financial institutions, and in-depth development of bank-fintech collaboration. The most successful companies will scale efficiently, navigate regulatory frameworks adeptly, and provide seamless and affordable transaction services. As competition intensifies, traditional institutions must innovate quickly or risk being marginalized in Africa's rapidly digitalizing financial ecosystem.

VI. Risks and Challenges of Financial Technology Development

Fintech companies in the cross-border payment space face multiple challenges that affect their scalability, profitability, and long-term sustainability. These challenges stem from the regulatory environment, financial risks, and intense competition. The following are the main risks and constraints that limit the development of fintech:

6.1 Regulatory uncertainty

Navigating a complex and evolving regulatory environment remains one of the biggest obstacles facing fintech companies operating in the cross-border payments space.

Diverse compliance requirements: Each country has its own financial regulations, anti-money laundering (AML) rules, and capital controls, making cross-border operations cumbersome.

Licensing and Approvals: Obtaining the necessary cross-jurisdictional remittance licenses can be costly and time-consuming, and regulatory approvals can take months or even years.

Data protection and privacy laws: Complying with regulations such as the General Data Protection Regulation (Europe), the Data Protection Regulation (Nigeria), and the Public Policy Act (South Africa) adds additional complexity, especially in terms of data localization requirements.

Sanctions and Fraud Prevention: Cross-border transactions are subject to intense scrutiny from global financial regulations such as the Financial Action Task Force (FATF), making compliance an ongoing challenge.

Example: A cryptocurrency remittance service in Nigeria was shut down due to a regulatory crackdown, highlighting the unpredictable nature of fintech operations in emerging markets.

6.2 Credit, foreign exchange loans and funding risks

Many fintech companies, especially those involved in foreign exchange trading, provide credit to customers by providing loans or liquidity support for foreign exchange positions. However, this carries the risk of counterparty default, currency fluctuations and mismanagement of funds.

FX liquidity provision and position lending:

When corporates and fintechs need to settle cross-border payments but lack instant foreign exchange access, foreign exchange providers can act as a source of liquidity. They provide credit in the required currency, allowing transactions to be executed before they are fully settled. If clients fail to repay or experience delays, foreign exchange providers are exposed to risk.

Foreign exchange volatility risk: Exchange rates continue to fluctuate, and sudden currency depreciation could cause fintech companies to default on loans for foreign exchange positions. Foreign exchange providers facing large exchange rate fluctuations may have difficulty maintaining liquidity, especially if local market conditions deteriorate.

Chain reactions in the ecosystem: If multiple fintechs default, liquidity shortages will occur, widening spreads and transaction costs across the market. Banks and liquidity providers will respond by tightening credit lines, increasing collateral requirements, or raising fees, which puts further financial pressure on fintechs.

Money Management Risk: Most Forex companies generate revenue by earning the difference between the bid and ask prices.

However, without sound cash management, such as accurate pricing of foreign exchange spreads, proper configuration of balance sheets, and effective currency hedging, they are at risk of large losses. Poor cash flow management can deteriorate rapidly, putting the company at risk of bankruptcy.

6.3 Market Competition and Profit Pressure

Competition in the fintech space is growing, making differentiation and long-term profitability increasingly difficult.

Established competitors: Traditional banks, global remittance giants (Western Union, MoneyGram) and large fintech companies (Wise, Revolut) occupy key markets. However, African fintech companies such as LemFi, Geegpay and Chipper Cash have gained significant development, providing more localized and cost-effective solutions for cross-border payments.

The rise of these companies, which use digital wallets, multi-currency accounts and direct integrations with mobile payment platforms to simplify transactions, cut costs and improve settlement times, highlights growing competition in Africa and a shift toward fintech-driven remittance solutions.

Price wars and thin margins: Many fintechs compete to drive down transaction fees, which reduces profitability and makes it harder to scale. The average transaction fee charged by African fintechs is 0.5% to 2% per transfer, which is much lower than the 5% to 10% fees charged by traditional remittance service providers such as Western Union and MoneyGram. Some companies, such as LemFi and Geegpay, offer zero or near-zero transaction fees to attract users, further squeezing their profit margins. While this pricing strategy helps win market share, it can lead to sustainability challenges, requiring fintechs to diversify their revenue streams through FX spreads, subscription models, and embedded financial services.

Customer Acquisition Cost (CAC): High costs associated with acquiring and retaining users can add up, especially in emerging markets where fintech adoption is growing but customer education remains a challenge. Fintech companies’ customer acquisition costs (CAC) typically range from $5 to $30 per user, while lifetime value (LTV) depends heavily on transaction frequency and add-on financial services. In competitive markets, marketing expenses and new user incentives can further reduce profitability, making long-term sustainability a challenge.

6.4 Infrastructure and liquidity constraints

Fintech companies often have difficulty accessing banking infrastructure and liquidity, which affects their ability to scale effectively.

Dependence on partner banks: Many fintechs rely on traditional banks for cash deposit and withdrawal services, which limits their independence and increases costs.

Slow settlement times: Lack of real-time settlement solutions for cross-border transactions increases latency and affects user experience.

Liquidity Risk in Emerging Markets: Managing liquidity in multiple currencies without strong bank support remains a major bottleneck. FX fintechs typically rely on a network of liquidity providers, correspondent banks, and market makers to access currencies on demand. This reliance carries significant risks, including currency mismatches, high transaction fees (ranging from 0.5% to 3% per transaction), and exposure to exchange rate volatility. Without strong treasury management practices, fintechs may struggle to maintain adequate liquidity buffers, leading to potential settlement failures, higher borrowing costs, and reduced trading efficiency. Real-time FX settlement solutions and partnerships with stablecoin issuers are emerging strategies to mitigate these risks and improve liquidity management in the industry.

VII. Conclusion and Recommendations

Driven by the increasing adoption of digital applications, the growing penetration of mobile money, and the dominance of fintech, the cross-border payments market in Africa is expected to grow significantly. As more individuals and businesses seek cost-effective, faster and more convenient payment solutions, remittances within Africa are expected to continue to grow.

With the emergence of regional payment networks such as PAPSS, reliance on SWIFT-based correspondent banking is likely to decline, thereby reducing transaction costs and improving settlement efficiency. In addition, crypto remittances and stablecoins are gaining traction as alternatives to traditional foreign exchange and banking systems, providing seamless, low-cost cross-border payment services. However, regulatory challenges and liquidity constraints remain key barriers to mass adoption.

For FinTech Founders:

There are huge opportunities in solving the payment and trade financing problems of SMEs (B2B transactions are costly and inefficient). At the same time, working with mobile payment providers to build interoperability in the financial system will bring exponential growth in the market size. In terms of scenarios, expanding beyond P2P remittances: such as embedded financial services (loans, insurance, working capital solutions) will increase profit margins.

For investors:

Prioritize infrastructure investments, e.g. the biggest gaps (PAPSS adoption, FX liquidity solutions, API interoperability) represent a $10B+ opportunity. Second, watch for fintech connectors: interoperability will drive fintech adoption faster than cryptocurrencies right now. Finally, focus on high-frequency, low-cost trading: winners will scale by volume, not margins.

For policymakers:

Cross-border fintech licenses and a unified African KYC framework will unlock billions of dollars of trapped capital, and a huge regulatory coordination mechanism is needed here. At the same time, for supporting blockchain-based settlements, governments can pilot stablecoin-backed settlement networks instead of restricting cryptocurrencies to stop this bottom-up trend. Finally, accelerate the adoption of PAPSS: Strengthen regional banking integration to reduce the dependence of intra-African trade on the US dollar.