U Card Struggles Without Exchange and Card Issuer Support, Facing Short Lifecycle Challenges

The current payment track is in an intermediate stage before a qualitative transformation. Compared to the early stage, existing products have significantly improved in design details, usability experience, and compliance pathways, but are still far from establishing a complete and sustainable Web3 payment framework. Nevertheless, this "not yet fully formed" state has become a focal point of market discussion in recent months.

U Card, as the latest form of crypto payment narrative, is essentially a "transitional mechanism" - it is neither a simple replication of traditional Web2 prepaid cards nor the final form of a new generation of on-chain wallets or payment channels, but a product of compromise between current on-chain payment scenarios and off-chain consumption needs. In practice, U Card achieves a hybrid model between "Web2 familiar experience" and "Web3 asset logic" by binding on-chain accounts with stablecoin balances and providing a compliance-friendly off-chain consumption interface. The rapid attention this model has gained in the past half year is due to two factors: on one hand, users' imagination about "using on-chain assets for daily consumption" has never faded; on the other hand, it also indicates that stablecoins are trying to further penetrate C-end retail and local payment systems beyond traditional strong scenarios like cross-border remittance and OTC settlement.

U Card is precisely the product implementation of this trend.

After enabling "crypto assets to be spent," U Card attracted significant market attention. Bybit, Infini, Bitget and others successively launched related services, momentarily creating the impression that "crypto currency payment was about to become widespread." However, the reality is that most projects contracted their business after brief operations, especially those without exchange backgrounds or primary card issuer support, which could barely sustain themselves.

The operational model of U Card is essentially highly dependent on traditional financial system permissions, barely maintaining itself between compliance pressure and minimal profits, making long-term sustainability difficult.

Strictly speaking, "U Card" is not a stable profitable business model, but merely a service form dependent on external permissions.

Project parties need to rely on multiple financial intermediaries like card organizations and card issuers to complete settlement, with themselves being mere executors at the end of the chain. An even greater challenge is that U Card's operational costs are extremely high, essentially a loss-making business. Project parties neither have stable transaction fee income like exchanges nor can control discourse like primary card issuers, yet must bear user service pressure. The key issue is that if project parties remain in the "intermediary of intermediaries" role, they can only passively operate at the bottom of the license ecosystem. To change this situation, there are two paths: either join the account system and develop as an ecosystem connection for the crypto industry with discourse rights in compliance mechanisms; or establish an independent platform, waiting for further improvement of the US stablecoin legislation, bypassing the current complex and inefficient settlement system, and closely embracing the new trend brought by US dollar stablecoins during the decline of the US dollar's position.

For wallets and exchanges, U Card is more of an auxiliary function to enhance user stickiness rather than a primary profit source. For exchanges like Bybit, even if the U Card business doesn't generate profit, it can drive user growth and asset management scale. However, for Web3 startup teams lacking traffic entry points and financial infrastructure experience, attempting to create a sustainable U Card project through subsidies and scale is akin to a trapped beast in a cage.

Is the Next Step in Crypto Payment an Underground Money House or an On-chain "New" Bank?

We can now confirm an initial conclusion: the settlement system of traditional finance is what troubles crypto payments. But there are many views in the market about what crypto payment is - whether it's a scan-to-pay method completely mimicking daily life habits, or finding a new meaning in anonymous networks. For the latter, the significance of payment is not transfer, but precipitation; therefore, in this semantic context, the essence of payment is not settlement, but circulation, which is an industry growing wildly in the dark forest accompanying blockchain development.

[The translation continues in the same professional and accurate manner, maintaining the original structure and meaning while translating the entire text to English.]The TON red packet system and various on-chain point accounts are doing one thing: converting payment entry behavior into sediment. Similar to the "Alipay-like" logic of the Web2 era. This sedimentation model indeed has commercial value, but it cannot break down ecological barriers. Users cannot freely use assets in their TON wallet for cross-border payments, merchant payments, POS machine collection, and cannot obtain a stable mapping with the real-world account system. "Chaoshan people" may not need mapping, but you cannot do the same thing in the United States using "Chaoshan dialect".

In other words, this "backyard circulation" model is not infrastructure, but an ecological self-reinforcement mechanism. Strengthening fund usage scenarios in a closed system is important, but it does not constitute the basic logic of "payment" as a global service.

What truly drives Web3 payment from the "Dark Web" to the "mainnet" is the US policy-level support for stablecoin payment networks. After the US Treasury officially promoted the GENIUS Act in 2024 and passed the Clarity for Payment Stablecoins Act in Congress, stablecoins were first given the policy positioning of "strategic payment infrastructure".

Companies like Circle, Paxos, Stripe, Visa, and Mastercard are rapidly expanding the application of US dollar stablecoins in international settlement, merchant acquiring, and platform settlement. Data published by Visa in early 2024 shows that over 30 global payment institutions are integrating USDC as a cross-border settlement asset; the issuance and usage scenarios of USDC and PYUSD are also beginning to penetrate the retail end.

These are not circulations and sedimentations in the virtual economy, but fund flows between real goods and services, settlement behaviors with legal protection and audit compliance. In comparison, token payments in the TON ecosystem and "scan-to-pay" functions in some wallets still belong to local functions within a closed system before truly entering enterprise financial reports, cross-border e-commerce platforms, and credit networks, rather than global payment standards.

We cannot deny that the mechanism design of "digital money houses" is inspiring. Proposals like Intent and account abstraction are indeed upgrading traditional on-chain payments from "machine-to-machine" transfer behaviors to "human intent-driven" fund coordination. This resonates philosophically with the application of "strong relationship trust" mechanisms in traditional underground money houses. However, a systematic payment structure cannot be built solely on vague social trust and local circulation logic; it must ultimately connect to regulation, with user identity, transaction processes, and fund sources being traceable.

At the same time, we must view the development direction of crypto payments from a more macro perspective: As the global monetary status of the US dollar faces structural challenges, the US fiscal and monetary system is trying to construct a new dual-track monetary system of "US dollar + US dollar stablecoin". Whether hedging RMB settlement expansion, responding to emerging markets' trends of using euros/gold for settlement, or maintaining its financial influence in the Middle East, Southeast Asia, and other regions, stablecoins are no longer marginal financial innovations but strategic tools actively deployed by the US in international financial competition.

This is why in recent years, we have seen the advancement of US dollar stablecoins accelerating comprehensively, from congressional legislation to Treasury guidance, from traditional bank participation to payment network embedding, deeply integrating with sovereign currencies and sovereign regulatory frameworks.

So the question is: Can the digital money house payment model carry such a strategic system? Clearly not. The essence of the underground money house model is to evade regulation, while what the US wants to build is a globally embedded regulatory financial network; the digital money house relies on community trust and gray space arbitrage, while the US dollar stablecoin system must be built on compliant financial institutions and regulatory permission chains.

It's hard to imagine the US Treasury would entrust a key payment infrastructure to a fund network that relies on non-KYC wallets, anonymous bridging, and OTC transactions. Digital money houses can solve circulation problems in marginal areas but cannot constitute a sovereign national monetary governance structure. Stablecoins are being given this role.

In other words, the future of the crypto industry will not be a future of symbiosis with gray industries. It played a supporting role in the dark side when the crypto industry had not yet grown, but the approval of the Bitcoin ETF has brought the crypto industry into a new cycle, a future of comprehensive integration and mutual embedding with traditional finance.

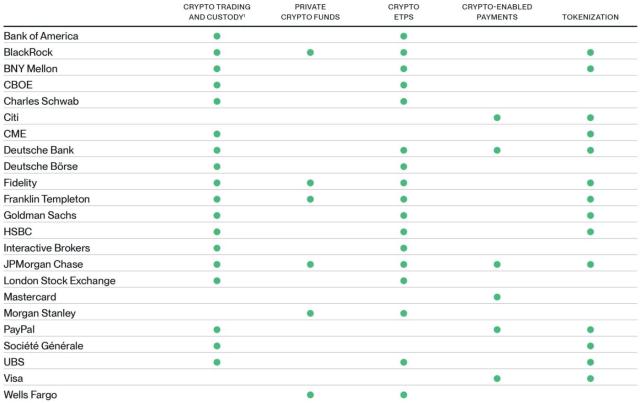

Whether it's JPMorgan Chase launching JPM Coin, BlackRock deploying the BUIDL fund, Visa integrating USDC, Stripe accessing on-chain payments, or Circle engaging in policy alignment with multiple global central banks, these actions all indicate that traditional finance is accelerating its entry into the on-chain world, and their standard is clear - compliant, transparent, and regulatable. This standard naturally rejects the expansion of underground money house logic and thus constitutes the fundamental limitation of the "digital money house" model as the main path of crypto payments.

The true future of Web3 payment is a network built on US dollar stablecoins and compliant settlement channels. It can both inherit the openness of decentralization and leverage the credit foundation of the existing fiat currency system. It allows funds to freely enter and exit without worshipping sediment; it emphasizes identity abstraction without evading regulation; it integrates user intent without departing from legal boundaries. In this system, funds can not only enter the Web3 world but also freely leave; not only serve on-chain financial activities but also embed into global commodity and labor exchanges.

Digital money houses are like water, formless, moving with the trend. A drop of rain falling into it becomes the ocean; the next stage of crypto payments should be more like light - capable of merging yet having its own origin, tracing upwards, able to clearly find its way back, not seeking to devour but focusing on illumination.