On July 17, BlackRock, a global asset management giant, made another precise move - its iShares Ethereum Trust (ETHA) officially submitted a 19b-4 filing to the U.S. Securities and Exchange Commission (SEC), intending to introduce staking functionality for its Ethereum ETF.

Although predecessors like Franklin Templeton, Grayscale, 21Shares, and Fidelity had already submitted similar proposals, the market sentiment instantly warmed up when BlackRock joined the battle. The reason is simple: BlackRock is not the fastest to act, but always ends up being the one to "successfully pass through", once again igniting strong expectations for the SEC to approve a staking-based crypto ETF.

According to analyst calculations, the SEC is expected to provide an initial response to early-submitted staking proposals by October this year, and if the review goes smoothly, the formal approval time could be advanced to the fourth quarter of 2025.

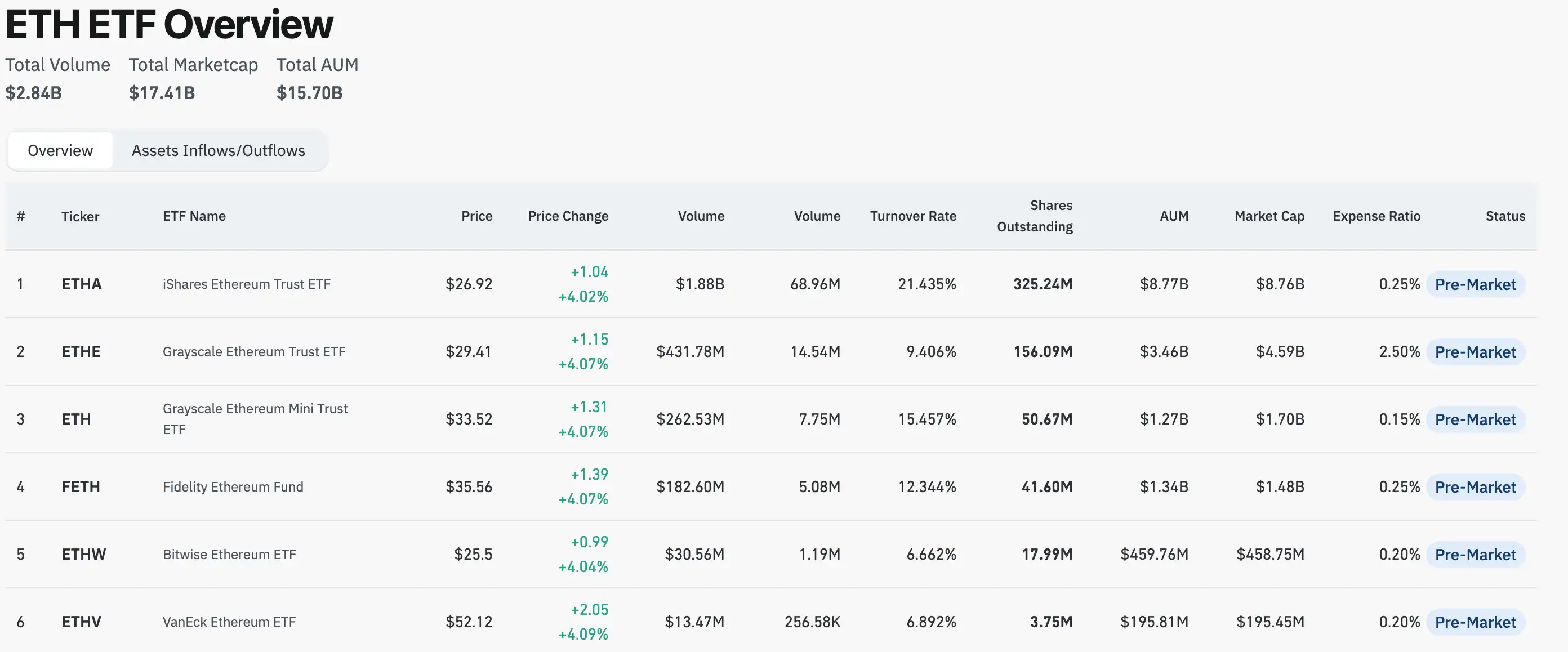

Currently, the total managed assets of Ethereum spot ETFs have exceeded $17 billion, with ETHA leading at $8.7 billion. If the staking function is approved, it will not only reshape the investment logic of Ethereum but also inject new growth momentum into the entire on-chain ecosystem. This article will focus on this historic turning point and systematically sort out which tracks and projects will benefit first after the introduction of the staking mechanism in the Ethereum ETF.

From Speculative Tool to Yield Asset, ETH's Asset Attributes Are Being Reshaped

For ETH, the launch of a staking ETF may mean a structural reassessment of its asset nature.

Compared to traditional financial assets, Ethereum has a "native advantage" - it is not only a speculative asset but can also obtain staking rewards by participating in on-chain verification, with the current actual annual yield around 3.5%. Once the ETF is approved to introduce the staking mechanism, its investment logic will upgrade from a single price appreciation expectation to a dual-engine drive of "price + yield". This model is similar to earning interest on government bonds or receiving dividends from blue-chip stocks, and will become the first U.S. crypto ETF to provide yield to institutional and retail investors. This transformation may convert Ethereum into a yield-generating financial asset within regulated investment tools, making it an attractive choice for traditional finance.

Eric Jackson, founder of EMJ Capital, once predicted that Ethereum could challenge $10,000 or even higher in this cycle. His model attributes ETH's potential growth drivers to four factors: its stable 3.5% staking yield, the net deflationary trend since the merge, new demand brought by the soon-to-be-approved staking ETF, and network activity growth driven by Layer2 and tokenized assets. Jackson's team points out that ETH's supply and demand structure is rapidly tightening, and if the ETF approval progresses beyond expectations, coupled with large-scale Layer2 adoption, breaking through $15,000 in the next few quarters is not a fantasy.

Who Are the True Winners of the Staking Track

Liquid Staking Protocols

The biggest technical and operational challenge in integrating staking functionality into the Ethereum ETF is liquidity management. Unlike the "T+0 tradable" characteristics of traditional financial assets, once ETH is staked, it will be locked in the network, and exiting requires a formal unbonding process. According to the Ethereum protocol design, when validators choose to exit staking, they must wait for block queuing, block confirmation, and other stages, and the exit queue is limited by the current network load - during peak periods, this process may take days or even weeks.

This is a tricky issue for ETF issuers. ETF products need to ensure that users can buy, sell, and redeem their shares at any time. However, if a large amount of ETH held by the fund is locked in staking and faces sudden massive redemption requests, the fund may not be able to liquidate assets in a short time, thus creating a liquidity mismatch risk.

To mitigate this issue, ETFs typically reserve some unstaked ETH as a liquidity buffer pool, but this sacrifices staking rewards and weakens the product's inherent "on-chain yield" appeal. A more operationally feasible solution is to leverage Liquid Staking Derivatives (LSD).

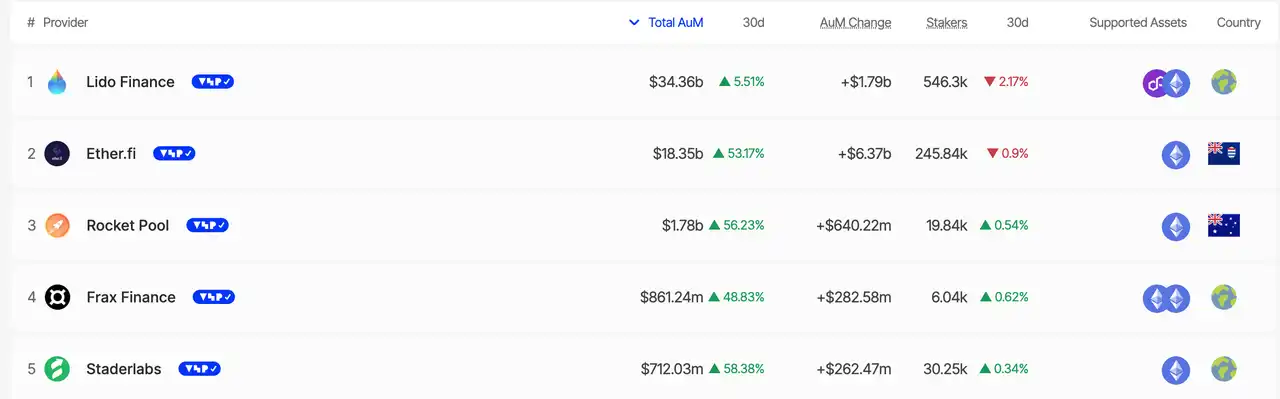

Its core mechanism is to generate tradable "staking certificate" tokens (such as Lido's stETH, Rocket Pool's rETH) from staked ETH, which represent ownership of the staked ETH and can be traded in secondary markets, thereby maintaining on-chain liquidity of staked assets. If the Ethereum ETF uses an LSD protocol, it can not only continue to receive staking rewards but also meet redemption demands at any time through derivative assets like stETH, solving the liquidity pain points of traditional staking. This makes LSD protocols a key "liquidity intermediary" between ETFs and the Ethereum network.

The market has already responded quickly to this logic. After the news of BlackRock's ETHA staking application was announced, Lido's governance token LDO rose over 20% within 24 hours, indicating that funds are rapidly flowing into the potentially benefiting LSD sector. Once the SEC formally approves the staking-supported Ethereum ETF, protocols like Lido and Rocket Pool may see significant TVL expansion, and their native tokens will also welcome a new round of valuation reassessment.

Centralized Trading Platforms

For Ethereum ETF issuers, the most realistic and convenient option is to use centralized staking service providers like Coinbase and OKX if they choose not to build nodes themselves or rely on decentralized protocols. These platforms have established mature node infrastructure and can provide one-stop staking solutions for institutional clients, including node operation, reward distribution, and key management, greatly lowering technical barriers.

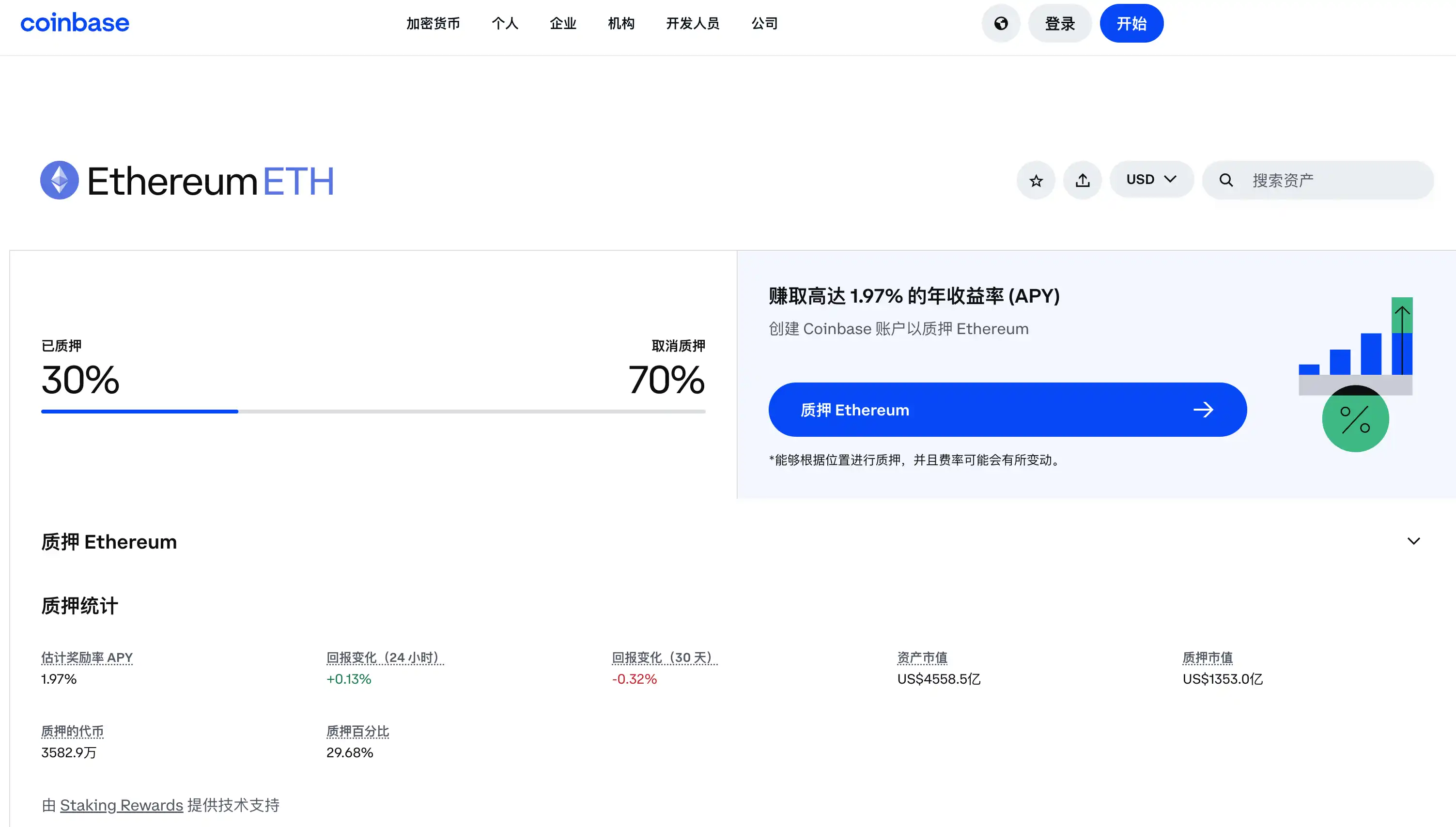

Taking Coinbase as an example, its liquid staking token cbETH (Coinbase Wrapped Staked ETH) provides users with a way to enjoy both staking rewards and on-chain liquidity. cbETH represents users' staked ETH on Coinbase, and users can transfer, trade, or interact on-chain without unstaking. Its principle is similar to Lido's stETH, but issued and managed by a regulated centralized platform, making it more acceptable to regulatory agencies and more aligned with traditional financial institutions' compliance needs.

Other trading platforms like Kraken and OKX also offer similar staking services and can provide customized solutions for institutional users. It's worth noting that although centralized staking services have obvious advantages in convenience and compliance, they also face certain potential risks. For example, the SEC has initiated enforcement actions against centralized exchange staking services, alleging they constitute "unregistered securities offerings".

Overall, under the current trend of stricter compliance requirements, centralized trading platforms remain an important option for ETF issuers to implement on-chain staking functionality, thanks to their technological maturity and license resources. Especially products like cbETH, which may become a representative asset of "compliant LSD" in the future, balancing liquidity and yield.

Summary

The strong expectation of Ethereum ETF staking approval not only means that traditional finance is officially entering the "on-chain yield era" but also marks ETH's complete transformation from a speculative asset to a yield-generating asset. As institutions like BlackRock lead the way into this track, LSD protocols, node operators, and centralized trading platforms are stepping into the spotlight, welcoming a new window of valuation reassessment.

As regulation gradually becomes clearer and infrastructure becomes more sophisticated, this multi-party collaboration around "ETH staking yield" may become the key convergence point of Web3 and Wall Street. Whoever first wins ETF collaboration resources will occupy a more core position in the next crypto cycle.