XLM of Stellar has increased by over 90% in the past month, becoming one of the prominent altcoins in recent weeks.

While Bitcoin (BTC) and other top assets have cooled with a slight correction and sideways price movement, XLM is emitting new price increase signals that could pave the way for another strong rally.

XLM forms a bullish pennant pattern as traders place large bets on a breakout rally

On the daily chart, XLM has formed a bullish pennant pattern. This pattern appears when a strong price increase (flagpole) is followed by a horizontal period similar to a small symmetrical triangle (pennant).

XLM Bullish Pennant. Source: TradingView

XLM Bullish Pennant. Source: TradingViewThis pattern typically suggests that buyers are pausing before potentially continuing the upward trend. Traders often look for a breakout above the top trend line of the pennant as a signal to enter a long position.

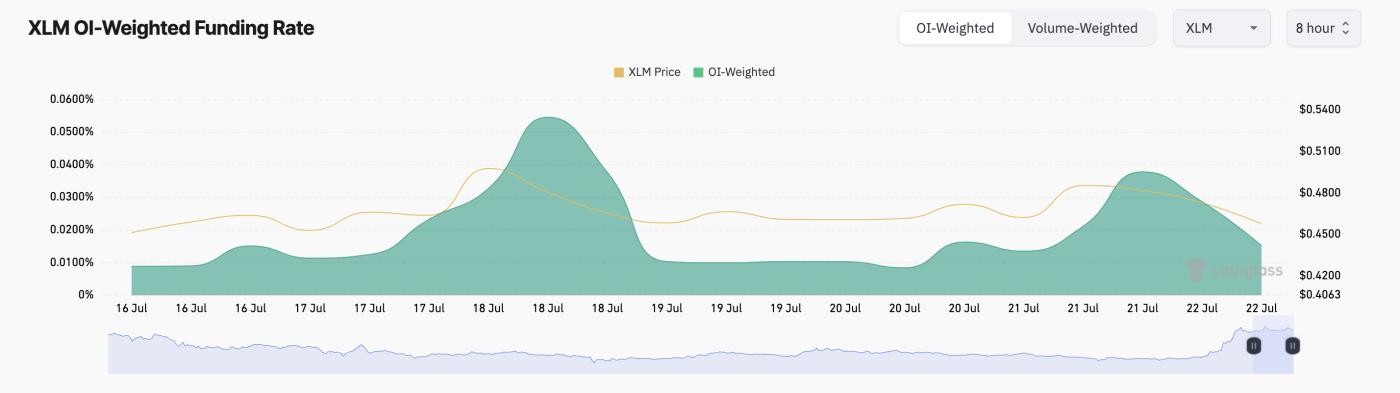

On-chain data confirms the possibility of XLM breaking above this pennant in the short term. For example, the token's funding rate remains positive, indicating demand for long positions. According to Coinglass, this rate is 0.0152% at the time of writing.

XLM Funding Rate. Source: Coinglass

XLM Funding Rate. Source: CoinglassThe funding rate is a periodic fee exchanged between buying and selling traders in the perpetual futures market. It keeps the contract price in line with the spot price. A positive funding rate means traders are paying a fee to maintain long positions, indicating an optimistic market sentiment.

For XLM, the positive funding rate shows that its futures contract traders are strongly leaning towards long positions. This reinforces the bullish pennant pattern, signaling confidence in a continued price increase.

XLM's bullish pennant pattern indicates a large move

These indicators suggest XLM may be preparing for a new price rally. If demand increases and XLM successfully breaks out of the bullish pennant pattern, traders can expect a strong upward movement.

Typically, when an asset breaks out of this pattern, its price is expected to increase by the length of the initial price increase—or the "flagpole"—before forming the pennant. This means XLM's price could climb to $0.73.

XLM Price Analysis. Source: TradingView

XLM Price Analysis. Source: TradingViewHowever, if market sentiment shifts from optimistic to pessimistic, XLM's value could break below the pennant and drop to $0.39, invalidating the above price increase prospects.