After a strong 26% increase last week, Pudgy Penguins (PENGU) is currently fluctuating just below an important resistance level.

While most of the altcoin market is cooling down, PENGU's price seems ready to break out. It just needs to overcome an important wall. A deeper look at price strength, liquidity, and price chart suggests this token may still have room to increase.

PENGU Bulls are completely in control

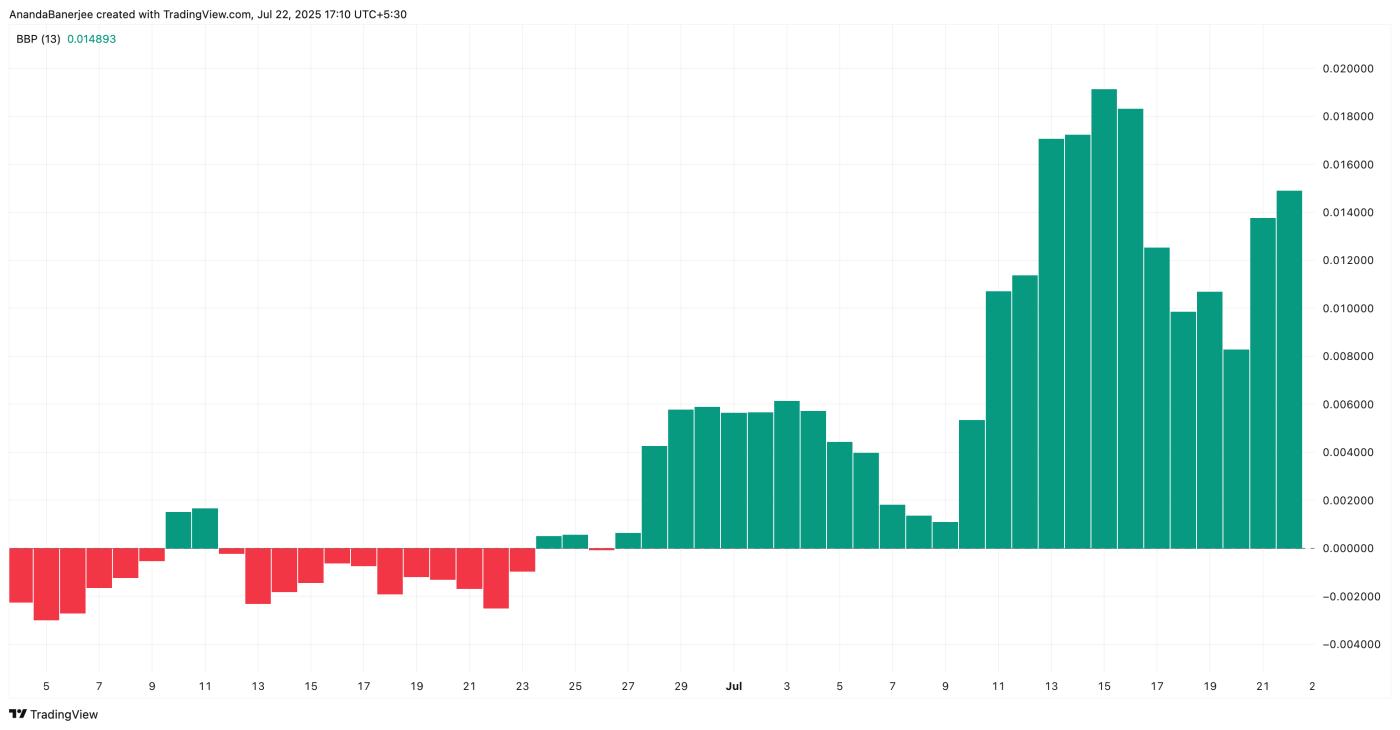

Although PENGU has dropped around 2% in the past 24 hours, the Bull side still appears to be in control. The Bull-Bear Power (BBP) index, which compares recent highs and lows to measure market strength, is currently blinking green, at around 0.0148. This level indicates buyers are still dominant, despite a slight short-term decline.

For TA and token updates: Want more detailed information about such tokens? Subscribe to the Daily Crypto Newsletter by Editor Harsh Notariya here.

PENGU Bull Bear Index: TradingView

PENGU Bull Bear Index: TradingViewSimply put, when BBP is positive, Bulls are stronger than Bears. And Pengu's BBP has remained above 0 since late June, even as price fluctuates below an important resistance level. This stable strength could indicate that any price drops are just part of a cooling process before further increases.

If BBP remains positive while price breaks through resistance, it could confirm that PENGU still has momentum. But if BBP turns negative, it might warn of a deeper decline ahead.

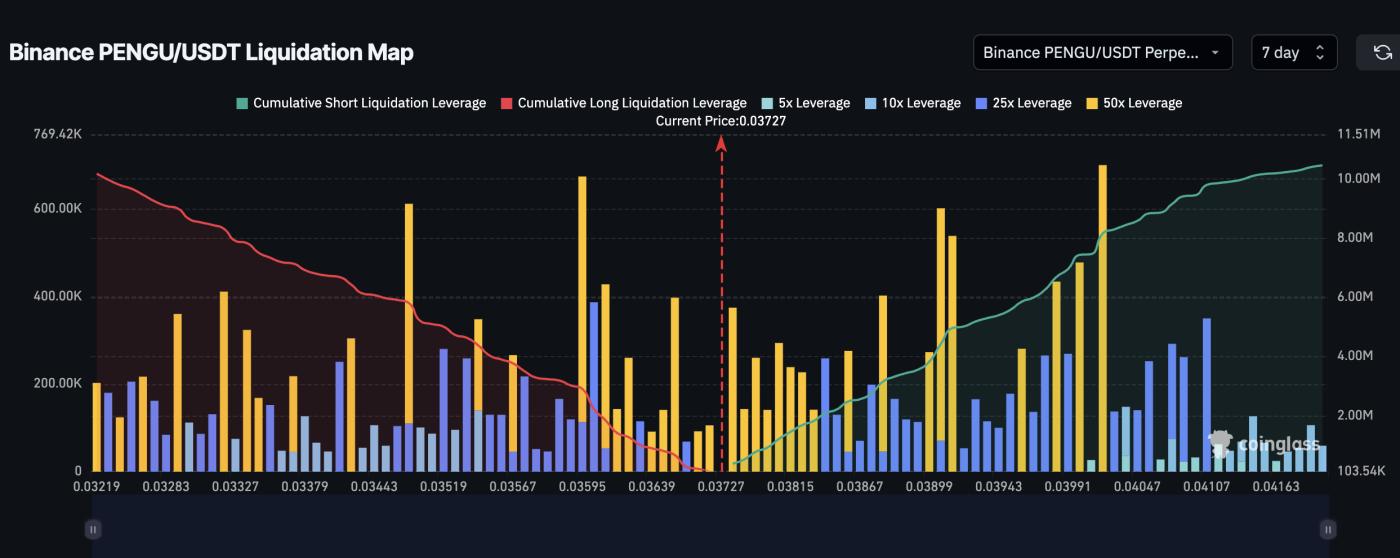

7-Day Liquidation Map Shows Short-Selling Bias

PENGU is currently trading around $0.036. The 7-day liquidation map shows short-term leverage accumulating to $10.46 million compared to $10.18 million for long positions; a slight bias towards short positions. Note that there isn't much difference between Longs and Shorts, and a price push in either direction could determine PENGU's next step.

However, with Bulls in control and by a significant margin, as determined by the BBP index, price action could impact short positions more than long positions.

PENGU Liquidation Map: Coinglass

PENGU Liquidation Map: CoinglassIf price breaks above $0.039, with Bulls breaking an important resistance level, and even near $0.042, a large liquidation cluster of short positions will be triggered. This would reduce downward pressure and potentially push PENGU to the next important price level.

The liquidation map shows accumulation of short positions; if PENGU's price rises quickly, those betting against it may be forced to buy back, pushing the price even higher.

PENGU Price Action Suggests 38% Potential Increase

Technically, PENGU's price has tested the Fibonacci 0.382 level near $0.039 twice and failed to clearly break through. Currently, it's trading just below that resistance. Note that beyond the extended Fib resistance, there's an important resistance at $0.037.

PENGU Price Analysis: TradingView

PENGU Price Analysis: TradingViewThe chart uses the Fibonacci extension tool based on trend. It connects the lowest point of $0.0077 with the recent high of $0.035 and then to the immediate pullback price of $0.028. This tool helps outline the next price targets for a coin/token in an upward trend.

If PENGU's price can clearly break above $0.037, $0.039, and then $0.042 (Fib 0.5 zone), it opens the path to $0.045 first, a 25% increase. If that happens, the next important resistance point, or more accurately target, will be $0.050, the Fibonacci 0.786 level. This would represent a 38% increase from the current price of around $0.036.

Confirmation for this move comes from the weakening of Bear power, accumulation of short positions, and strong chart structure. The upward trend will be invalidated if PENGU breaks below the resistance-turned-support level of $0.035. Or if it continues to drop to touch the Fibonacci extension pullback zone: the $0.028 level.