Written by: Wenser, Odaily

As time enters 2025, only 2 types of KOLs remain active in the crypto market: one type makes profits or bears losses through contract trading in volatile markets; the other type flexibly adjusts direction in a market with changing trends and plays whatever is hot. After previously proving his contract trading ability through activities like the 500U live trading challenge, crypto KOL Chuan Mu (@xiaomucrypto) has once again attracted market attention through a series of crypto concept stock trades in recent months.

Although there are some voices questioning whether he "uses followers as exit liquidity", his publicly disclosed crypto concept stock operations still have some reference value in terms of entry and exit timing. Odaily will briefly analyze the three major investment targets of Circle (CRCL), Guotai Junan International, and SBET that Chuan Mu has mentioned and traded in recent months for readers' reference.

Chuan Mu's SBET Operation Replay: From Refusing Entry to Profitable Exit

On May 27, Sharplink Gaming officially announced financing and additional issuance to establish an ETH reserve, after which SBET once rose over $100. As an acute trader, Chuan Mu also paid attention to this stock for the first time and experienced a quite dramatic trading journey.

Dramatic "Four Palace Entries": From Selling and Missing the Pump to Profiting Over $1 Million

On May 28, Chuan Mu wrote: "This SBET cannot be bought, with 69.1 million additional shares, the market value will change from 30 million to over $3 billion on the 29th... Many people are being misled." His words showed wariness about "Sharplink Gaming raising market value through stock issuance", but soon he changed his mind and resolutely entered the "ETH version Strategy" and other crypto concept stock markets.

[The rest of the translation follows the same professional and accurate approach, maintaining the original meaning while translating to fluent English.]

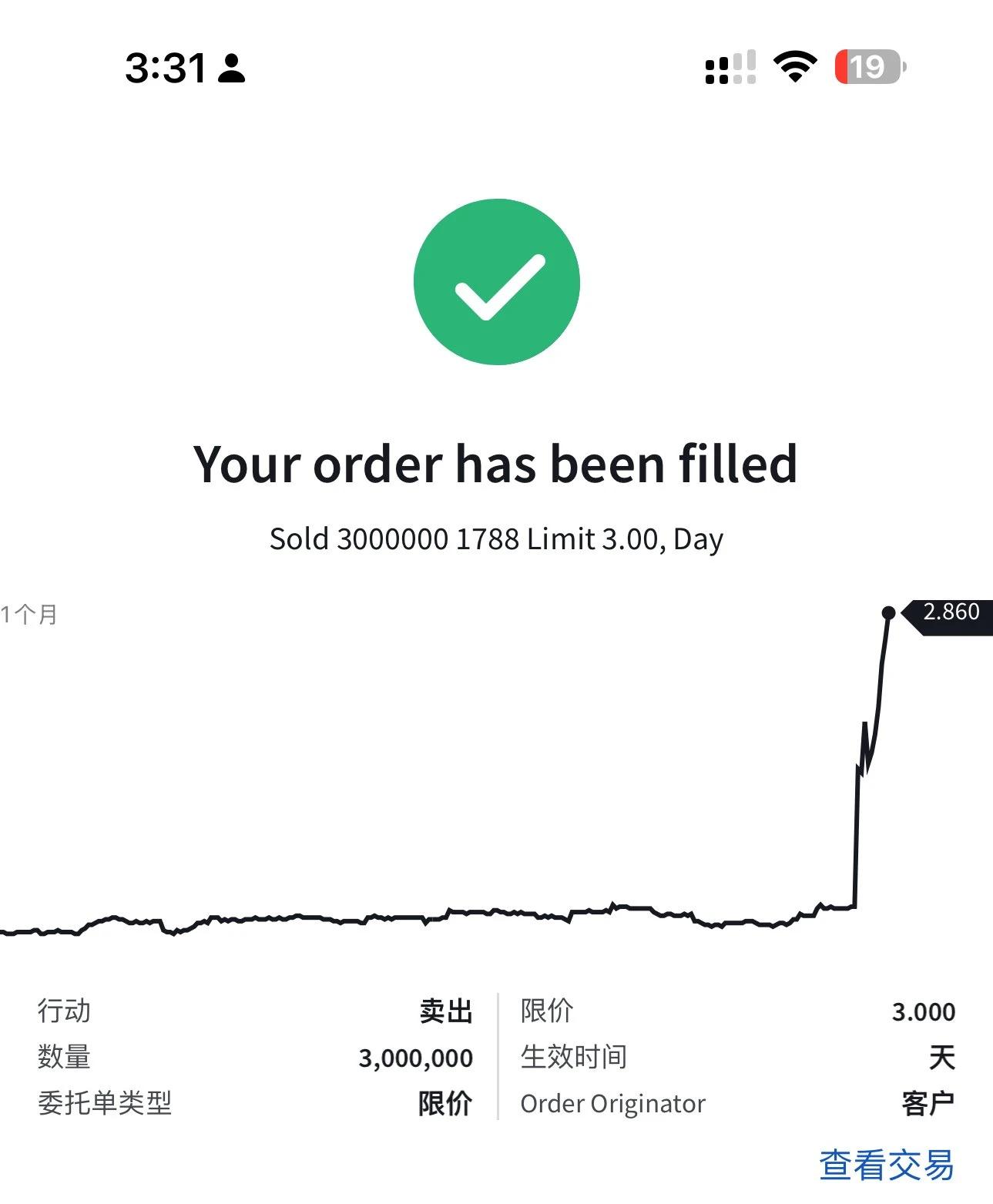

Chuan Mu's Selling Screenshot Record

Moreover, it is worth mentioning that as early as June 25, based on the logic of crypto brokers, Chuan Mu bought 40,000 shares of Robinhood (HOOD) at $84.4, although the stock price dropped to around $82.1 that night with a small loss. However, after Robinhood launched stock tokenization trading, the stock price once rose above $100, creating a new high. It is unknown whether Chuan Mu still held the stock at that time.

Finally, according to his own post, Guotai Junan International's single stock profit was approximately 3 million Hong Kong dollars.

Chuan Mu's Circle Operation Replay: Over $1 Million from 6 Trades

In early June, Circle (CRCL), which landed on the US stock market with the concept of the "first stablecoin stock", completed a terrifying surge from around $30 to nearly $300 in just over ten days. During this process, Chuan Mu navigated the US stock market with his bold and meticulous operations, earning millions of dollars in profits.

First Trade: Nearly $800,000 Profit

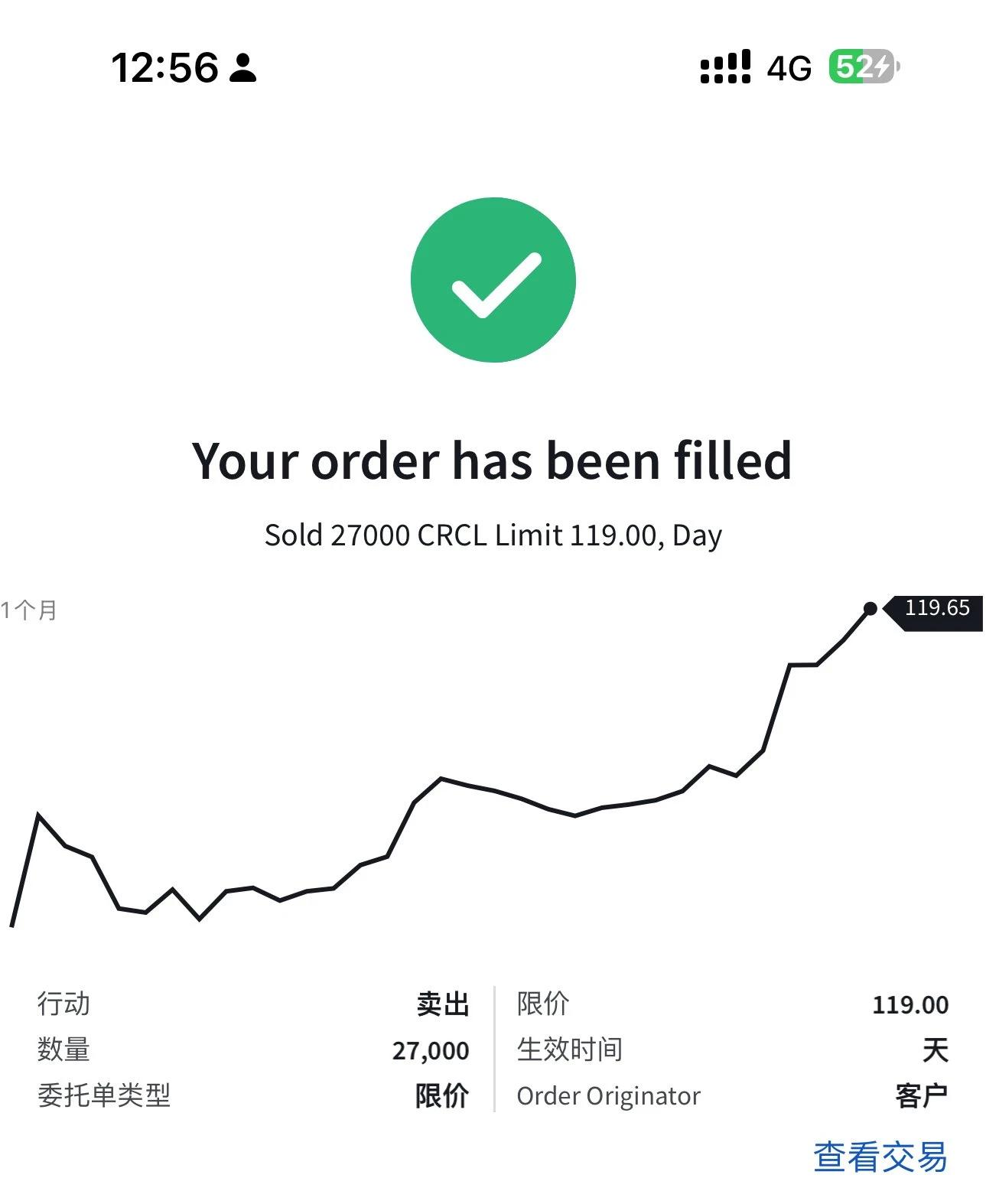

On June 6, Chuan Mu bought 30,000 shares of CRCL with tears, at an average price of $98; ultimately, on the morning of June 7, he successfully sold 27,000 shares at $119, gaining about $700,000.

Chuan Mu's Selling Record Screenshot

Just 2 hours later, Chuan Mu again bought back 20,000 shares of CRCL at an average price of $113.6, and sold 18,000 shares at an average price of $118 on June 9, with a single profit of about $80,000, still holding about 10,000 shares of CRCL. That day, CRCL surged nearly 30%, with the stock price soaring to around $128.

Second Trade: 30,000 CRCL Shares, Profit Exceeding $160,000

On June 9, Chuan Mu bought 30,000 shares of CRCL at an average cost of $111.

On the morning of June 10, he sold 14,000 shares at an average price of $118; in the afternoon, as CRCL's price broke through to $119, he sold another 10,000 shares at $118, leaving about 6,000 shares.

Chuan Mu's Second Selling Trade Screenshot

From this, in the second trade, Chuan Mu accumulated a profit of about $168,000.

Third Trade: Nearly $350,000 Profit

On the evening of June 10, Chuan Mu again purchased 30,000 shares of CRCL at an average price of $108. On June 11, he reduced 15,000 CRCL shares at $113 (mentioned in previous text), with a single profit of about $75,000.

On June 11, he posted that he still held 25,000 CRCL shares, and calculated at the then price of $118, his cumulative floating profit was about $405,000.

Chuan Mu's Floating Profit Screenshot

On June 16, Chuan Mu's CRCL position increased to 30,000 shares, with his holding average price rising to around $133.5, with a floating profit of about $208,000 at that time.

Chuan Mu's Floating Profit Screenshot

That day, he sold 20,000 shares at an average price of $142, initially estimated to have profited nearly $170,000; the last 10,000 shares were sold at an average price of $143.5, with a profit of about $100,000.

Fourth Trade: Profit of About $90,000

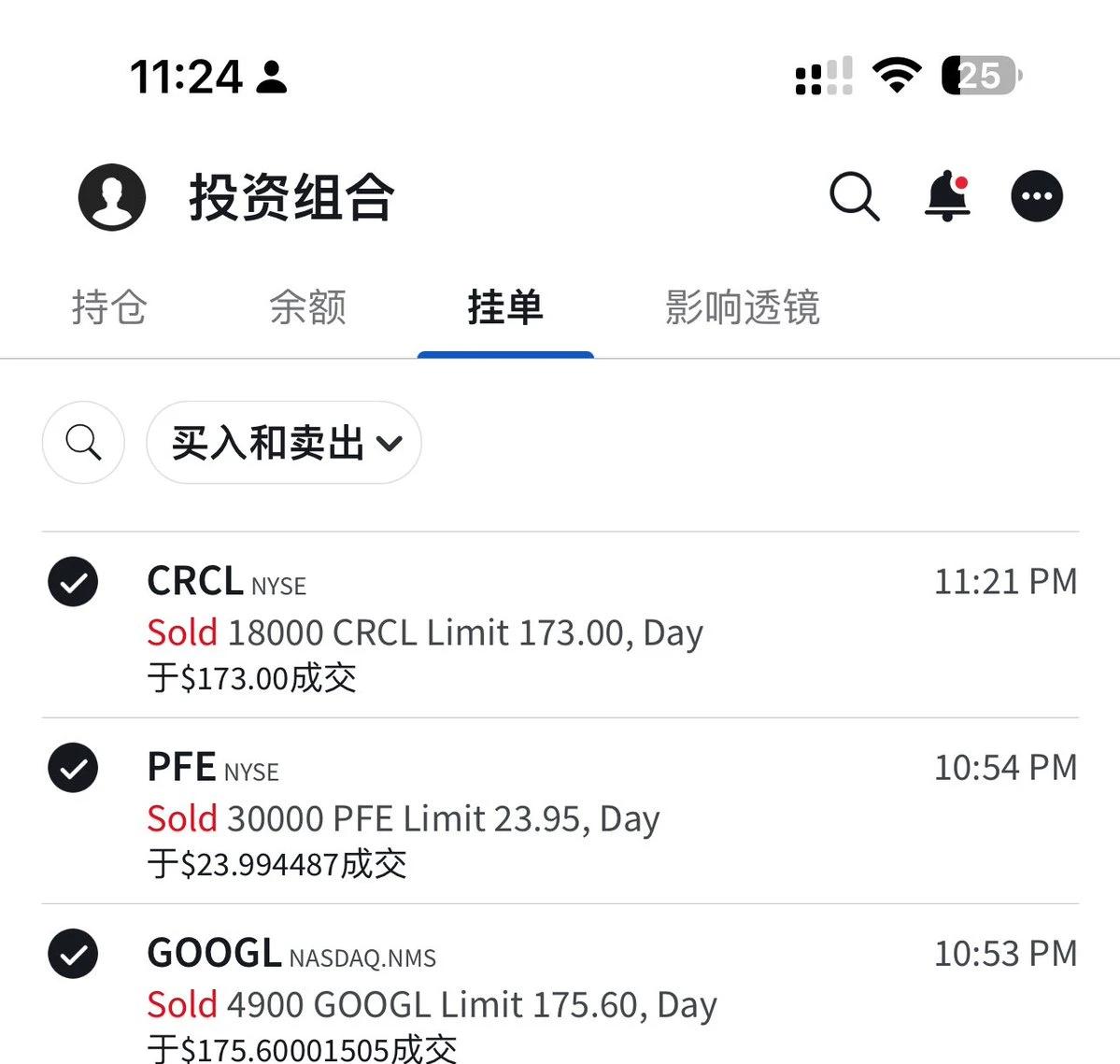

On June 18, Chuan Mu posted that CRCL's wave trading was getting smaller, reducing his position from 40,000 shares to 18,000 shares. At that time, CRCL's price had soared from around $140 to around $172, with Chuan Mu's position floating profit of about $70,000. That day, he sold all 18,000 CRCL shares at an average price of $173, estimated profit of about $90,000.

Chuan Mu's Selling Screenshot

Fifth Trade: Impacted by Cathie Wood's Sell-off, Loss of About $15,000

On June 25, Chuan Mu bought 15,000 shares of CRCL at an average price of $226.5, but quickly sold out at $225.5 due to the news of Cathie Wood selling $100 million worth of Circle stock.

His intention was to bet on a market rebound, but helplessly had to cut losses due to the "big shot's sell-off" news, a situation similar to what many experience.

Chuan Mu's Liquidation Tweet Screenshot

Sixth Trade: Profit of About $270,000 Again

On July 15, nearly 20 days later, Chuan Mu made a comeback, buying 15,000 shares of CRCL again at an average price of $202.

Purchase Screenshot

The next day, CRCL immediately crashed to around $191, and Chuan Mu cried out: "I've been buried alive".

But soon, CRCL rose again to $209, and Chuan Mu came back to life. Subsequently, CRCL's price surged over 10%, rising to around $218.

Finally, Chuan Mu chose to liquidate the last 5,000 CRCL shares at the $220 point. This trade was estimated to have a cumulative profit of about $270,000.

From this, through 6 trades, on CRCL alone, Chuan Mu's total profit was around $1.65 million.

Conclusion: Without Wisdom, Follow and Run

Overall, Chuan Mu's timing for buying and selling crypto concept stocks was relatively accurate. If one has a certain stock trading investment foundation, it can be used as a reference coordinate. As the saying goes, "Without wisdom, learn to follow".

However, it is worth noting that such trading KOLs sharing information and views have 2 problems: 1) Sometimes limited by information transmission speed or market sentiment lag, after building positions and buying, they publish related information, making followers easily become "bag holders", especially in markets with poor liquidity; 2) They are often part of the "following army", like Cathie Wood or famous institutions, sometimes at the end of information channels, easily causing chasing highs and killing dips. It is recommended to enhance one's ability to discern information and make investment judgments, and not blindly believe.

After all, most of the time, investing is a game of "running fast".