21Shares, a leading cryptocurrency exchange-traded product (ETP) provider, has filed a Form S-1 with the United States Securities and Exchange Commission (SEC) for the 21Shares Ondo Trust.

This Exchange-Traded Fund (ETF) will track the price performance of ONDO. This is the native token of Ondo Finance, a DeFi platform focused on real-world asset (RWA) tokenization.

21Shares Brings ONDO into Focus with ETF Filing

The company filed the document on 07/22/2025, marking an important milestone for ONDO. According to the S-1, the '21Shares Ondo Trust' will hold ONDO tokens. Coinbase Custody Trust Company will serve as the custodian.

Moreover, the ETF will track ONDO's price using the CME CF Ondo Finance-Dollar Reference Rate. Notably, this proposed ETF is structured as a passive Investment Vehicle.

21Shares explains that the ETF is designed to only track ONDO's price fluctuations rather than attempting to generate profits. Therefore, it will not use leverage (borrowing Capital), Derivative instruments (such as options or Futures Contracts), or similar financial tools.

"This means the Sponsor will not speculatively sell ONDO when its price is high or speculatively buy ONDO at a low price with expectations of future price increases," the filing states.

However, some information remains unconfirmed in the document, such as the name of the exchange where it will be listed. These factors may be determined or added later. Meanwhile, the filing has created optimism in the community.

"IMO: This is the first Spot ETF based on ERC-20 and will open doors for many non-L1 blockchain assets to be listed as ETFs," analyst Marty Party posted.

Trader and analyst Jeff Cook called ONDO the next 'institutional favorite'. He emphasized that the 21Shares Ondo ETF filing could trigger significant Capital flow from institutions into this asset.

Cook also suggested that 'smart money' is positioning early, hoping to capitalize on the opportunity before the retail investor market catches up.

Besides ONDO, 21Shares has also filed for several other altcoin ETFs, including Polkadot (DOT), XRP (XRP), Sui (SUI), and Solana (SOL). Currently, many ETF applications are awaiting SEC approval, and new filings continue to extend the list.

"NGL had to Google it. Same with Injective. The filings are outpacing human awareness," senior Bloomberg ETF analyst Eric Balchunas wrote.

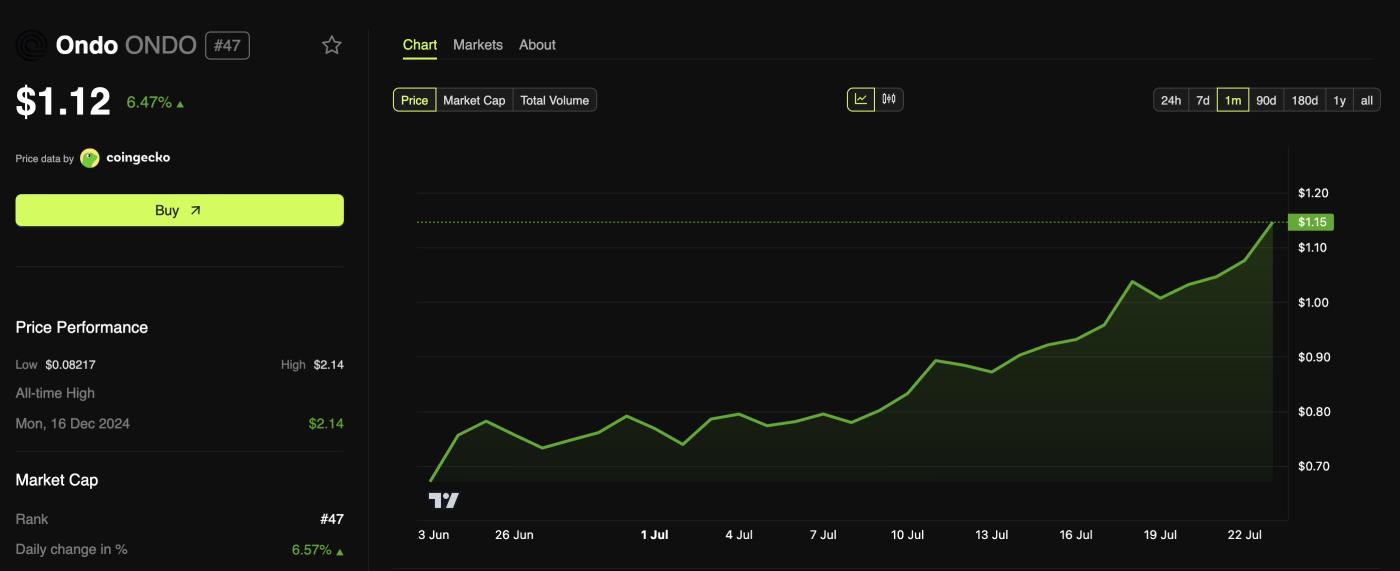

Meanwhile, the announcement comes as ONDO continues its upward trend. Data from BeInCrypto shows the token has increased 64.7% over the past month. Market capitalization has also grown from around $2 billion to over $3.5 billion.

ONDO Price Performance. Source: BeInCrypto

ONDO Price Performance. Source: BeInCryptoAt the time of writing, ONDO is trading at $1.12, up 6.47% over the past day. Moreover, while many cryptocurrencies have increased in price, ONDO's growth rate over the past week has been higher than the global cryptocurrency market, making it a standout.