Solana (SOL) is trading with an upward trend, thanks to positive sentiment towards altcoins. However, analysts believe this could be the calm before the storm as SOL shows weakness across all major trading pairs.

A capital rotation is occurring, prioritizing altcoins with strong foundations and high liquidation. However, will some altcoins miss the expected altcoin season?

Expert Warns Solana Could Repeat LUNA's Collapse Amid Multiple Asset Breakdowns

Solana has increased over 20% in the past week and slightly rose 0.609% in the past 24 hours. At the time of writing, SOL is trading at $201.01, with the broader altcoin market sparking price increase hopes among investors.

Solana (SOL) Price Performance. Source: BeInCrypto

Solana (SOL) Price Performance. Source: BeInCryptoHowever, not everyone believes in Solana. While some traders predict a move towards $300 and beyond, one analyst is issuing a warning.

Technical analyst Gert van Lagen compares Solana's weak structure on major trading pairs with the early signs of Terra LUNA's famous collapse in 2022.

Gert van Lagen points out Solana's decline on high timeframes (HTF) against Bitcoin (BTC), Ethereum (ETH), Cardano (ADA), and XRP as major warning signs.

Emphasizing the widespread price divergence, he says Solana's current trajectory reflects a multi-asset decline. Moreover, the token shows no recovery signs when measured against its largest competitors.

Against Bitcoin, Solana is showing a downward trend after the 2023 price surge, with SOL price stuck below the high timeframe moving average (MA). Similarly, Solana is showing weakness compared to Ethereum, with MA curving into a prolonged bear market.

Simultaneously, Solana is declining against Cardano, displaying a similar price-reducing MA and SOL/ADA price continuously being rejected at the trend. It shows an almost identical prospect for XRP, extinguishing any recovery signs.

SOL/BTC, SOL/ETH, SOL/XRP, SOL/ADA Price Performances. Source: TradingView

SOL/BTC, SOL/ETH, SOL/XRP, SOL/ADA Price Performances. Source: TradingView"So what happens if an asset declines against each major competitor? It will be swapped," he added.

This gloomy prospect raises the provocative question of whether Solana might miss the anticipated altcoin season.

However, not all analysts have a bearish view. Zyn, a Web3 investor and influencer, describes Solana's current price structure as "a confirmed breakout." This assessment comes after SOL surpassed the resistance threshold within the range.

"Momentum belongs to the bulls, and SOL seems ready for the next step," Zyn posted.

The analyst predicts a potential price increase to $260 if the consolidation above $200 is maintained.

Solana (SOL) Price Performance. Source: TradingView

Solana (SOL) Price Performance. Source: TradingViewSolana Increases Block Size by 20% to Boost Throughput, But Reliability Concerns Persist

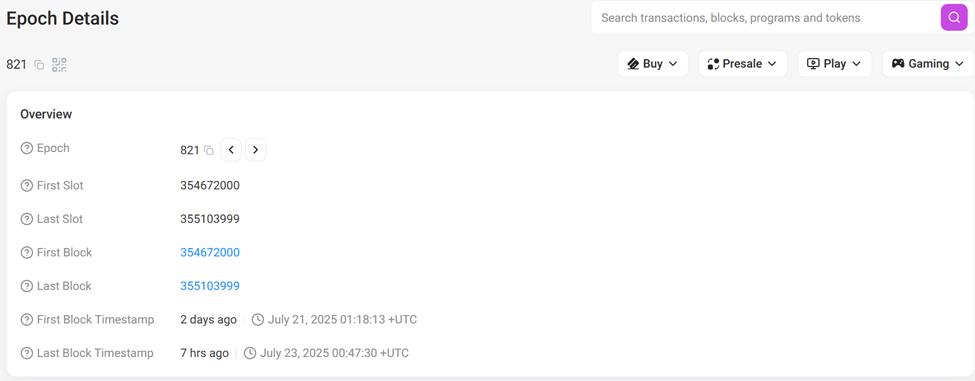

In addition to the price increase scenario, Solana is undergoing a significant network upgrade as part of Epoch 821.

Solana Epoch 821. Source: SolScan

Solana Epoch 821. Source: SolScanAccording to Helius Labs' CEO, Solana blocks are increasing in size by 20% in an ongoing protocol-level improvement aimed at enhancing throughput.

When completed, the upgrade could push transaction capabilities beyond 60,000 transactions per second (TPS), leveraging the QUIC network protocol and blockchain's proof-of-stake (PoS) architecture.

This technical progress could strengthen Solana's competitive position, especially as Ethereum undergoes its expansion journey after Pectra.

However, concerns remain. Solana's history of network outages and performance instability during previous demand surges still raise significant questions about its long-term reliability.

"Not sure how to feel about this," a user commented.

Based on this, Solana stands at a critical crossroads. While optimists see structural breakouts, increased throughput, and institutional attention as drivers for the next step, skeptics warn of deeper systemic weaknesses lurking beneath the surface.