After trading in a narrow range, XRP broke down, showing profit-taking pressure from short-term investors. However, lower price areas may become attractive opportunities for buying pressure to return.

Previously, XRP surged strongly, setting a multi-year high of $3.66 on Friday, indicating strong demand from the Bull side. This momentum even helped XRP's market capitalization surpass the "fast food giant" McDonald's at the beginning of the week. However, the inability to maintain the price increase subsequently led to a correction.

The question is: which support and resistance areas are playing a crucial role in XRP's next trend? Let's analyze the chart to explore.

XRP Price Prediction

XRP's failure to break through the $3.66 resistance level in recent days has led to a price correction, causing XRP to drop below $3.40.

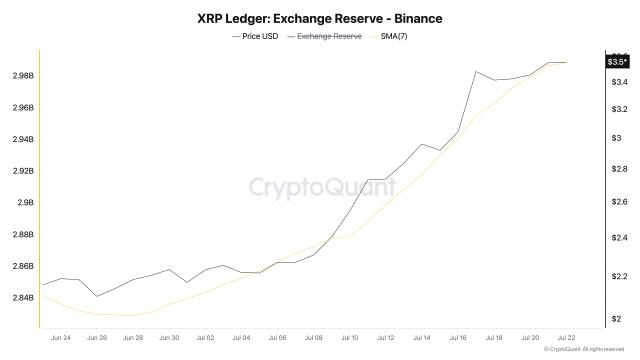

The XRP/USDT pair is at risk of a deeper correction, with the 20-day EMA at $2.99 being an important support level to watch. If prices recover strongly from this level, it will indicate that buying pressure at lower prices remains strong, and Bulls can take advantage to bring the price back to the $3.66 resistance area.

Once the price breaks and closes firmly above $3.66, the XRP/USDT pair could extend its upward momentum to $4, even $4.86 in subsequent moves. However, this optimistic perspective will be invalidated in the short term if the price continues to weaken and breaks below the 20-day EMA. This would suggest that the previous breakout above $3.40 might have been a Bull Trap, and Bears are gradually regaining control of the short-term trend.

The XRP/USDT pair has broken below the $3.34 support level, indicating that Bears are trying to regain control. The next support levels to watch are at $3.00, and deeper at $2.80. However, if the price strongly rebounds from this support area and returns above the moving averages, especially the 20-day EMA, this could indicate that the correction phase has ended, opening the possibility of recovery back to the $3.66 resistance area.

Conversely, if the recovery is blocked at the 20-day EMA, this suggests that market sentiment is shifting from buying on dips to selling on rallies – a negative signal. This scenario would increase the risk of a deeper price drop to $2.60, while delaying the return to an upward trend.

This article does not contain investment advice or recommendations. All investment and trading decisions involve risks, and readers should conduct their own research when making decisions.