Ethereum has risen 150% since its April low point. Bitwise ETF founder Matt Hougan points out that the demand from Exchange Traded Funds (ETF) and Ethereum reserve strategy companies is so massive that it has caused a severe supply-demand imbalance. He believes this situation will continue, and ETH still looks bullish!

Table of Contents

ToggleContinuous Capital Inflow Causes Supply-Demand Imbalance, Driving ETH's Significant Rise

Matt Hougan explained the reasons behind ETH's recent price increase.

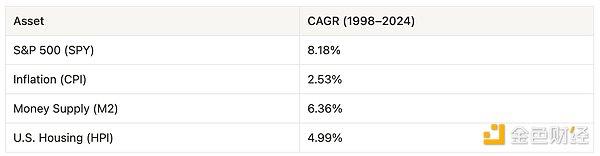

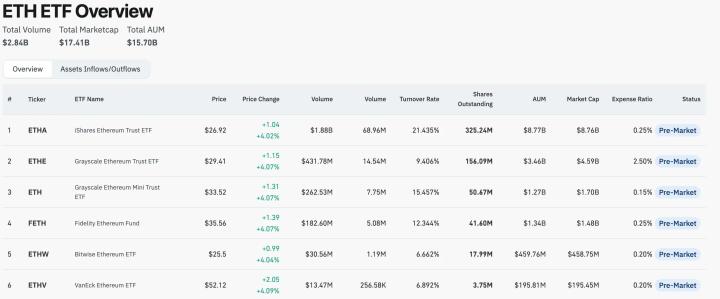

Since mid-May, over $5 billion has flowed into Ethereum ETFs, with Ethereum reserve strategy companies like Bitmine and SharpLink also entering the market aggressively. According to Bitwise's estimates, during this period, ETFs and Ethereum reserve strategy companies collectively purchased 2.83 million ETH, valued at over $10 billion, which is 32 times the ETH supply increase during the same period. No wonder Ethereum's rise is so remarkable!

Ethereum Reserve Strategy Companies to Accelerate ETH Purchases

Hougan predicts this situation will continue!

Ethereum's market cap is currently 20% of Bitcoin's, but Ethereum ETF scale is less than 12% of Bitcoin's ETF. With the growing demand for tokenization and stablecoins (primarily based on Ethereum), Hougan believes this will change, and billions of dollars will flow into Ethereum ETFs in the coming months.

Meanwhile, all signs indicate that the "Ethereum Reserve Strategy" trend will accelerate. The key to crypto fund management companies' growth is whether their publicly traded stock prices are higher than the value of their crypto assets, which is currently true for ETH fund management companies. For example, BMNR and SBET's trading prices are almost twice the value of their ETH holdings. As long as this continues, Wall Street companies will certainly invest more in ETH.

In 2025, ETF and Ethereum Reserve Strategy Companies Will Purchase Over 5 Million ETH

Looking ahead, Bitwise predicts that ETFs and Ethereum reserve strategy companies will purchase ETH worth $20 billion next year, which at current prices is equivalent to 5.33 million ETH. During the same period, the Ethereum network will produce about 800,000 ETH. This represents a demand approximately 7 times the supply.

ETH is certainly different from BTC. Its price is not solely determined by supply and demand, nor does it have a long-term issuance cap like BTC. But Hougan believes this is currently irrelevant.

In the short term, all commodity prices are determined by supply and demand. Currently, the demand for ETH far exceeds the new supply.

Risk Warning

Cryptocurrency investments are highly risky, with potentially volatile prices, and you may lose all your principal. Please carefully assess the risks.

(Original article by researcher Yu Zhe'an 'US Stablecoin Series #5: Where Are Stablecoins Heading? From Institutional Penetration to Central Bank Embedding', edited by ABMedia)

Table of Contents