Written by: TechFlow

On July 28th, at $861, BNB reached a new historical high, rising over 5,700 times from its initial issuance price of $0.15 in 2017.

BNB has never been like today, with one side close to the elite Wall Street, and the other side reaching ordinary people's Main Street.

In July 2025, the alternative asset management firm 10X Capital and venture capital company YZI Labs announced that they are preparing to establish a "micro-strategy" fund specifically investing in BNB, aiming to provide institutional and family office investors with a compliant path to BNB reserves through a US stock market listing.

BNB is integrating into US stocks, and US stocks are entering the on-chain world through BNB Chain.

In July, the RWA platform xStocks, supported by Kraken and Backed Finance, will launch on-chain products for over 60 US stocks and ETFs on BNB Chain, covering Tesla, Apple, NVIDIA, and even the S&P 500 ETF.

On the other side of Main Street, BNB Chain has penetrated into every cross-border family needing efficient transfers and every developer wanting to try entrepreneurship on the blockchain.

From mobile payment providers in Africa to remittance workers in the Philippines, to crypto freelance markets in Latin America, BNB Chain provides real financial infrastructure for these users through low fees and fast confirmations.

If Bitcoin is the "digital gold" of the crypto world, and Ethereum is the "underlying mine of smart contracts", then BNB, once considered the "pioneer of exchange tokens", has now evolved into a completely new crypto species.

It is no longer just a platform token for fee discounts, nor merely a public chain fuel, but a multi-dimensional value carrier bridging centralized finance, on-chain ecology, and real-world assets:

One side connecting to Wall Street's capital markets, the other side deeply embedded in ordinary users' life scenarios, the following story is the beginning of this identity transformation.

[The translation continues in the same manner for the rest of the text...]Overall, whether in RWA applications or institutional warehousing, BNB's financial path is still in its early stages. However, these attempts reflect a direction - BNB is seeking an entry point into the traditional financial system, and this exploration is likely to be an indispensable part of the future crypto asset ecosystem.

Scenario Implementation: Payment and User Expansion

BNB Chain's technological upgrades and financial attempts have attracted much attention, but its ecosystem has always been built on a core logic - to truly serve more real users through blockchain.

In recent years, the on-chain ecosystem around BNB has gradually revealed a clear trend: based on low cost and high efficiency, continuously penetrating payment scenarios, community inclusiveness, and developer ecosystem.

In the payment domain, BNB is becoming one of the "candidates" for small transactions and cross-border settlements.

Since 2025, BNB Chain's transaction costs have been compressed to around $0.01-0.05 per transaction, coupled with a confirmation speed of less than 2 seconds, providing a technical foundation for micropayments and cross-border remittances.

BNB Chain has also provided merchants with easily integrated CMS plugins, supporting mainstream online payment solutions including Shopify, WooCommerce, Magento 2.

The combination of "simple and easy to use + fast settlement" is driving some of BNB Chain's payment experiments into the real market.

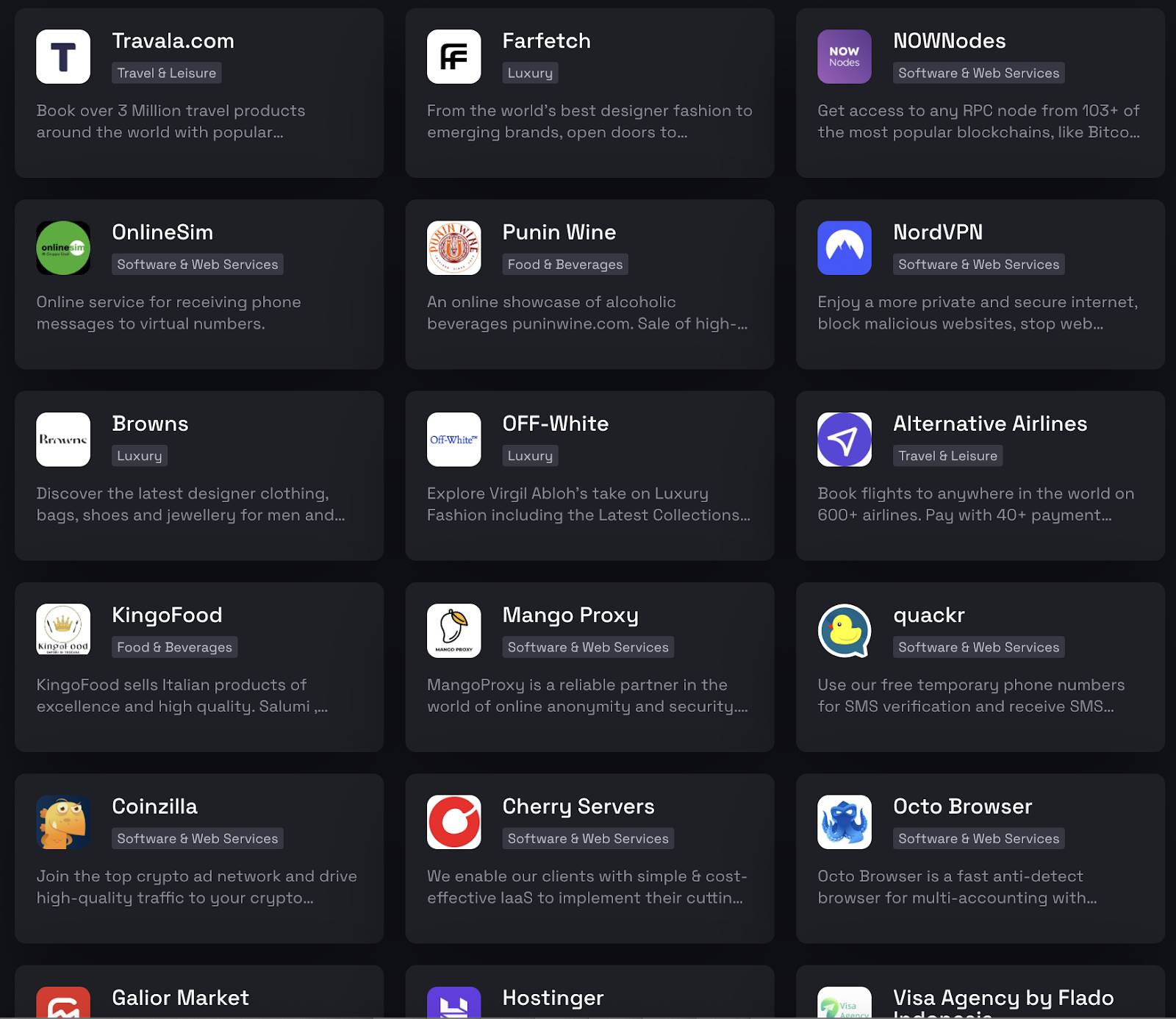

For example, luxury online shopping platform Farfetch, clothing brand MAINLESS, virtual number service platform Onlinesim, travel platform Travala, and dozens of other well-known platforms have integrated BNB Chain, supporting cryptocurrency payments like BNB, providing an almost "Web2 experience" for online consumption.

More notably, BNB is deeply penetrating financial scenarios.

Besides RWA, BNB Chain has also built an increasingly comprehensive stablecoin ecosystem, including established stablecoins like FDUSD, TUSD, USDT, and USDC.

In 2025, Trump family's crypto project World Liberty also deployed its stablecoin USD1 on BNB Chain, with over 90% of its supply now deployed on BNB Chain and establishing trading pools on platforms like PancakeSwap, making BNB Chain the main base for the USD1 ecosystem.

This stablecoin system not only provides liquidity foundation for DeFi protocols but also offers rich combination possibilities for on-chain payments, lending, clearing, and asset issuance.

Based on the stablecoin liquidity foundation, BNB Chain's Builder Support Program covers hackathons, MVB (Most Valuable Builder) accelerator, and incubation fund support system. Many DeFi, GameFi, and SocialFi projects in the ecosystem choose to prioritize deployment on BNB Chain for the following reasons:

Mature stablecoin basic liquidity, facilitating lending pools, AMM pools, and payment channels;

Low-fee, high-throughput on-chain interaction environment, suitable for financial-grade micropayments and flash transactions;

Official and partner support for early user acquisition, making it easier for startup projects to scale and promote.

As the BNB team describes:

"From Wall Street to Main Street, BNB Chain powers real users, real builders, and real results. Performance, fairness, and cost-efficiency — not just in theory, but in every block."

This infrastructure capability that can be used by entrepreneurs and truly used by users allows BNB to maintain strong ecosystem vitality even during periods lacking new narratives.

Looking back at BNB ecosystem's development paths, the underlying logic behind both off-chain payments and on-chain finance remains unchanged - using low-threshold on-chain interactions and richer liquidity to cover more ordinary users and explore possibilities for scalable expansion.

BNB: A New Cross-Border Species

BNB's story is traversing the inherent boundaries of crypto assets.

From an initial exchange token to a public chain's Gas, then to payment network and developer ecosystem construction, and now entering real-world assets (RWA) and US stock capital markets...

BNB is no longer just a simple label of "platform token" or "public chain token", but is evolving towards "cross-border financial infrastructure": a new cross-border species that connects on-chain and off-chain, serves users and institutions, possesses both financial liquidity and public chain performance, and can be simultaneously accepted by traditional markets and decentralized ecosystems.

In the centralized crypto world, BNB is the core asset of the Binance ecosystem, participating in transaction fee deductions, Launchpool, airdrops, and other practical scenarios, binding with the liquidity and user network of the world's largest trading platform;

On the decentralized chain, BNB is the Gas Token of BNB Chain, the fuel for various contract interactions in DeFi, payments, games, RWA, etc., with its low-fee and high-efficiency on-chain environment becoming the first choice for entrepreneurs to deploy and implement projects;

In the real world, with the access of RWA and compliant financial projects like xStocks, Ondo, and USD1, BNB is becoming an "anchor" for mapping traditional financial assets, with some US stock companies beginning to use BNB as a reserve asset.

This makes BNB one of the few "hybrid assets" that can simultaneously capture centralized financial returns, on-chain infrastructure value, and real-world asset bridging potential.

Therefore, BNB can not only meet institutional compliance entry needs but also carry the liquidity network built by developers, maintaining its narrative dominance between centralization and decentralization with ease.

This might be the true significance of BNB as a "new species" -

From Wall Street to Main Street,

Beyond Bitcoin's value storage and Ethereum's smart contracts,

BNB is opening up a completely new track of "usability + financial attributes + user scale".