Author: Bright, Foresight News

Non-Fungible Tokens seem to be following ETH back to $4,000, with veteran blue-chip Non-Fungible Tokens thawing and recovering from an 18-month-long ice age.

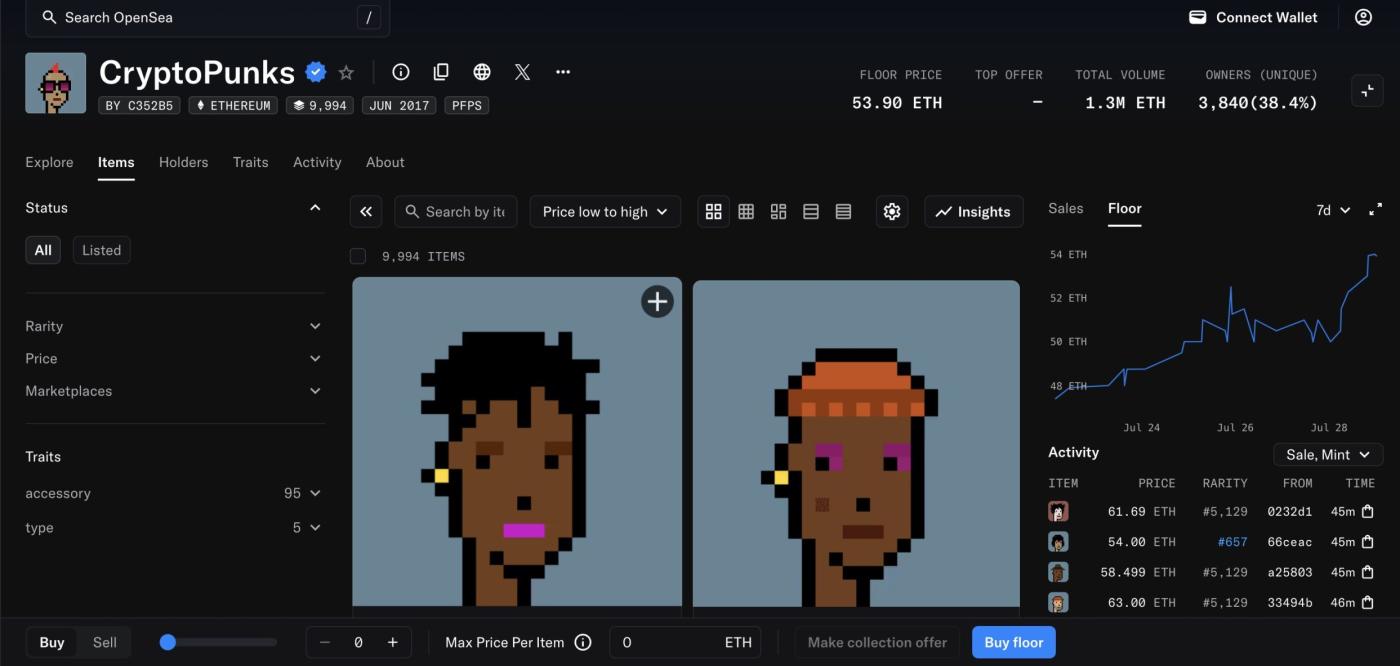

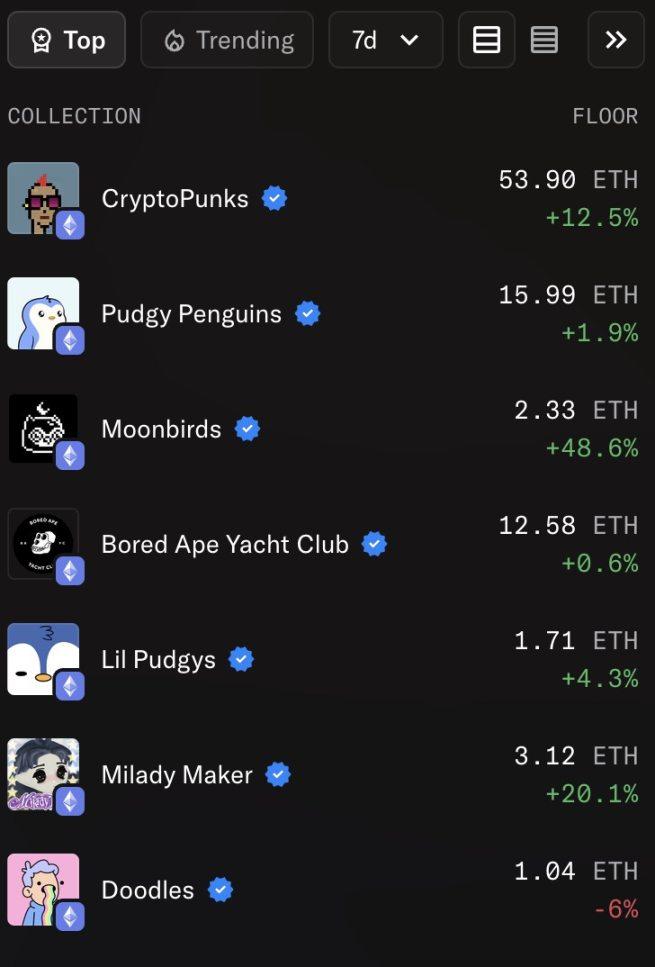

Among them, the CryptoPunks Non-Fungible Token series had a trading volume of over $24.6 million last week, reaching its highest record since March 2024, an increase of 416% from the previous week.

On the evening of July 24, NASDAQ-listed GameSquare announced that its board has approved a strategic purchase of CryptoPunk #5577 from Robert Leshner, founder of the DeFi protocol Compound and CEO of Superstate. According to the acquisition agreement, GameSquare issued preferred shares worth $5.15 million to Robert Leshner, which can be converted to approximately 3.4 million GameSquare common shares at a price of $1.50 per share.

This move triggered a trading frenzy for CryptoPunks Non-Fungible Tokens, with significant increases in floor price and average selling price. As public companies become the main holders, Non-Fungible Tokens seem to be "saved" through corporate entities.

Previously, Arthur Hayes stated that when ETH rises, DeFi and Non-Fungible Tokens will also rise. He predicted that the returns from holding ETH this round would not outperform CryptoPunks.

Other ETH blue-chip Non-Fungible Tokens also rose in tandem within a week. Moonbirds' floor price broke through 2 ETH, rising nearly 50%; Milady Maker's floor price broke through 3 ETH, rising over 20%.

However, Non-Fungible Tokens are just gaining momentum. Last Sunday, Solana co-founder Anatoly Yakovenko and Base founder Jesse Pollak started a Twitter "confrontation" about whether creator tokens on Zora could be compared with anonymous meme coins on Pump.fun.

Jesse Pollak claimed that creator tokens on Zora have unique value in content and creators, and equating them with tokens on Pump.fun is a logical fallacy. Anatoly Yakovenko argued that these tokens are merely viral products, with buyers just wanting to quickly resell. Pollak countered that tokens are powerful technology enabling value flow for creators, and those who disagree can maintain the "content has no value" perspective.

During the debate, Anatoly Yakovenko bluntly concluded that "Memecoins and Non-Fungible Tokens are digital garbage with no intrinsic value". He compared these digital assets to the "unboxing" mechanism in free games.

Although Solana greatly benefited from meme-driven activities in the first quarter of 24-25, toly himself has repeatedly stated that memecoins have no intrinsic value.

However, toly has undoubtedly taken on the role of a shill KOL in the community, long famous for "crazy promoting Memes on Solana". By the late stage of the Solana Meme boom, toly's shill credibility as Solana's co-founder had almost disappeared.

Rewinding to two years ago, from its creation in December 2023 to the Chinese Lunar New Year in 24, Silly Dragon became one of the most explosive Memes on Solana. The reason for this Meme's birth was simply that toly personally liked the dragon's image and appeared in events with that design.

After Silly Dragon's creation, when it only had 1,454 followers, toly had already followed it. This action caused Silly Dragon to surge 10 times within 1-2 hours at the time.

Subsequently, as the Silly Dragon community continued to grow, toly became "addicted to promoting" it. Not only did he subtly include dragon emojis in tweets, but he also directly retweeted related Meme project tweets.

Looking back, Solana's rise from obscurity to the third-largest market cap blockchain was due to its lowest transaction costs, with most new Non-Fungible Tokens and protocols initially choosing Solana. As the most prominent symbols of the crypto-native community, Non-Fungible Tokens and Memes objectively helped Solana form one of the strongest communities in the entire crypto field. Toly's attempt to cut off Non-Fungible Tokens and Memes and morally judge speculative assets feels like "scolding the chef after eating".