Author: Zz, ChainCatcher

"With Machi Big Brother ahead and Ying-Ying behind, many previous Non-Fungible Token big shots have returned."

In 2021, the star effect fueled the Non-Fungible Token craze. Now, they are returning with different stories and bets.

Meanwhile, as the Non-Fungible Token market's trading volume rebounds and buyers surge, is this a true spring or just an illusion in the cold winter?

Non-Fungible Token Market Entering a Deep Transition Period?

The market's macro data presents a confusing contradiction.

On one hand, long-term expectations remain optimistic. Authorities like Vancelian predict this year's market size will break through hundreds of billions of dollars. On the other hand, the short-term reality is exceptionally cold: DappRadar reports show that Non-Fungible Token transaction amounts declined by nearly 29% quarter-on-quarter in the second quarter.

However, this seemingly receding tide has not triggered market panic, but instead revealed a structural transformation.

According to DappRadar data: In the second quarter of 2025, despite the total Non-Fungible Token transaction amount declining due to fewer high-priced collectibles, transaction counts surged 78% from about 7.02 million to 12.5 million, and independent buyer numbers significantly increased 44% from 651,000 to 936,000.

This set of "price drops while volume increases" abnormal data reveals the deep changes the market is experiencing. Non-Fungible Tokens are quietly transitioning from a high-price speculative game for a few to a broader "popularization process".

As Coindoo reported: Despite the decline in transaction volume, the increase in sales numbers and decrease in average transaction value precisely indicates broader market participation, with transaction motivation shifting from pure speculative trading to utility and community consensus.

And at this delicate moment, a group of previously departed "star players" are returning. What does their comeback mean?

Star Return, Is the Sickle Still Sharp?

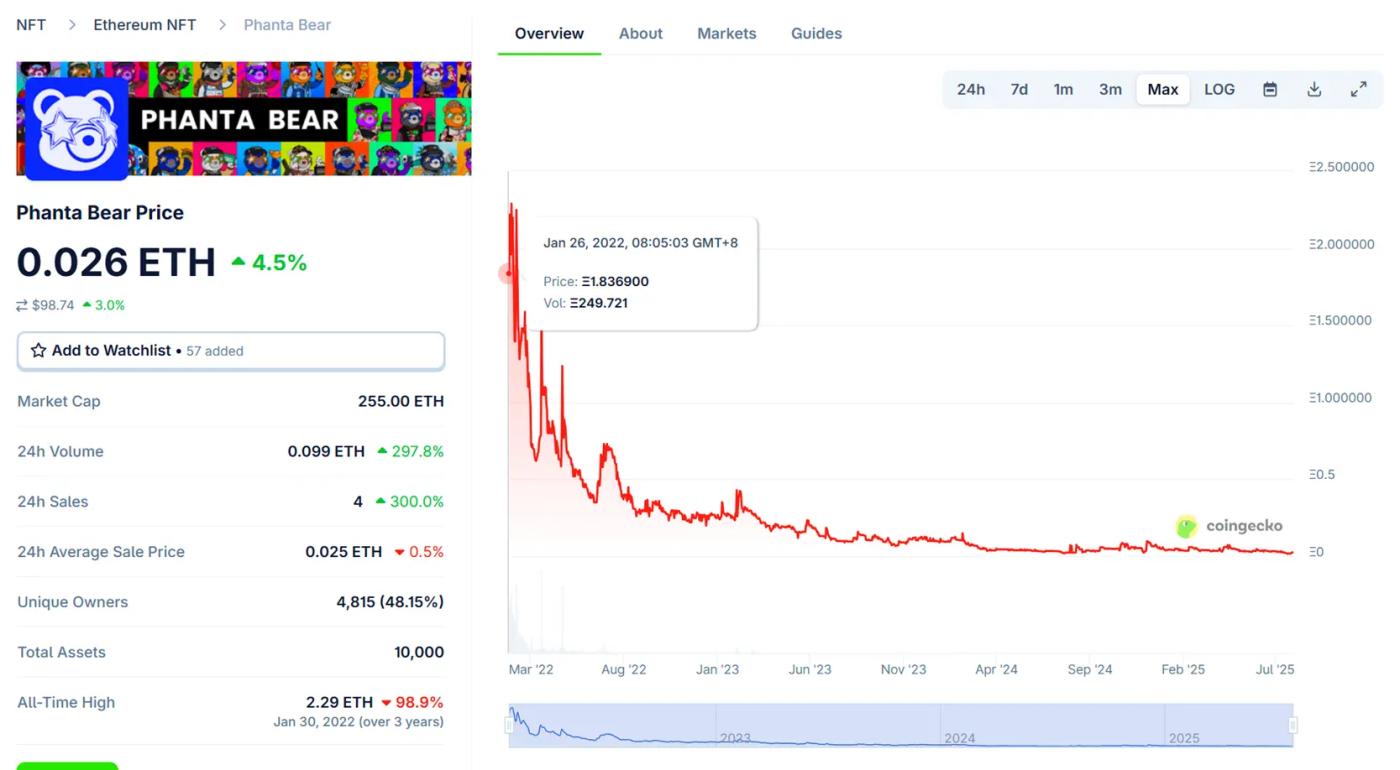

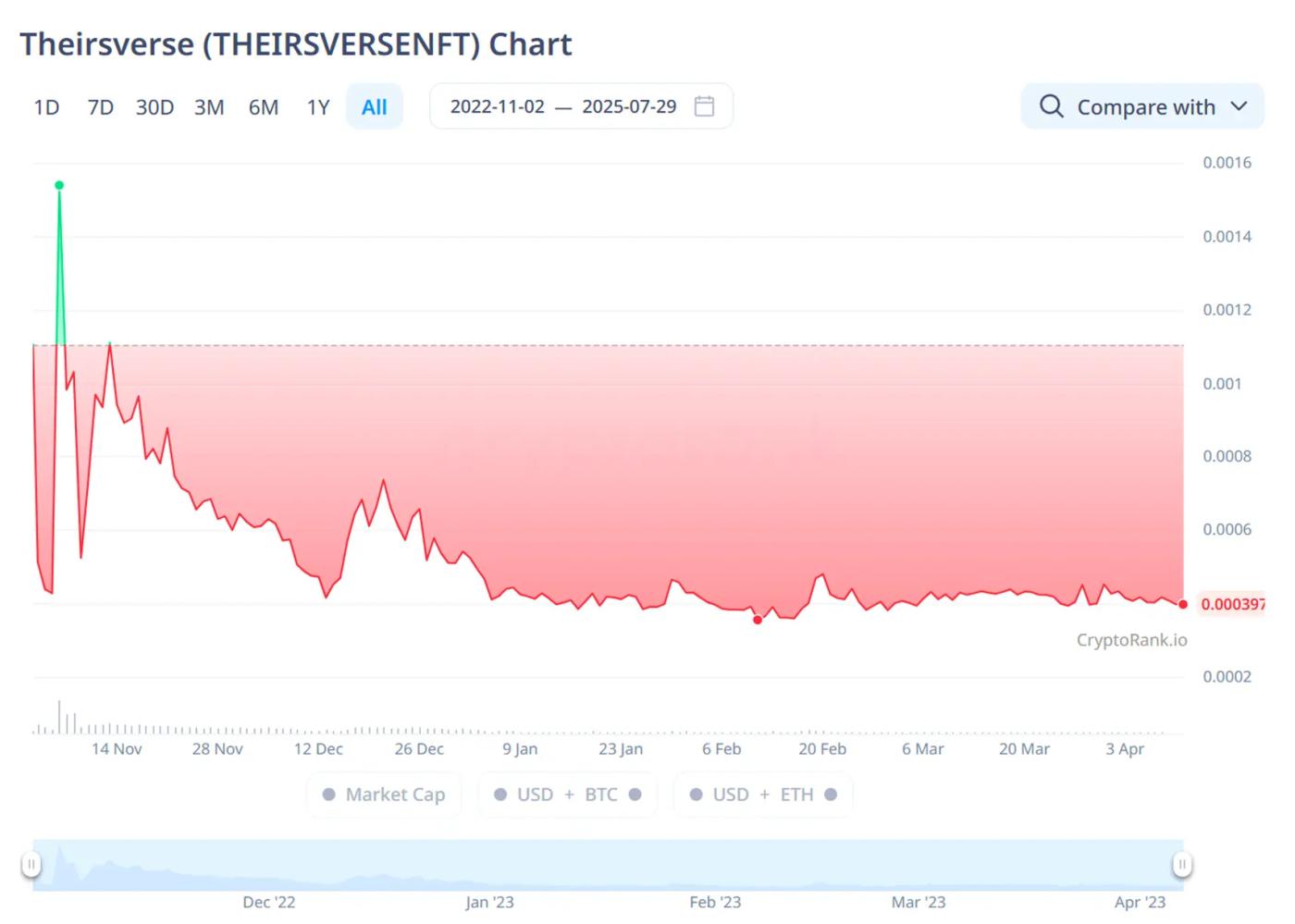

From Jay Chou's PhantaBear concept to Edison Chen's ZombieClub, and Ying-Ying's own Theirsverse. These once-crazy-hyped projects now have floor prices that have dropped over 98% from their peak, almost to zero. Behind these cold numbers are wounds that countless investors are still silently licking.

Source: CoinGecko, Cryptorank

To understand today's market, we must look back at that year intertwined with passion and sobriety.

2021: Peak of Revelry

This was a golden age where dreamers and speculators danced together.

Bitcoin hit the historical high of $69,000, and Non-Fungible Tokens leaped from a niche plaything to a global topic. In October 2021, Machi Big Brother boldly spent 425 ETH to buy a Cyborg Bored Ape, instantly igniting FOMO emotions.

By year-end, Jay Chou's PhantaBear sold out within 40 minutes of launch, with daily sales exceeding millions of dollars.

2022: Winter Descends

But prosperity vanished instantly. Under multiple impacts like black swan events, high inflation, interest rate hikes, and war, Bitcoin dropped below $20,000, and crypto market value was halved to $1 trillion.

Edison Chen, Edison Chen, and Ying-Ying successively launched Non-Fungible Token projects but ultimately collapsed in the bear market wave. Theirsverse dropped from 0.219 ETH to 0.02 ETH, a decline of over 96%, earning Ying-Ying the "leek queen" label.

2025: Old Faces Return, New Forces Enter

Currently, Machi Big Brother has completed his identity transformation, from Non-Fungible Token big player to MEME coin high-leverage trader. He's betting real money on BLAST and PUMP tokens, publicly disclosing profits and losses, becoming the "number one gambler" coexisting with the market. Meanwhile, Ying-Ying has also quietly returned.

Additionally, legendary businessman Qian Fenglei entered Web3 with his "billions in assets" at the beginning of the year, claiming to invest $1 million to create a "Peach Blossom Spring NFT"; Galaxy Digital's head Mike Novogratz quietly changed his avatar to Pudgy Penguin.

Everything seems to return to 2021, with stars back in place and the market stirring. But this time, beneath the heat, there's less blind faith and more restraint.

Community Transformation: From Followers to Value "Judges"

In the 2025 Non-Fungible Token market, the community is no longer a simple participant, but has transformed into a true "judge".

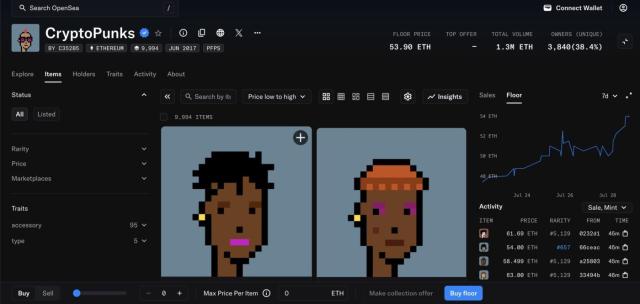

On the surface, data looks promising: Non-Fungible Token trading volume steadily recovers, with blue-chip projects like CryptoPunks, BAYC, and Pudgy Penguins continuously rising in price. But this time, the community's reaction is unprecedented in its calmness.

"The 2021 Non-Fungible Token boom will not reappear," @RicecakeNFT frankly stated on X, "Entry barriers have significantly increased, and investors care more about utility and community value." This statement reveals the truth of the 2025 Non-Fungible Token market, where value return becomes the main theme after speculative bubbles recede.

Community member @waleswoosh predicted: "In 2025, a top Non-Fungible Token project might no longer exist, and we'll see several Non-Fungible Token projects with floor prices above 50 ETH. This year will be about repricing and actual value."

The 2025 Non-Fungible Token world appears lively but is actually calm.

From speculation to consensus, from passion to rationality, this deep transition is a reshaping of value.

Recommended Reading:

Solana and Base Founders Start Debate: Does Content on Zora Have "Basic Value"?

Surging 30 Times in a Month, Is Graphite Protocol the "Tax Collector" Behind Bonk.fun?