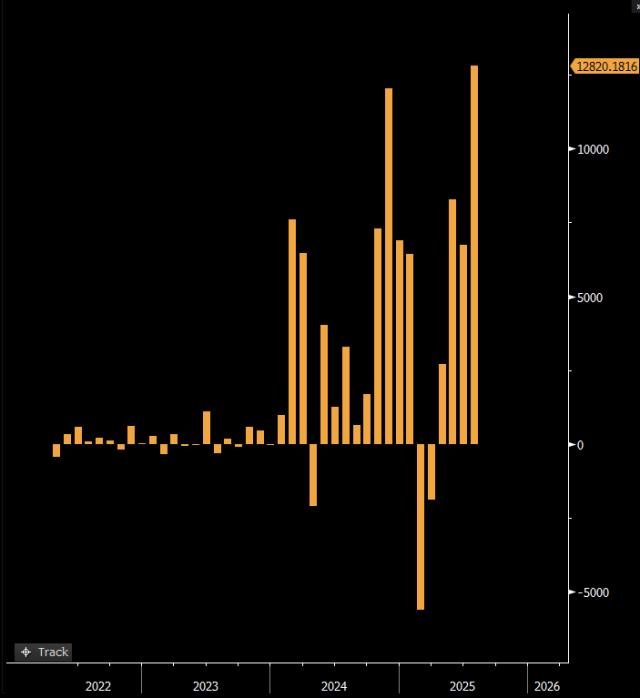

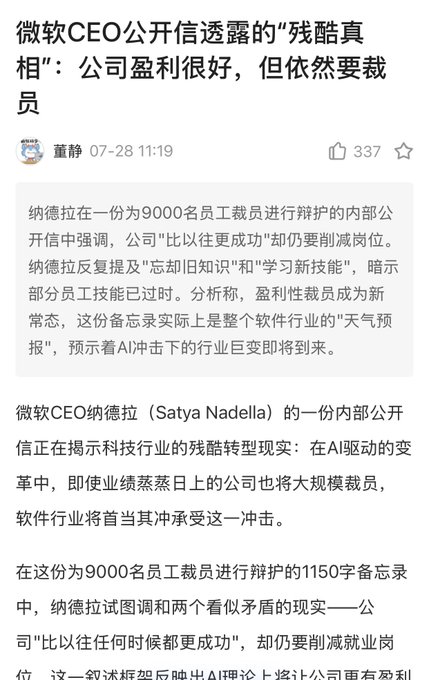

After reviewing Microsoft and Meta's financial reports, I can't help but recall Lou Gerstner's quote "Who says elephants can't dance": Microsoft's second-quarter revenue reached a one-and-a-half-year high quarterly growth rate, with EPS profit growth accelerating to 24%, and Azure and other cloud services revenue unexpectedly growing 39%, reaching a two-and-a-half-year highest growth rate; Microsoft disclosed Azure revenue for the first time, with full-year revenue exceeding $75 billion, a 34% increase; second-quarter capital expenditure returned to quarter-on-quarter growth, unexpectedly increasing 13% to a record $24.2 billion. Meta's second-quarter revenue reached $47.5 billion, with earnings per share of $7.14, both significantly exceeding market expectations. Advertising revenue was strong, and Reality Labs' losses were lower than expected. The company anticipates third-quarter revenue between $47.5 billion and $50.5 billion, higher than market consensus, and has raised the lower limit of 2025 full-year capital expenditure from $64 billion to $66 billion. Both performance and AI investment outlook are strong. Both companies' U.S. stock profit growth rates are higher than revenue growth rates: Microsoft is 24% > 18%, Meta is 38% > 22%, indicating better growth quality. Meta's PEG is only 0.7, far below 1, showing a growth stock posture despite its large market value. The two key medium to long-term factors boosting U.S. stock fundamentals are: weakening U.S. dollar, capital expenditure deductions in the <大美丽法案>, and strategic profitable layoffs driven by AI cost reduction and efficiency improvements.

This article is machine translated

Show original

qinbafrank

@qinbafrank

07-29

聊聊从宏观看美股财报季的两个角度和影响业绩的三个中长期因素:这里不聊具体某家公司的财报表现,而是去看财报季所呈现的宏观视角。个人觉得主要有两方面:

1、从财报季看美国消费的真实表现如何。这里个人觉得代表性的四家公司是:美国银行、沃尔玛、costa、亚马逊。 x.com/qinbafrank/sta…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share