A Bitcoin transaction worth $9 billion unveils the transition of old and new capital in the crypto world.

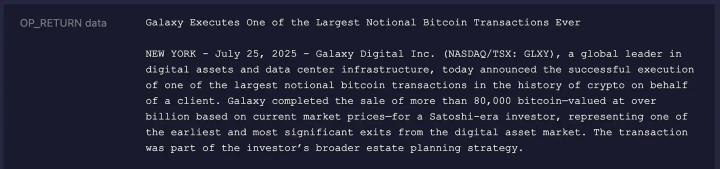

At the end of July, the cryptocurrency market witnessed an epic transaction: Digital asset company Galaxy Digital assisted a "Satoshi Nakamoto era" whale investor in selling 80,000 Bitcoins in a single transaction, valued at over $9 billion. This figure set a record for the largest single transaction in crypto history. Surprisingly, such a massive sell-off did not trigger a market crash - Bitcoin's price briefly dropped 3% before quickly rebounding to $119,000, even rising $5,000 above the pre-sale price.

Behind this transaction, a debate about Bitcoin's essence is brewing, with some analysts exclaiming "belief system collapse", while institutional investors are quietly buying in. As this ancient whale awakens and leaves after 14 years of slumber, how should ordinary people respond to this capital transformation?

I. Whale Emerging: The Background of the $9 Billion Sell-off

The protagonist of this market-shaking transaction is a Bitcoin address that has been dormant for over 14 years, which accumulated Bitcoin between 2010-2011 when the price was only $1-10, and now has surpassed $120,000.

According to on-chain data analysis, these Bitcoins were likely mined early on - when network hash rate was extremely low, and ordinary laptops could mine hundreds of coins. The ingenious operation method was key to not impacting the market, with Galaxy Digital using a staged order strategy:

• 14,000 BTC entered Binance

• 8,975 BTC entered Bitstamp

• 7,420 BTC entered Bybit

• 7,150 BTC entered OKX

• Remaining 30,400 BTC distributed through OTC trading

This multi-channel synchronized operation avoided concentrated selling pressure on the order book, a classic case of "whale falling silently".

Estate planning was the officially announced direct motive. Galaxy clearly stated that this sell-off was part of a client's "estate inheritance strategy", and if not handled in advance, the 40% federal estate tax in the US would consume billions of dollars in wealth.

Deeper concerns come from tightening regulations. The 2026 FATF new rules require tracing transaction history for addresses dormant over ten years, and exchanges have begun requiring old wallet users to supplement identity verification. Predictions about the disappearance of anonymity have accelerated the whale's exit decision.

II. Timing of Sell-off: Why Choose to Cash Out at $120,000?

For an investor holding for over a decade, choosing to exit now reflects multiple considerations:

Intergenerational wealth transfer needs: Early-stage Bitcoin holders have mostly entered middle or old age, and incorporating crypto assets into estate planning has become a practical need. When the earliest investors start considering how to pass Bitcoin to the next generation, this is the most powerful endorsement of its value storage attributes.

Mature market liquidity window: Currently, Bitcoin market depth has reached an unprecedented level. The popularity of spot ETFs has brought institutional-level buying from the traditional financial world, providing a liquidity foundation for large-scale exits. Galaxy Digital's involvement as a regulated listed company ensures the transaction's professionalism and compliance.

Price entering an ideal range: Bitcoin just created a new all-time high of around $123,000 on July 14, providing long-term holders with an ideal exit point. Technical analysis shows that Bitcoin quickly stabilized after the whale sell-off and is currently forming a "descending wedge" pattern, with a breakthrough target pointing to $125,000.

By choosing to exit at the current $110-120,000 price range, the whale demonstrated incredible patience and precise calculation.

The massive difference between cost and returns forms the basis for cashing out. Calculating the initial cost at around $5, the original investment of 80,000 Bitcoins was only $400,000, now worth $9 billion, with a return over 22,000 times. Even calculating from the 2011 high of $30, the returns are still 4,000 times.

Capturing signals at the cycle top is equally crucial. Bitcoin has risen nearly 7 times from its 2024 low point, breaking $120,000 in July to a historical high. Many analysts point out that $120,000 is three times the 2017 bull market high point, naturally creating selling pressure. The whale's choice to sell after a new high ensures maximum profit while using market euphoria to absorb the sell-off.

From a market structure perspective, the institutionalization process provides a perfect exit channel. After spot ETFs, institutions like BlackRock and Fidelity can absorb thousands of Bitcoins daily. For example, during this sell-off, BlackRock's IBIT added over 3,000 BTC in a single day, becoming a key buyer.

The deeper anxiety comes from the dissolution of Bitcoin's original spirit. As ETFs, corporate treasuries, and custody solutions incorporate Bitcoin into the traditional financial system, the initial "censorship-resistant, decentralized" ethos is diluted. Some community members lament: "The whale's exit confirms Bitcoin's descent from a 'personal sovereignty tool' to a 'financial engineering product'."

III. Market Impact: The True Landscape Under the Sell-off Shockwave

The $9 billion sell-off acted like a touchstone, revealing Bitcoin market's surprising resilience.

The price stability was most unexpected. Despite the sell-off size representing 0.6% of circulating supply (actually lower due to ETF lock-up), Bitcoin only briefly dropped from $118,000 to $115,000, recovering within hours. Compared to the 10% crash from a 10,000 BTC sell-off on July 25, this performance was a "soft landing".

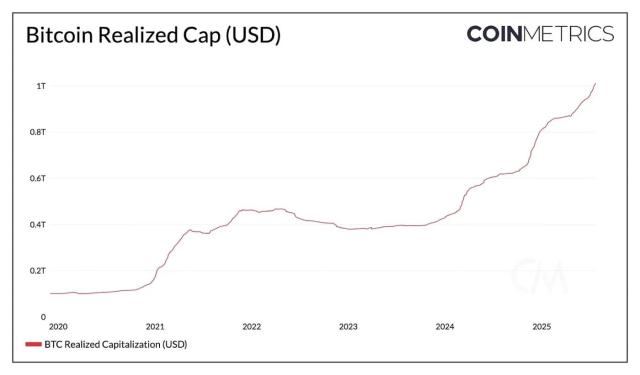

The essence of chip transfer is the handover of old and new capital. On-chain data shows:

• Bitcoin from the Satoshi Nakamoto era (over 10 years old) dropped from 20% in 2020 to less than 5% currently

• During the same period, institutional Bitcoin holdings through ETFs exceeded 800,000 (4% of total supply)

This confirms Galaxy founder Mike Novogratz's judgment: "Old money is handing over the baton, new money is taking the relay".

The market's calm digestion of this epic sell-off reveals four key changes:

1. Institutional liquidity as a "ballast": The popularity of Bitcoin spot ETFs brings continuous institutional-level buying. Ongoing purchases by traditional financial institutions like BlackRock provide solid bottom support, making the market structure vastly different from the early ecosystem where "tens of thousands of coins dumping" would cause a crash.

2. Professionalized transaction execution: Galaxy Digital used over-the-counter (OTC) large-scale transactions to match massive sell orders with multiple large buyers, avoiding direct impact on the open market order book, playing a crucial "shock absorber" role. This demonstrates the maturity of crypto market infrastructure.

3. Smooth handover between old and new whales: CryptoQuant CEO Ki Young Ju pointed out a key phenomenon: "Old whales selling to new whales". On-chain data shows that while ancient whales are selling, institutional investors are actively accumulating Bitcoin, reaching near-recent highs in holdings.

4. Evolving investor mentality: The market is shifting from panicked "Who is he, what did he do" to rational "Why did he do this, how did he do it". Once it became clear this was professional estate planning by an institution, market sentiment quickly turned to a positive "bad news is priced in" signal.

Liquidity depth evolution is the core support. Currently, Bitcoin spot daily trading volume exceeds $3 billion. The 80,000 BTC (about $9 billion) sell pressure is only a three-day trading volume, compared to the 2020 market where a $500 million single-day sell-off could cause a 30% crash, today's depth is incomparable.

However, risks still exist. Bitcoin's on-chain activity continues to shrink. As mining rewards decrease, can transaction fees alone maintain network security if it primarily serves as a store of value rather than a trading medium? This is the fundamental contradiction between Satoshi Nakamoto's vision and institutional reality.

For long-term investors, whale exit marks the beginning of institutional dividends. Continued accumulation by institutions like BlackRock, MicroStrategy's "digital asset reserve" strategy of holding over 200,000 BTC, and Standard Chartered Bank's year-end price target of $200,000 under Federal Reserve rate cut expectations all point to a more stable long-term bull market.

This $9 billion sell-off is actually a microcosm of power transfer in the crypto world. As idealists from the Satoshi Nakamoto era exit with ten-fold returns, Wall Street's quantitative models are redefining Bitcoin's value logic.

For ordinary people, instead of worrying about whale movements, it's better to focus on the liquidity dividends brought by institutional entry. As Bitcoin's historical cycles have shown - each deep squat is for a higher jump. When the September rate cut window opens, a new capital wave may push Bitcoin to unprecedented heights.

The market always swings between fear and greed, and clear-minded investors understand: "Bull markets always grow in doubt and end in revelry."