The U.S. economic data, including the small non-farm payrolls, GDP, and core PCE and unemployment claims up to last night, all indicate that the U.S. economy and employment situation are good, with no immediate need for rate cuts. Therefore, as expected, the Fed will maintain unchanged rates at the upcoming Thursday morning meeting, and Powell will continue his hawkish stance. This has dampened market expectations of imminent rate cuts, with September rate cut probability now below 50%, causing the cryptocurrency market to remain low and oscillating.

VX: TZ7971

The best way to observe market sentiment is by looking at contract funding rates. Last night, except for Bitcoin, most mainstream Altcoins had negative funding rates, indicating more short sellers than long buyers, completely opposite to the situation earlier this week. This shows that in a relatively bearish environment, most investors are cautious or pessimistic about cryptocurrency prices. However, Bitcoin and Ethereum are hovering near six-month highs, which is relatively more optimistic compared to Altcoins.

Tonight, the U.S. will release non-farm employment data, unemployment rate, and ISM manufacturing PMI, all important indicators influencing rate decisions. If the data continues to be unfavorable for rate cuts, the market is likely to see a risk-averse trend before the weekend. Another destabilizing factor is today's tariff negotiation deadline. Although Trump has likely negotiated agreements with key countries, uncertainties exist until the last moment, so market volatility beyond expectations is possible.

To avoid risks, those who must trade should use stop-profit and stop-loss orders. For those with empty positions, now is a good opportunity to enter spot markets by choosing strong sector cryptocurrencies.

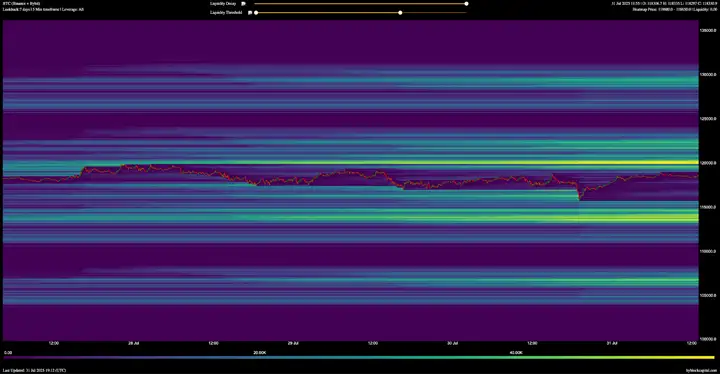

Although Bitcoin's price briefly dropped below $116,000, it has maintained a range between $115,000 and $121,000 for the past 18 days. Technical data suggests a high probability of breaking this consolidation range. The price movement before and after the FOMC meeting shows "liquidity hunting" behavior, with wicks on both ends of the 15-minute candlestick chart clearly indicating market hesitation. The 10% buy-sell ratio turning negative increases the likelihood of price reaching the $115,883 liquidation level.

Liquidation chart remains unchanged: if the price exceeds $120,000, shorts will face liquidation threats, while if it drops below $115,000, longs will be at risk.

TRDR order book data (depth 2.5%–10%) shows increased selling pressure at $121,100 and significant buying interest at $111,000.

BTC price is being compressed, suggesting an imminent range expansion. Derivatives market lacks high leverage, and Bollinger Bands are narrowing, indicating an upcoming breakthrough. Although the market currently favors liquidity from long positions, positive factors exist.

Over the past six weeks, the number of companies buying Bitcoin daily has dramatically increased, with a buyer to seller ratio of 100:1.

Capital is also flowing back into spot Bitcoin ETFs. Despite recent BTC price pullback, total net inflows have reached $641.3 million since July 23.

Additionally, Paul's Thursday speech set an important precedent, providing the first concrete guidance on how Trump and regulators might promote the U.S. digital asset industry. Although not yet reflected in price, these are strong signals that should help enhance institutional investors' confidence in Bitcoin and the broader crypto market.

In the short term, if selling pressure continues to dominate, BTC price might further retrace to the $111,000 to $115,000 range to absorb long position liquidity. Conversely, for buyers, the most optimistic scenario is strong demand at $111,000, creating momentum to return above the $116,000 region. If both spot and derivatives markets send positive signals through CVD indices, BTC is fully capable of breaking the $120,000 resistance in the next few trading days.