Foresight News takes you to quickly browse this week's hot topics and recommended content:

01 Ethereum's Tenth Anniversary

《Ethereum: Still Has 100 Times Growth Potential》

《A Decade of the World Computer》

《The Risk Dilemma Behind Ethereum's Treasury》

02 Regulatory Trends

《Hong Kong Stablecoin Regulation About to Take Effect, License Competition Heats Up》

《SEC New Standards Announced, Spot ETF Approval Wave Imminent?》

《Full Text of SEC Chairman's Speech on "Crypto Plan"》

《The Power Game Behind Stablecoins》

《Under $4 Trillion Market Value: Decoding the Capital Flow of Crypto Market》

03 US Stock Tokenization Wave

《How to Make US Stocks Great Again?》

《Q2 Net Profit of $386 Million, Robinhood Strikes Gold with "Crypto Trading"》

《Robinhood's Crypto Ambition: Becoming the "Only Financial Entry" for Young Generation》

《Tokenized Stock Market Expected to Grow 2600 Times, Who Will Benefit?》

01 Ethereum's Tenth Anniversary

On July 30, Ethereum celebrated its tenth anniversary. Over the past decade, its market value has grown 3600 times to $45 billion, becoming one of the top 30 global assets, with an ecosystem nurturing groundbreaking products like stablecoins and DAOs. This article analyzes its potential for further hundredfold growth. Recommended article:

《Ethereum: Still Has 100 Times Growth Potential》

Looking back over a decade, Ethereum's ecosystem has grown at least three era-defining products, just like Apple's Mac, iPhone, AirPods, and iPad, and Ethereum is the absolute market leader in its domain.

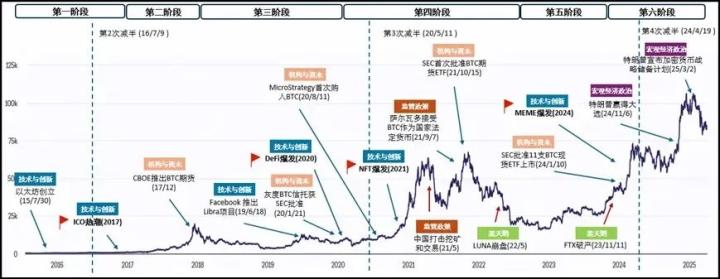

Stablecoins have an annual transaction volume of $28 trillion, with over 70% of transactions occurring on Ethereum; in 2016, the first global DAO was born on Ethereum, and now over 90% of the largest global TVL DAOs are in the Ethereum ecosystem; during the 2020 DeFi Summer, Ethereum was the sole center with a market share of 95%-99%; in 2021, when NFTs first broke through on a large scale, Ethereum was the main battlefield, accounting for over 90% of annual transaction volume... while US stock tokenization, US debt tokenization, RWA, AI Agent meme are just beginning.

So what about ten years from now? Ethereum is already among the top 30 global assets by market value, surpassing famous companies like Meta, TSMC, Visa, and Mastercard. Is this its endpoint?

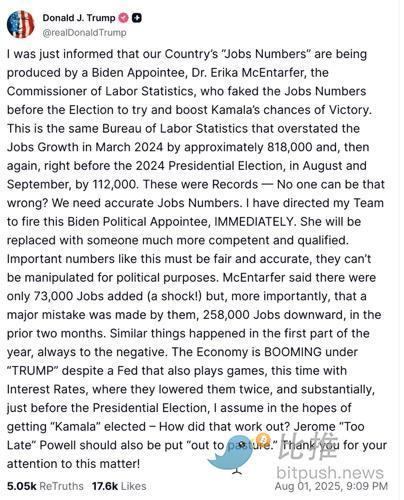

No, this might just be the true starting point.[The rest of the translation follows the same approach, maintaining the structure and translating all text while preserving special terms and proper nouns.]Here's the English translation: Cryptocurrency, once viewed as a "revolution to disrupt traditional finance," ultimately did not take a path of violent confrontation, but instead became deeply tied to the regulatory system and political consensus, becoming a "tamed revolution". From challenging tradition to seeking permission, from decentralization ideals to centralized regulatory reality, the absurdity and contradiction of this "revolution" is the core this article aims to analyze. When rebels bow to the system, is it a game of interests or an inevitable trend of the times? Recommended article: 《The Power Game Behind Stablecoins》 The "GENIUS Act" is the most sophisticated diplomatic policy operation, disguised as domestic financial regulation. This raises some interesting questions: What happens when the entire crypto ecosystem becomes an appendage of US monetary policy? Are we building a more decentralized financial system or creating the world's most complex US dollar distribution network? If 99% of stablecoins are pegged to the US dollar, and any meaningful innovation requires approval from the US Office of the Comptroller of the Currency, have we accidentally turned revolutionary technology into the ultimate export business of legal tender? If the rebellious energy of cryptocurrency is directed towards improving the efficiency of the existing monetary system rather than replacing it, as long as payment settlements are faster and everyone can make money, would anyone really care? These may not be problems, but they are far from what people initially wanted to solve in this movement. The digital asset market has approached the $4 trillion mark for the first time, a significant milestone in the industry's development. The latest price surge is due to a combination of structural and cyclical factors, including continuous capital inflows from Bitcoin and Ethereum spot ETFs, accelerated asset accumulation by digital asset management companies, and major regulatory breakthroughs like the passage of the GENIUS Act. Recommended article: 《Under $4 Trillion Market Cap: Decoding the Capital Landscape of the Crypto Market》 Recent market dynamics suggest we may be in the early stages of expanding market leadership patterns. Ethereum has begun to show relative strength, with the ETH/BTC rate rebounding 73% since May, and ETH price breaking through $3,900. This momentum is thanks to record ETF capital inflows, increased enterprise fund reserve adoption, and Ethereum's continued dominance in the stablecoin sector, making it a beneficiary of the GENIUS Act. [Image] 03 US Stock Tokenization Wave What if purchasing such assets no longer requires an account and is not limited by region or trading hours? Using just a mobile phone and crypto wallet balance to buy "stocks" of US stock giants anytime, anywhere, is no longer a fictional scenario but a real transformation brought by "US stock tokenization". Recommended article: 《How to Make US Stocks Great Again?》 So why is the tokenization wave rushing into US stocks? US stocks have unique advantages not found in other assets. First, as the world's largest stock market, the total US stock market value in 2025 is between $52 trillion and $59 trillion, far exceeding stock markets in other countries or regions. The global stock market total value in 2025 is about $124 trillion, with US stocks accounting for over 40%. [Image] Tokenized stock track representative project Robinhood has made a fortune from "crypto trading". On July 30, the US fintech platform Robinhood released its Q2 2025 financial report, showing continued strong business growth, especially in the cryptocurrency sector. Recommended article: 《Q2 Net Profit of $386 Million, Robinhood Has Made a Fortune from "Crypto Trading"》 In terms of products, Robinhood continues to iterate in the crypto sector. In Q2 2025, the company expanded its service range to 30 European countries, far higher than 4 countries in the same period last year. Robinhood also launched a "stock token" product, allowing users to trade token versions of over 200 US stocks and ETFs in Europe. In the US market, the company has launched staking services for ETH and SOL, and plans to introduce crypto perpetual contracts. [Image] Robinhood has risen strongly through its crypto business, with stock prices hitting new highs and market value near $98 billion. Its layout of stock tokens, crypto staking, and exchange acquisitions aims to become the "sole financial entry" for the younger generation. Recommended article: 《Robinhood's Crypto Ambition: Becoming the "Sole Financial Entry" for the Younger Generation》 Tokenization might be Robinhood's long-term goal, but its core crypto business is already a powerful force. In 2024, Robinhood's crypto-related revenue reached $626 million, a significant increase from $135 million in the previous year, accounting for over a third of total trading revenue. In Q1 2025, crypto-related revenue was already $252 million. "They are now capturing Coinbase's market share in the US," said Rob Hadick, general partner at crypto venture capital firm Dragonfly. Cantor Fitzgerald's Knoblauch noted that in May 2025, Robinhood's crypto trading volume surged 36% month-on-month, while Coinbase declined. He acknowledged that Coinbase still dominates the institutional market, "their services are broader, and they have custody business", but after Robinhood's acquisition of Bitstamp in June, they gained 5,000 institutional accounts and licenses in Europe and Asia. The tokenized stock market currently has a scale of $500 million. If 1% of global stocks are tokenized, it may reach $1.34 trillion by 2030, an increase of 2,680 times. In 2025, mature regulation and infrastructure will be the driving force, and its combination with DeFi creates unique advantages, with multiple participants laying out this field. Recommended article: 《Tokenized Stock Market Scale Expected to Grow 2,600 Times, Who Will Benefit?》 The tokenized stock market is still in its early stages. According to rwa.xyz data, the current market scale is about $500 million. Compared to the $134 trillion global stock market, this figure is only 0.0004%. However, if only 1% of global stocks are tokenized in the next decade, the market scale could grow to $1.34 trillion, 2,680 times its current size.