As the Bit price has recently declined, the stock (MSTR) of Microstrategy (formerly Microstrategy) has experienced a double-digit significant decline.

While there are speculations about the company having to liquidate its Bit holdings, the Kobeissi Letter mentioned that such a move is highly unlikely but cannot be completely ruled out.

MSTR Declines Amid Bit Downturn

Over the past 24 hours, the Bit price has declined by more than 3%, leading to an 11% drop in MSTR. According to Yahoo Finance, the stock closed at $250, a 55% decline from its all-time high (ATH) in November 2024.

Amidst this decline, the Kobeissi Letter explored the possibility of the company's forced liquidation of its Bit holdings.

"The forced liquidation of MSTR is not necessarily impossible, but it is highly unlikely. A 'Meltdown' scenario would have to occur," the post read.

The analysis explained that the company's business model relies on raising capital to fund cryptocurrency purchases rather than selling Bit.

By issuing 0% convertible bonds and selling shares at a premium, the strategy was able to fund Bit purchases without liquidating assets, even during market downturns.

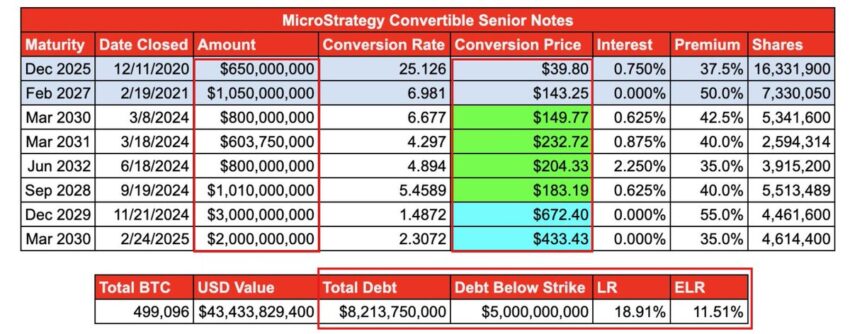

According to the latest data, the strategy holds approximately $43.4 billion in Bit against $8.2 billion in debt, resulting in a leverage ratio of around 19%.

Notably, most of the debt is in the form of convertible bonds, with conversion prices lower than the current stock price and maturities extending beyond 2028. This structure provides the company with significant flexibility.

However, the company's new capital-raising ability is not entirely free from challenges.

"This ability could deteriorate in a scenario where debt grows significantly larger than assets," the analysis reviewed.

This does not automatically imply "forced liquidation," but it could put pressure on the company's financial flexibility. However, the analysis emphasized that liquidation remains a possibility, but only under "fundamental changes."

"Realistically, for liquidation to occur, a shareholder vote or corporate bankruptcy would be required first," the Kobeissi Letter mentioned.

Nevertheless, given Michael Saylor's 46.8% voting power, this scenario is considered unlikely. This effectively protects the company from such moves without his consent.

Saylor has been a staunch supporter of Bit, emphasizing its long-term growth. In fact, last week, the company added 20,356 BTC to its holdings.

However, the Kobeissi Letter stressed that the true concern for the strategy lies in the future, when its convertible bonds mature after 2027.

If the Bit price declines by more than 50% and remains low, the strategy may struggle to refinance or repay its debt in cash, which could test the company's reserve funds and investor confidence.

"Maintaining investor confidence will be crucial for MSTR in a downtrend," the publication added.

Therefore, while the short-term likelihood of liquidation is low, the long-term risks associated with Bit's volatility and the company's debt obligations remain a concern.