"Trump's actions, a series of shows to raise funds for the purpose of realizing his policies"

"BTC, Trump's actions and the clearing of the futures market could lead to a drop to $70,000"

"$250,000 due to bottom-fishing buying pressure and demand for hedging assets due to the dollar crisis"

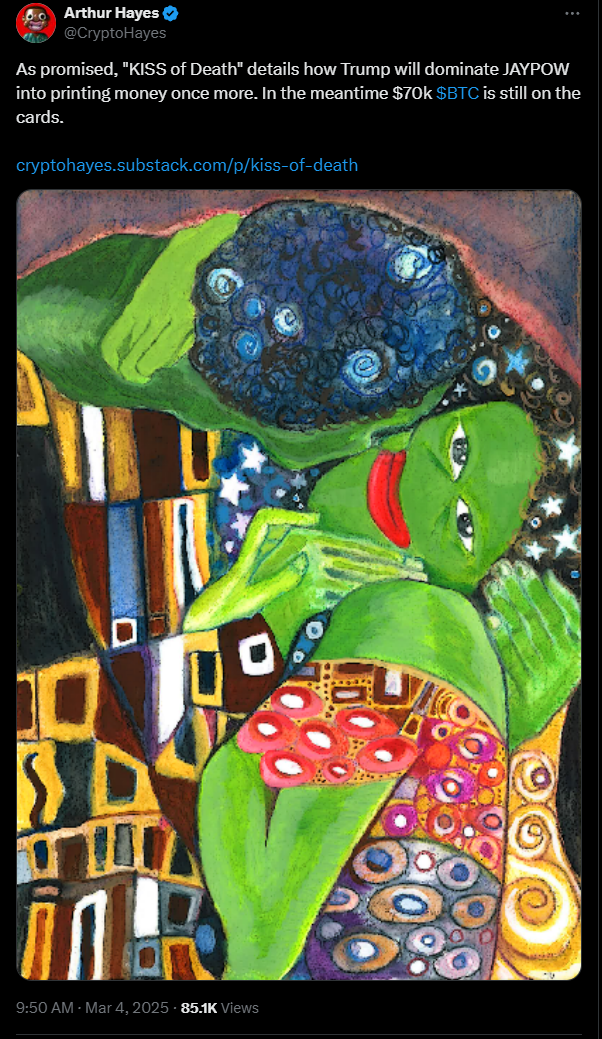

Hayes posted a lengthy article titled 'The Kiss of Death' on the paid professional news posting platform Substack, arguing that Trump's actions, which have driven the rise of various cryptocurrencies including Bitcoin, are largely showmanship.

Hayes pointed to the background of President Trump, a real estate mogul, and explained that Trump is staging various shows, including cryptocurrencies, as part of his efforts to raise funds for the realization of his desired policy goals, and this has exposed the cryptocurrency market to high volatility.

In particular, Hayes pointed out that the realization of the cryptocurrency strategic reserve mentioned by President Trump on the 2nd is realistically pessimistic. He wrote that "there was nothing new except words" and that "the US government does not have the financial capacity to accumulate various cryptocurrencies including Bitcoin until the approval of Congress for spending and the realization of the rise in the value of gold (owned by the US government)."

Hayes explained that Bitcoin could drop to $70,000 due to the excessive issuance of the US dollar, the investment fervor in the cryptocurrency futures market caused by Trump's actions, and the high leverage. However, he argued that Bitcoin could rise to $250,000 by the end of this year due to bottom-fishing buying pressure and demand for hedging assets due to the decline in the dollar in the asset market.