Bit is maintaining a broad macroeconomic Longing outlook, but is experiencing a continuous downward trend. The Longing-term outlook is positive, but the short-term weakness suggests that BTC may continue to face selling pressure.

Investor behavior is further exacerbating the market's uncertainty.

Bit, the need for investor support

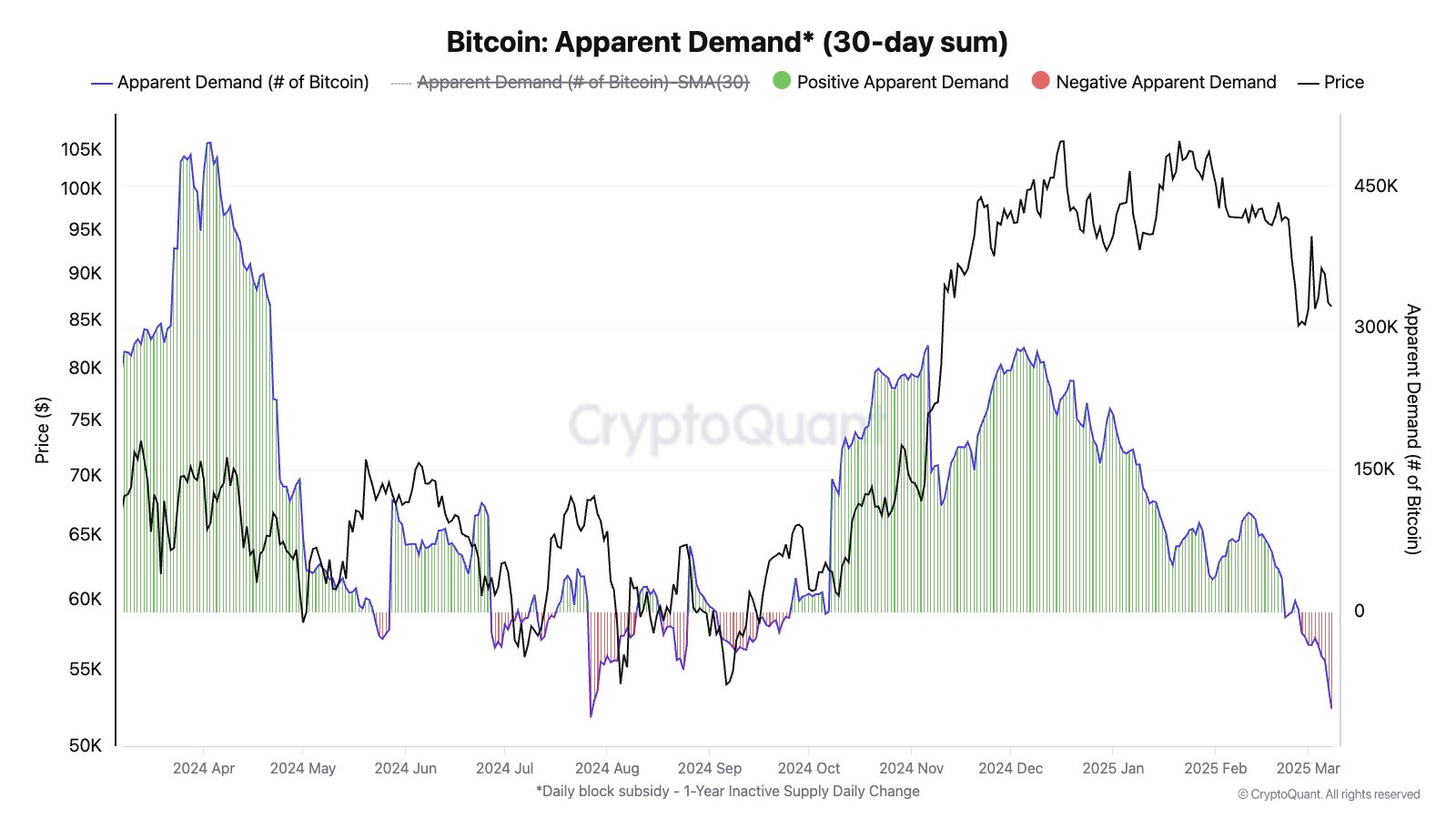

Bit's apparent demand has suffered a major blow in recent days as spot demand has plummeted. This contraction is the largest since July 2024 and the first in four months. This decline indicates an increase in skepticism among investors, a decrease in buying interest, and an increase in short-term bearish pressure.

The decrease in demand suggests that market participants are hesitant to take new positions. If demand does not recover soon, Bit may have difficulty maintaining its current price level, and the risk of further declines may increase.

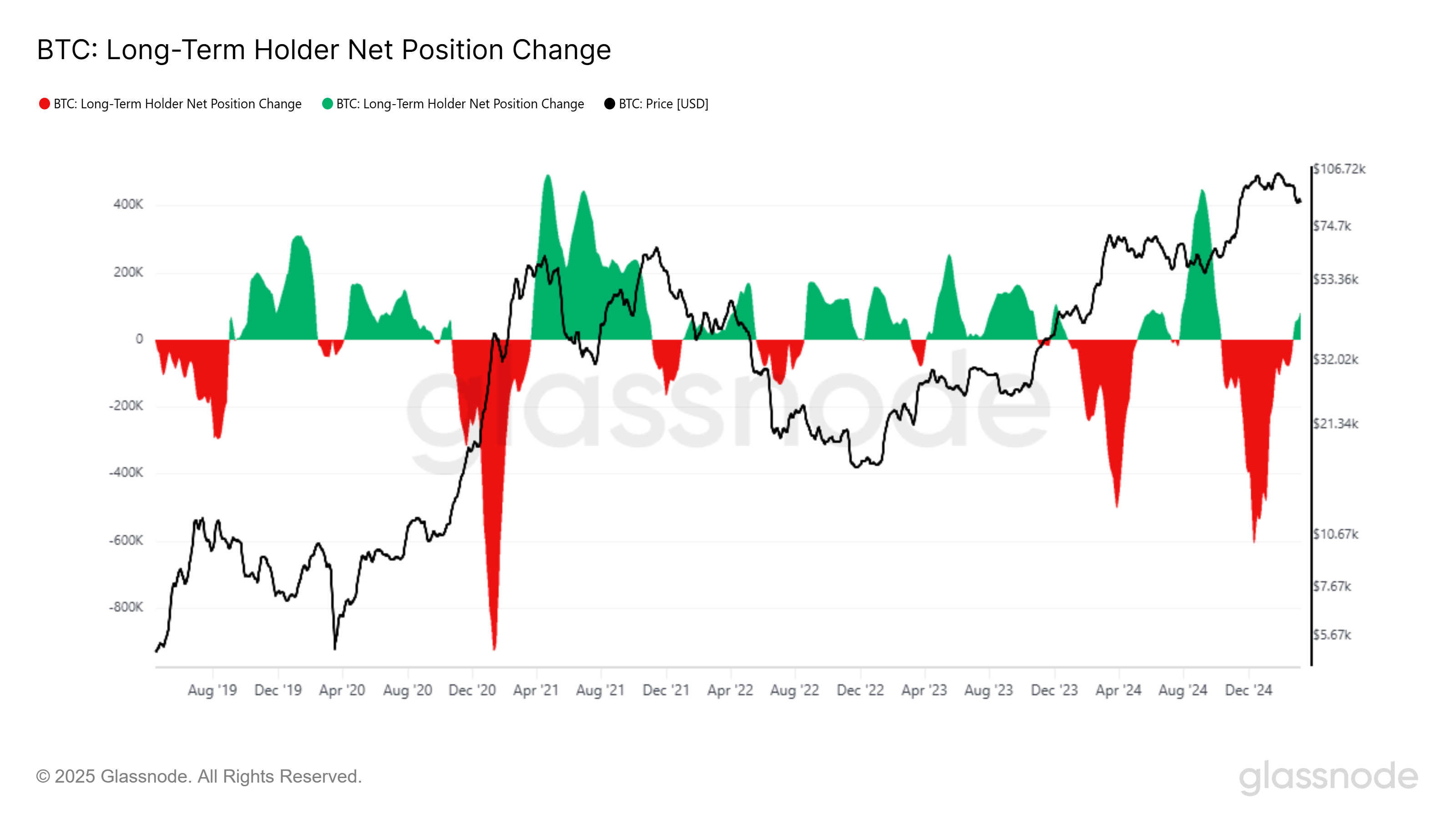

Long-term holders (LTHs) have shifted towards accumulation rather than selling, as shown by the LTH Net Position Change indicator. Over the past 30 days, these investors have accumulated over 107,413 BTC. Historically, LTH accumulation has signaled long-term confidence, but it has often preceded periods of price weakness in the short term.

LTHs tend to accumulate at lower prices and start distributing during bull markets. This pattern suggests that Bit may still face a downward trend before a meaningful recovery begins. While the Longing-term accumulation is positive, the immediate impact may be additional short-term volatility and potential price adjustments.

BTC price may decline further

Bit price is currently at $82,305, moving within an expanding bearish wedge pattern. This pattern historically indicates a macroscopic Longing trend, but in the short term, the downside potential is higher. BTC may need to test lower support levels before confirming a reversal.

Considering the market conditions, the short-term price forecast suggests that Bit may lose the critical $80,000 support level and test $76,741. If the broader macroeconomic factors deteriorate further, the decline could extend, potentially reaching $72,000. Such a scenario would exert additional bearish pressure on the cryptocurrency market.

However, a change in investor sentiment could alter this path. If accumulation increases at the psychological $80,000 support, Bit could regain upward momentum. Breaking above $82,761 could see BTC exceed $85,000 and eventually reach $87,041. Such developments would invalidate the bearish outlook and signal a new bullish phase in the market.