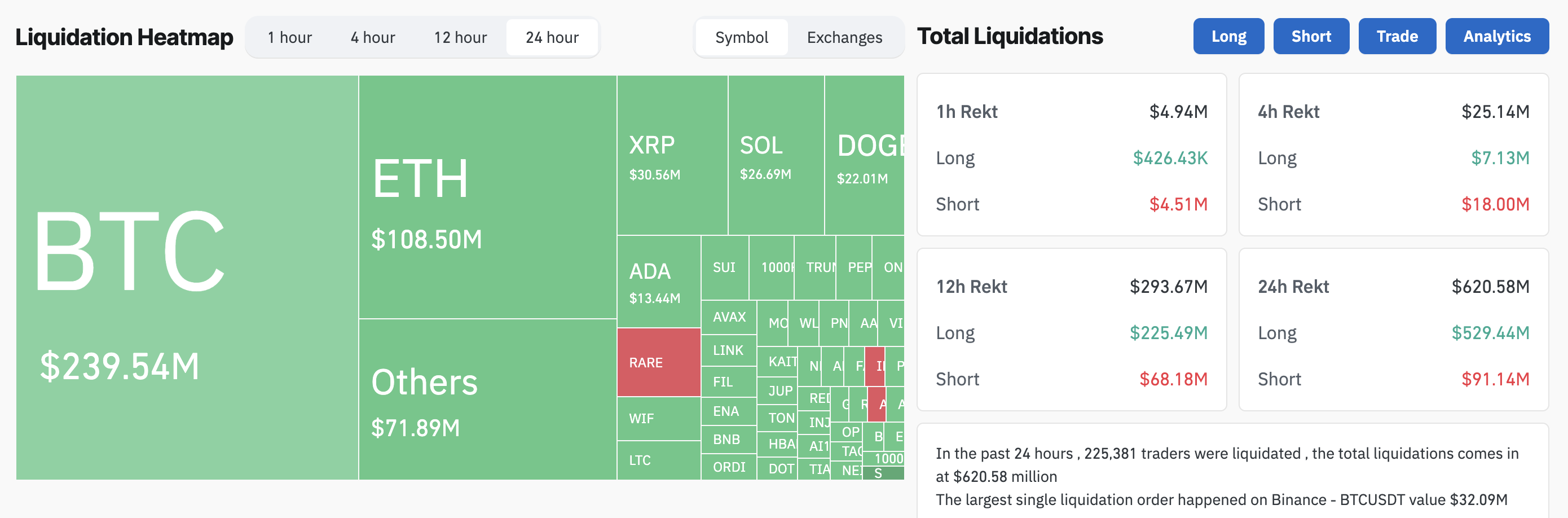

The cryptocurrency market started this week with a sharp decline. Over the past 24 hours, $620.5 million in liquidations have occurred.

The price of Bit(Bitcoin) (BTC) plummeted to $80,000 over the weekend, triggering a sell-off. The sudden drop caused widespread margin calls, forcing traders to unwind their leveraged positions and amplifying volatility across the market.

Crypto Market Sees $620 Million in Liquidations

According to Coinglass data, 225,381 traders were liquidated in the cryptocurrency market over the past 24 hours.

Long positions took the biggest hit, recording $520.94 million in losses. Meanwhile, Short positions saw $91.1 million in liquidations.

Bit(Bitcoin) led the liquidation frenzy, with $230.95 million in positions being liquidated. $205.6 million came from panicked Long traders, triggering forced selling. The largest single liquidation order occurred on Binance, where a $32 million BTC/USDT position was liquidated.

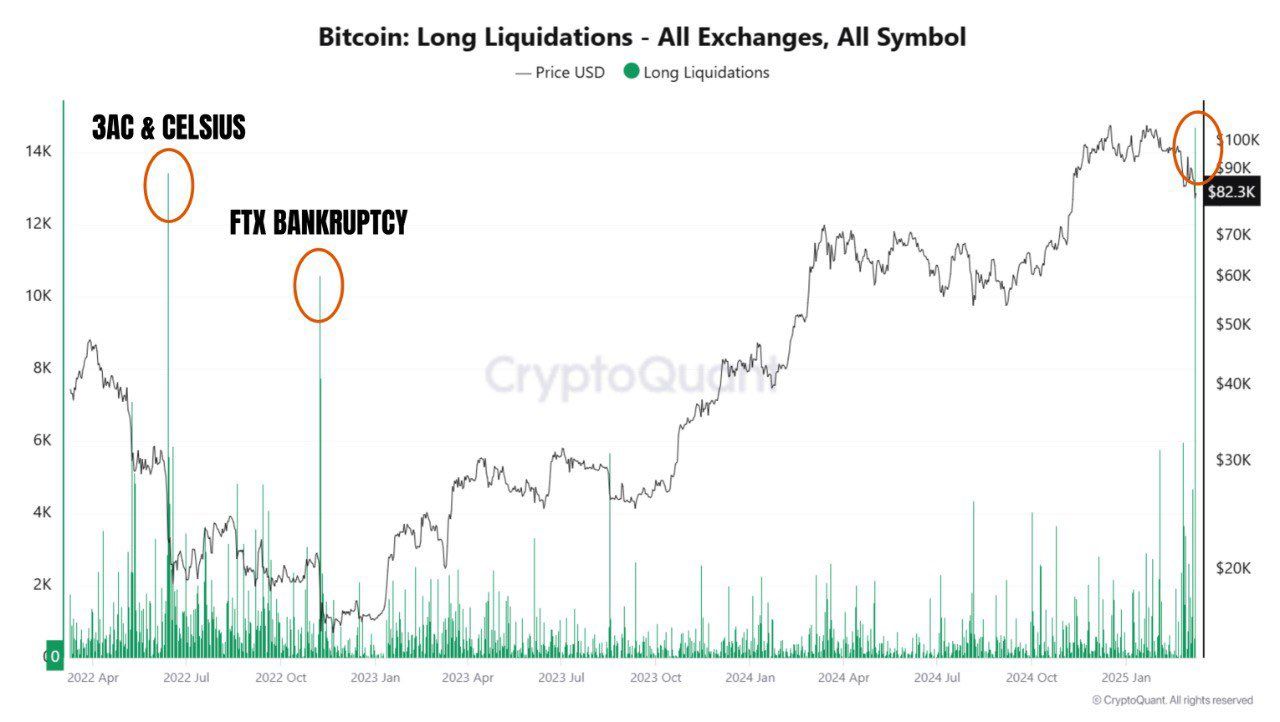

Analyst Ash Crypto emphasized the severity of the recent market turmoil in a recent X (formerly Twitter) post.

"Bit(Bitcoin) Long liquidations across all exchanges have exceeded 3AC, Celsius, and FTX collapses," the post read.

According to CryptoQuant data, Bit(Bitcoin)'s Long liquidations reached $14,714 yesterday. For comparison, 13,453 BTC were liquidated during the Celsius collapse, 1,807 BTC during the FTX collapse, and 1,311 BTC during the 3AC collapse.

As Bit(Bitcoin) struggled in the market, facing downward pressure, the wave of liquidations ensued. Contrary to expectations, President Donald Trump's strategic Bit(Bitcoin) stockpiling executive order triggered a sharp decline in Bit(Bitcoin) value.

Furthermore, growing concerns about an economic recession have exacerbated the downtrend, adding further uncertainty to the market.

"Ugly start to the week. Looks like BTC will retest $78,000," former BitMEX CEO Arthur Hayes wrote.

He predicted that if $78,000 is not maintained, $75,000 will be the next crucial support level. Hayes also noted that there is significant open interest (OI) in Bit(Bitcoin) options between $70,000 and $75,000, so volatility could increase if BTC enters that range.

Currently, BTC is holding above $80,000, trading at $82,629 at the time of writing, down 3.9% over the past 24 hours.

Market Crash Causes Chaos Among Crypto Whales

The widespread impact of the Bit(Bitcoin) price decline has been felt across the industry. The total cryptocurrency market capitalization decreased by $14.8 billion. Ethereum (ETH) was the second-most affected asset, with $108.5 million in liquidations. According to BeInCrypto data, ETH has declined 5.3% over the past day, trading at $2,062 at the time of reporting.

The downtrend is putting increasing pressure on whales, with some facing the risk of large-scale liquidations. According to Lookonchain data, a whale holding 65,675 ETH (worth $135.8 million) on Maker is at risk of liquidation.

The whale's health ratio has dropped to 1.05, and the liquidation price is set at $1,931. If ETH continues to decline, forced selling could occur, raising concerns.

Additionally, an on-chain analyst revealed that World Liberty Financial (WLFI)'s investment portfolio has suffered significant losses. The company initially invested $336 million across 9 tokens, but the portfolio's value has plummeted to $226 million, resulting in a $110 million loss.

Ethereum accounted for 65% of the entire portfolio, making it the most impacted. ETH's average purchase price was $3,240, but it is currently trading around $2,000. DeFi projects have incurred a 37% loss, amounting to $80.8 million.

Amid the chaos, OnChainLens reported that whales have increased their Long positions across multiple assets, including Solana (SOL), Ethereum, DogWithCoin (WIF), and Bit(Bitcoin).

These positions are currently working against the traders, resulting in $14.3 million in unrealized losses. The whales still hold $8.4 million worth of pending orders and have supplied 19,413 ETH and borrowed $16.2 million in USDC to take Long positions on Hyperliquid.

However, not all whales are losing money in this market volatility. According to data from Lookonchain, other whales have successfully Shorted BTC multiple times during the recent price decline. This trader has accumulated over $7.5 million in unrealized profits.

"He has now set up additional Short positions at $92,449 - $92,636, and placed limit orders to realize profits between $70,475 - $74,192." - Additional post.