After recording a low of $78,620 on March 10, Bit has rebounded and is currently rising gradually.

Major cryptocurrencies recorded a 1.2% price increase last week, and on-chain data indicates the accumulation of new whales.

Surging Bit Whale Demand...Investors Buying the Dip

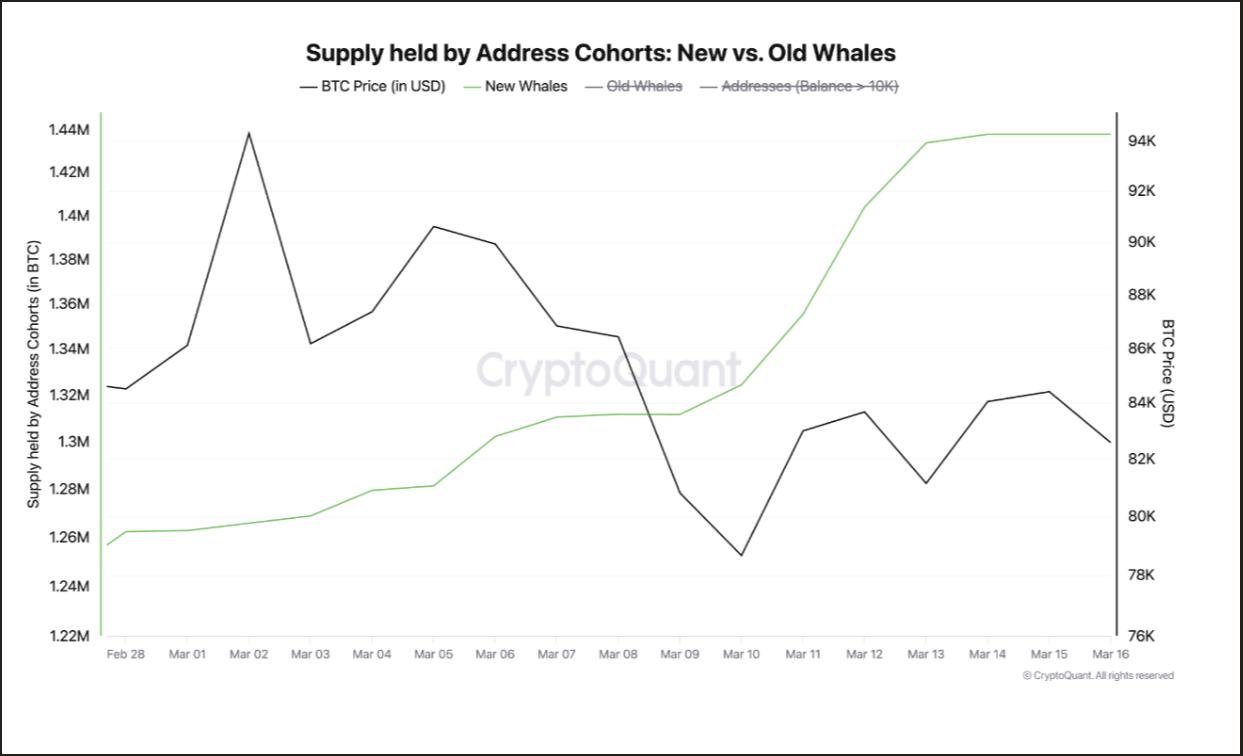

In a new report, CryptoQuant analyst Onchained revealed that new Bit whales have emerged. These large investors hold at least 1,000 BTC wallets, with an average acquisition age of less than 6 months.

"According to on-chain data, since November 2024, these wallets have accumulated over 1 million BTC, making them one of the most influential participants in the market. Their accumulation pace has accelerated noticeably in recent weeks, with over 200,000 BTC accumulated just this month." – Onchained, CryptoQuant analyst

When new whales show interest in BTC, it signifies the revival of bullish confidence in long-term performance. The recent multi-year low of BTC triggered this accumulation trend, providing a good opportunity for whales to "buy the dip". They can sell at higher prices.

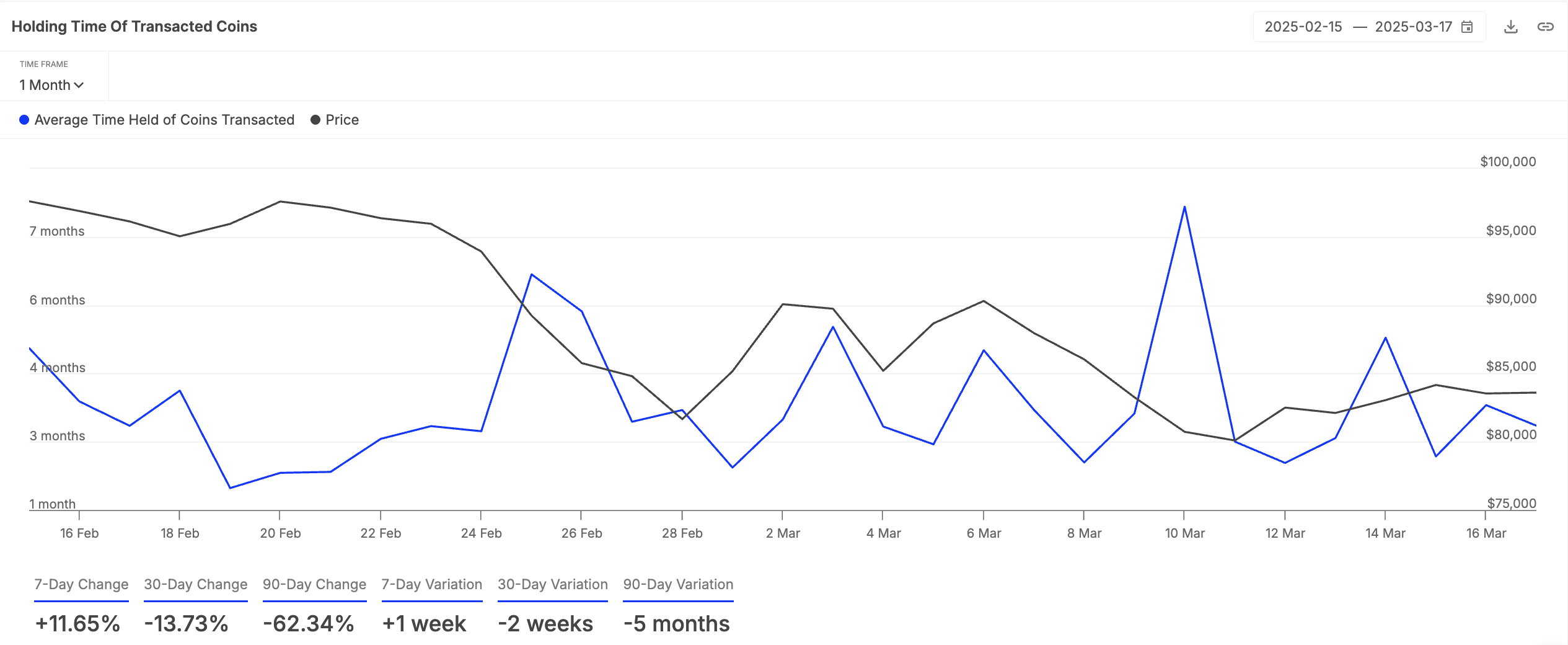

Additionally, BTC holders increased their coin holding time last week, emphasizing the gradual recovery of bullish sentiment on the coin. According to the cryptocurrency on-chain data platform IntoTheBlock, this increased by 12% in the past 7 days.

The average holding time of a traded coin measures the time a token is typically held before being sold or transferred. Longer holding times reflect stronger investor conviction, as investors choose to hold the coins rather than sell them.

This can help reduce selling pressure as the supply of BTC gradually decreases, potentially increasing the value of the coin in the short term.

Rebound to $89,000? VS Decline to $77,000?

The Bit Elder-Ray index is still posting red histogram bars, but their size has been gradually decreasing over the past few days.

This indicator compares buying and selling pressure to determine the price trend of an asset. A decrease in the height of the bars indicates that bearish pressure is weakening.

This suggests that Bit sellers are losing momentum, and buyers may gradually start to intervene. If this trend continues, the downward trajectory of Bit could slow down. The price could rebound and rise to $89,434.

However, if selling pressure strengthens, Bit risks a sharp drop to $77,114.