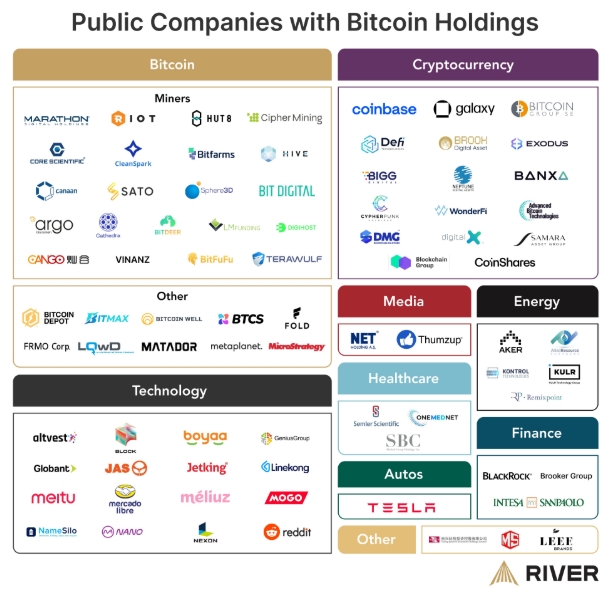

The number of listed companies that purchase and hold Bit(Bitcoin) increased to 80 by 2025. This is a 142% increase from 33 companies in 2023.

This trend reflects that Bit(Bitcoin) is increasingly being accepted as a strategic reserve asset and a hedge against inflation.

Reasons for Public Companies Holding Bit(Bitcoin) in 2025

Digital asset brokerage firm River revealed that 80 listed companies hold Bit(Bitcoin), up from 33 two years ago.

"There are currently 80 listed companies buying Bit(Bitcoin). Two years ago, there were 33. How many will there be in two more years?" River asked.

The companies adopting Bit(Bitcoin) span across various industries, with a focus on the technology and finance sectors. The technology sector accounts for half of the listed companies holding Bit(Bitcoin). Bit(Bitcoin) treasury data shows that companies like MicroStrategy (now Strategy), Tesla, and Block are at the forefront of integrating Bit(Bitcoin) into their financial strategies, as shown.

Financial institutions make up 30%, including Fold Holdings and Coinbase Global, which are indirectly exposed through ETFs (exchange-traded funds). The crypto mining industry accounts for 15%, with major mining companies like Marathon Digital and Riot Platforms holding substantial Bit(Bitcoin) reserves.

The remaining 5% consists of companies from other sectors, such as retail and energy, which are experimenting with Bit(Bitcoin) holdings for transaction and balance sheet diversification.

Several key factors are driving the adoption of Bit(Bitcoin) by listed companies. Inflation hedging has become a major consideration as companies seek alternative stores of value beyond traditional assets.

"Bit(Bitcoin) is the money of freedom, an inflation hedge for middle-class Americans, a solution to the debasement of the dollar as the world's reserve currency, and an escape from ruinous national debt. Bit(Bitcoin) could have no more powerful advocate than Robert F. Kennedy Jr.," the U.S. Secretary of Health and Human Services recently said.

Many companies are also adopting Bit(Bitcoin) as a financial preparedness strategy, betting on its long-term value appreciation. In this regard, companies like Strategy are at the forefront.

Investor pressure has also played a role, with institutional investors and shareholders increasingly pushing companies to diversify into digital assets. Regulatory clarity and crypto-friendly policies in some regions have further encouraged corporate adoption.

Bit(Bitcoin) Accumulation Continues to Grow

Meanwhile, listed companies are accumulating Bit(Bitcoin) at an unprecedented pace. From 2020 to 2023, they have amassed around 200,000 BTC. In 2024, an additional 257,095 BTC were acquired, doubling the total from five years prior.

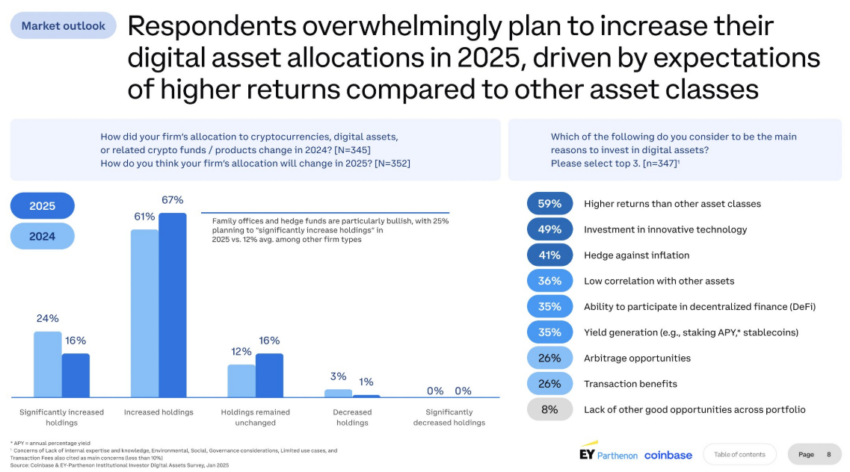

In the first quarter of 2025, an additional 50,000 to 70,000 BTC have already been added. Notably, MicroStrategy and Fold Holdings are leading the acquisition charge. Coinbase's recent institutional investor survey also showed that 83% of institutions plan to increase their crypto asset allocations by 2025.

The surge in public company Bit(Bitcoin) adoption coincides with a new wave of crypto-related IPOs (initial public offerings). Notable companies, including Gemini and Kraken, have plans to go public. This underscores the increasing institutional trust in the digital asset space. These IPOs will provide new capital inflows and further legitimize the broader crypto market.

Bit(Bitcoin) is also becoming a financial lifeline for companies struggling to boost their stock prices. Some companies with declining revenues have opted for Bit(Bitcoin) investments to attract new investors and strengthen their market position. As a result, Bit(Bitcoin) is playing an increasingly important role in corporate strategies.

Despite the impressive growth in corporate Bit(Bitcoin) adoption, public crypto companies still account for only 5.8% of the total crypto market capitalization. This suggests there is still significant room for expansion.

In addition to corporate finance, the increased Bit(Bitcoin) adoption is also impacting other financial planning areas. Parents are increasingly choosing Bit(Bitcoin) as an alternative to traditional college savings plans, betting on its long-term growth potential to cover education costs.

Currently, 80 public companies hold Bit, and this trend shows no signs of slowing down. If the current growth trajectory continues, more companies will convert to Bit, leading to deeper institutional adoption.